LilliDay/E+ via Getty Images

The current problems of the U.S. economy

The expansionary policy that the Fed adopted after the subprime mortgage crisis and specially to defeat the pandemic was unprecedented and may have led to a point of no return.

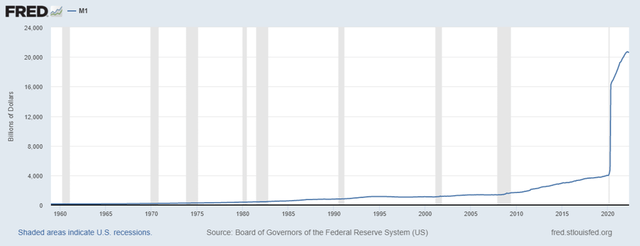

The M1 monetary aggregate during the pandemic had an abnormal increase that brought currency in circulation from $4 trillion to about $26 trillion in a short time. With such a sloping curve, no matter how much the FED may reduce its balance sheet it appears to be difficult to see how we can return to pre-pandemic levels; therefore, I view such high levels as “a new normality.”

M1 (Federal Reserve Bank of St. Louis)

What is more, problems in the supply chain and the war between Russia and Ukraine have only worsened the global macroeconomic picture, which to date is rather weakened. All these components have taken a major role in creating the main problem of 2022: high inflation.

These days we hear nothing but talk about the possible recession that will hit us all, but the data say something quite different: we are already in a recession. From a technical point of view the recession has already happened as the S&P500 (SP500) has collapsed by more than 20%, and from a purely economic point of view we are instead close to a recession. A recession is generally indicated by a declining GDP for 2 quarters in a row: Q1 was negative and there is a lot of uncertainty about Q2.

The Atlanta Fed’s GDPNow indicator predicts a GDP decline in Q2 of -2.1%, and combined with the previous Q1 of -1.6% would put the U.S. officially in a recession. To be more precise, however, defining the onset of a recession is not so simple since there are many variables to take into account, which is why this task falls to the National Bureau of Economic Research. However, since World War II, after 2 negative quarters we have always entered a recession.

I want to make it clear that the purpose of this article is not to create panic and alarmism, but to point out some objective problems that the U.S. economy must solve if it wants to continue its growth. No one can know how long a recession and its consequences may last since people’ forecasting ability is much less accurate than we believe. In the next few months, it could happen that Russia will end the war, inflation will peak, and supply chain problems will decline rapidly, but the opposite could also happen. Business cycles have always consisted of expansionary phases and contractionary phases, the important thing is to be fully aware of this. In the long run, returns are always positive, so getting overwhelmed by fear will only lead you to lose money. If you believe in your investments, you should not fear a bear market, but take advantage of it by averaging down.

Key data about a bear market

Although no one can predict a market bottom, we can, however, put the current recession in context with data from previous recessions. Statistics in this case can be very useful to us in getting a clearer picture and understanding the extent of an economic slowdown.

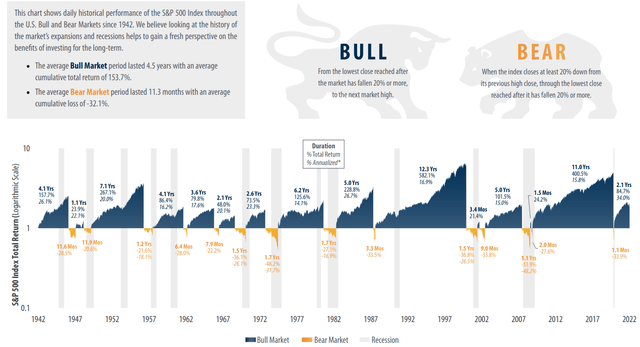

S&P500 historical performance (First Trust )

Within this chart published by First Trust we can highlight the main features of the business cycle through stock market returns since 1942:

- Bull markets last an average of 4.5 years and have an average cumulative return of 153.7%.

- Bear markets last on average 11.3 months with an average collapse of 32.1%.

In light of this, we can make some comparisons with the current economic situation.

S&P500 historical performance (Trading View )

In this other chart I have highlighted 2 main retracement levels: the one related to the average decline and the one related to the biggest decline since 1942. Considering the average retracement, the S&P500 should fall about another 10% from the June lows, so we are quite close to the bottom if we believe in this option. If, on the other hand, we believe that this recession is comparable to the great financial crisis of 2008 and that of 1972 then the S&P500 should collapse to $2493. Although as of today this seems unlikely, if so we are 31% far from the June low. As for timing, the average duration is just under a year, so theoretically 2023 will be the beginning of a new bull market. The maximum duration recorded since 1942 has always been less than two years, and since the recession began in January 2022, there is a good chance that at least the second half of 2023 will be positive.

