cagkansayin/iStock via Getty Images

Shares of Regeneron Pharmaceuticals (NASDAQ:REGN) are down 8% since the company announced the purchase of global rights of Libtayo from Sanofi (SNY), a sign of the market showing a lack of appreciation for the deal. The deal is not as simple as just the purchase of rights to Libtayo because it has other terms, such as an acceleration of payments from Regeneron to Sanofi, but overall, looks like a great deal for the company.

The cost of global rights for Libtayo

Regeneron paid $900 million upfront for Libtayo and has committed to pay an 11% royalty on global net sales. Regeneron will also pay Sanofi two milestone payments – $65 million if global net sales of Libtayo exceed $475 million in 2022 and $35 million if global Libtayo sales exceed $475 million in 2023. This seems a low bar and it is more than likely that Regeneron will make both payments in the next two years since the annualized net sales run rate after Q1 is already $500 million and Libtayo is growing more than 20% Y/Y.

Regeneron will take over the development of Libtayo and will pay 100% of the R&D and commercialization expenses and it will record 100% of global net sales.

There are also terms that are not tied directly to Libtayo, which make this deal more expensive. As of March 31, 2022, Regeneron has $3.1 billion to pay back to Sanofi for the expenses Sanofi incurred under the antibody collaboration. Until this deal was announced, Regeneron was obligated to make repayments out of the profits from this collaboration and the rate was 10%. The rate will now increase to 20%.

The repayments in 2020 and 2021 were $86.3 million and $148.5 million, respectively, thanks to the significant increase in Dupixent revenues and collaboration profits. This number has already increased to $46.9 million in the first quarter of 2022, and when the repayment rate doubles in the third quarter, Sanofi could get more than $300 million this year (as it will be applied only in the second half of the year or in Q4, depending on when the deal closes) and more than $500 million in 2023, assuming profits of the collaboration continue to rise, and they should.

There is also $35 million in repayments under the oncology collaboration with Sanofi and Regeneron will pay a 0.5% royalty on global sales of Libtayo until the balance is fully paid off.

Regeneron expects the acceleration in repayments to shorten the payback period by three to five years.

A no-brainer deal for Regeneron

While the market has apparently punished the company for making this deal, I believe it is a great one for Regeneron. Yes, there is the increased repayment rate and the $900 million upfront payment, but what Regeneron is getting far outweighs these costs.

Regeneron gets full control of Libtayo and it will have the freedom to develop and commercialize Libtayo, without Sanofi’s interference. This freedom also allows for greater investments in combination treatments and full control of the pricing and commercialization strategy of such combinations.

And Regeneron also gets higher profits in the long run. Sanofi’s part of Libtayo is now down from a 50:50 profit split to an 11% royalty. In simple terms, if Libtayo generates $1 billion in net sales and if the profit is $500 million, Sanofi would now get a $110 million royalty instead of $250 million for its share of profits. And, at scale, profits can be a lot higher. For example, Regeneron has a 50:50 profit/loss split with Bayer on Eylea and the profit margin (as a percentage of net sales) was 76% in 2021 (based on Regeneron’s part being 38%).

And there is a broad pipeline supporting this transaction. Libtayo is already approved as monotherapy for the treatment of advanced cutaneous squamous cell carcinoma and advanced basal cell carcinoma, and it is the first approved anti-PD-1 product for both indications. It is also approved as monotherapy for the treatment of first-line non-small cell lung cancer.

The next and much larger indication is under regulatory review with approvals in the United States and Europe expected in the second half of the year – combination with chemotherapy for first-line non-small cell lung cancer. On the call with analysts after the deal announcement, management stated that this is currently an $8 billion market and about eight times larger than the monotherapy treatment for the same indication.

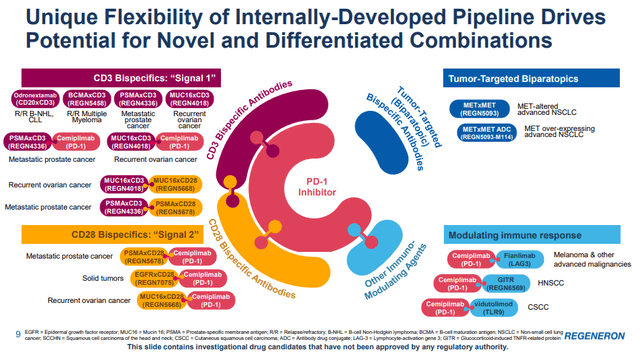

Beyond monotherapy and combination with chemotherapy, there is a broad development program with Regeneron’s internal candidates and the company is collaborating with other companies.

The presentation slide below looks complicated but shows the multipronged approach with Libtayo.

I understand that it is hard and probably next to impossible to challenge the leadership position of Merck’s (MRK) Keytruda, but Libtayo does not need to be the leading anti-PD-1 drug for this deal to pay healthy dividends in the long run. The key going forward is to find good combinations that could have an edge over Keytruda and its combination approaches.

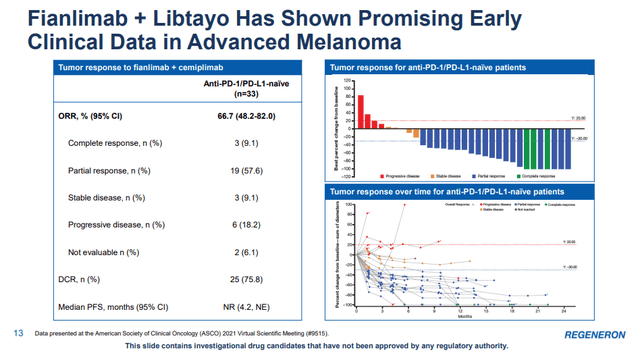

An example of such an approach is the combination of Libtayo and Fianlimab, Regeneron’s anti-LAG-3 antibody. LAG-3 stands for lymphocyte-activation gene 3, and it is an immune checkpoint receptor that delivers an inhibitory signal to activated T cells. In melanoma, LAG-3 expression has been shown to be associated with therapeutic resistance to anti-PD-1, and inhibition of LAG-3 in addition to PD-1 may enhance the antitumor effect.

The combination has generated encouraging early-stage data in advanced melanoma with an overall response rate (‘ORR’) of 66.7% in 33 patients and a disease control rate (‘DCR’) of 75.8%. The company claims clinical activity was similar to the combination of anti-PD-1 and CTLA-4 mechanisms, but with lower demonstrated events of treatment-emergent adverse events.

Overall, this looks like a no-brainer deal for Regeneron. The upfront cost is not too high, and the acceleration of repayments does mean Regeneron needs to pay Sanofi more in the following years, but it will free itself of this repayment burden sooner and will have higher profitability in the back half of the life of the collaboration.

Conclusion

The market has not appreciated the Libtayo deal, sending Regeneron’s share price 8% lower during a period of relative stability for the biotech market (the Nasdaq Biotechnology index is just slightly lower during this period), but I believe this deal is great for the company in the long run as it gives full control of the asset and improved long-term economics.

But this is not the main reason Regeneron is well-positioned for long-term growth. Libtayo is just a part of an expanding product portfolio and pipeline and Dupixent and Eylea are much larger and more important products. There is also a broad pipeline behind these products and given the increasing cash flows, we are likely to see the company become more active on the business development side. The acquisition of global rights for Libtayo and the acquisition of Checkmate Pharmaceuticals represent the first two steps in this direction.

Be the first to comment