zoranm

U.K. consumer goods group Reckitt Benckiser (OTCPK:RBGPF) is showing positive signs that its core business continues to move forward well, while it puts its costly 2017 infant nutrition acquisition increasingly in the rearview mirror. I see the shares as fairly valued.

The Business is Performing Strongly

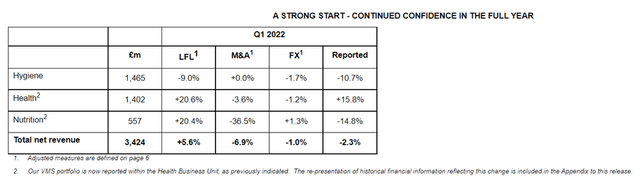

The first quarter saw like-for-like revenue growth, although most of that was down to price and mix changes, as I discuss below. I think it is noteworthy how unevenly the business is performing. While the health division is performing well, it is a different story in the hygiene part of the business.

I do not think the hygiene fall is too much to be worried about long term, as I see it as a reflection of the elevated demand seen during the pandemic falling back closer to normal. Volumes were 12% lower, which the company said was primarily due to a decline in Lysol volumes. Although the business may be getting back closer to normal, I would be surprised if it does not see a long-lasting structural uptick in demand as a result of Covid-19. Although Lysol declined around 30% in the quarter, that was compared to 70% growth in the quarter last year. So the hygiene business seems to be doing very well compared to before Covid-19.

I think we are now seeing the benefit of a more focused Reckitt that is starting to move beyond the disastrous infant formula acquisition that has been dogging it for years. The company is forecasting like-for-like net revenue growth towards the upper end of its guidance of +1-4%.

Infant Nutrition is Still a Problem, but Getting Smaller

Reckitt has been trying to offload its remaining infant nutrition business. Bloomberg reported last month that it is considering shelving the $7bn sale but the company has not commented on that report.

The business has long been seen as a millstone around Reckitt’s neck. If it can unload it for $7bn, I see that as good news for Reckitt. If it can sell it but gets less, I do not think it is much worse than expected: at this point, shareholders are well aware that valuing the business has never been Reckitt’s strength. If it has to keep holding the baby, then so be it. The business was overvalued but it is not rotten and Reckitt has talented managers so holding onto it rather than selling it at a song makes strategic sense until markets become more favorable again to a sale.

How Big a Risk Is Inflation?

One thing that surprises me about this point is how comfortable it sounds about its ability to manage inflation. Consider this from its first quarter trading statement: “Inflation on our cost of goods sold has increased from low teens to high teens based on current commodity pricing” and yet the firm also said, “Despite significant cost inflation, we expect adjusted operating margins in-line with prior year and current market expectations.“

Now compare that to rival Unilever (UL). In its first quarter statement, that company said, “There is more to do as we navigate our business through unprecedented cost inflation, but we are making good progress.” It went on to say, “We expect underlying operating margin for the first half to be within our guided 2022 range of 16% – 17%. As a result of the forecast increase in costs in the second half, we currently expect the full year underlying operating margin to be at the bottom end of that range.”

In fairness, both companies reckoned they would come in in line with expectations. But Unilever is already guiding to the bottom end of its range on margin expectations, just one quarter in. Its message was also notably more downbeat than Reckitt’s.

First it’s worth noting the obvious, which is that cost inflation on this scale is a phenomenal thing for a business to need to deal with. That said, one of the arguments for holding shares in the owners of premium brands is that those brands give pricing power that can be used to overcome inflation. Unilever’s first quarter results showed that working in practice: underlying sales growth of 7.3% was actually 8.3% pricing growth and 1% volume decline. In other words, Unilever’s pricing power allowed it to raise prices 8% and still hang onto 99% of purchase occasions. I think that is pretty impressive.

In its own first quarter, Reckitt actually saw 0.3% like-for-like volume growth and a 5.3% benefit from price and mixing. So its pricing power seems to be working even better than Unilever’s. However, putting prices up by c. 5% while input costs are up close to 20% and expecting to stick to margin expectations strikes me as odd. However, for now at least, Reckitt seems to have inflation under control which is to its credit.

Reckitt Benckiser’s Valuation Looks Reasonable

Since I last covered the company with a neutral rating in November in Reckitt: The Consumer Goods Maker Looks Fairly Valued, the shares have retreated 6%.

Given the strength shown by the company since then, I continue to see the valuation as fair but not especially exciting. Reckitt’s earnings are hard to forecast given how much havoc infant nutrition has played with the accounts in recent years but the market cap is around 20 times 2018 earnings, which I think the company can hit again in the next couple of years if things continue as they are.

The shares yield 2.8%. They are now 20% cheaper than they were in 2017. The business has changed a lot but I am upbeat about where it goes from here. Its stable of high-quality premium brands gives it pricing power, as we are seeing, and could drive substantial profits.

Be the first to comment