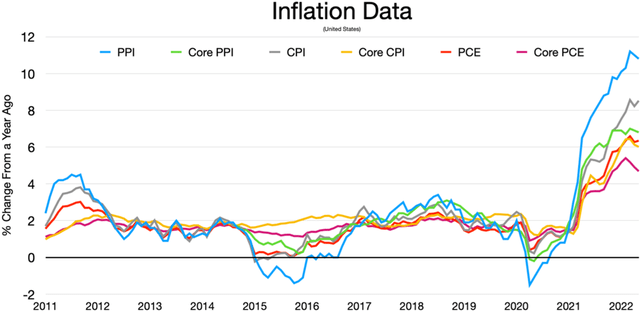

Inflation is the market mover

Inflation has never been a serious problem in recent decades, and the FED has been able to reach the 0-2% target over the long term without too much trouble. During the major recessions since the beginning of the new millennium, the FED responded with expansionary monetary policy by reducing interest rates and implementing QE, but as of today this is no longer possible. The current economic slowdown cannot be fought with the same tools previously used because the level of inflation is the highest in 40 years.

Although the FED emphasizes that the U.S. economy is strong and will be able to solve the inflation problem without reducing GDP growth too much, I do not believe this is the case. The FED has repeatedly shown that it does not understand the extent of inflationary growth, and last year it repeatedly talked about “temporary” inflation. Now that the CPI is at 8.6%, however, they seem to have changed their minds and are raising interest rates rather quickly. Either way, the Fed is now in a trap.

- If it does not raise interest rates double-digit inflation would cause a recession far more severe than the one we are experiencing today.

- If it raises interest rates too fast to reduce inflation the capital market will weaken. When interest rates rise, the present value of securities falls. Moreover, with an even more distressed ECB, the Euro/Dollar exchange rate is approaching parity. A very strong dollar reduces the cost of imports but also reduces export volumes.

Overall, this is an extremely complex situation, and the only way to improve it is to have positive inflation data after the recent interest rate hike. The problem with this is that monetary policy does not have an immediate impact on the real economy; therefore, the recent hikes may only lead to positive results in a few months. I personally believe that this economic slowdown may last for a few more months, and perhaps for the whole of 2022. In contrast, my expectations for 2023 are more positive for 3 reasons:

- Supply chain problems should be resolved.

- There will be more clarity regarding the war between Russia and Ukraine.

- Much of the interest rate hike will already be discounted within 2022, barring unforeseen events.

Market sentiment

As announced earlier, although officially we are not in a recession actually it is as if we already are. Market sentiment is very negative, and both investors and consumers are preparing for an adverse scenario economically speaking.

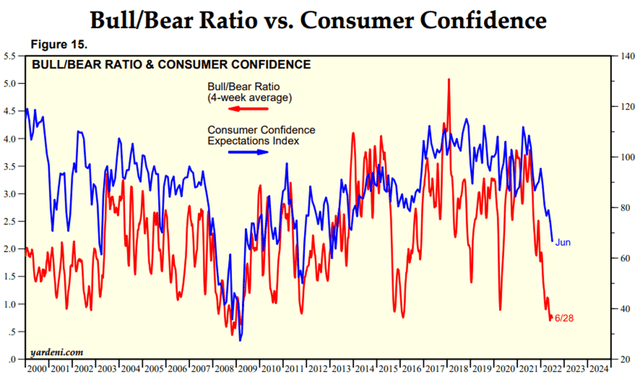

Bull/Bear ratio ; Consumer confidence (Yardeni Research)

The bull/bear ratio has reached extremely low levels almost comparable to the 2008 financial crisis. Investor sentiment is near historic lows and consumers are also losing confidence. Since the beginning of 2021, the drop in the consumer confidence index has been remarkable, although it is still at acceptable levels. The trend is downward and reaching a level like 40 would be worrying.

One of the reasons the FED believes the U.S. economy is strong is because of a currently very low unemployment rate of 3.6%. This is indeed very low, but how long will it last? Managers of many companies are beginning to predict a recession and are moving ahead by starting to plan mass layoffs.

