guvendemir/E+ via Getty Images

Lockheed Martin (NYSE:LMT) and Raytheon Technologies (NYSE:RTX) are ranked #1 and #2 on the BGOV 200 List of U.S. defense contractors. As such, the two companies are involved in almost every aspect of defense involving the high tech weapons which make up an increasingly large percentage of defense spending. While they compete in bidding on large government contracts their businesses are cooperative to some degree because of the common industry practice of outsourcing components of a weapon system to a number of contractors. A current example is the F-35 Joint Strike Fighter for which Lockheed is the primary contractor and builder of the airframe. Raytheon contributes a number of important components including the Pratt and Whitney engines. Raytheon engineers say half jokingly, “We don’t actually make the F-35 – we just make the important parts.”

How Are Raytheon And Lockheed Martin Different?

The major difference between the two companies is that Raytheon’s business is 65% defense by sales volume and 35% commercial aviation. Lockheed’s business is almost entirely defense. This meant that Raytheon was hit much harder by the huge 2020 pandemic reduction in air travel when its commercial aircraft business was sharply reduced. This resulted in 8000 layoffs. On the other hand, the continuing commercial aviation business means that Raytheon’s future sales are likely to climb more sharply than those of Lockheed as the aviation industry recovers. Putting numbers and time frames on the commercial recovery is difficult.

Both Lockheed and Raytheon came to have their present shapes through mergers and accompanying spin-offs which reduced the level of non-defense business in both cases. Lockheed Martin was created by a merger with Martin Marietta in 1995. The merger was accompanied by a spin-off of Martin Marietta (MLM), a natural resource building materials business, and a mid-sized defense contractor, L3 Communications, which later merged with Harris Corp to become L3Harris Technologies (LHX), making it the #6 defense contractor by market cap.

Raytheon Technologies was put together in a merger of equals announced and completed on April 2, 2020, between Raytheon and United Technologies (UTC). UTC was the nominal survivor although the newly merged company took the name of Raytheon Technologies. In 2018 United had acquired Rockwell Collins, now the Collins Aerospace division at RTX. Just as Lockheed had done in its merger with Martin Marietta, United Technologies spun off its businesses which were not related to defense, elevator maker Otis (OTIS) and air-conditioner maker Carrier (CARR). The new Raytheon thus has no remaining divisions which are unrelated to defense. Reflecting the spin-offs, shares of RTX began trading at $51 per share.

If your vision blurred a little reading through the various acquisitions, mergers, and spin-offs, take comfort in knowing that it’s an important element of the defense business. In the larger picture both Lockheed and Raytheon are part of a trend toward getting rid of the distraction created by non-defense businesses and create an aerospace and defense company that has a single theme and focus. What comes with the additions and subtractions of various units makes it hard to make long term comparisons in major metrics including sales, operating costs, shares outstanding (and buybacks), debt, earnings per share, cash flow per share, return on equity, and the overall rate of growth in primary businesses. Those of you who have read my past articles will know that these are the exact metrics I like to assemble into a table and comment on.

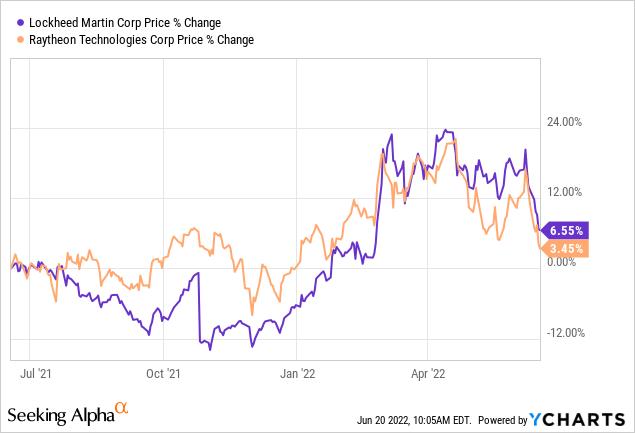

With the Raytheon/United Technologies merger and accompanying spin-offs only two years in the past (and the Rockwell Collins acquisition having taken place two years before that) any long term numbers for RTX going back more than two years will be pro forma. Pro forma means that they are thrown together from hypotheticals which often do not serve well for long term comparisons and future projections. This is undoubtedly the major reason that articles on Raytheon Technologies include very few actual numbers as well as the fact that RTX and LMT cannot be satisfactorily compared. Even their charts reflect the complexity of a merger and two major spin-offs which began stock trading on the same day. Their price charts are similarly imperfect when used for long term comparisons. Their one year charts may be more helpful as they date back to the moment when the blow-up of high-priced tech stocks began to spread to more areas of the market. Both Lockheed and Raytheon did relatively well:

A glance at the middle of the chart above Jan 22 shows that despite declines in the past month both stocks have held up much better than the market in 2022. As I write this line LMT is up 13.67% and RTX is up 3.28%. That’s a great performance for both companies, underscoring the fact that defense companies are highly stable and great portfolio diversifiers.

