AndreyPopov/iStock via Getty Images

We reiterate in this article our bullish position on sleep and respiratory medical device maker ResMed Inc. (NYSE:RMD). We wrote several bullish articles over five years beginning when its shares sold in the $60 and $70 range. The stock shot to a high of $296. Shares are selling for around $220 despite sales and profits remaining strong.

Macroeconomic issues like the stock market’s volatility, semiconductor chip shortages, and other supply chain interruptions are a drag on the stock. ResMed is a potential opportunity for retail value investors to profit from this low-risk market leader.

The Company

ResMed Inc. specializes in sleep apnea and respiratory management medical devices. The company’s products and Software as a Service sell in over 140 countries. Some products require a medical prescription but most do not; some insurance plans reimburse the costs of respiratory and sleep apnea therapy devices. The products are relatively easy to access. The company has distributors, a direct sales force, and online stores.

Its medical and consumer products include ventilation devices, diagnostic products, mask systems for the hospital and home, headgear and other accessories, and dental devices. ResMed offers software informatics solutions to manage patient outcomes, and customer and business processes.

The cloud-based software monitors patient data from its products. The data are shared over the Internet with sleep clinics and medical personnel for faster follow-up and treatments. Here is a synopsis of the ResMed product portfolio:

· AirView is a cloud-based system that enables remote monitoring and changing of patients’ device settings.

· myAir is a personalized therapy management application for patients with sleep apnea that provides support, education, and troubleshooting tools.

· U-Sleep is a compliance monitoring solution that enables home medical equipment (HME) to streamline their sleep programs.

· Brightree business management software and service solutions sell to providers of HME, pharmacy, home infusion, orthotics, and prosthetics services.

· MatrixCare care management and related ancillary solutions sell to senior living, skilled nursing, life plan communities, home health, home care, and hospice organizations.

· HEALTHCAREfirst offers electronic health records, software, billing and coding services, and analytics for home health and hospice agencies.

CPAP machines are the industry’s workhorse. ResMed’s AirSense 10 is the best-selling CPAP device. A new report confirms that sleep apnea management device sales are projected at $5.98B by 2028. The market is growing annually at a CAGR of 5.9%. ResMed, Koninklijke Philips N.V. (PHG), and Fisher & Paykel Healthcare are the market leaders.

ResMed sales got a boost when, on October 24, ’22, the CEO of Philips announced 4K job cuts because of a product recall. We expect the recall to cost Philips around €300M plus damage to its reputation since this is not the first recall of its medical devices. We expect ResMed and other device makers to benefit from troubles at Philips.

In the interest of transparency, ResMed had a device recall in 2019. It cost the company about $40M. The sound alarm on its CPAP machine allegedly failed and might have contributed to one death.

Sentiment and Concerns

ResMed investors are very positive about the stock. In the last 30 days, 22.3% of more than a half-million portfolios added shares. We expect the average price target over the next 12 months to top $250 per share; we concur with the consensus of analysts NASDAQ surveyed that the share price might hit $280 if supply chain issues ease.

Over the years, the share price tends to rise in accordance with revenue and earnings.

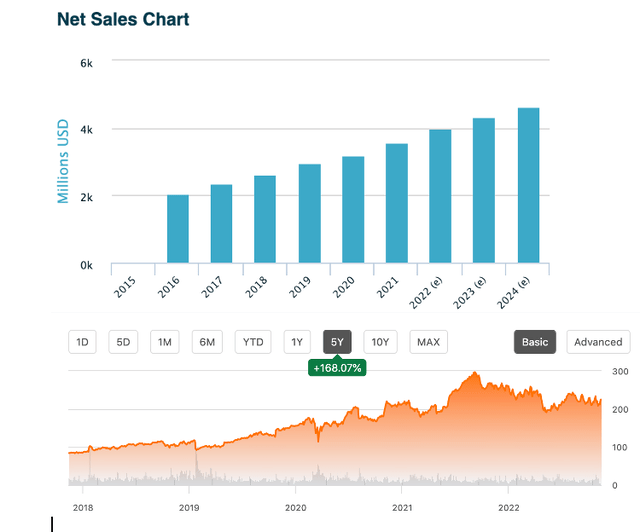

ResMed Sales & Share Price (Seeking Alpha)

For instance, the share price is up to +168% over five years. It hit $296 per share in September ’21, then slid. The share price is -13.22% over the last 12 months concomitant to reports about rising inflation, interest rate hikes, and renewed lockdowns interrupting supply chain operations in China. ResMed’s CEO told the hometown newspaper, The San Diego Union-Tribune, cost increases eating at profits are because of “higher component and freight costs” and chip shortages.

The CEO told shareholders recently talked about other downward pressures on the stock price, as reported on Seeking Alpha:

We are building on the success we achieved last quarter with our reengineered AirSense 10 Card-to-Cloud device. Customer acceptance has been strong, particularly in the United States region, and this has enabled us to substantially increase shipping volumes to support patient demand while we continue to fight through global supply chain challenges…(But) we are not seeing the same magnitude of adoption of the AirSense 10 Card-to-Cloud device as we are in the U.S… due to the fact that our 100% cloud connectable platforms, such as AirSense 11 and others, and our ecosystem of software solutions are so embedded into the workflows of health care systems. This is particularly evident in countries where we have partnered to develop digital health reimbursement models.

Pressures are coming from the expanding marketplace. Revenue keeps growing and it is profitable, but new FDA-approved oral devices are increasingly entering the arena. Also, foreign exchange rate fluctuations hurt earnings. China lockdowns, supply chain problems, and persistent competition for semiconductor chips cause to worry. Yet, none of these are negatively affecting sentiment about ResMed.

