barisonal/E+ via Getty Images

Dear Fellow Unitholders,

Ravensource Fund’s (“Ravensource” or the “Fund”) net asset value (“NAV”) per unit increased by 11.9% over 2021, including distributions received by investors.

2021 was a good year: successful in capturing the value created on the investments from which we exited; fruitful in creating future value on our existing investments; and productive in surfacing compelling new opportunities. The progress across our portfolio and competition for our capital has rarely been greater than it was in 2021. For the first time in many years, we are fully invested, with our capital efficiency at an all-time high.

It was also a transformative year in how we manage your – and our – capital. The achievements of 2021 reflect the growing influence and contributions of my younger partners: Brandon, Daniel and Mahesh. They have been a key ingredient in Stornoway’s success over the past several years but are now really flexing their muscles. In short, Stornoway’s bandwidth is deeper; our collective edge is sharper. While we believe the benefits of this development were significant in 2021, we have only scratched the surface of our potential.

However, not all is roses. Effecting the necessary change to revitalize a struggling company is a rewarding, but challenging and uncertain process. And as you all have experienced, it can take much longer than we expect and sometimes we struggle and even fail to capture the potential we identified at time of our investment. As we will share with you, 2021 was no different. We appreciate your patience as we work through the revitalization process and look forward to the outcomes rewarding you in the coming periods.

You are our partner. Our objective is to meaningfully increase the value of your Ravensource investment over the long term. Our goal with this letter is to help you better understand your investment by sharing the philosophy and approach we take to meet that objective. We will also provide a closer look at our results and portfolio developments during 2021 in a candid and open manner. In other words, we will walk you through the value creation opportunities that exist in our portfolio and what actions we are taking to harvest our ‘Carrots’.

The Stornoway Way

As a reminder, Ravensource seeks to generate superior long-term absolute returns by investing in and actively revitalizing troubled and out-of-favour companies. Our differentiated approach to investing – our Edge – focuses our capital and expertise on “connecting the dots” between a challenged company dismissed by the market and a quality asset of strategic value. We deploy our capital strategically, in concentrated investments that both meet our specific mandate and where we can employ our Edge. This enables us to become actively involved in the revitalization process, which reduces our risk and helps to capture the value we saw at the time of our investment.

Our success is predicated on reaching tangible milestones that mark fundamental change in our underlying investees. Often, completing a financial restructuring is only the first step. Once put on strong footing, these companies can then use their financial flexibility to undertake initiatives that create meaningful further value. Through these final steps of the revitalization process, as the financial restructuring gives way to business revitalization, our investments are materially rewarded. It is at this stage that our value creation is recognized and we seek to exit. As agents of change, we are focused on driving these outcomes. This is what generates superior returns for you, our partners.

Investment Performance

Ravensource’s investment portfolio generated a 14.4% return over 2021. The investments that materially contributed to Ravensource’s performance are as follows:

|

Investment |

2021 Gross Return on Investment |

Impact on Fund 1 |

|

Spanish Broadcasting System Inc. |

52.4% |

4.0% |

|

Firm Capital Apartment REIT |

45.9% |

3.7% |

|

Kiwetinohk Energy Corp. |

52.4% |

3.4% |

|

Dundee Corp. |

11.2% |

1.7% |

|

GXI Acquisition Corp. |

15.5% |

0.7% |

|

Quad Graphics Inc. |

6.7% |

0.5% |

|

Genworth Financial Inc. |

3.1% |

0.4% |

|

Other 2 |

0.0% |

|

|

Pre-expense / Incentive Fee Investment Return |

14.4% |

1 Increase in NAV associated with the investment’s gross return for the period.

2 Includes other asset investment returns

We would like to share with you what specifically drove results for the year and the actions we are taking to maximize and protect the value of our investments.

