petesphotography/iStock Unreleased via Getty Images

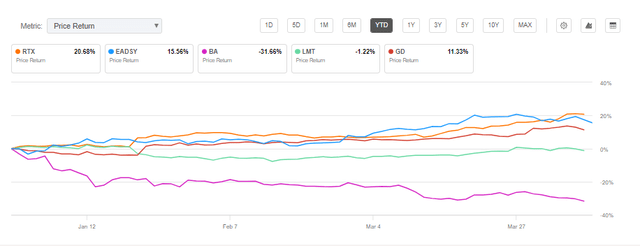

About six months ago, Raytheon Technologies (NYSE:RTX) was in Wall Street’s proverbial doghouse because of an engine issue requiring major fixes, major financial hits, and a major inconvenience to its customers. At the time, I pointed out that finding out about the issue this way, instead of in a tragic news headline, was much preferred. Raytheon has had a bout of very strong performance lately. I think it will continue, and I believe that this firm is one you should own for the long haul, through thick and thin. Recent events have proven that sentiment correct.

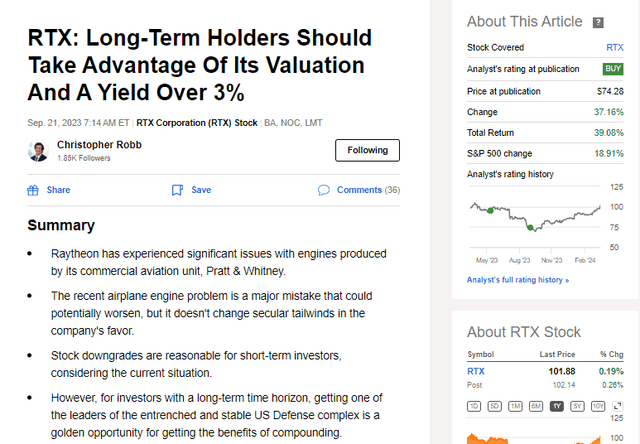

Seeking Alpha

I also pointed out that I thought this issue would ultimately be an opportunity for long-term shareholders. This has definitely been the case. The natural question is whether to take the gains or continue owning the stock. Given Raytheon’s core strengths, I’m willing to shoulder increased valuation risk:

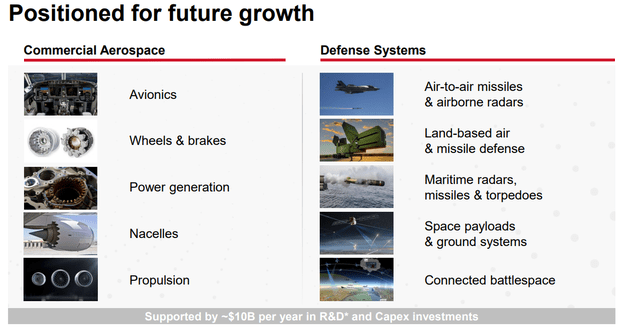

- Strong Competitive Position: Raytheon is increasingly distinguishing itself among peers and winning key projects, like its recent successful bid on the hypersonic missile (a point of pride in the aerospace world). Of course, the increased business from US allies boosting their defense spending and former clients of Russia’s distracted arms industry is a boon to their more defined and steady US business.

- Raytheon Disproportionately Benefits from Economic Strength: Compared to peers, Raytheon is more exposed to the resilient economic strength in the US economy. The company just had a bumper year, but the economics of its business are accelerating due to the militaristic environment. 60% of its backlog will be realized in two years, and the commercial aerospace after-market is driving performance that will likely increase with economic strength. It has a larger exposure to commercial aerospace than most peers.

- Competitive Products: Raytheon’s specialty in national air defense will be particularly sought after by nations all over the world after seeing what has happened to Ukraine in their absence. Raytheon’s NASAMs made the difference between people being able to resume every day life in Ukraine, and not when the aid ran out. The diverse product mix of Raytheon will benefit from increasing national defense expenditures.

