passion4nature/iStock Editorial via Getty Images

Two years ago in 2020, Raytheon (NYSE:RTX) had tons of upside potential. Since then, the stock exceeded the $80 price target, meeting the 40% upside target. One would assume that in 2022 when Russia invaded Ukraine, war economy stocks including Raytheon would thrive. While RTX stock is barely up this year (up 1.4% year-to-date), when might the stock break out from here? Lockheed Martin (LMT) rose by 17% last week to lead the industrial stocks and is up around 30% YTD.

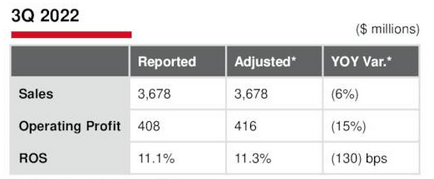

Third Quarter 2022 Results

Raytheon posted non-GAAP earnings per share of $1.21. Revenue increased by 4.9% Y/Y to $17 billion. Besides the $616 million in stock buyback, investors will like the strong operating cash flow of $778 million and free cash flow of $263 million. In addition, Raytheon grew its backlog to $168 billion, up by $6 billion.

Chief Executive Officer Greg Hays said that investments in next-generation technology and innovation would increase its backlog. At the time of writing, RTX stock fell ~ 2%, potentially due to the CEO’s acknowledgment of industry-wide challenges in the near term.

Outlook

Per Raytheon’s press release, the outlook for the full year of 2022 is mixed. Sales will fall, EPS is within range, and FCF and stock buyback are as expected:

Sales of $67.0-$67.3 billion, down from $67.75-$68.75 billion Adjusted EPS of $4.70-$4.80, up from $4.60-$4.80 Confirms free cash flow of approximately $4.0 billion Confirms share repurchase of at least $2.5 billion of RTX shares

The outlook and backlog are not as stellar as that issued by Lockheed Martin. Lockheed has similar backlog levels at $140 billion. However, it increased its stock buyback to as much as $14 billion. It will buy back another $4 billion in the remaining three months of the year. The total buyback is $8 billion, four times that of Raytheon’s buyback plan.

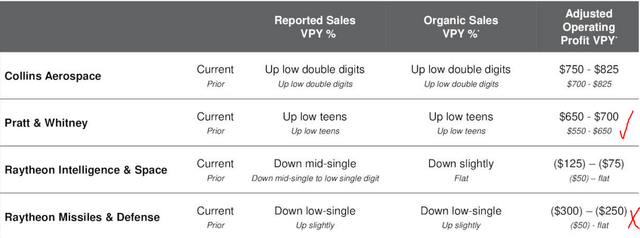

In the table above, the company increased its operating profit outlook for Pratt & Whitney. It lowered its outlook for the Missiles & Defense unit. As explained below, the sales realization is only delayed due to the product upgrade cycle.

CEO Hays expects the commercial aerospace business will recover. In the defense segment, supply chain challenges and labor availability will restrain growth. Its commercial business accounts for most of the company’s mid-to-high single-digit sales growth next year.

Opportunities

International flight traffic is recovering. This broadens margins for Raytheon’s Collins unit. The company has the pricing power to pass its inflationary costs to customers. Inflation will persist into next year but will not hurt its margins.

Collins has several projects in the pipeline to increase its efficiencies. It will consolidate its footprint, plus automate and digitize its factories. Expect the company to post lower costs next year. As a result, Raytheon will meet its 20% margin commitment set in 2021.

The Advantage engines for the A320 or the 1100GTF Advantage Engine will enter service in 2024. Customers will find their 30-year life cycle appealing. Beyond that, the company believes that hybrid electric propulsion has a market in the regional jets and turboprop markets.

Capital commitments for large investments limit Raytheon’s FCF growth this year. For example, it’s upgrading its facilities in Texas. Its Asheville facility for Pratt is also getting upgrades. Those costs might explain the stock’s flat performance this year. Fortunately, in 2023, profits and free cash flow will improve. A refund on tax payments will also help.

Headwinds

Raytheon’s pension headwind is material to results. However, at around 40 cents a share, it is due to market conditions.

Chief Financial Officer Neil Mitchill said that the company has to manage a lack of productivity this year. For example, the supply chain disruption is delaying Raytheon’s receipt of material. This slows its production and development cycles, especially at Raytheon Missiles & Defense. In addition, the product upgrade cycle will weigh on margins in the near term.

Raytheon Q3 2022 Presentation

Sales fell Y/Y, as shown in the table above. Sales in Land Warfare and Air Defense and Navel Power declined. This also hurt profits. An unfavorable product mix and lower efficiencies also hurt this unit’s performance. Fortunately, Raytheon has $1.0 billion in bookings for its Hypersonic Attack Cruise Missile and $972 million for AMRAAM (Advanced Medium-Range Air-to-Air Missile).

Long-term investors may ignore the noise from slower margin growth. The product upgrade cycle will ramp up. When the company wins more contracts, profits will expand as productivity recovers.

Stock Grade

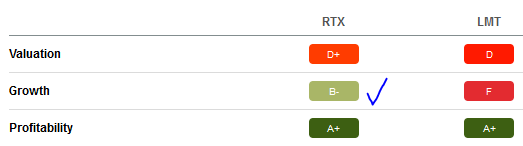

Although this article is not intended to compare which company – Raytheon or Lockheed – is a better investment (they both are), the stock grades are similar.

SA Premium

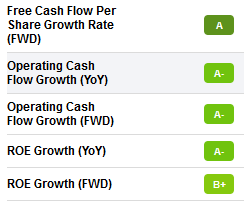

Investors building a war economy portfolio would want to invest in both Raytheon and Lockheed Martin. RTX stock has a better growth score with a B-. Raytheon earns a better growth score because of its EBIT growth, EPS growth, and the following factors below:

SA Premium

Your Takeaway

Raytheon posted strong growth in the Collins Aerospace and Pratt & Whitney divisions. RMD lagged due mostly to supply issues and the timing of product completion. Investors should take advantage of the market’s disappointment by accumulating the stock. The company’s backlog will continue to grow.

The company’s strong buyback program will limit the stock’s downside. Shareholders benefit from management’s commitment to return capital to investors.

Be the first to comment