JJ Gouin/iStock via Getty Images

In early September, we published the Apartment REIT Sector Update for REIT Forum members. To summarize it briefly, we highlighted that we were changing our expectations. Prior to September 2022, we expected leasing spreads to fall off hard in Q3 2022 and Q4 2022. However, we determined that early data on market rates suggested leasing spreads in Q3 2022 would remain high and that Q4 2022 would see pretty strong leasing spreads as well.

The Update

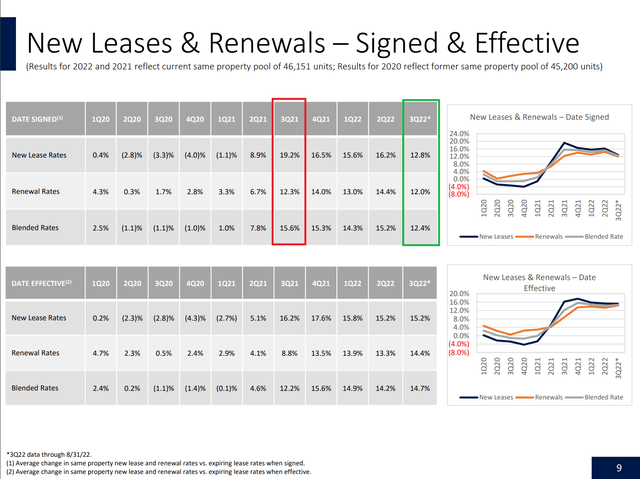

Shortly after we published it, Camden Property Trust (CPT) provided an updated presentation. CPT confirmed those new expectations in their latest presentation and again while speaking at the Bank of America Securities 2022 Global Real Estate Conference.

I’ve highlighted some data (in red and green) on one of CPT’s slides:

CPT Presentation

I expected those leasing spreads to fall off quicker in Q3 2022 because they were lapping the huge increase from Q3 2021.

However, rapidly rising mortgage rates make buying a home much more difficult. Since moving out to buy ceased to be an option, there are more renters competing for space. Those leasing spreads should still be falling off as we go into Q4 2022, as we are lapping a period of 15.3%, but the big increase in mortgage rates over August and September are a huge tailwind. We have seen a slight dip in occupancy year-over-year with the first 2 months of Q3 2022 average 96.7% (down from 97.2% year-over-year) as higher rents create a huge incentive for people to find roommates or live with their parents.

As we look at projections for forward rents, we consider the commentary from Keith Oden, Executive VP and Chairman of CPT. At the Bank of America event, he said:

Market rates have continued to increase, but it’s not anything like the rate of increase that we saw last year. But yeah, they are definitely continuing to increase. I think the really interesting question is going to be, as you roll into 2023, what kind of market rate behavior we’re going to see in 2023? Obviously, we’re in a, as all of our competitors are, a very strong situation with regards to the earn-in for 2023 rents. Right now, if we forward our guidance to the end of the year, and then you look at what the earn-in would be. That assumes that we would be basically freezing market rents at that level and operating the portfolio without any market rate increases. That number is already about 5%. So, whatever happens in 2023 is going to be additive to that. So, there’s a lot of thought about, you know, rent exhaustion and rental increase exhaustion and conversations about how high is too high for rents.

Note: There wasn’t an official transcript to my knowledge. I listened to the presentation to record his commentary.

He goes on to say that if general inflation numbers remain high, then consumers should expect to see another “pretty stout round of rental increases”.

New Supply

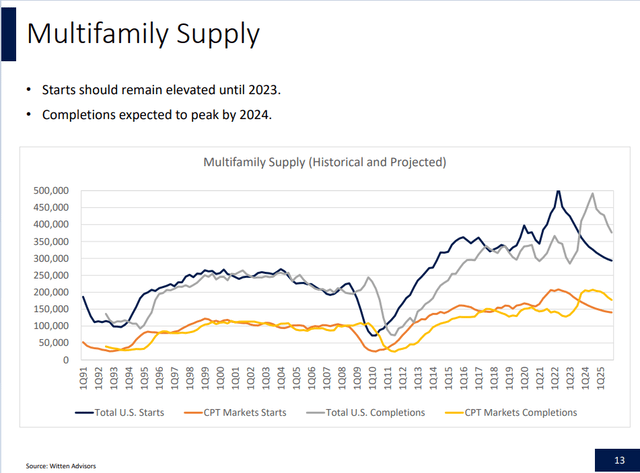

Looking at supply, we’re still expecting elevated new supply in 2023 and 2024. That’s just based on all the permitting that’s been done and the early construction that is underway. However, apartment construction is expected to plunge in 2025:

CPT Presentation

Massive new construction creates pressure on rents. Supply and demand actually work! However, these buildings take time to complete. New “starts” should fall off in 2024 (as completions peak).