- Great Capital Return Policy With Countercyclical Drivers: One of my favorite parts about owning the US Defense Industry is that its primary driver of the US Defense Budget is not highly correlated to economic cycles. This means that the dividends and capital return policies can be especially reliable. Raytheon’s management team has made hay when the opportunity presented itself. It bought back a lot of stock cheaply during the recent engine debacle, which adds nicely to the tailwinds from its attractive dividend.

I think subsequent events involving Boeing and its customers provide a nice contrast that highlights the capability and diligence of Raytheton’s management team. This makes me more comfortable with continuing to own a stock that has more than doubled the market’s gains over the past six months.

Seeking Alpha

I will be making a much larger purchase of Raytheon than my regular monthly purchases soon to take advantage of the price weakness on what I deem ultimately to be a short-term catalyst, given my time horizon, even though it does have the potential to get even worse. The way management is handling this is the harder but safer way. The charge is large and the problem inconvenient, but that doesn’t change the great record of returning capital and the strong secular tailwinds for the company’s defense and commercial aerospace segments.

So far, I appear to have been correct in my choice to increase my buying of Raytheon last September. Raytheon has gained nearly 40% in total return since then. I’m very pleased that Raytheon has performed very well since then. There was only a bit of downside left in the stock after it began recovering from the engine issue. Furthermore, the company had a very strong year in 2023 from several perspectives. Mostly, a critical engine issue that could have paralyzed the company if not properly handled has been mostly rectified.

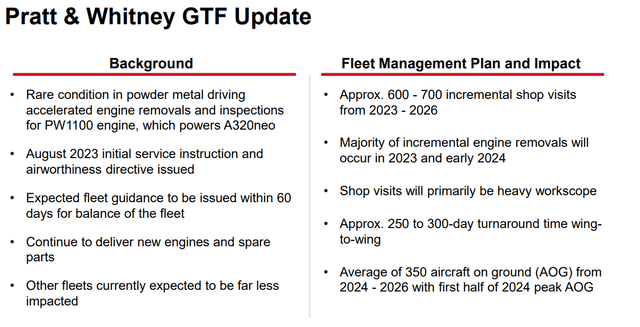

Company Reports

Importantly, those companies need to have the means to maintain and augment capital return policies through the toughest brutal market and the cold world have to throw at them. For example,

Exxon Mobil (XOM) has maintained an admirable capital return policy through thick and thin by size, diversification, and ruthless cost-cutting to the benefit of shareholders.

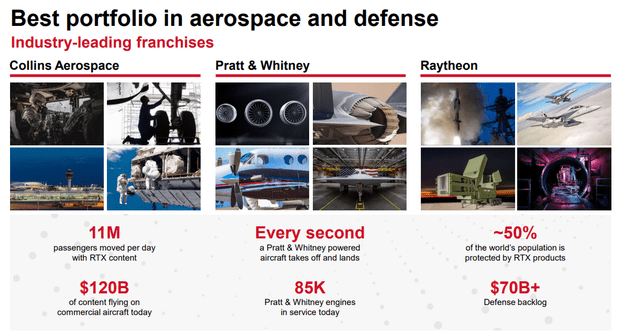

Raytheon Technologies is becoming perhaps the most indispensable piece in the US Defense Complex. It has certainly been one of the more indispensable firms in the defense of Ukraine. The firm’s unique product mix is proving particularly important in Ukraine’s fight against Russia, a fact only made more painfully apparent by the current interruption of aid to our allies. The air defense umbrella that has protected Ukrainian cities is primarily comprised of Raytheon’s PATRIOT missile system and NASAMs.

Company Reports

Of course, earlier in the conflict, both the Stinger and Javelin missiles played a decisive role in stopping the Russian invasion. These weapons were built to destroy Russian armor and air assets and they did exactly as they were designed at a crucial moment in history.

