Eoneren

The US Dollar has hit a 20-year high. Currency is often counterintuitive in that strength can be a headwind. Indeed, this is proving to be a substantial headwind for large portions of the NASDAQ and S&P. IBM (IBM), for example, cut its guidance largely as a result of forex headwinds.

Currency functions as a multiplier on revenue. If there is no change to exchange rates from when a project was initially underwritten, the multiplier will be 1.00. However, when currency fluctuates this number can move substantially, and right now, the US dollar has strengthened so significantly that the multiplier is well below 1.00, making each sale overseas far less effective.

Currency headwinds bigger than normal

The magnitude of the currency headwind is abnormally large for 2 reasons:

- Companies have become increasingly international in their sales.

- The fluctuation to exchange rates has been quite significant.

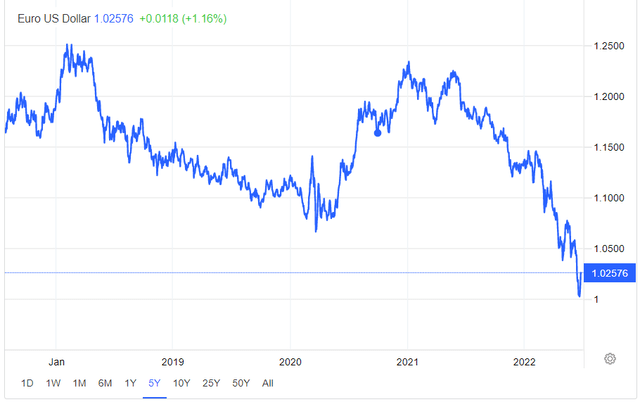

If we look at the Euro, it has eroded from about 1.2 U.S. dollars to just barely over 1.0 U.S. dollars.

The U.S. dollar has also strengthened against the Chinese Yuan from 6.4 Yuan to 6.75 Yuan.

I anticipate substantial weakness this earnings season as a result of exchange rates. Fortunately, there are ways to evade this challenge with certain areas of the market being immune or even benefitting from the strong dollar.

3 ways REITs outperform with strong dollar

There are 3 categories by which REITs come out ahead in this strong dollar environment

- By not having exposure to currency

- By having substantial Euro-denominated debt

- By being exposed to net importers

The portion of sales for the broader market that comes from overseas is variable but consistently rather high. It peaked in 2017 at 43.6% of S&P revenues coming from overseas.

In contrast, the majority of REITs are domestic with properties in the U.S. collecting rents in U.S. dollars. We can now add this to the list as yet another headwind that is harsher for the broader market than it is for REITs:

- Inflation (REITs benefit from inflation)

- Rising interest rates (REITs have lower duration which mitigates impact)

- Currency (REITs are mostly domestic)

The reduced exposure is particularly true of small and mid-cap REITs. Some of the large caps do have international properties.

Euro-denominated debt

During the zero interest rate environment, REITs had the opportunity to lock in cheap debt. Those with good balance sheets could get debt at low rates, and those with European exposure could get even cheaper rates with Euro-denominated notes. Interest rates in Europe have been consistently lower than in the U.S., so some opted to overleverage in Europe to lock in the basically free financing.

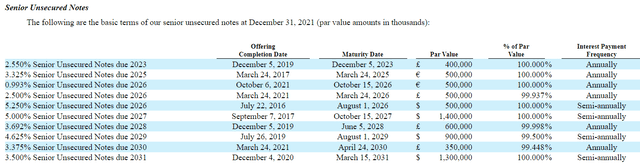

One of the greatest beneficiaries of this opportunity is Medical Properties Trust (MPW). Below is their debt table:

MPW successfully issued £1.85B pounds and €1.0B Euros of debt at exceedingly low interest rates. With the other currencies weakening since issuance, MPW’s interest burden is further reduced and its debt load is slightly lower.

This largely offsets MPW’s revenue exposure in these areas. Since MPW overleveraged in Europe and underleveraged in the U.S., they do not have to redomicile foreign revenues. The earnings made in Europe pay off European loans making it essentially hedged to currency.

Net importers

Retail is one of the areas that REITs will particularly benefit from with regard to the strong dollar. Retailers who buy goods from overseas and sell in the U.S. will get expanded margins, but the challenge with buying the retailers themselves is that most of the publicly traded ones also sell around the world.

However, in buying the retail real estate here in the U.S. you are exclusively getting exposure to the U.S. sold products. Ralph Lauren (RL) sells all over the world, but if you own a brick and mortar store in the U.S. with Ralph Lauren as a tenant, that particular store is going to get currency benefitted imported goods being sold for U.S. dollars which raises the margins of that particular store.

It’s not huge, but it might add a couple of percentage points to the productivity of the real estate which in turn increases the rent it can collect via either percentage rents or market rents upon lease rollover.

My retail REITs of choice are Whitestone (WSR), Kite Realty (KRG) Spirit Realty (SRC) and Simon Property (SPG). Note, however, that SPG is net harmed by the strong dollar as it has substantial international holdings.

Don’t overtrade it – just be aware

While it reduces the thrust of the article, I don’t think one should drastically alter their portfolio just because currency exchange rates are bouncing around. If a company misses earnings due to exchange rates the market is usually quite quick to forgive them.

Think of currency as just an additional factor to consider. If an already strong stock is benefitting from currency, it is incrementally stronger. I am leaning in the direction of the beneficiaries but not uprooting to capture a couple of percentage points.

Heading into earnings season, it behooves us to be aware that there will be significant exchange rate impacts on earnings. There will be bad reports that end up hitting estimates due to a forex benefit and good reports that end up missing due to currency.

Don’t make the mistake of just looking at the headline number. Know the cause of misses and beats and make the adjustment for currency.

Be the first to comment