Firm Capital Apartment REIT (OTCMKTS:FCAFF)

FCA is a publicly listed (TSXv: FCA-U) Canadian real estate entity that makes debt, preferred and common equity investments directly into select U.S. multi-residential rental properties. In 2016, Stornoway injected equity to rescue FCA from the brink of insolvency. Our investment thesis was that the market price of FCA was extremely low due to its then-incompetent management, heightened insolvency risk due to too much debt, and its poorly positioned real estate portfolio. Through our involvement and the leadership of Firm Capital as the new management team, we believed we could correct those issues to drive a much higher asset value and share price.

While our FCA investment generated a 45.9% return over 2021, the shares remain significantly undervalued, trading at a 33.6% discount to FCA’s net asset value. Since our initial investment, the asset value of the company has increased and driven a great return, but the discount that we first invested at has only marginally narrowed. Despite the significant operating improvements; solid earnings; stable rent collections; and accretive share buybacks, the market is still placing a significant ‘distressed discount’ on the share price. FCA and its insiders recognize that the best use of their capital now is to narrow this discount through share buybacks. We believe their actions and the company’s strong footing will lead to this gap closing over the course of the year and our ultimate exit from the position.

Kiwetinohk Energy Corp. (TSE:KEC)

Our investment in KEC was our largest contributor in 2021 as its share price rose by 52.4%, increasing the value of your Ravensource investment by 3.4%. 2021 was a transformational year for Kiwetinohk. Following a complete overhaul of its management team, significant asset acquisitions and a game-changing merger with Kiwetinohk Resource Corp., the company is hardly recognizable from the insolvent entity we rescued from CCAA in late-2020. In January 2022, the newly formed Kiwetinohk Energy Corp. listed its equity on the TSX, representing a culmination of these accomplishments as well as a starting point for the next stage of its revitalization.

Typically, the last phase of our investment lifecycle is its most accretive, and we strongly believe that will be the case here. For KEC, they have great assets – low-cost production with significant existing physical infrastructure – now matched with a best-in-class management team, led by Pat Carlson of Seven Generations fame, and a strong balance sheet. The opportunity now is for KEC to capitalize on the strong asset base we purchased and reap the rewards of our revitalization efforts.

To do so, Pat Carlson and his team are undertaking one of the most aggressive drilling programs in the oil patch, investing more than $200mm — almost 40% of its market cap — over 2022 to increase production by over 50%. KEC has the financial flexibility to do this while maintaining a conservative debt to EBITDA ratio of less than 1.0x because of the stable foundation built through the restructuring. We believe KEC’s plan to continually add ‘straws into the ground,’ leveraging the existing fixed asset base and significant reserve life will generate annualized returns of upwards of 50% on the new drilling capital (and closer to 100% at today’s commodity prices!) The more straws they put in the ground, the more barrels of oil and gas come out, the more cash gets generated for equity holders.

We project that as KEC ramps its production into the end of the year, the company will be generating almost $200mm per year, representing a 35% free cash flow yield based on KEC’s December 31, 2021 share price. With this level of production and cash flow our shares should be worth conservatively $16.50 to $17.50 per share, a 43.8% to 52.6% increase over thier 2021 year-end price of $11.47– and that’s at US$70 WTI.

Dundee Corp. (OTCMKTS:DDEJF)

Dundee’s Series 3 preferred shares generated an 11.2% return in 2021, increasing the value of your Ravensource investment by 1.7%. Dividends received accounted for just over 50% of the gain, while the price of our securities increased from $18.28 to $19.28 as Dundee continued to sell its legacy non-core assets over the course of the year, further de-risking our investment.

The company – and our investment – is now in the final phase of its transformation it began in 2019 to re-align its capital structure to its asset base. With the proceeds of its asset sales in 2021, Dundee has the wherewithal – and more importantly, the economic incentive – to repurchase its preferred shares and complete this initiative of eliminating its leverage. This is made all the more pressing by management’s new focus on investing capital in risky junior mining companies. Thus the question remains: does the company / board of directors have the will and foresight to complete the de- risking of its balance sheet?

As we control approximately 50% of the Series 3 preferreds, at the right price, we can be Dundee’s one-stop solution. At the same time, sitting at the top of the capital structure, with Dundee having over $70 of assets backing each $25 preferred, our margin of safety is significant.