Risks and Where I Could Be Wrong

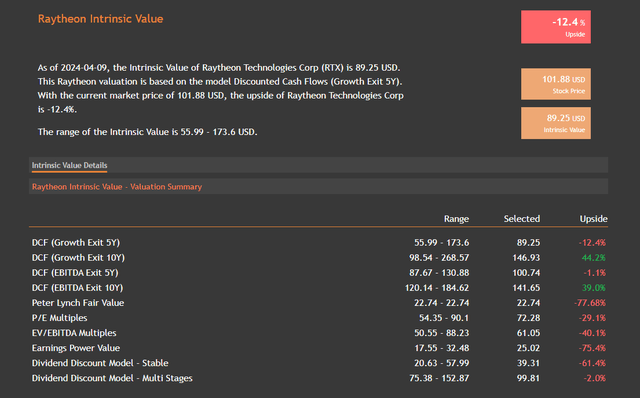

One of the biggest risks for Raytheon right now is that it has had a strong, uninterrupted rally over the past six months and it could be considered to have a stretched valuation from several perspectives. Both on a free cash flow and dividend discount model basis, the stock is currently overvalued by several measures. However, I have pointed out that I am a long-term holder in Raytheon, and thus I do put some additional weight on the 10-year DCFs.

valueinvesting.io

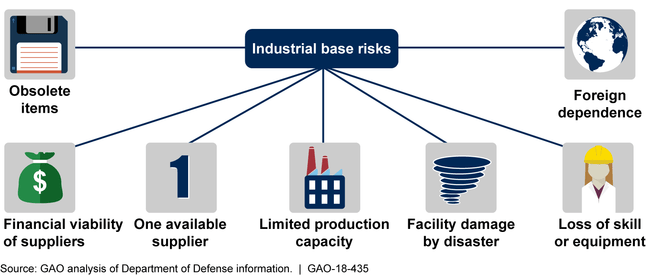

Nonetheless, the stock is certainly much more toward the overvalued column than when I recommended the name around six months ago. The company has worked pretty admirably thus far in dealing with two risks that will always plague major US Defense manufacturers in our modern world; supply chain and labor. Of course, one mitigating factor in valuation risk is that the firm enjoys a de-facto state of protection from Uncle Sam, particularly given his urgent need to modernize and revamp the defense industrial base.

GAO

Labor issues will always be an issue that needs to be managed given the convergence of specialization, security clearance, and quality required. But the supply chain issues could still show their ugly faces again. Two main sticking points that continue to cause problems are:

- Rocket engines on the defense side

- Castings on the commercial aerospace side

The emergence of new supply chain issues, or the exacerbation of existing ones, can hit Raytheon’s earnings. I’m encouraged by how management has managed these seemingly intractable and tedious risks so far.