In 2025, new starts are expected to be lower than at any point since early 2024. Think raising rates is “fixing” inflation? It is succeeding in lowering living standards.

Higher rates are projected to reduce new starts from 500,000 units to 300,000 units. That’s 200,000 rental units that simply won’t be available for anyone to live in. Wealth for an economy is measured by the goods and services it can produce and consume. Thanks to higher rates, the United States will produce fewer goods and services.

Looking over to the MH park REITs, we see lower oil prices as being positive for RV parks. The hit to Florida should be covered under insurance (including business interruption insurance).

However, business interruption insurance can take time to pay out. Consequently, we could see a temporary hit showing up to revenue and passed through to FFO/AFFO even though the REIT should be reimbursed by their insurance plan. If we see that in earnings, keep in mind that it is simply an accounting impact. It could create some fear though. If the reimbursement won’t be included as part of their results, it could weigh on guidance for FFO/AFFO in 2022. This is purely an accounting impact, but it can create fear. These events are rare enough that many investors don’t understand them and/or don’t read past the headlines anyways.

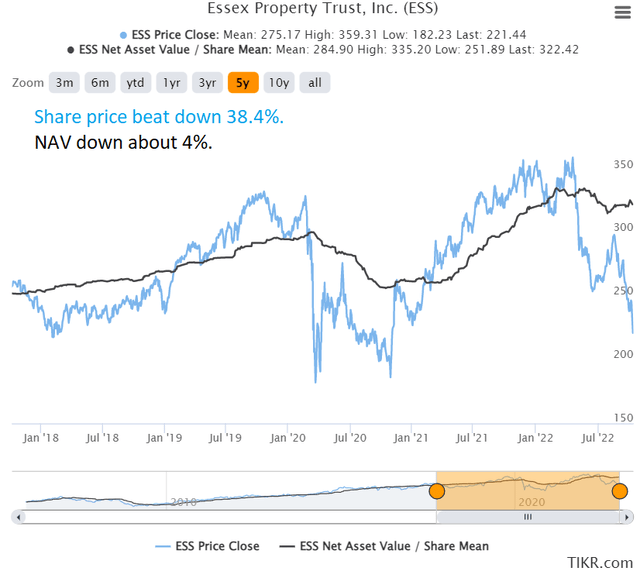

Housing REIT share prices have been butchered. Is their Net Asset Value per share plunging? No, absolutely not.

Consider Essex Property Trust (ESS), where the price is down 38.4% and the NAV is down about 4%:

TIKR.com

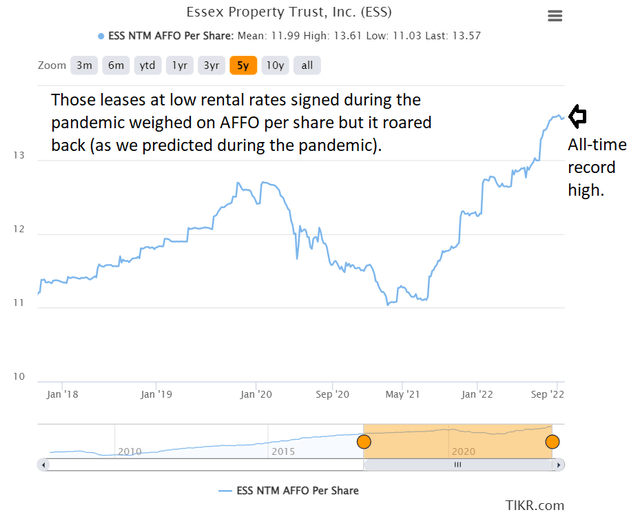

What keeps NAV up? Net Operating Income. The same net operating income that is driving AFFO per share:

TIKR.com

Do you see why I’m not concerned now? Prices are plunging, but my work on forecasting leasing rates and revenue (driven by leasing) indicates that these are still good estimates.

A Few Ratings

I’ll share just a few of the stocks we’re bullish on for this sector.

