LilliDay/E+ via Getty Images

This article’s title is a play on the famous line spoken by the three witches in Shakespeare’s Macbeth (Act IV, Scene I): “Double, double toil and trouble; Fire burn and cauldron bubble.”

Current market conditions

With inflation at levels not seen in decades, war in Europe, the cost of food, gas, and shelter shooting through the roof, and a recession looming, the Dow Jones Industrial Average Index (NYSEARCA:DIA) is nearing bear market territory.

The DIA ETF is down 17% YTD and teetering on the edge of bear market territory. The index is trading at the low end of the trend channel, basically a falling knife at present.

The DIA is trading at a new 52-week low presently. What’s more, it has completed a round trip back to the lows of 2021.

The five biggest losers leading the way are Boeing (BA), Disney (DIS), Salesforce (CRM), Nike (NKE), and Home Depot (HD). All down over 30% for the year.

The five biggest Dow winner are Chevron (CVX), Merck (MRK). Travelers (TRV), Amgen (AMGN), and Dow (DOW). Chevron leads the way with an astounding 42% gain in the year.

5 Biggest DOW Winners (Finviz)

Even so, I’m not so sure the pain is over quite yet. There are times to make money in the markets and times to not lose money. We’re now in a time to not lose money. A time to focus on preserving capital and keeping your nest egg from being decimated. The market selloff has been a complete liquidation. This is the fourth major market downturn I have endured in my investing career. I feel the current market conditions may be a culmination of the after effects of those events. Let me explain.

What’s Past is Prologue

The irrational exuberance of the late 1990s culminated in the Dot Com Bubble bursting in March 2000. Then, 9/11 happened in September of 2001, a terrible tragedy. With the economy still in shambles and no one wanting to invest in stocks coupled with the added pressure of the 9/11 attacks, the Bush administration changed the mortgage rules so that just about anyone with a pulse could qualify to buy a home with a NINA (no asset no income) loan. The subsequent housing boom was as insane as Dot Com bubble. Nonetheless, the house of cards eventually fell with the bubble finally bursting in 2008. Once again, the economy was in trouble. Moreover, it was in even in deeper distress due to the fact the issues from 2000 and 2008 were compounded which essentially created “The Great Recession.”

However, the Federal Reserve came to the rescue with the ZIRP (Zero interest Rate Policy) program. This greased the market’s wheels once again producing one of the greatest stock market bull runs in history, until the COVID pandemic and ensuing crash of 2020 occurred. At this point it was so bad the Fed and Congress implemented some of the most egregious and shocking policies ever employed to keep the economy from falling off a cliff. These policies included free helicopter money, trillion-dollar stimulus packages, and buying mortgage back securities and treasuries to the to tune of $9 trillion.

This has put the Fed firmly between a rock and a hard place at present. Fed Chair Powell must raise rates due to out-of-control inflation just as the economy is on the verge of going into recession. The three major issues I see going forward are out of control inflation, the Fed’s heavy hand destroying demand, and a looming global recession. Let’s review each.

Out of control inflation

It appears we have reached peak inflation frustration folks! Nonetheless, so far it appears consumers seem to be holding up well. The job market still appears strong. Yet, I have several friends living month to month, as a majority of Americans do, and they are having to make hard choices with their rent, food, and fuel costs shooting through the roof. This leads me to believe a recession of some magnitude at the very least may be on the table, particularly with the Fed’s hawkish policies coming into play. Let me explain.

Fed’s hawkish policies

Man, has the Fed gotten it all wrong this time around or what? This has got to be one of the worse miscalculations in the history of the Fed as far as I’m concerned. Powell’s legacy as Fed Chair will go down in infamy for stating inflation was only “transitory.” At this point, a soft landing is clearly off the table. After the hotter than expected CPI number released last week, the word is they will raise 75 basis points ad infinitum potentially until they reach the terminal rate. Lest we forget, they are about to begin quantitative tightening on June 15as well.

The balance sheet roll off begins

Quantitative tightening refers to the strategy of permitting a capped level of proceeds to roll off the $9 trillion balance sheet each month. The number being bandied about at present will reach $95 billion by August. The lowering of liquidity levels due to quantitative tightening could be the final nail in the market’s coffin engendering a recession.

