jaturonoofer

Realty Income Corporation (NYSE:O) is one of the largest real-estate investment trusts, with an almost $40 billion market capitalization, that has seen its market cap drop almost 25% lately. That weakness means despite rising interest rates and the market volatility, the company has become a valuable investment, one that has the ability to drive substantial shareholder returns.

Realty Income Positioning

Realty Income is incredibly well-positioned in its market.

Realty Income Investor Presentation

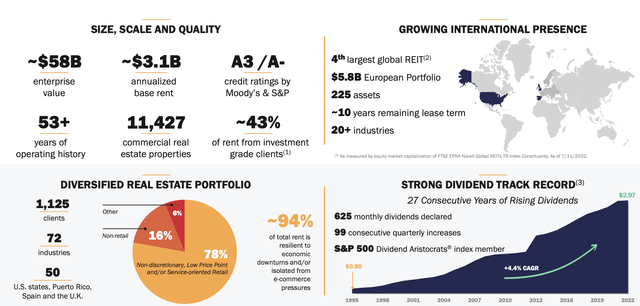

Realty Income has an almost $60 billion enterprise value, with a market capitalization of almost $40 billion. The annualized base rent for the company is roughly $3 billion, with an A3/A- credit rating. The company has more than 50 years of operating history showing its strength and it has continued to grow rapidly across the last several years.

The company has several unique strengths. It has an incredibly diversified client base with more than 1 thousand clients and more than 10 thousand properties. The company views 94% of its rent as resilient to macroeconomic effects and 43% of its rent from investment grade clients. The company has an incredibly strong track record.

Realty Income Growth

The company has the ability to continuing growing its income, something it has a strong history of doing.

Realty Income Investor Presentation

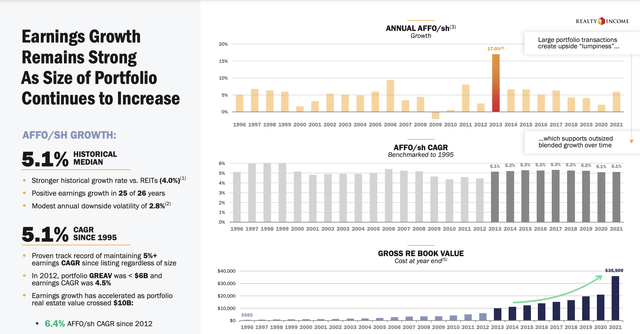

Realty Income has a strong history of growth which will help support additional shareholder returns. The company has 5.1% historical AFFO/SH growth and historical dividend yield growth on top of its almost 5% dividend yield. The company has had massive consistent growth here with only one negative year (2009), and we see no reason why that trend wouldn’t continue.

It’s important to not only pay attention to the company’s historic growth rate but also the reliability of its growth rate. This, in our view, implies whether the company can continue its growth.

Realty Income Balance Sheet

Realty Income has an incredibly strong balance sheet that it’ll be able to continue utilizing to drive shareholder returns.

Realty Income Investor Presentation

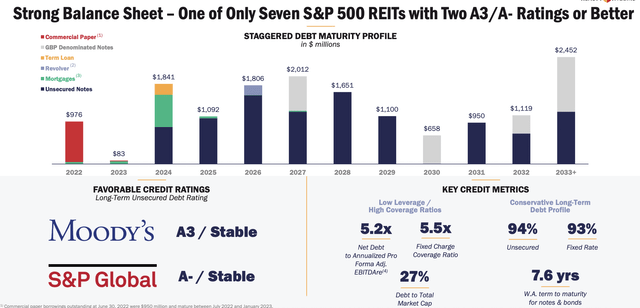

The company does have a substantial long-term debt load. However, it has a very strong balance sheet. The company’s 5.2x net debt ratio is very manageable and the company has 93% debt with a 7.6 year weighted average term to maturity. The company can comfortably cover its debt obligations for the next several years.

There is some interest rate risk to the company here, where rising interest rates could hurt its ability to refinance its interest. Despite that, the company’s balance sheet remains reliable, at least for the next several years.

Realty Income Reliability

Realty Income’s portfolio also helps to support its overall reliability, which will support shareholder returns.

Realty Income Investor Presentation

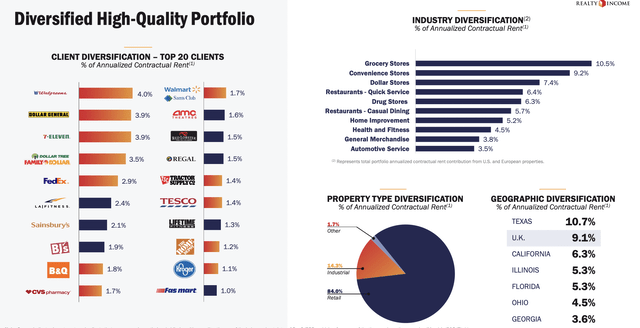

Reality Income’s reliability comes from its diversified asset base. The largest state to the company is Texas, making up just over 10% of its properties. The company is one of the few U.S.-based real estate investment trusts (“REITs”) with substantial UK-based diversification as it moves its business model there. There, the company’s rent already makes up almost 10% of its portfolio.

The company is diversified across numerous industries and businesses, and many such as Walmart (WMT), Seven & i (OTCPK:SVNDY), and Dollar General (DG) are very recession-resistant. Grocery stores and dollar stores are other recession resistant businesses. The company suffered from lockdowns at the start of COVID-19, but we view its current portfolio as being more resistant.

Realty Income Shareholder Return Potential

At the end of the day, Realty Income’s shareholder return potential is based on its unique and diversified portfolio of assets, historic growth, and strong dividend yield.

The company has a dividend yield of almost 5%, a dividend yield that it pays monthly and one that has a strong potential to continue for the long run. Second, the company has a diversified and reliable asset base. That means even in a potential recession we expect the company’s cash flow to be able to remain strong.

On top of these two factors, the company has continued substantial growth potential. It’s expanding into Europe making it one of the few REITs to be doing so, while also taking advantage of opportunities elsewhere. We expect the company to be able to maintain its strong financial position and continue its consistent growth.

Thesis Risk

The largest risk to our thesis here is a recession. Many might think it’s inflation, but in general, minus short-term volatility from a harder time selling, property prices tend to appreciate with inflation. A recession, however, could potentially cause some of the company’s customers to go bankrupt hurting its potential future income and returns.

Conclusion

Realty Income has had substantial share price weakness recently, presenting the company as a unique investment opportunity. The company currently has an almost 5% dividend yield, a dividend yield that it can comfortable afford with its impressive portfolio of assets. The company can continue covering its financial expects.

Going forward, we expect the company to continue growing its dividend. We expect the company to opportunistically grow its portfolio of assets, especially in Europe where the UK already makes up almost 10% of the company’s revenue. All of this makes the company a valuable investment, let us know your thoughts in the comments below.

Be the first to comment