Baris-Ozer

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 22th.

The Dividend Aristocrats are some of the most popular investment in income and retirement circles, and with good reason. The Dividend Aristocrats encompass all S&P 500 components with at least twenty-five consecutive years of growing or stable dividends. The Dividend Aristocrats are all relatively safe, blue-chip companies with outstanding dividend growth track-records, making them perfect investment for most long-term dividend growth investors. The more traditional Dividend Aristocrats only include large-cap U.S. equities, without mid-cap or small-cap exposure. For investors looking for some mid-cap exposure, we have the ProShares S&P Midcap 400 Dividend Aristocrats ETF (BATS:REGL).

REGL is exactly what it says on the tin: an S&P 500 Mid-Cap Dividend Aristocrats ETF. REGL offers investors diversified exposure to mid-cap U.S. equities with outstanding dividend growth track-records. REGL’s outstanding dividend growth track-record, good performance, and cheap valuation, make the fund a buy.

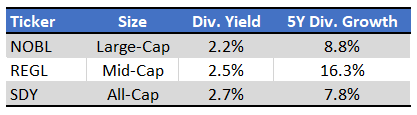

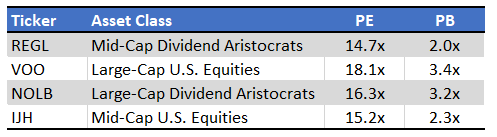

As a final point, thought to include a quick table with three ETFs targeting Dividend Aristocrats of different market-caps. Large-caps are the more traditional, lower risk Aristocrats, but the mid-cap and all-cap ETFs might provide added diversification, and higher yields and / or dividend growth.

Seeking Alpha – Chart by Author

REGL – Basics

- Investment Manager: State Street

- Underlying Index: S&P High Yield Dividend Aristocrats

- Dividend Yield: 2.45%

- Expense Ratio: 0.40%

- Total Returns CAGR 5Y: 6.72%

REGL – Overview

REGL is an equity index ETF, tracking the S&P MidCap 400 Dividend Aristocrats Index. It is a relatively simple index, including all mid-cap U.S. equities with at least 15 consecutive years of growing dividends, and meeting a basic set of inclusion criteria. It is an equal-weighted fund, with industry caps meant to ensure industry diversification.

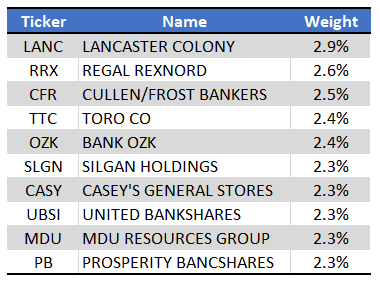

REGL has some diversification, but markedly less than average for an equity fund. REGL currently has just 47 holdings, while most broad-based U.S. equity index funds invest in hundreds, a couple even in thousands, of securities. Concentration is somewhat below-average, with the fund’s top ten holdings accounting for just 24% of its value. These are as follows.

REGL

REGL’s holdings are generally not household names, due to their comparatively small size.

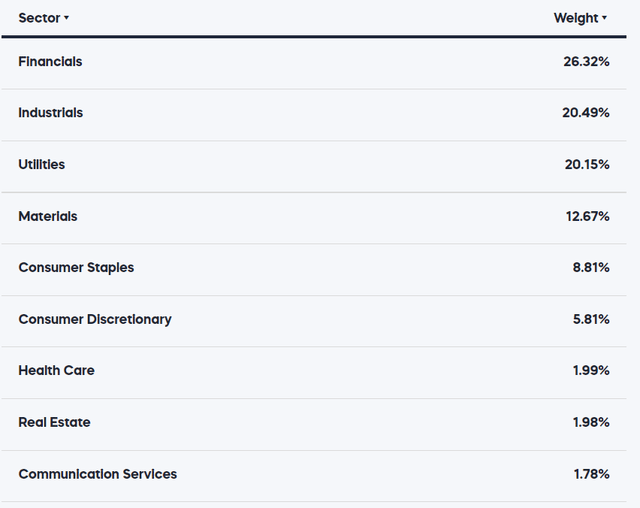

REGL does provide investors with exposure to most relevant equity industry segments. As is common for dividend equity ETFs, REGL is overweight old-economy industries like financials, industrials, and utilities, due to their longer business and dividend growth track-records. REGL has negligible / zero tech exposure, as tech companies rarely have long, sustained dividend growth track-records.