Looming Recession

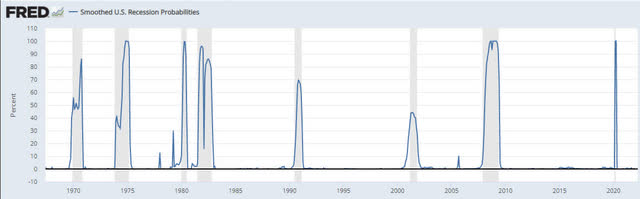

Recessions have occurred through out history. It’s part of the boom-and-bust economic business cycle.

Recessions Throughout History (St. Louis Fed)

If you notice on the above illustration a recession occurred after the 2000 Dot Com and housing bubbles burst. However, the recession after the housing burst was much worse. So much so, it was referred to as “The Great Recession.” I submit this is because the issues from the 2000 Dot Com bubble were never fully addressed. Moreover, I posit the coming recession could be even worse. When the Fed’s punch bowl is finally removed, I expect market participants will go into withdrawals after being on a sugar high for the past 22 years. Nonetheless, the seeds of the coming boom and inevitably sewn during the current bust. Here’s why.

The seeds of the boom are sewn in the bust

Over the years, I have gained a reputation on Wall Street for my ability to preserve principal during times of market duress due to my successful navigation of the 2000 and 2008 bubbles. Furthermore, I warned investors to employ portfolio protection based on my intuition a market crash was coming due to the onset of the COVID pandemic in a Yahoo Finance article published in January of 2020 for being named Stock Picker of the Decade based on my track record. Thereafter, I was fortunate enough be documented calling the bottom at the March low in a follow up Yahoo Finance article as well. So, I completely understand the full cycle the market can take.

Yahoo Finance Article Dates (CNBC)

It’s never fun, but recessions are a necessary evil. The analogy I like to use is my dad making me trim the hedges each year. I dreaded having to trim the hedges. Even so, my father explained the importance of trimming the hedges. Frequent trimming is important for the health of hedges. Trimming out dead or diseased parts of the plant will keep the hedge healthier while allowing new growth to proceed. It’s the same for the markets. Every so often stocks selling for outlandish multiples must be trimming back as well as stocks of zombie companies with no earnings and declining revenues must be sheared from the markets completely. I will now wrap this up with by detailing my strategy going forward and the actions I’m currently taking.

The Bottom Line

With recessionary risks rising in the current late cycle environment, I’m laser-focused on identifying only the best-in-class high quality securities to provide income for expenses and capital appreciation for wealth creation. I believe maintaining a balanced portfolio composed of a diversified set of securities selected from a wide spectrum of market sectors, structures, and asset classes is a must in times such as these.

Furthermore, when navigating a high inflation environment, you will want to have a substantial portion of your portfolio invested in quality high dividend paying stocks. Dividend paying stocks help weather the volatile markets by providing stability in the midst of the madness. It’s time in the market not timing the market that creates true wealth. I always continue to DRIP and layer in to positions during downturns effectively employing a dollar coast averaging strategy. On the recent pullback, I have added to my positions in AT&T (T), Verizon (VZ), Bank of American (BAC), Ford (F), and Amazon (AMZN). You can buy more shares for the same amount of money when the price is less. Subsequently, when things turn around, your gains are greater. The time to buy is when stocks are on sale! Its just that simply my friends! You must have courage in your convictions to make money in the markets!

Final Note

There’s a fine art to investing during highly volatile markets such as these. It entails layering into or out of positions over time to reduce risk. I believe the markets have further to fall, of this I have no doubt. Yet, if you look at the chart of the past recessions, you will see that they always end, and don’t last nearly as long as expansions.

As a Veteran Winter Warrior of the US Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence my investing motto “patience equals profits.” And remember, sooner or later the selling will end and the market will turn higher. Here’s a picture of my unit loaded into the back of a C141 heading for home after spending a few months in the jungles of Panama in 1989, a vacation I thought would never end.

C141 Flight Out of Panama ( )

Those are my thoughts on the matter! I look forward to reading yours! Do you believe we are heading for a recession? Why or why not?

My New Marketplace Service Launches on June 28!

The Winter Warrior Investment service is launching on June 28! Please mark your calendars, so you can reserve your spot as a Charter Member! There will be a very special introductory price for a limited number of the first subscribers. The key objective of the service is to assist you in devising a robust retirement plan, allowing you to maintain and even improve your lifestyle while increasing wealth, so you never run out of money!

Be the first to comment