Quad Graphics Inc. (QUAD)

Quad is a publicly listed (NYSE:QUAD) commercial printing company based in Wisconsin. It is the second-largest commercial printing company in North America, with a broad range of products and services including direct mailings, catalogs, magazines, ad campaign design and analytics. In 2021, the market price of our Quad common shares increased from $3.82 to $4.00, growing the value of your Ravensource investment by 0.5%.

This modest increase in the price of Quad’s shares belies the significant progress made by the company. Over the course of 2021, Quad reduced its debt by 29%, serving to further de-risk common shareholders while freeing up more cash previously being used to pay interest. At the same time, Quad is seizing market share from weaker competitors, enabling it to grow its top line and keep cash flow stable despite broader industry declines. The company is now back on strong footing and we expect it will re-start its dividend later this year, bringing back many income-oriented investors it lost when it cut its dividend. Based on this and Quad’s strong cash flow profile, we believe we can realize at least $7.50 per share representing an 87.5% return from their December 31, 2021 market price.

Genworth Financial Inc. (GNW)

Genworth is a U.S. publicly listed (NYSE:GNW) insurance company that covers mortgage, life and long-term care needs. In 2021, the market price of our Genworth common shares increased from $3.78 to $4.05, growing the value of your Ravensource investment by 0.4%.

Much like Quad, Genworth had a transformative year. And much like Quad essentially none of its achievements were reflected in its share price. In 2021, Genworth sold its stake in its Australian mortgage insurance unit and successfully completed a partial IPO of its crown jewel U.S. mortgage insurer, both key milestones for our thesis. These non-core asset sales enabled Genworth to reduce its debt by ~$1bn / 50% in 2021, with over $3bn of total debt reduction since our initial investment. Genworth has gone from a company whose senior debt was trading at 10% yields, to a strong healthy company intending to return capital to shareholders in 2022 — the first time it will have done so since 2008. This is a critical final-stage step to Genworth rebuilding its market credibility and investor base, and will help bridge the gap between the current price and our conservative value of $5.00, representing a 23.5% potential return.

The Carrot

The Investment Performance section is devoted to reviewing how Ravensource performed in 2021 and the actions we have taken to create and capture value on our investments. But investing is a forward-looking business with investors rightly focused on future results, not past ones.

Our approach to investing is to “connect the dots” between companies that few others want to invest in, into revitalized companies of great value to strategic acquirers. In this section, we seek to help you better understand your profit potential if we are successful connecting the dots that lie in front of us. We call it the ‘Carrot’. That ‘Carrot’— the gap between the December 31, 2021 market price of our investments and the value we are working to realize when it comes time to sell — is quantified below:

|

Investment |

12/31/21 Price |

Exit Proceeds 1 |

Total Return 2 |

Estimated Time to Exit |

|

Crystallex International Corp. |

$110.00 |

$220.00 |

100.0% |

2 – 4 years |

|

Dundee Corp. |

$19.28 |

$21.80 |

13.0% |

6 – 12 months |

|

Genworth Financial Inc. |

$4.05 |

$5.00 |

23.5% |

1 – 2 years |

|

Kiwetinohk Energy Corp. |

$11.47 |

$17.00 |

48.2% |

12 – 18 months |

|

Firm Capital Apartment REIT |

$6.75 |

$8.30 |

23.0% |

12 – 18 months |

|

Quad/Graphics Inc. |

$4.00 |

$7.50 |

87.5% |

1 – 2 years |

|

Algoma Steel Group Inc. |

$10.81 |

$16.00 |

48.0% |

1 – 2 years |

|

GXI Acquisition Corp. |

$0.72 |

$2.00 |

178.8% |

3 – 5 years |

|

Stelco Holdings Inc. |

$41.22 |

$63.00 |

52.8% |

1 – 2 years |

|

Brookfield DTLA |

$13.20 |

$25.00 |

89.4% |

2 – 4 years |

|

Spanish Broadcasting System Inc |

$4.00 |

$5.41 |

35.3% |

1 – 2 years |

|

Old PSG Wind-Down Ltd. |

$0.100 |

$0.128 |

28.0% |

6 – 12 months |

1Conservative estimate of the proceeds received on a succesful realization plus any interim dividends / distributions received.

