Alexan2008/iStock via Getty Images

Introduction

On July 6, I wrote an article titled “Assessing Bunge’s Agriculture Dividends”. In that article, I discussed the agriculture sector based on energy prices, crop conditions, the situation in Ukraine, and other factors. Since then, the stock has advanced 8% despite missing earnings at the end of the month. I believe the situation remains very favorable for investors as a lot of bad news has been priced in. For example, Ukraine just restarted grain exports via the Black Sea. That’s fantastic news for global food insecurity, but not for people hoping that crop prices will come down hard. A lot has been priced in as crop supply is set to remain tight. Bunge Ltd (NYSE:BG) is in a fantastic position to benefit from that, meaning the same goes for its investors. In this article, I will assess the situation and explain why Bunge has more upside.

So, bear with me!

Food Supply Is An Issue

Although my master’s studies had an emphasis on supply chain management and I’m truly passionate about it, I’m getting (almost) a bit fed up with global supply chain problems. Since 2020, “we” have broken almost every supply chain imaginable. Automotive, global trade, electronics, energy, and agriculture. While the degrees of severity vary, the supply situation in agriculture is worrying me.

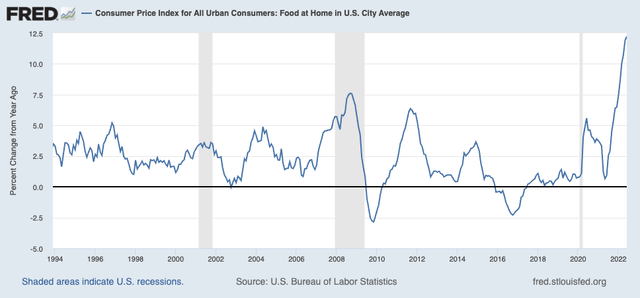

For example, food at home inflation in the US is now above 12% (as of June). The same is happening in Europe and other parts of the world. In addition to already right budgets due to energy and other factors, families are now being squeezed where it hurts most.

Federal Reserve Bank of St. Louis

In a recent article covering agriculture machinery giant AGCO Corp. (AGCO), I highlighted the bigger picture in the industry.

In that article, I focused on recent comments from the OECD on its long-term agriculture outlook, which highlighted extremely tight supply. In its 363-page long report, the OECD predicted 1.1% annual agriculture production growth.

The Outlook assumes wider access to inputs as well as increased productivity-enhancing investments in technology, infrastructure, and training as critical drivers of agricultural development. However, a prolonged increase in energy and agricultural input prices (e.g. fertilizers) will raise production costs and may constrain productivity and output growth in the coming years.

After all, the problem was that demand growth is expected to be 1.4% due to population growth.

With that said, the Wall Street Journal published an article in light of the deal that Ukraine can start exporting grains again using its Black Sea ports.

Despite the news that (limited) exports are resuming, supply is expected to remain extremely tight:

Russia’s invasion of Ukraine is continuing to disrupt supplies from one of the world’s top grain-exporting regions. Bad weather affecting big crop-producing regions, including in South America, is also helping to fuel the supply crunch.

Archer Daniels Midland Co. and Bunge Ltd., among the companies that dominate global grain trading and processing, said this past week that this combination is keeping supplies tight while the appetite for agriculture products such as cooking oils and soybean meal for livestock feed remains robust.

ADM made the case that two very good crop years in both North and South America are needed to bring “a little bit more relief” to the current supply side.

Unfortunately, it doesn’t look like that is happening. Reason one is high energy prices and export restrictions in various countries when it comes to fertilizers. Both of these factors hurt fertilizer availability and pricing. Hence, it is expected to pressure yields going forward.

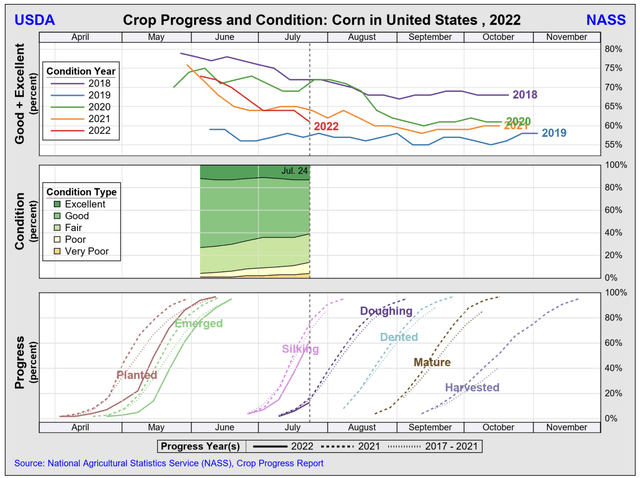

Moreover, crop conditions continue to fall. In this case, corn conditions in the US are now below 2021 levels (compared to July 2021) and headed for 2019 levels. A full overview of crop conditions can be found here.

With all of this in mind, I do believe that key crops like corn, wheat, and soybeans will remain in a volatile long-term uptrend with support from high energy prices, various export bans, high demand, and weather-related headwinds.

Where Does Bunge Stand?