I think Sun Communities (SUI) has suffered far too much. Headwinds from the currency exchange rate and higher oil prices are real, but not enough to derail the REIT. Not even close to that. They took damage in the hurricane, but the business interruption insurance should come through. Sure, there’s a delay. However, I think this should’ve hit the share price for something closer to $1.00 per share. Accounting for typical market overreaction, perhaps make it $2.00 or $3.00. However, SUI has been pounded materially harder than most housing REITs year-to-date.

Equity LifeStyle (ELS) is the direct competitor to SUI. The two great MH Park REITs. Both REITs have respectable balance sheets, but ELS tends to be stronger in that regard. They also pushed the maturity out on their debts previously to lock in low rates. The downside is that ELS hasn’t fallen as hard as SUI. Investors could pick either one. I own both.

Moving over to apartment REITs, I like Essex Property Trust is a great deal. Shares are trading at an unusually low multiple of projected AFFO. I expect higher interest rates may have some negative impact to the market value of the apartments, but we should still see strong growth in Net Operating Income.

For a more diversified pick, I think AvalonBay (AVB) is a good idea also. Once again we have a relatively low multiple of AFFO and a huge discount to consensus NAV estimates. Even if higher rates put some pressure on the value of apartment buildings, the massive discount to NAV already covers it.

How about a pick that isn’t in the gateway cities? We’ll go back to the first stock we discussed. CPT is a good choice also. Great balance sheet. Huge discount to consensus NAV estimates. Strong rent growth. The year-over-year growth rates should be falling from their insanely high levels. However, that doesn’t mean rental rates falling. Slower growth is not negative growth. Not even remotely close. Within this article, it is the only one we don’t own yet. It just refuses to go on sale without other shares going on sale at the same time, which regularly pushes us in difficult positions on which share to buy.

One More Rating

This article is about housing REITs, but we’re deep in Q3 2022 earnings. When things get this busy, my volume on public articles often falls off. That makes it harder to provide enough updates to our readers.

Another REIT that has really caught my eye is Rexford Industrial (REXR). REXR delivered an outstanding Q3 2022 earnings release. We included an analysis of the Q3 2022 earnings in a huge subscriber article on REXR (published last night). Based on our research, we believe consensus analyst estimates for REXR for 2023, 2024, and 2025 are a bit too low. Those consensus estimates call for massive growth in FFO and AFFO per share. However, management’s commentary on the expected growth in NOI (Net Operating Income) over the next two years suggests that growth in FFO and AFFO per share should actually be a bit higher. We already adjusted for the change in interest rates on variable debt, refinancing expiring debts, new share issuance, cash outflows to complete redevelopment and repositioning projects, interest expense on cash to finance those projects, annual rental increases, and projected spreads on new and renewal leases during the next 24 months.

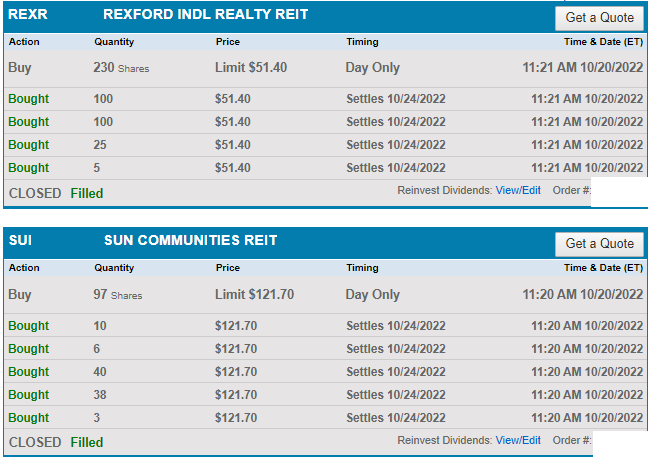

Earlier today (assuming this gets published on 10/20/2022), we raised our position in SUI and REXR. I stand behind my work and happily added another 97 shares of SUI and 230 shares of REXR.

Schwab

If you’re not familiar with our work, you should know that we actually follow our ratings. We don’t just write articles about what you should buy, collect the payment for writing, and go on our way. We share our analysis of what we decided to buy (and sometimes sell). Analysts should have skin in the game. Obviously, they should also be very transparent about those trades.

We don’t expect to pick the exact bottom, but we can keep buying great companies at great prices.

Ratings: Bullish on SUI, ELS, ESS, AVB, CPT, REXR

Be the first to comment