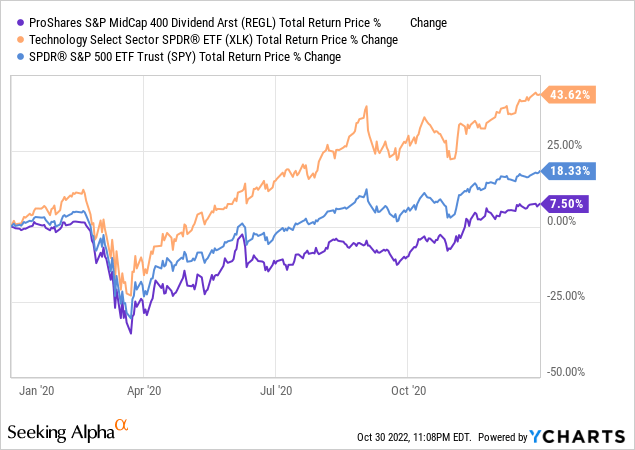

REGL’s underweight tech position means that the fund’s relative performance is strongly dependent on the relative performance of said industry. The fund tends to underperform when tech outperforms, as was the case during 2021, during which tech soared as the coronavirus pandemic led to significantly increased demand for software and online services.

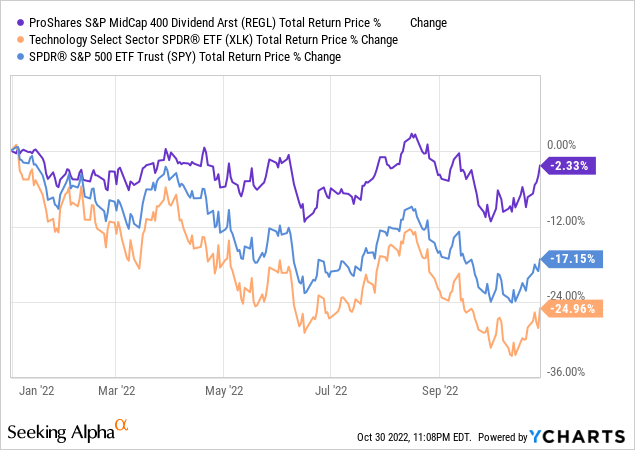

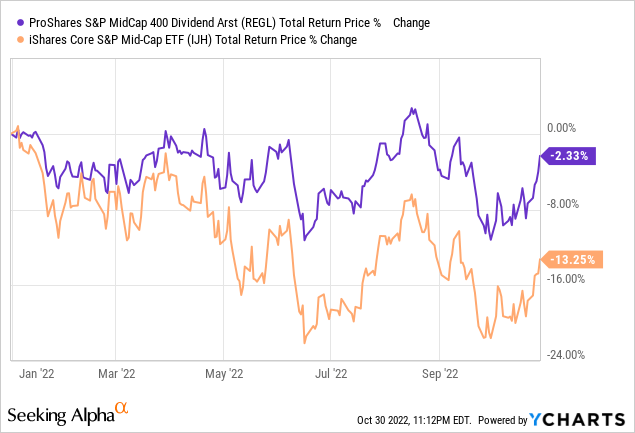

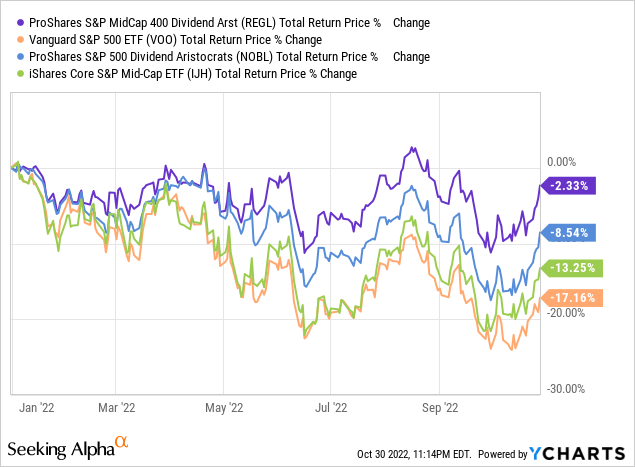

REGL tends to outperform when tech underperforms, as has been the case YTD, during which tech valuations have started to normalize.

In my opinion, REGL’s underweight tech position is neither a positive nor a negative, but is an important fact for investors to consider. The fund might be inappropriate for tech bulls, but might be particularly compelling for tech bears. In my opinion, tech valuations are currently reasonable, so further outperformance from being underweight tech is unlikely.

In general terms, although REGL does provide investors with some diversification, the fund is markedly less diversified than most broad-based U.S. equity index funds. Lack of diversification increases risk, volatility, and the possibility of underperformance relative to benchmark indexes.