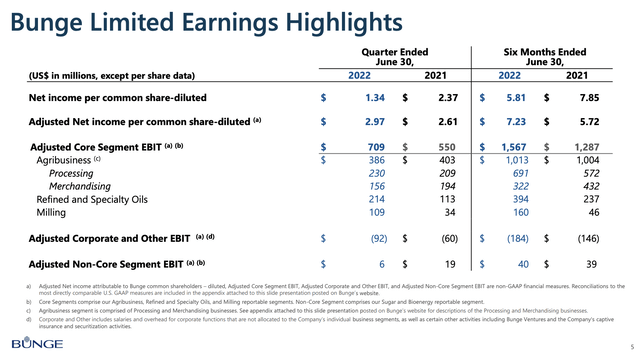

Let’s get the bad news out of the way first. On July 27, Bunge reported $17.93 billion in revenues. That was $710 million less than expected.

This was the main reason why adjusted EPS of $2.97 came in $0.23 below estimates.

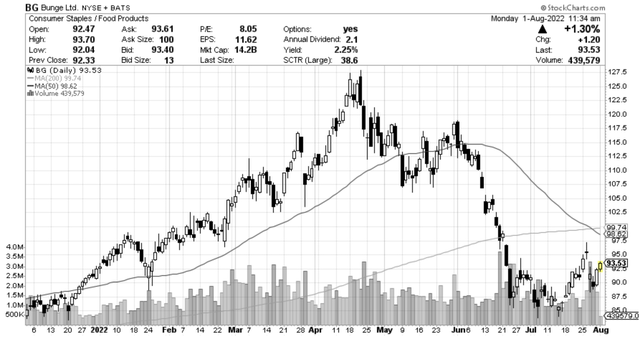

It caused the uptrend that started in mid-July to take a breather, but BG shares have resumed what they started prior to the earnings call.

In 2Q22, Bunge benefited from strong demand and tight commodity supplies in its agribusiness. Results of refined and specialty oils were higher in every region. Milling results were also higher as the company effectively managed supply chain headwinds.

Moreover, after increasing its full-year earnings per share outlook to $11.50 in 1Q22, the company is now raising its outlook to $12.00, which tailwinds in all segments.

According to the company:

Supplies remain tight in the physical markets across all of our key businesses, regardless of the commodity volatility driven by the broader financial markets. Regular seasonal production factors and continued global supply chain challenges make the value of the services we bring to our customers more relevant than ever and gives us confidence in our outlook.

The “value of the services we bring to our customers” is based on a well-diversified business model. As I wrote in my July article:

[…] the company is a leading:

- “global oilseed processor and producer of vegetable oils and protein meals, based on processing capacity;

- global grain processor, based on volume;

- seller of packaged vegetable oils worldwide, based on sales;

- producer and seller of wheat flours, bakery mixes, and dry milled corn products in North and South America, based on volume.”

The company also produces sugar and ethanol in Brazil, through its 50% interest in BP Bunge Bioenergia, a joint venture with British oil giant BP (BP).

It is important to mention that the company has updated its “baseline” in the earnings framework from $7.00 to $8.50 in EPS, which reflects the new agriculture environment as well as structural improvements in the oilseed market environment that lets BG benefit even more thanks to its operating model.

This basically means that the company is expected to be more profitable in general, using mid-cycle estimates. In other words, if prices for crops come down in the future, BG is still in a better position. The same goes for supply availability and related factors.

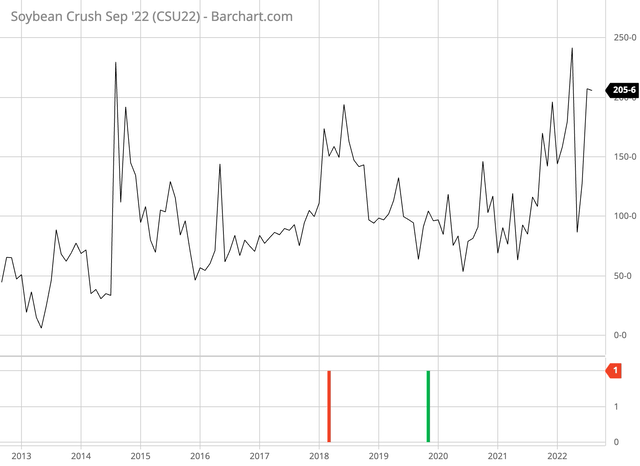

With that said, tailwinds this year include a higher US and Brazil soy crush thanks to strong soybean meal and oil demand (it makes more money when “crushing” soybeans), as well as higher demand for soft seed crush products.

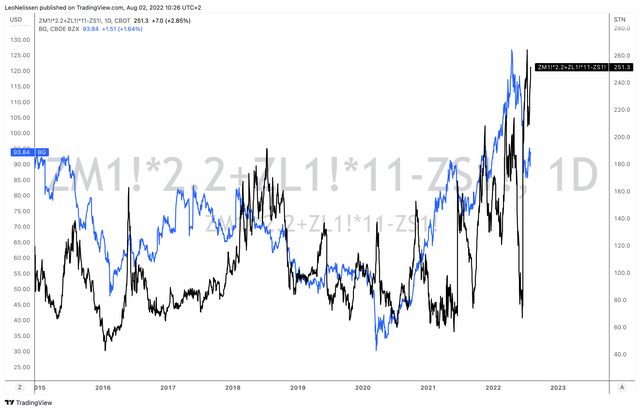

Using CBOT Soybean Crush futures, we see that margins are indeed extremely favorable. I believe that this will remain the case, especially if energy prices remain strong (or rise further).