2Unannualized return to the midpoint Estima ted Time to Exit.

While we have made great strides in 2021 on most of our investments, some are closer to being realized than others. Timing is still one of our most uncertain and uncontrollable factors. However, as investors focused on creating sustainable wealth, we find our longer termed investments are often our most rewarding — the power of compounding is one of investing’s most potent forces.

As with any forward-looking analysis it comes with a necessary caveat: this is not a projection of future annual returns. Rather, it is our assessment of the value we believe we can receive on exit. We believe our assessments are conservative and grounded in today’s reality, not based on hopes and dreams that the underlying businesses will sell more widgets or increase their profit margins. For example, despite our conviction that we are currently owed — and should ultimately be paid over $300 per $100 face value Crystallex bond, we have instead shown a target almost 30% lower. We have not priced our end-goals to perfection. In any investment, there are a range of potential outcomes; the values in this table reflect our low estimate of that successful range.

In that vein, we want to acknowledge the results of our exited investments versus the expectations we had laid out for them. In 2021, we fully exited our position in Colabor and largely exited our position in Spanish Broadcasting. Our investment in Colabor was highly successful: we realized an exit price of $100.25 on our position, which we had purchased for an average of $81, yielding a 29.5% annualized return, exceeding our expectations for the investment. Our only disappointment was that we couldn’t buy more – and not for a lack of trying! On the other hand, our investment in Spanish Broadcasting fell well short of our expectations. Despite our significant time investment and return it generated in 2021, its annualized return over its 4-year life was 3.1%. While it was a good outcome to earn a positive return on a failed investment, it was paltry compared to what we anticipated at investment.

We also want to stress that there is a risk of loss. Despite our thorough analysis, active involvement and paying a thrifty price to acquire an investment, sometimes we are wrong, fail to de-risk the company, lose the battle over what share of the pie we are entitled to, or the potential we identify does not materialize. Investing is an inherently uncertain pursuit. As the great philosopher, Yogi Berra, was aware: “It’s tough to make predictions, especially about the future.”

Fund Liquidity and Investment Activity

It was a busy year: after generating significant liquidity from two exits in February, we re-invested those proceeds — and then some — into three new opportunities over the latter three quarters. Along with opportunistic add-ons in certain existing positions, Ravensource invested more capital in 2021 than any other year in its history.

It is rare we can so quickly redeploy proceeds from sale into new investments, given our rigorous due diligence process, multi-year holding period and skeptical / critical disposition. However, our opportunity set grew dramatically as 2021 went on, and armed with the expanded bandwidth and responsibilities of Brandon and Daniel, we seized them. The issues that had been bubbling below the surface throughout COVID are starting to rise to the top. Banks began to cut back on the excess lending they had been providing and investors pulled capital out of certain areas of the market, e.g. energy and metals. As a result, Ravensource was able to fill those shoes at highly attractive prices.

As a result of our investment activities, Ravensource ended 2021 in a leverage position of 23.7% of net assets. For the first time in years, we are fully invested.

The sources and uses of the Fund’s net cash during the period are outlined on the following page:

|

Amount |

% of NAV (1) |

|

|

Starting Net Cash |

3,285,527 |

15.7% |

|

Sources |

||

|

Investment Divestitures |

4,705,738 |

22.6% |

|

Dividends and Interest |

125,215 |

0.6% |

|

Foreign Exchange |

55,912 |

0.3% |

|

Total Sources |

4,886,865 |

23.4% |

|

Uses |

||

|

Investment Purchases |

(8,239,343) |

(39.5%) |

|

Unitholder Redemptions |

(3,928,336) |

(18.8%) |

|

Operating Expenses |

(561,101) |

(2.7%) |

|

Distributions to Unitholders |

(393,200) |

(1.9%) |

|

Total Uses |

(13,121,980) |

(62.9%) |

|

Change in Net Cash |

(8,235,115) |

(39.5%) |

|

Ending Net Cash |

(4,949,588) |

(23.7%) |

(1) % of December 31, 2021 NAV

Investment Purchases

We established three new positions in 2021 — Algoma Steel common shares, Brookfield DTLA preferred shares and Stelco common shares — which represented the vast majority of the capital invested.

