Abstract Aerial Art/DigitalVision via Getty Images

I’m not quite sure why energy production has become such a political topic, but for the purposes of this article I will be analyzing it from a strictly investing perspective. There are a wide range of views on which forms of energy the government should encourage or even whether to subsidize/penalize it at all. As investors, it behooves us to look past the “should” and instead focus on what is.

The Inflation Reduction Act (IRA) has now been put into law and it is both massive and long lasting. It fundamentally alters the profitability of energy production. Interestingly, the impacted stocks barely reacted when it got passed so I suspect some have become quite opportunistic. I set out to find the stock best positioned to benefit from the rollout.

The Buy thesis for ARRY

Array Technologies (NASDAQ:ARRY), manufactures and supplies trackers for utility scale solar arrays. It is among the best positioned to benefit from the IRA.

- Direct recipient of subsidies

- Supply chain is U.S.A. so it gets an additional 10% adder

- Demand for its core products is rapidly increasing

There are a number of other solar stocks that get significant benefits from the IRA, but what sets Array apart is that it is already trading at a reasonable value at 26X next 12 month consensus earnings.

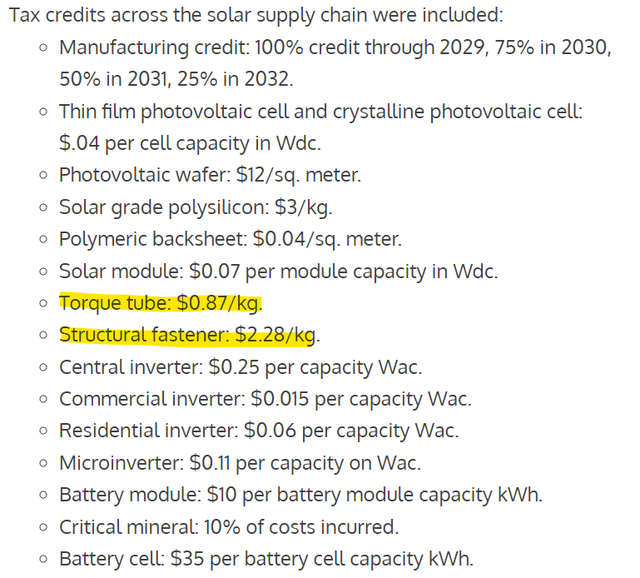

Subsidies dramatically shifting profitability of solar builds

There are huge subsidies in the IRA across the entire solar supply chain. Some of the key one’s are listed below and I have highlighted the ones most relevant to ARRY.

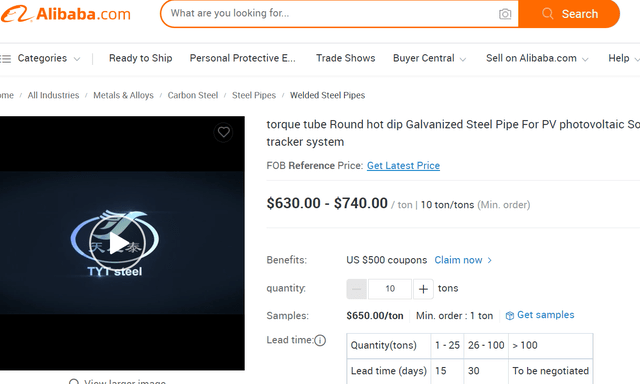

Torque tubes are one of the largest revenues and expenses for Array as they make up much of the physical structure of a tracker system. Taking full note that I do not have experience procuring large steel products so I could be missing something, the subsidy appears to be nearly 100% of the cost. A quick search for tracker torque tubes shows they can be bought via Alibaba (BABA) for $630-$740 per ton.

There are 907 kilograms per ton so the IRA subsidy of $0.87 per kilogram for torque tubes gives a $789 subsidy per ton to what appears to cost $630-$740 per ton.

A couple caveats:

- That is the price of Chinese steel. U.S. steel is slightly more expensive

- To get full subsidy, a solar project must use U.S. products.

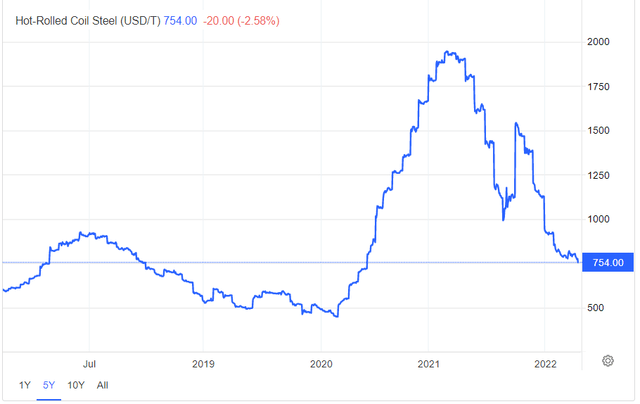

Steel as a commodity appears to be priced in the same ballpark at $754 U.S. dollars per ton.