In my opinion, and considering the above, REGL would make an inappropriate core or significant portfolio holding. Position sizes should be kept relatively small too, as a risk-reduction measure. Investors desiring significant exposure to dividend growth stocks should consider the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which focuses on large-cap dividend growth U.S. stocks, as an addition to REGL.

Besides the above, nothing much else stands out about REGL’s index or holdings. With this in mind, let’s have a look at the fund’s investment thesis.

REGL – Investment Thesis

REGL’s investment thesis is quite simple, and rests on the fund’s outstanding dividend growth track-record, above-average performance track-record, and cheap valuation. In my opinion, these combine to create a strong, well-rounded investment opportunity, and one which is particularly well-suited for long-term dividend growth investors.

Let’s have a look at each of the points above.

Outstanding Dividend Growth Track-Record

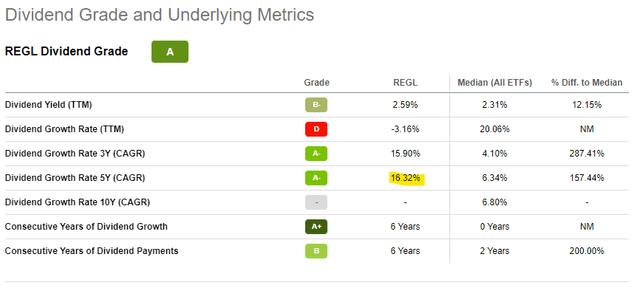

REGL invests in companies with at least 15 consecutive years of dividend growth. These are, almost by definition, outstanding dividend growth track-records, significant benefits for the fund and its shareholders. The fund itself has seen its dividends grow at a CAGR of 16.3% these past five years, a very strong figure. Assuming growth is sustainable, investors would double their dividends every five years.

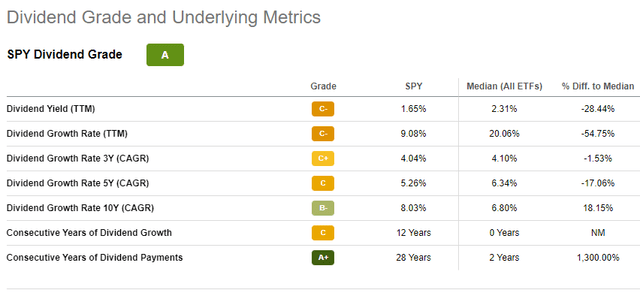

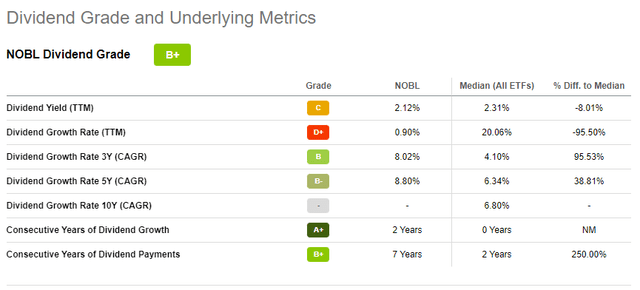

REGL’s dividend growth track-record compares favorably to its peers, with the S&P 500 growing its dividends at a 5.3% CAGR these past five years, 8.8% CAGR for NOBL.

On a more negative note, REGL’s dividends have stagnated YTD, even decreased a bit, by 3.2%. Looking through fund data and documentation, I’m not entirely sure why dividends have decreased, but composition effects from companies entering and leaving the index seems like the most likely culprit. ETF dividends are somewhat volatile, so volatility is a possible culprit as well. In any case, considering the fund’s outstanding long-term dividend growth track-record, and the track-record of its underlying holdings, I’m confident that growth should resume in the coming months.

REGL’s strong dividend growth is a direct benefit for the fund and its shareholders. In my opinion, strong dividend growth is also indicative of underlying business strength, an even greater benefit. Only the strongest, most resilient companies have the capacity to grow their dividends uninterruptedly for decades, throughout recessions and downturns. Only companies with shareholder-friendly management teams with long-term visions have the desire to do so. REGL’s underlying holdings are all strong businesses with fantastic management teams, as evidenced by their dividend growth track-records.