- Elon Musk has publicly stated his negative sentiment about the current economic scenario, and he has expressed his concerns to Tesla executives, urging them to curb hiring and to cut 10% of salaried staff.

- Coinbase CEO Brian Armstrong has also announced that he intends to lay off about 18% of the staff since there is likely to be a recession after 10 years of an expansive business cycle.

Coinbase (COIN) and Tesla (TSLA) are just two of the many companies that are making this choice. Today it is crucial for companies to cut costs since revenues may be slowing down.

Was the 25% drop enough?

Statistically we have seen how the average slump during a recession is 32%, so theoretically there is still room for decline. On the other hand, considering the profits earned by S&P500 companies, the market is not so expensive after all.

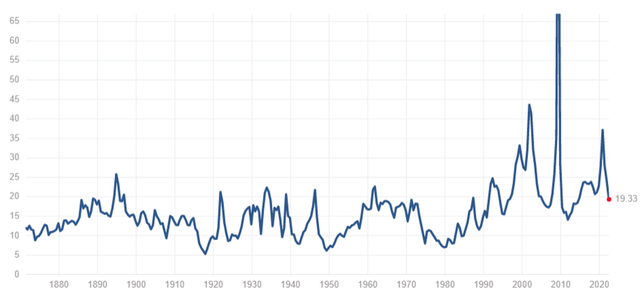

Historical S&P500 P/E ratio (multpl.com)

In this graph we can see the P/E trend from 1880 to the present. The average is 15.97x, but if we considered the last 20 years this figure would increase. We are certainly not in an undervaluation phase, but we are past the irrational euphoria phase of late 2021.

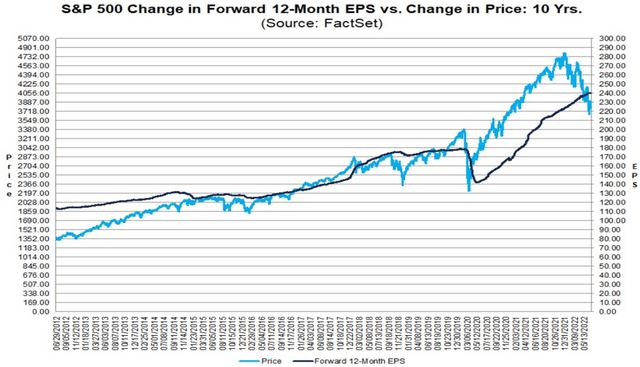

S&P500 & Forward EPS (Factset.com)

By relating forward EPS to the S&P500 instead, we are even in an undervalued phase. The S&P500 line is below companies’ expected earnings per share, just as it was during the March 2020 bottom. So looking at P/E and especially forward EPS, the stock market does not look like it can go down much longer, but there is a basic problem with this reasoning: it is not certain that companies will make more profits in the next few years.

It is being assumed that forward EPS will rise, but in a scenario of an economic slowdown, just the opposite will happen. If the earnings of the companies belonging to the S&P500 fall faster than their prices, the P/E would rise even if the market is falling. Personally, I think this scenario is not that unlikely, especially looking at the recent forecasts for 2022 and 2023 EPS.

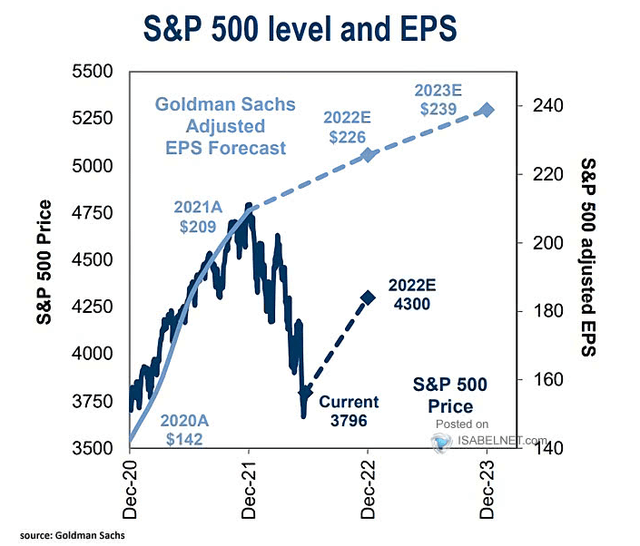

S&P500 and forward EPS (Goldman Sachs )

According to Goldman Sachs, the EPS of the S&P500 will rise from $209 in 2021 to $239 in 2023. In a scenario of rapidly rising interest rates and with companies increasingly frightened of a possible recession I would be surprised if 2021 EPS is even maintained. I see an increase in layoffs as likely in the short to medium term, and we have already seen how the consumer confidence index is falling dangerously. Inflation may be defeated by the end of 2022, but if interest rates are raised too quickly the risk is that inflationary pressures may be replaced by deflationary ones. The second half of 2022 could be upward, but Goldman Sachs’ forecast of $4300 seems too optimistic to me.