While this subsidy level seems absurd at basically 100% of cost, it is possible the $0.87 per kilogram level was decided upon in the months when steel prices were substantially higher. During much of the negotiation of the IRA, steel prices were over $1000 per ton.

So the subsidy appears quite significant and Array can get the full amount because it does use U.S. made steel via multiple in-place supply agreements including a large recent agreement with Nucor (NUE).

In addition to torque tubes, Array makes and sells the structural fasteners that hold panels in place as they rotate to face the sun. These have a subsidy from the IRA of $2.28 per kilogram.

Finally, as an American provider of solar parts, Array contributes to a project’s eligibility for the 10% adder to income tax credits.

Sharing across the supply chain

There are so many subsidies at so many levels of the supply chain as the building of new solar projects gets subsidized, the manufacturing of the products gets subsidized and then the actual production of the solar energy gets subsidized via the ITC and PTC (income tax credit and Production tax credit).

While each is given to a specific level of the industry vertical they will effectively be shared via pricing adjustments.

As a simple example there might be a $50 credit to one party in a transaction but the other party knows about it and wants their cut so they agree to adjust the price by $25 such that each party is functionally getting a $25 credit as compared to before the subsidy was available.

Which entity ultimately gets the lion’s share of the subsidies is the million dollar question. The company with the negotiating power due to having some sort of proprietary capability is going to be the huge winner. I don’t think I am smart enough to figure that out and hats off to those who can.

As for Array, I do think they have enough power to at least capture a significant portion of the tracker subsidies. They are among the market leaders in trackers and have significant intellectual property in both tracker designs and software. Per ARRY:

“As of December 31, 2021, the company had two U.S. trademark registrations, eleven issued U.S. patents, 152 issued non-U.S. patents, eighteen patent applications pending for examination in the United States, fourteen U.S. provisional patent applications pending, 94 patent applications pending for examination in other countries, and eight domain name registrations. Its U.S. issued patents are scheduled to expire between 2030 and 2037”

With intellectual property it is often hard to tell if there is real value there or just a slightly different design. In this case I do think ARRY has real value to its intellectual property as a competitor, Nextracker, attempted to access Array’s technology through hiring a former employee with a non-compete clause.

Array sued Nextracker and received a monetary settlement.

By having valuable IP and proving that they are willing to protect their IP in court, I think Array has what it takes to grab on to their tracker subsidies.

Significant margin improvement ahead

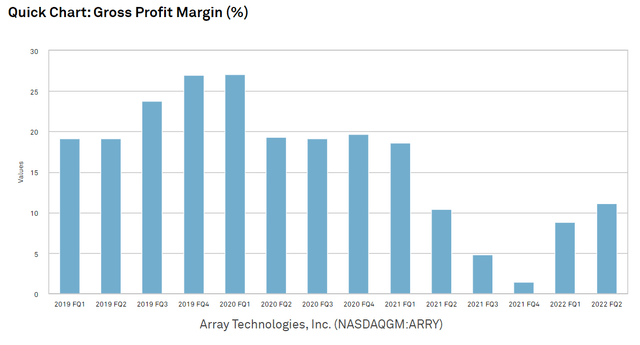

Array’s usual profit margin is around 20%. It recently fell sharply, however, as a result of the big spike in steel prices (see graph earlier in article).

S&P Global Market Intelligence

What happened was that there was a lag time between locking in prices to Array’s customers and the actual procurement of steel. So ARRY charged their customers the appropriate price that would have been a 20% margin at the then current steel price, but then steel shot up and Array had to eat the difference.

It was a clear mistake, but Array learned and has since fixed their supply chain so as to match the pricing of their customers to the pricing at the time of procurement.

This alone is poised to return margins to their formerly higher level. On the 2Q22 earnings call CEO Kevin Hostetler said:

“we still stand by our high teens, low 20s exit rate on margins than we certainly do. We feel really good about that. We see that trajectory. I don’t think anything is changing our assumptions in that with what we see in the next 6 months or so”

At this point I think it is worth pointing out that the 2Q22 call was before the IRA was passed. Thus, the margin recovery is not coming from subsidies, but rather from the fix to their supply chain.

The aforementioned IRA subsidies have the potential to take margins much higher given their magnitude relative to the cost structure.

An enormous pipeline of projects

As of the latest quarter, ARRY had $1.9B of projects awarded or under contract:

“Total executed contracts and awarded orders at June 30, 2022 were $1.9 billion, with $1.5 billion from our Array Legacy Operations segment and $0.4 billion from STI Norland. The $1.9 billion represents an increase of 110% from June 30, 2021.”

