yipengge/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Booze, Tobacco, Gambling And… Wireless Telephony?

Traditionally, when the economy hits the skids you can expect folks to find solace in the usual places, the legal corners of which can be traded on public markets. Tobacco stocks, gambling stocks, alcohol stocks, these are all convincing places for capital to find a home in times of trouble.

Is The US Heading For A Recession?

Now, the world isn’t quite in the same place as it was in the 1970s, no matter how often furniture or apparel retailers try to convince you to buy “mid-century style” items. Because when you find yourself unemployed in 2022, sure you can still smoke and drink yourself into oblivion, maybe gamble a little too, but you also have one piece of capital equipment that The Man gonna have to prise out of your cold broken hand, and that is… your cellphone. The portal to a better world. And a new career as a blogger/TikTokker/stock guru/whatever.

It’s unclear to us whether a recession actually takes hold in the US. As of today, the yield curve is telling you that it might do. Talking heads everywhere are telling you that it will. The World Economic Forum is telling you that it will. Bank of America is saying otherwise but they are one of just a handful of voices doing so.

So, let’s say the Doomsters have it and US GDP is heading into a sustained decline. Where do you put your money? Not in actual money of course, not at let’s call it 8% inflation. At some point you want to put it in high-growth names because they are all beaten and bleeding and left for dead, which happens periodically in the sector, usually delivering a sound long-term buying opportunity. Indeed, equities in general at this level make a lot of sense to us. Heck, Jeremy Siegel isn’t often made to look a fool.

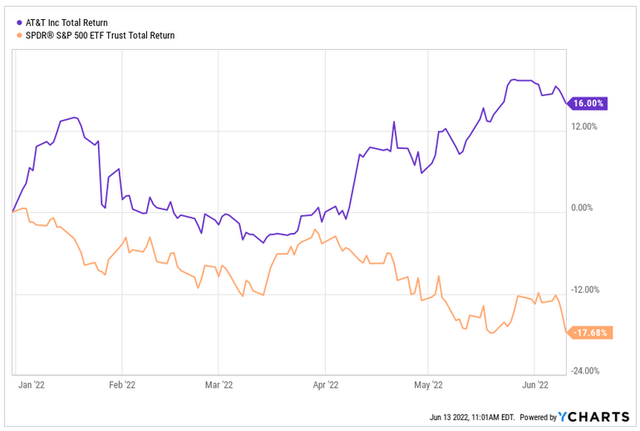

But in the event that the rest of 2022 is as grim as the first part, we have an idea for you. AT&T. Yes, that AT&T. First, take a look at how it’s performed in this, er, trying year to date for the market. This is the stock as you can currently buy, retrospectively pro rata modeled as if the WBD spin took place before this chart was drawn.

T vs SPY, Total Return Basis, 2022YTD (YCharts.com)

Not too shabby. This is telling you that when trouble hits, the market values the boring T stock more than the higher growth names in SPY.

Why might this be?

Well, telephony in all its forms – cellular, wireline, fiber – is of course essential to any modern economy, and further, despite all efforts of regulators to the contrary, large telcos continue to be able to generate strong cashflows even without growing revenues very much. Capex is a periodic pain in the wallet, but it comes around in heavy doses only so often, usually when rolling out new generation wireless networks. The periods in between big capex are times when telco shareholders can enjoy gushers of cash.

Where telcos go wrong in our view is when they try to become something other than telcos – for instance, pay-TV operators or movie studios. The DNA required to run a creative business well is not at all like the DNA required to run a telecom company. One requires a deliberate, stepwise approach to squeezing ever more cash flow out of a set of depreciating hard assets, and limiting new capex to just enough to keep the regulator happy and still have plenty of cash flowing. The other requires prescient insight into, or ability to neurolinguistically influence, consumer desires. One leadership style is rational-functional, task-oriented, bureaucratic; the other, mercurial and charismatic. And ne’er the twain shall meet, since the rationalists believe the mercurial to be unpredictable and untrustworthy, and the mercurial believe the rationalists to be blinkered and fusty. Which is why we don’t want our telco stocks owning media assets.

Fortunately, T recently spun a whole lot of media assets into the WBD tracking stock. Which means that the T you now own or can buy is much closer to the telco ideal of being just a company that sends electrons, photons and radiowaves from point A to B and then charges the customer for it.

If you care to dig through the company’s pro forma standalone financial reports (here) you will find a company achieving the following:

- FY12/2021 Revenue – $118.2bn (+4.3% on FY12/20 – that’s strong growth for a large incumbent telco)

- FY12/2021 EBITDA – $40.0bn (33.8% margin, which is about right for a somewhat competitive telco)

Elsewhere, (here) you will find AT&T telling you that standalone pro forma capex in the first quarter of FY12/21 was $3.9bn, culminating in FY12/21 capex of around $20bn. So we can say that FY12/2021 EBITDA-Capex was in the region of $20bn.

T has provided guidance for FY12/22, here. In short:

FY12/22 – Revenue, ‘low single-digit growth’ – let’s call that +2% on that pro forma 2021 number, so, $120.6bn maybe. EBITDA calculated on a similar basis to the above, around $41.5bn at the midpoint estimate, and capex $24bn. So, EBITDA-Capex in the $17.5bn range.