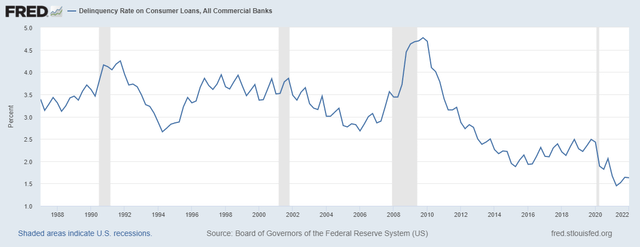

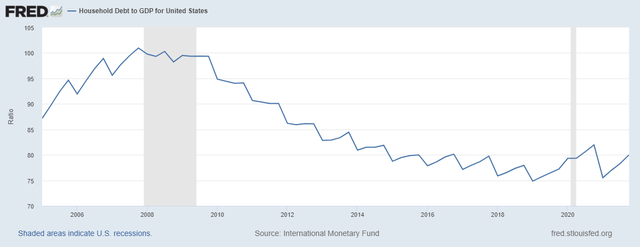

This recession is not as severe as in 2008

Despite the complexity of the choices the FED will have to make to reduce inflation, comparing the current recession with that of 2008 I think is a mistake. In those years the S&P500 lost about 50% and it was the biggest recession since 1929. The underlying problem was excessive indebtedness of U.S. households combined with a bubble in the housing sector, as well as a massive write-down in the banks’ assets. To date, banks have a very low delinquency rate on loans made and U.S. households do not have excessive debt. Here are two graphs showing this.

Delinquency rate on consumer loans (Federal Reserve Bank of St. Louis) Household debt / GDP (Federal Reserve Bank of St. Louis)

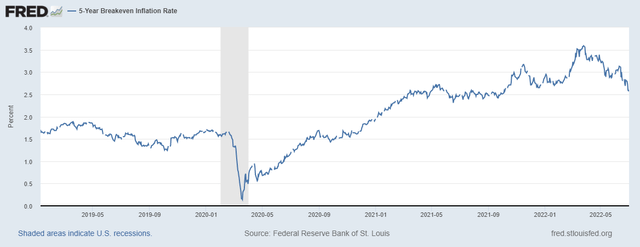

Finally, although inflation is still high, annual inflation expectations from now to 5 years are falling rapidly.

5-year inflation rate (Federal Reserve Bank of St. Louis)

From 3.59% at the end of March to the current 2.59%, a drop of 1% in just a few months. Therefore, the market expects that the Fed can reduce inflation already in the short term and bring it down to a reasonable level over the next 5 years.

As you can see currently it is very complex to make forecasts because there is a lot of conflicting information that gives room for many scenarios. I personally do not believe in a doomsday scenario as predicted by Michael Burry but certainly the issues are evident, and the markets may not have fully discounted the consequences of high inflation. If I had to hazard a prediction, I would expect the market to fall at most another 10-15% from the June lows and thus remaining in line with the average decline during a recession, but this is just a personal opinion.

Summary

The U.S. economy already seems to have entered recession even though Q2 GDP data have yet to be released. It is not possible to precisely stabilize the bottom of the S&P500, but what is certain is that it will depend a lot on the inflation data in the coming months. Higher than expected data could lead to a much deeper recession; therefore, inflation is definitely the market mover of the moment. Analyzing all bear markets since 1942, the average duration is less than a year and the average decline is about 32%. To date the peak of the S&P500 was reached about 7 months ago with a maximum drawdown of 25% in June: we may be close to the bottom if we do not believe in a tragic scenario.

In any case, it is good to remember that the U.S. economy has always achieved a strong expansionary phase after a recession, so what is happening is simply part of the business cycle. Averaging down on solid companies in these times is what can lead to excellent returns over the long term.

Be the first to comment