Successful investing is not only about “picking winners”. It requires optimizing the amount of capital we deploy in each of our investments. This means pressing our advantage by aggressively adding to investments when the risk / reward proposition materially improves and we have an Edge over other investors; and increasing our investments proportionally when we raise new capital. This is what we call “capital allocation” and throughout 2021, we materially increased our focus on making our capital sweat harder.

As part of this capital allocation initiative, we opportunistically increased our investments in Kiwetinohk common shares and Dundee preferred shares, as well as in Colabor debentures — the latter of which was particularly fortuitous as we paid $95 shortly before the debentures were redeemed at $100. Finally, we injected a small amount of capital into GXI Acquisition Corp. to support the launch of its exciting new product.

Algoma Steel Group Inc. (ASTL)

Algoma is a Canadian steel producer based in Sault Ste. Marie, Ontario. It emerged from insolvency in November 2018 with a clean balance sheet and began its operating turnaround. It remained a private company until October 2021, when it merged with a public SPAC.

Algoma is the classic “orphan security” we’ve successfully profited off in the past: a post- restructuring stock which has yet to find a stable, long-term oriented investor base. Algoma is unquestionably cheap. It generates tremendous cash flow at current steel prices, and likely will earn its entire market cap in less than 18 months — both quickly de-risking us and providing substantial upside. The issue is that despite the public listing Algoma: 1) remains largely owned by its pre-CCAA creditors, who want out; and 2) new equity investors are staying away for now due to its CCAA overhang; out-of-favour industry; and lack of historical public financials.

Our history with steel and Algoma specifically, along with our comfort investing in post-CCAA companies, enabled us to invest where others resisted. We believed Algoma would use its cash as a tool to foster investor demand by distributing it through dividends and buybacks. However, like KEC, Algoma has only recently become a public company: its management has yet to pitch itself to institutional investors and develop a broad, strong, investor base who have bought into its long- term prospects. Building a public track record and following will take time but ultimately, consistent cash flow and investor greed will prevail.

The rewards for Algoma completing this transformation from “orphan security” to a company with a strong, stable long-term investor base are significant. As of December 31, 2021, Algoma shares were trading at US$10.81 — roughly our average cost — equating to approximately 2x operating earnings in an industry where peers trade from 3x-5x. While all steel companies have their unique aspects, they are fundamentally similar: they make steel. We believe Algoma shares will ultimately converge to their steel industry peers, making them worth US$20, or 85% above their December 31, 2021 price. Longer-term, we believe there is a path to US$25+ as the company transitions its blast furnace to a much more cost-effective electric arc furnace which will boost cash flow; reduce earnings volatility; and lower carbon taxes. In either case, we believe Algoma will create meaningful value for your Ravensource investment.

Brookfield DTLA Fund Office Trust Investor Inc. (DTLA)

Brookfield DTLA owns six class A office properties and one retail property in the downtown core of Los Angeles. It was formed and is managed by one of the preeminent and savviest real estate investors in the world — and that’s not just our patriotism talking. Brookfield created the entity to take advantage of what they believed would be a broad-based revitalization of the downtown Los Angeles district. To do so, they acquired several assets from an insolvent real estate trust by exchanging new Brookfield DTLA preferred shares for ones of the insolvent trust.

As with many of Brookfield’s investments, the capital structure is highly complex; however, it is clear these preferred shares hold a critical place in it. Absent a negotiated deal, Brookfield cannot realize on any of its common equity value until these preferred shares are paid their full economic claim. As Brookfield has not paid cash dividends on these preferred shares, this claim has accreted to $47.85 per $25.00 face value as of December 31, 2021.