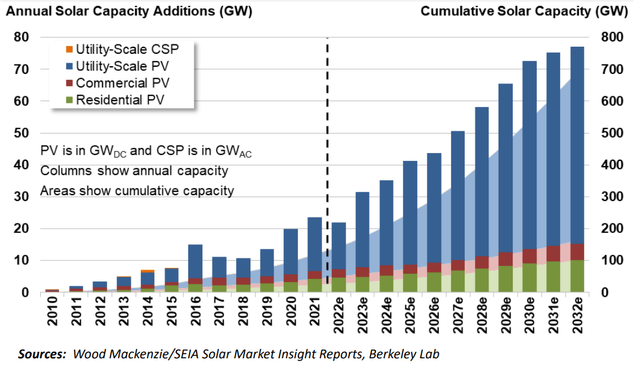

I posit that $1.9B is only the tip of the iceberg as the number of solar projects is skyrocketing. A recent study from Berkeley Labs projects ramping solar project rollout through 2032.

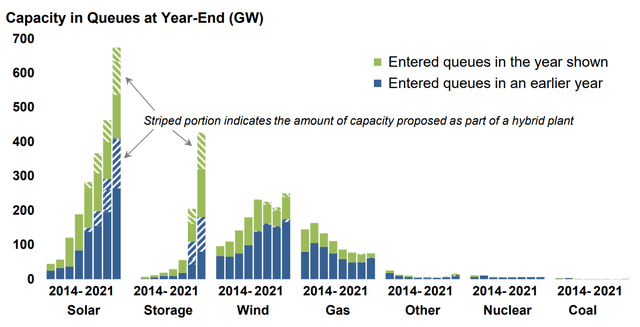

The main driver behind this is that solar is dominating energy capital spending. A certain amount needs to be spent on energy production each year to keep up with energy demand and that capital is overwhelmingly going to solar.

These numbers are through 2021 so they are before the stimulation of the IRA. With sizable additional subsidies that outpace the solar subsidies previously available, the forward volume of solar construction should be quite large.

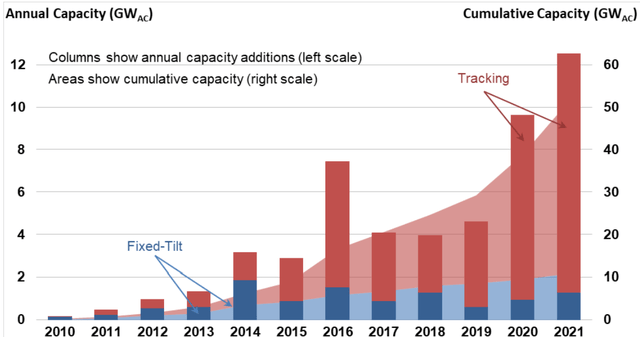

Array’s slice of this pie is the tracking systems and increasingly solar projects are being built with single axis tracking systems like the ones Array builds.

In 2021, about 90% of capacity was built with tracking and nearly all of that was single axis.

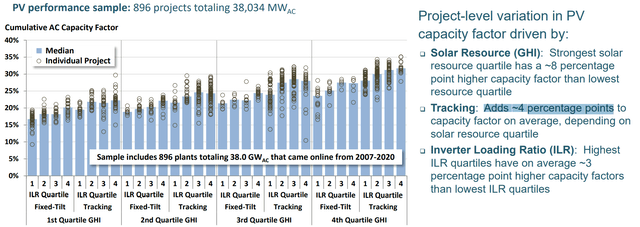

Trackers are quite cost effective since they are not terribly expensive but substantially increase the efficiency of the panels. On average, trackers add 4 percentage points to capacity factor.

That may not sound like much, but 4 percentage points when capacity factor is otherwise around 20% is a roughly 20% increase in output of the panels.

So going forward, here is how I see demand.

Solar projects were plentiful in 2021 and were expected to ramp up due to demand. The tax incentives provided in the IRA make solar projects more profitable for the entire supply chain. That represents a positive shift in the supply curve. Basic economics teaches us that a positive shift in the supply curve increases the overall quantity of units produced.

Additionally, an increasing percentage of solar arrays are being built with trackers. Thus, Array Technologies is getting a slightly bigger percentage of a much bigger pie.

This increased volume should have amplified impacts on bottom line earnings because Array is on the cusp of 2 sources of margin increase.

- The restoration of normal margins from fixing timing issues involving steel prices

- Direct and substantial subsidy from the IRA

Higher revenues at higher margins means much higher earnings.

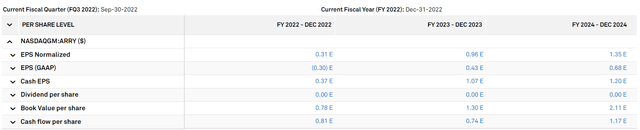

Indeed, consensus estimates reflect this with normalized, GAAP, and Cash earnings expected to climb to $1.35, $0.68, and $1.20 by 2024, respectively.

S&P Global Market Intelligence

That level of growth makes Array undervalued at $17.53. Current multiples are quite low relative to other companies with that pace of growth.

I think there is potential for ARRY to beat consensus estimates as most of the estimates came out before the IRA was passed.

Risks to thesis

Various parts of the solar development process require skilled labor which is in short supply. This may slow the development pipeline.

At this point it is highly unclear who will capture the value provided by the subsidies. Default assumption is that it will be shared among industry participants as well as the end user, but that could change as bottlenecks emerge.

Be the first to comment