Reported net debt at 31 March 2022 was $159.5bn (source – YCharts.com); on the April 21 earnings call following completion of the Warner deal, T CEO Stankey stated that net debt had been reduced by $10bn since the end of Q1 (see transcript, here). So let’s call that pro forma net debt of $149.5bn and let’s assign that to 31 December 2021 for simplicity (the errors introduced here vs. trying to construct a true pro forma for 31 Dec 2021 don’t change the story).

On this basis, AT&T is valued thus:

- Stock price $19.76 at the most recent close

- Shares outstanding, 7.159bn (source – YCharts.com)

- Market capitalization = $141.5bn

- Net debt = $149.5bn

- Enterprise value (= market cap + net debt) = $291bn

- EV/FY12-22 revenue, 2.4x; EV/FY12-22 EBITDA, 7x; EV/FY12-22 EBITDA-Capex, 16.6x

You can sometimes buy big telco for less than those multiples, but going into a recession, if that is what happens, investors tend to gravitate towards stable, cash-generative assets like this one. The EBITDA-Capex multiples will come down by themselves once 5G rollout starts to subside by 2024, and we would be surprised if investors buying at this point were obtaining much less than a 4.5-5% dividend yield over the next couple of years.

Bottom Line

So in short – if a recession is heading our way, as many say it is, we see T as a store of value and potentially a way to grow value. The price has been bid up somewhat on this basis already, but we think it’s still reasonable to add here if one has a long-term outlook.

The stock chart offers some help here. First, the stock has traded in a sideways range since the market began to emerge from the 1999/2000 tech and telecom wreck.

T Range 2003-22 (TradingView, Cestrian Analysis)

As you can see, the lows in 2021 that followed the announcement of the Warner spin were right at the bottom of that sideways range.

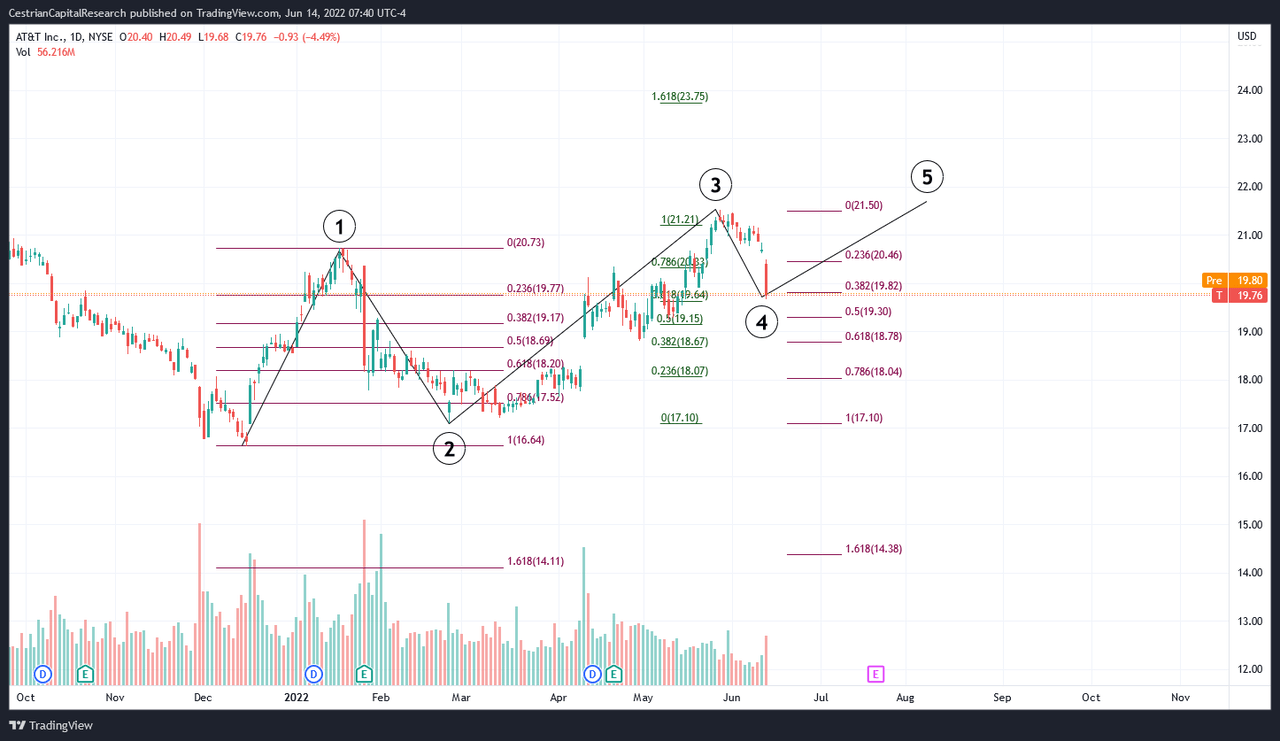

Since the recent low, the stock has put in a standard set of Fibonacci extensions and retracements, which as we saw above has meant a very material outperformance vs. the market in 2022 so far.

T Moves Since The Lows, 2021-22 (TradingView, Cestrian Analysis)

Near term, assuming a continuation of this standard Elliott Wave/Fibonacci structure, we would expect a modest run-up to the low $20s, followed by a pullback to maybe the $18-19 zip code and then a move higher. So if this is a name you want to own, you could certainly convince yourself to buy now; or, if you want more certainty as to what could occur following FOMC and options expiry this month, wait for that likely peak in the stock and buy on the next pullback.

We are long T in Cestrian staff personal accounts with a long-term outlook.

Cestrian Capital Research, Inc – 14 June 2022.

Be the first to comment