We have been watching these preferred shares keenly for several years. Following the uncertainty COVID brought to office space occupancy, the preferred shares fell below $15.00 per $25.00 face value. We believed the risk / reward to be highly attractive and invested. Like other similar capital structure opportunities, e.g. Dundee, a successful result will require time and our direct engagement with other preferred investors and Brookfield itself. In the meanwhile, we firmly believe there is sufficient asset value to cover the full claim of the preferred shares, supported by recent bank refinancings of the asset level debt.

Divestitures

Two of our investee companies — Spanish Broadcasting System and Colabor Group — capitalized on the buoyant credit markets of early 2021 to refinance us out of our investments.

Spanish Broadcasting System Inc. (OTCPK:SBSAA)

After years of unproductive negotiations, in February 2021 we entered into the Settlement Agreement with SBS whereby we largely exited the investment. Through the Settlement Agreement, 95.1% of the value we received was in cash with the rest being a small amount of newly issued common equity. While our exit triggered a 52.4% gain over 2021, our investment generated a disappointing 3.1% annualized return over its approximate 4-year life.

After a frustrating four years of attempting to negotiate a restructuring plan with the Company, the strong credit markets of early-2021 provided an offramp to our impasse. Rather than convert our preferred shares into common equity, the company raised a large amount of high yield debt and repaid us primarily in cash. While we still believed SBS’ enterprise value supported a recovery for the preferreds substantially above our cost, the path to realize on that value would continue to be uncertain. Between the costs, potential impact on the business and the fact that we had no sightline to a start date for a restructuring process, the Settlement Agreement was superior on a risk-adjusted basis.

Critical to our investment process is ensuring a high margin of safety. Although our return on SBS was mediocre, we were able to make the most of a difficult situation by receiving such a high- quality recovery that provided a positive overall return, due in large part to the significant discount at which we originally purchased the preferred shares.

Colabor Group Inc. (TSE:GCL)

In February 2021, Colabor announced it was redeeming its 6% debentures at par / $100 per $100 face that we had purchased over the prior two years at prices averaging $81 per $100. Rather than wait around, we opportunistically sold our bonds at $100.25 soon after the call notice was issued generating a 29.5% annualized return on our capital. It was an excellent investment.

Distributions

Ravensource’s policy is to make semi-annual distributions to ensure it does not incur any tax while providing a reasonable yield for our investors. Distributions over 2021 amounted to $0.30 per unit, unchanged from $0.30 per unit paid in 2020, equating to a 1.9% annualized yield using December 31, 2021’s closing bid of $15.80.

Operating Expenses

Ravensource’s operating expenses include management fees, legal fees, trustee fees, TSX listing fees, accounting expenses, transaction costs and a host of other operating expenses. The table below shows how these expenses reduced the Fund’s gross return on investment to arrive at the Fund’s net investment return during 2021 and 2020.

|

Dec 31, 2021 |

Dec 31, 2020 |

YoY Change |

|

|

Pre-Expense / Incentive Fee Investment Return |

14.39% |

(7.07%) |

|

|

Less: |

|||

|

Management, administrative and IR fees |

1.27% |

1.07% |

0.20% |

|

Other operating expenses |

0.50% |

0.23% |

0.27% |

|

Legal fees |

0.45% |

0.38% |

0.07% |

|

Audit and accounting fees |

0.32% |

0.34% |

(0.02%) |

|

Total Expenses Before Incentive Fee |

2.54% |

2.02% |

0.52% |

|

Pre-Incentive Fee Investment Return |

11.85% |

(9.09%) |

|

|

Less: Incentive Fee |

0.00% |

0.00% |

0.00% |

|

Ravensource Fund Net Investment Return |

11.85% |

(9.09%) |

Over 2021, operating expenses represented 2.54% of Ravensource’s starting NAV, 52 basis points higher than 2020’s levels.

To be clear, the Fund’s 1% management and administrative fee has not changed. Rather, the table expresses performance and expenses as a percentage of starting net asset value rather than average net assets throughout the period. As net assets per unit grew over 2021, unlike in 2020, management fees as a percentage of starting net assets increased year-over-year.

