jittawit.21/iStock via Getty Images

“It’s funny how people choose to believe in magic, miracles, fate and all sorts of superstition but not in themselves!“― Mouloud Benzadi

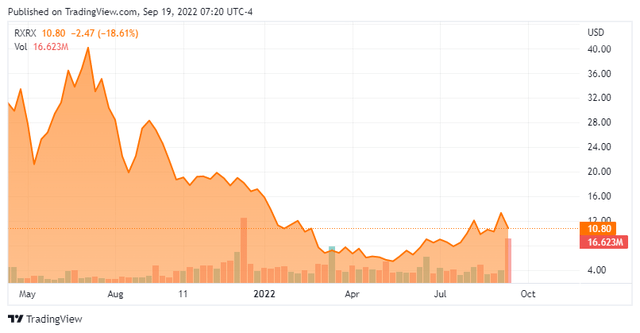

Today, we take our first look at Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX). The stock is now deep in Busted IPO territory. Do the shares merit that fate or is something better ahead? An analysis follows below.

Company Overview:

Recursion Pharmaceuticals Inc. is based out of Salt Lake City, UT. This clinical-stage biotechnology company’s mission is to ‘decode biology by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery‘. The stock currently trades just under $11.00 a share and sports an approximate market cap of almost $1.9 billion.

Recursion’s aim is to unite technology, biology and chemistry to advance the future of medicine. This is how the company describes how it intends to accomplish via its last quarterly earnings press release:

Earnings Press Release

The core of this effort is Recursion OS, a platform built across diverse technologies that continuously expands one of the world’s largest proprietary biological and chemical datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale – up to millions of wet lab experiments weekly – and massive computational scale – owning and operating one of the most powerful supercomputers in the world.“

So far, Recursion has now generated and controls over 16 petabytes of proprietary biological and chemical data and 2.4 trillion predicted biological and chemical relationships. The purpose of which is to turn the process of drug discovery into a more efficient and less costly search and validation problem.

Company Website

The company came public at $18.00 a share in April of 2021 to much fanfare and the shares touched the $40 level soon thereafter. Unfortunately for initial shareholders it has been a consistent decline down from those levels over the past five quarters.

The company does have several partnerships to develop drug candidates including with Bayer, Roche, Genentech and with Mila, the Quebec Artificial Intelligence Institute. Some of the details of these partnerships can be seen here. Revenue from these collaborative agreements was $7.7 million for the second quarter of 2022.

The company also has several drug candidates in mid-stage development and numerous others in earlier stages of development.

The company has received Fast Track designation and the European Commission Orphan Drug designation for REC-4881 to treat Familial adenomatous polyposis or FAP. This affliction is a rare inherited cancer predisposition syndrome characterized by hundreds to thousands of precancerous colorectal polyps. Phase 2 clinical trial for RECC-4881 for this indication should initiate soon. This trial was originally slated to begin in the second quarter of this year.

The company also has REC-994 in development to treat a type of neurovascular disorder called cerebral cavernous malformation or CCM. The first person of a 60 subject Phase 2 trial called SYCAMORE was dosed in March. CCM affects over 350,000 Americans annually and this diseases consists of an abnormally formed blood vessel that develops in the brain or spinal column causing risk for seizures, and progressive neurological deficits. REC-994 has Orphan Drug designation both in the U.S. and Europe. SYCAMORE continues to enroll patients.

The company is also developing REC-3599 for a rare genetic disorder, infantile GM2 gangliosidosis or GM. REC-3599 has Orphan Drug status for this indication. A decision to delay a Phase 2 study around REC-3599 to treat GM by some approximately two years was made in March of this year.

Finally, the company has REC-2282, which is being developed to treat patients with Neurofibromatosis type 2. A Phase 2/3 90-person randomized study is currently enrolling subjects.

The company has numerous other efforts within its pipeline but they are earlier stage candidates and not germane to this particular analysis.

Analyst Commentary & Balance Sheet:

The analyst community has largely turned negative since the company’s last quarterly earnings report on August 9th. Since then, SVB Securities ($10 price target), Goldman Sachs ($8 price target) and Bank of America ($10 price target) have all reissued Hold ratings. Berenberg Bank ($38 price target) has maintained its Buy rating while KeyBanc initiated the shares with a new Outperform rating, $20 price target and the following commentary:

Recursion is at the “forefront” of an emerging industry, advancing cloud computing and data science to “disrupt” traditional drug discovery. The company to date has initiated drug development programs, four of which are in clinical trials.”

Several insiders are frequent sellers of the stock and so far in the third quarter they have disposed of nearly $2 million worth of shares in aggregate. Approximately 13% of the outstanding float is currently held short. After posting a net loss of $65.6 million for the second quarter, the company ended the first half of 2022 with approximately $515 million of cash and marketable securities on its balance sheet. The company has negligible long term debt.

Verdict:

Recursion Pharmaceuticals has some positive traits. It is pioneering what could turn out to be an intriguing developmental approach to drug discovery which has garnered partnerships with several well-known drug giants. The company has several ‘shots on goal’ and is well-funded at the moment.

On the downside, there is not a whole lot of information around this company. There are no earnings call transcripts available and the company does not do much in the way of corporate presentations, but this is the latest corporate deck. In addition, Recursion Pharmaceuticals has seen a couple of key mid-stage trial push out start dates this year. One reason the analyst community doesn’t seem that sanguine on the company’s prospects right now. That also makes it difficult for an investor to settle on an appropriate development timeline with any certainty.

Therefore, the conclusion is the company’s destination is hard to project at the moment and no investment recommendation can be made around RXRX at the present time. However, the company’s story is interesting enough to circle back on once Phase three development commences.

“Fate usually sends us back to the drawing board.”― Bert McCoy

Be the first to comment