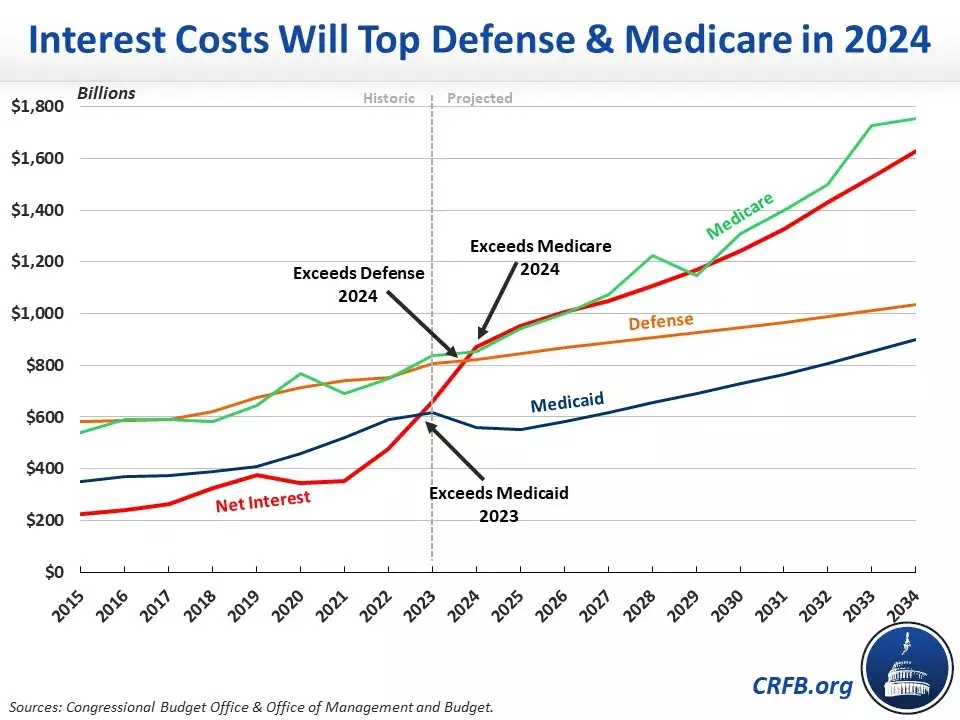

Of course, political risk should always be considered for a firm that gets so much of its revenue from one place, the U.S. defense budget. Any severe curtailment of this revenue source will hit the firm, but that seems unlikely. It is also less consequential as foreign nations and allies majorly boost defense spending in response to the environment of war and Great Power standoff.

CBO

Deteriorating US finances and rising interest costs could prove a major risk if the Defense Budget ends up on the chopping block. Generally, the increased threat environment should mitigate this, but predictability is low inside the Beltway these days. However, current Defense Budget priorities align well with Raytheon’s strengths.

The twin tailwinds of increased foreign and domestic defense spending on a generational level mitigate many typical risks on the defense side of the business.

Conclusion

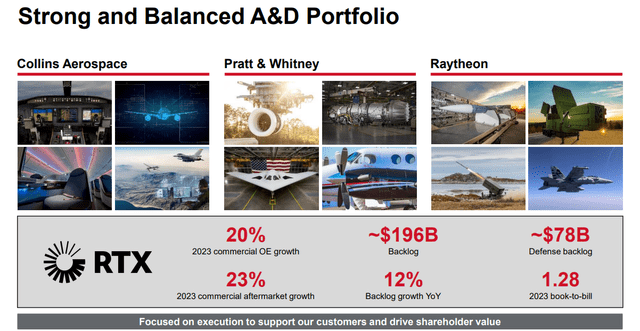

Raytheon is coming off a very strong year, their sales grew 11% organically. This is very fast for a mature defense giant. They have a record backlog of 196 billion dollars. The company has proven capable of executing on the backlog, other than the key risks I mentioned above which the market understands well, the company has been executing on resolving supply chain issues admirably. This bodes well for the firm being able to deliver on this record backlog. As I mentioned earlier, 60% of that massive backlog will come to fruition in the next two years.

Company Reports

The firm is experiencing strength across all of its segments, and the commercial aerospace segment will likely have potential for upside because of continued economic strength in the United States and the continued resolution of the engine issue. 2024 will have some difficult comps, but 2025 looks like it will be a very strong year across all metrics. Remember, this stock is a mature lynchpin of the US Defense Industry. You’re not just owning a company, you’re owning a team that moved heaven and earth to get air defense up in Ukraine, saving countless lives.

A high-intensity conflict like the one unfolding in Ukraine is particularly advantageous for defense manufacturers because equipment, not personnel, is the primary deficiency in foreign militaries (although some could be said to suffer from shortages of both). But the point is, that the currents of new defense spending in response to the Russian threat in Europe and the Chinese threat in Taiwan heavily favor Raytheon’s strengths. The unique simultaneous strength in defense and commercial aerospace makes this firm simply able to grow better than the competition, in my estimation.

Company Reports

The changing nature of geopolitical relations and the degradation of international peace is never a good thing and never something that should be wished for. But when it does occur, it makes us realize how lucky we are to have the capable Americans working in our Aerospace & Defense sector. Both when we fly, and when we face adversaries directly or indirectly, we are immeasurably better off because of their intelligence, hard work, and priceless contributions.

One of the things that is resilient about the Raytheon thesis is that it is not dependent on the War in Ukraine or other active conflicts continuing. The momentum of conflict and Great Power standoff has become such that if the conflict in Ukraine ends and becomes frozen, it may even increase demand for Raytheton’s systems. The likeliest outcome is that any peace that materializes will be marked by frantic re-armament.

Be the first to comment