Good Performance Track-Record

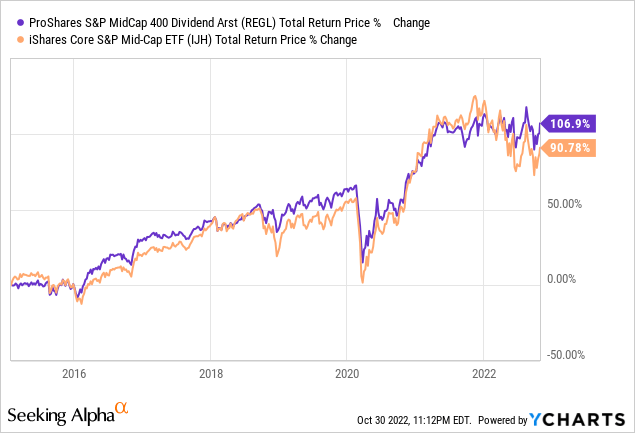

REGL’s performance track-record is reasonably good, if perhaps not outstanding. The fund tends to outperform relative to benchmark mid-cap U.S. equity indexes, as has been the case since inception.

REGL’s performance has been particularly strong YTD, as the fund’s overweight old-economy industry positions have fared relatively well these past few months, and as its underweight tech position served to significantly reduce losses from tech valuations normalizing.

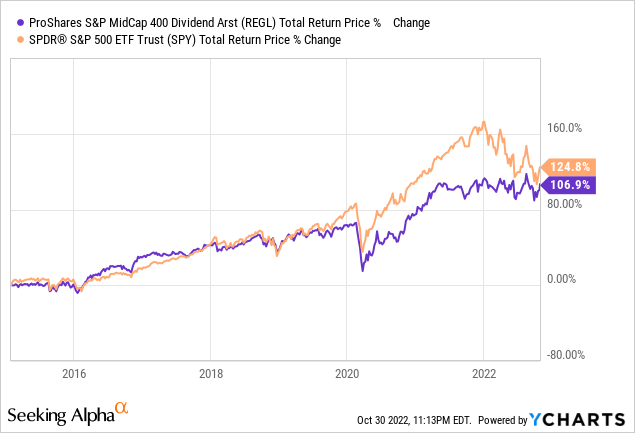

On a more negative note, the fund has underperformed relative to broader U.S. equity indexes, including the S&P 500, since inception.

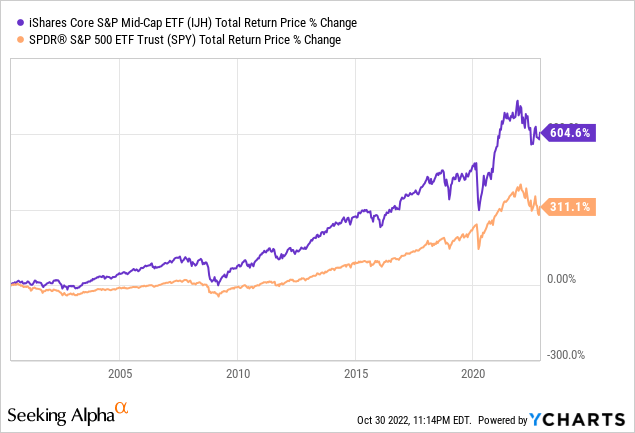

REGL’s underperformance is, in large part, simply the result of bad timing. Mid-caps underperformed from 2017 to 2021. REGL opened in 2015, so has mostly existed during a period of mid-cap underperformance, recent gains notwithstanding. Importantly, there are few reasons to believe that mid-caps will underperform moving forward. Valuations are reasonable, smaller companies tend to outperform larger ones, and investor sentiment surrounding mid-caps have improved as of late. Benchmark mid-cap equity indexes have actually outperformed large-cap equity indexes for decades, and by quite a large margin.

Considering the above, I see no reason to believe that REGL will underperform relative to broader equity indexes long-term.

In my opinion, REGL’s performance track-record is most accurately characterized as good, with the fund’s outperformance relative to its benchmark being its clearest positive. I see the fund’s performance as something of a benefit to shareholders, although a relatively minor one.

Cheap Valuation

REGL focuses on old-economy industries like financials and industrials. These industries currently sport below-average valuations, due to a relative lack of investor interest in these industries. Investors have mostly focused on high-growth tech these past few years, especially during and in the immediate aftermath of the pandemic, leading to skyrocketing tech valuations, and below-average valuations in most other industries. Although the situation has started to / mostly reversed itself by now, a modest valuation gap remains. REGL focuses on these cheaply valued industries and stocks, and so sports a relatively cheap valuation.

Fund Filings – Chart by author

REGL’s cheap valuation could lead to strong capital gains moving forward, assuming valuations normalize. Valuations have started to normalize, with the fund outperforming all year, as expected. As valuations remain somewhat depressed further outperformance is likely, in my opinion at least.

REGL’s cheap valuation is a benefit for the fund and its shareholders, although a relatively small one, as valuations have mostly normalized by now.

Conclusion

REGL’s outstanding dividend growth track-record, good performance, and cheap valuation, make the fund a buy.

Be the first to comment