Merchandising benefited from strong global grains, yet global shipments of grains (ocean freight) were down, which pressured results a bit. However, I expect that to improve as well as I believe that China will accelerate imports again due to the quality and quantity of grains imported over the past three years.

As a result and despite missing 2Q22 analyst targets, the company has hiked its full-year guidance to $12.00 per share based on the current margin environment as well as forward curves.

Moreover, these expectations include share buybacks as well as investments in growth. For example, Bunge is further strengthening its oilseed platform, expanding its refined and specialty oils, and increasing renewable feedstock. All of these segments have long-term potential. Not just because of high (and likely lasting) margins, but because renewable alternatives are a good spot to be in a situation where “traditional” energy markets continue to suffer from severe supply issues.

The chart below shows the soybean crush spread that I built myself (black line) based on soybean, soybean oil, and soybean meal futures (all next month futures). The blue line displays the Bunge stock price, which I believe has reacted too much to the decline in energy prices. If crush margins remain high, the stock has some catching up to do.

TradingView (Black = Soybean Crush, Blue = BG)

This brings me to the valuation.

BG Stock Valuation

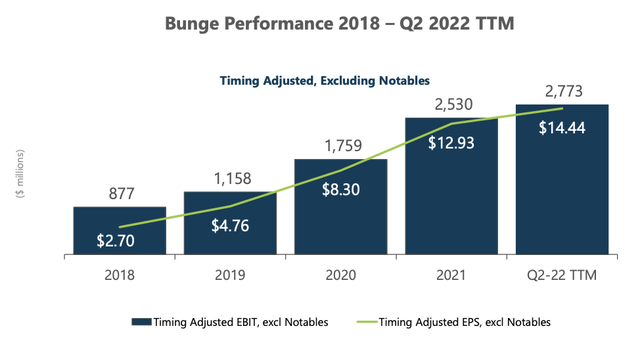

The long-term BG chart is fascinating. It perfectly follows most commodity stocks. Regardless of whether these companies mine copper, produce oil, or buy, crush, and sell soybeans.

Between 2002 and 2008, the company benefit from a weakening dollar, rising commodity prices, and exploding commodities (including agriculture) in China. Then, the stock price imploded in the Great Financial Crisis due to demand destruction. It was followed by a steady but volatile rally until the energy bear market of 2015. This lasted until the COVID bottom of 2020 as the inflationary trade had a hard time in general. Now, agriculture is back roaring.

Just by looking at it, it seems that BG is a better buy at $60. However, I don’t think it will be that easy. I do not believe that this bull market is over based on the agriculture fundamentals discussed in this article: tight supply, high energy prices, trade issues, and related problems and forces.

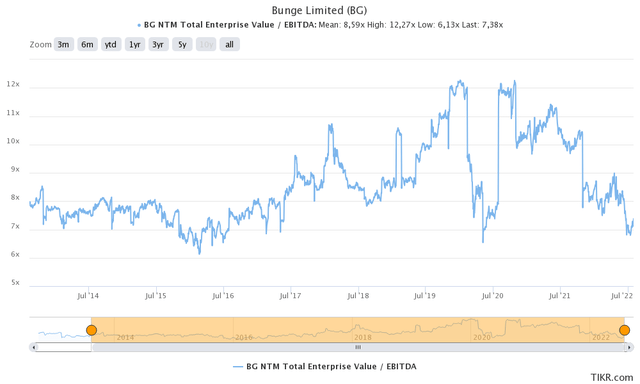

That said, the company has an enterprise value of $19.7 billion. That’s based on a $14.3 billion market cap, $4.4 billion in expected 2023 net debt (just 1.5x EBITDA), $800 million in minority interest, as well as $220 million in pension-related liabilities.

This is 6.6x EBITDA ($3.0 billion assumption).

I believe that BG is too cheap. This valuation would make sense in a low-inflation environment, but not given what seems to be lasting tailwinds in the industry.

Hence, I believe the stock has at least 30% upside from current levels. That’s my base case.

Takeaway

Bunge Ltd. is in a good place. The company benefits from what seems to be a lasting bull case in agriculture based on strong pricing, tight demand, and high margins in its oilseed business. If overseas import demand accelerates, I believe that Bunge will accelerate sales faster than expected in the 1-2 years ahead.

Moreover, despite missing 2Q22 earnings and sales estimates, the company raised its full-year guidance thanks to strong demand, high margins, as well as share buybacks.

The company also raised its mid-cycle EPS estimates as it is now benefiting from a more efficient business as well as lasting tailwinds in the industry.

Given the circumstances, I believe that Bunge is too cheap. My base case is at least 30% upside over the next 12 months.

(Dis)agree? Let me know in the comments!

Be the first to comment