The fact that Lockheed has outperformed in 2022 may simply be random noise. However, LMT and RTX moved in virtual lock step through the middle of March at which time LMT pulled ahead. That makes sense as the middle of March was about the time concerns about a coming recession began to appear. LMT’s business is almost entirely defense which involves long term contracts with the government. Per its 2020 Annual Report, Raytheon is roughly 65% defense and 35% commercial aviation. It is thus more vulnerable to downturns in the economy. This is heightened by the fact that the components it makes for commercial aviation are at the third level after the operating success of airlines and the level of business at primary suppliers of aircrafts Boeing (BA) and Airbus (OTCPK:EADSF).

LMT and RTX are both down about 15% from their all time highs which came in April. Most of the decline took place in the last two weeks. Again, there may be an element of randomness, but both the similarity in the price action and the relatively mild numbers suggest that the recent decline was mainly a matter of being pulled down along with the market as a whole. Drilling down for a more exact explanation one could reasonably make the argument that the recent moderate decline suggests that both have been pulled down with the part of the market decline which stems from a simple readjustment in valuations and has nothing much to do with inflation, recession, or their operating results.

A Few Things To Consider About The Defense Business

The defense business is unlike any other because in that it is a partnership between the state and the individual company. For superpowers the business of defense involves close collaboration among competitors to the extent that one cannot accurately say whether they are direct competitors or a cooperative group.

For defense company shareholders here are a few points to keep in mind:

- Defense companies don’t have to worry about customers not paying their bills. They also don’t need to worry much about inflation or recession. Defense operates with long cycles and contracts have clauses protecting against increases in the price of key inputs. As a result of these advantages defense stocks provide good diversification against more cyclical parts of a stock portfolio.

- There are high stakes bidding wars with winner-take-all outcomes as when Lockheed’s F-35 beat out Boeing’s F-32 in the competition to make the Joint Strike Fighter. In many cases, however, elements of a large contract are spread among many large and small defense companies. An example is the F-35 Joint Strike Fighter mentioned above as well the Javelin missile system for which Lockheed and Raytheon have a partnership with LMT making the airframe while RTX provides the 251 microprocessors used in guiding it. It is in the interest of the defense department to keep many providers busy and up to speed on defense needs.

- Large defense companies don’t have outstanding growth but they do well by their shareholders over the longer term with buybacks and dividends.

- The Russian invasion of Ukraine will likely lead to a significant increase in defense spending by the U.S. and its allies in an expanding NATO as the war in Ukraine has both depleted the inventory of munitions and made it clear that a military upgrade is required. This will not come immediately, however, as it will take time to tool up even if orders are received immediately. This is in part because of the necessity of passing down orders to makers of components. There are also questions as to the immediate availability of elements like rare earths. Each F-35 Lightning requires 920 pounds of rare earth material.

- Raytheon and Lockheed could be big winners both in backfilling arms already provided to Ukraine and in producing more for NATO countries and Ukraine itself. It will take some time, however, as military procurement normally has long lead times.

LMT Key Metrics

- Market Cap: $107.68B

- Quant Ranking: Hold

- Sector Ranking: 155 of 605 Industrials

- Industry Ranking: 7 of 50 in Aerospace and Defense

- Dividend Safety Grade: A+

- Dividend Growth Grade: A+

Holding LMT back from a Quant Ranking of Buy was its Factor Grade of F for Growth. Here are the numbers:

Growth: F

- Revenue (YoY): -0.39%

- Revenue 3 Year: (CAGR) 5.21%

- EPS Diluted (YoY): -9.49%

- EPS Diluted 3 Year: (CAGR) 4.96%

- Levered FCF (YoY): -4.35%

RTX Key Metrics

- Market Cap: $131.81B

- Quant Ranking: Strong Buy

- Sector Ranking: 58 of 605 Industrials

- Industry Ranking: 3 of 60 Aerospace and Defense

- Dividend Safety Grade: B

- Dividend Growth Grade: B+

RTX escaped the F Growth Rating and earned a C in spite of weak results in several metrics:

- Revenue (YoY): 7.23%

- Revenue 3 Year (CAGR): 1.40%

- EPS Diluted (YoY): .

- EPS Diluted 3 Year (CAGR): -20.88%

- Levered FCF (YoY): -14.56%

Is Raytheon Or Lockheed Martin The Better Buy?

That’s a tough question. The best short answer is that Lockheed is the steadier and more predictable of the two because it is more or less a pure defense stock. Raytheon, on the other hand, has sales that are about 35% commercial aviation, and its backlog is heavily tilted toward commercial aviation at $93 billion versus $63 billion for defense. Growth on the commercial side could be explosive if the airlines and aircraft manufacturers do well.

Here are key long term factors to remember for Lockheed Martin:

- Despite its Growth Factor Rating of F due to flat to down revenues over the most recent three years, revenue growth for LMT was up 35% over the past nine years.