Sentiment about ResMed has been consistently strong over the past few years. Hedge funds increased their holdings in the first three quarters of 2022. Fund managers sold ~30K shares in the last quarter but still hold more shares than in 2020 and 2021. Corporate insiders own less than 1% of the shares. Individuals and insiders own less than 1% of the shares, while institutions own nearly 74%. The public owns +25% despite a paltry dividend yield of 0.79%. Across the board, the healthcare device sector is attracting investment money faster and from more investors than many other industries.

Financial Snapshot

The stock has a tendency to make big moves. Its current Beta is 0.93. Seeking Alpha notes the “stock slumped as much as 9.9% (one day), despite the medical device company reporting a rise in quarterly revenue and gross margin on the back of strong sales growth in the Americas.”

The stock closed in September ’21 at over $290 per share. The price slumped by mid-June ’22 down to $196 on news inflation raged to 9.1%. The ResMed stock ticked up when inflation fell to 8.2%. The shares gained 13.22% on November 10, ’22 when the government reported the October inflation rate dipped to 7.7%. By comparison, the DOW average rose 3.7% ($1,201) on the news, and iShares U.S. Medical Devices ETF (IHI) moved +2.79% on November 10.

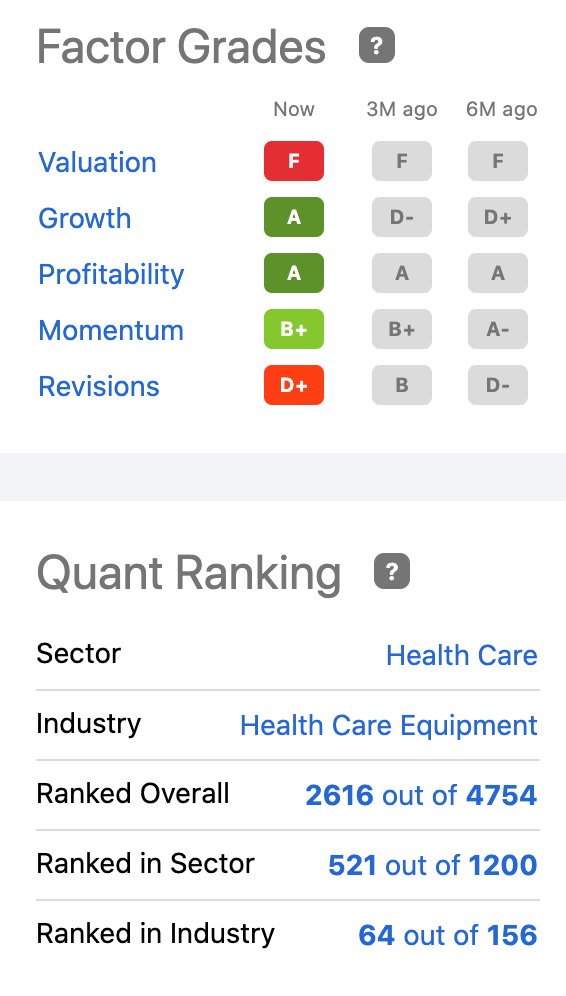

The Seeking Alpha Factor Grade for growth significantly improved over the previous three and six months. S A has maintained a hold on its Quant Rating for over three years while rating the valuation a D or F.

Factor Grades & Quant Ranking (Seeking Alpha)

In October, ResMed reported GAAP Q1 ’23 EPS was +2.9% Y/Y ($1.43). We forecast the non-GAAP EPS will be about $1.60 in the second quarter. The next reporting date is January 25.

Sleep and respiratory products sales in Q1 increased 18% Y/Y in the United States, Canada, and Latin America to $578.1 million. Revenue in other markets was -6%. Software as a Service revenue grew 9% to $105.9 million. Higher selling prices drove up the gross margin (57.6%). Cash and equivalents were also higher ($207.2M) than at the end of last year ($201.8M).

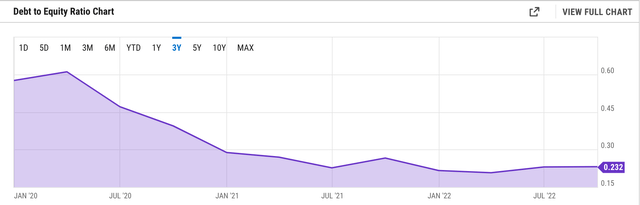

The share price steadily rose with better revenue and earnings while the company reduced its debt-to-equity ratio.

Debt-to-equity (YCharts)

Hold Your Breath

Take a deep breath before acquiring shares at any price over $200 because there are worrisome issues we are taking into consideration. Over the long term, we expect the share price to keep rising. The competitor’s recall will punch up ResMed sales and we do not foresee any significant risks. However, others talk about the stock being overvalued.

We believe a potentially fair value is ~$230 per share; we base this on historical multiples like PE, PB, and PS ratios, and price to free cash flow; past returns and future growth estimates are in the mix.

ResMed’s free cash flow was in decline from January ’22. Free cash flow picked up in the last reported quarter from $195.11M in June to $304.85M at the end of September. The average hovers around $468M over five years.

ResMed operates in a niche of the global healthcare device industry selling products and services that can be life-saving. Since it is a fragmented marketplace, ResMed has room to grow, and risks are manageable. Owning ResMed shares at a good price will let retail value investors sleep soundly.

Be the first to comment