- With the help of a controlled cost of revenues, gross margin has doubled over the nine years and operating income has done almost as well. The annualized growth rate is thus about 8%.

- Moderate but persistent share reduction through buybacks has reduced share count by 16.5% enabling diluted EPS to increase 2.6X over the nine years, an annualized rate slightly over 11%. With adjustment for outliers at the starting point, free cash flow has similar numbers.

- The dividend has increased annually compounding at about 11% with the payout ratio holding steady at 48%.

- Long term debt is modest at less than 10% of market cap and has grown at 7.5% annually, less than the growth rate of most other metrics.

- The P/E ratio is a modest 15 and the yield is around 2.7%.

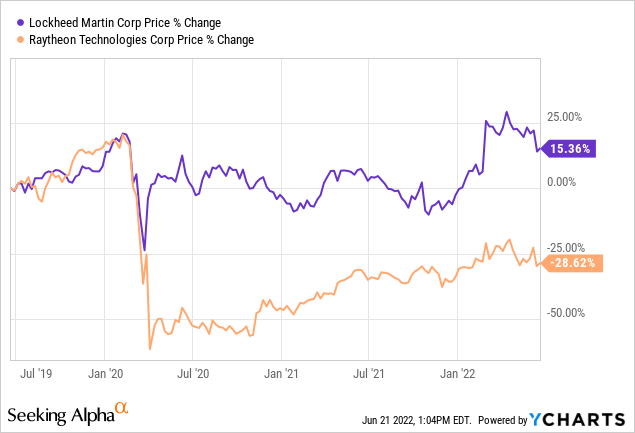

Raytheon does not have comparable numbers because the merger of United Technologies and Raytheon produces unhelpful pro forma numbers before 2020, further complicated by the acquisition of Rockwell Collins and the spin-offs of Otis and Carrier. The current numbers for Income Statement, Balance Sheet, and Cash Flow make the financial results of RTX look like a mess. The question is how much of mess has to do with the merger and how much with the catastrophe in non-defense aviation which started with the two Boeing 737 crashes (2018, 2019) which greatly damaged the whole aviation industry followed upon almost immediately by the COVID pandemic and shut down of air travel. Two charts with a little commentary serve better than the financial numbers:

The above chart shows that LMT and RTX were moving in virtual lock step until the pandemic crash starting in late February 2020. From top to bottom Raytheon fell twice as far, suggesting the market’s realization that half of Raytheon (actually its predecessor United Technologies) was in commercial aviation until April 2. The market suggests that the new RTX with its 35% commercial business has come back slowly. The 43% difference in favor of Lockheed still reflects the initial collapse and continuing punk numbers in commercial aviation.

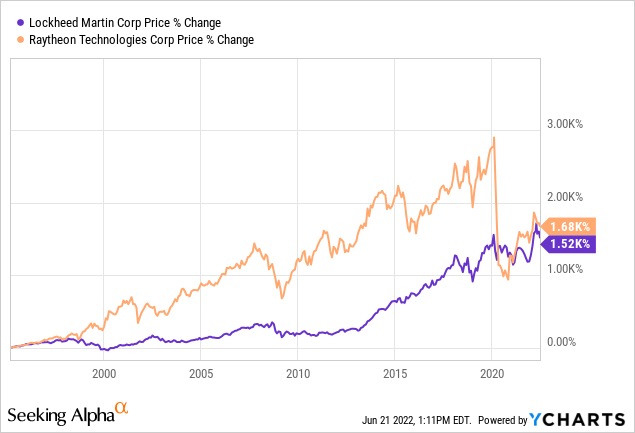

The above very long term chart amplifies the 3-year chart. Over 28 years the two stocks have arrived at the same price but through very different paths. LMT is clearly the steadier, and its stock has had a smoother path. Raytheon (weighted as 57% United Technologies to 43% the old Raytheon) grew much faster in good times for aviation in general but crashed much harder with its commercial orientation in the 2008-2009 financial crisis and again in the pandemic bear market of 2020.

The takeaway is that investors looking for growth stemming in part from commercial aviation might prefer the somewhat riskier RTX. Investors looking for a smoother and more certain ride in pure defense might prefer LMT.

Conclusion

Doing the work to produce this article was a revelation to me. Both LMT and RTX are solid dividend stocks. LMT has a history of increasing its dividend annually and has both a cheaper P/E (15 to 19) and a higher dividend yield (2.7% to 2.4%). On that basis alone Lockheed beats out Raytheon for dividend investors.

Ironically, I own RTX, having originally owned United Technologies and kept my shares after the merger into Raytheon Technologies. When and If I make a new commitment to the industry, it would be Lockheed Martin. It’s a wonderful portfolio diversifier especially with a general economic slowdown on the horizon. LMT offers rising shareholder return of almost 5% including buybacks, and is selling at a price promising total return of around 10%. It’s a Strong Buy.

Be the first to comment