While other operating expenses and legal fees, as a percentage of starting NAV, increased by 34bps versus 2020, the absolute dollar amount of these expenses remained relatively unchanged in 2021. However, following the annual redemption in 2021, these largely fixed expenses are now being spread out over a lower asset base, increasing their relative cost versus 2020.

Incentive Fee

Stornoway as Ravensource’s Investment Manager is entitled to an annual incentive fee equal to 20% of Ravensource’s net profits over and above a 5% annual hurdle rate, after making up any losses or shortfalls from prior years (the “Incentive Fee”).

While Ravensource generated a positive return in 2021, we have yet to make up the shortfall from our negative performance in 2020. As a result, no Incentive Fee was accrued in 2021. Until Ravensource investors first earn a 5% annualized return from where they stood on December 31, 2019, we are not entitled to $1 of Incentive Fee. Simply put, we only get rewarded if you do first.

Long Term and Relative Performance

Our objective is to generate superior, long-term, absolute returns for you. We do not look in the rear-view mirror — it does nothing to grow your capital today — nor do we fuss about what the broader markets are doing. The markets will do what they do. Our investments are highly eccentric — after all, that is our value proposition to you – and our returns will have little correlation with the market, in good times and bad.

That said, we accept that you will grade our performance relative to other investment vehicles. We have identified several indices below — see Appendix 1 for descriptions — we believe are appropriate in assessing our “relative” performance. We include this section to help you evaluate whether we have met our objective of producing significant long-term returns.

|

Annualized Total Return |

1 Year |

3 Year |

5 Year |

10 Year |

|

Ravensource Fund (1) |

11.9% |

2.2% |

5.9% |

8.4% |

|

S&P/TSX Composite Total Return Index |

25.1% |

17.5% |

10.0% |

9.1% |

|

S&P/TSX Small Cap Total Return Index |

20.3% |

16.3% |

5.7% |

5.0% |

|

ICE BofAML US High Yield Index |

5.4% |

8.6% |

6.1% |

6.7% |

|

Credit Suisse Distressed Hedge Fund Index |

12.5% |

5.8% |

4.6% |

5.3% |

|

Since July 1, 2008 |

Annual |

Total (2) |

|

Ravensource Fund (1) |

7.9% |

178.0% |

|

S&P/TSX Composite Total Return Index |

6.0% |

119.8% |

|

S&P/TSX Small Cap Total Return Index |

3.7% |

63.6% |

|

ICE BofAML US High Yield Index |

7.7% |

170.7% |

|

Credit Suisse Distressed Hedge Fund Index |

4.1% |

72.4% |

- Based on net asset value per unit, assuming all distributions are reinvested in units at net asset value.

- Un-annualized return.

While satisfied with our absolute performance in 2021, we have underperformed all the indices above over the past three years. We are not surprised: it is when markets are at their most exuberant that our distressed investments lag the most. Our value proposition to our investors is not to jump on others’ bandwagon, but to do the hard work of turning around distressed companies and profiting from the value created when they are sold. Our performance in 2021 directly results from the milestones we achieved, such as in Kiwetinohk, but we believe these gains are a fraction of what we expect to earn when these investments reach their final sale.

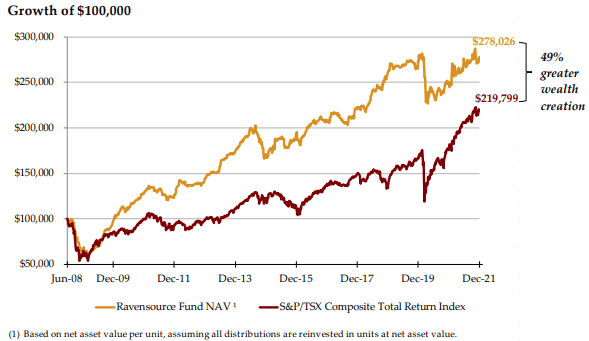

Consistent with our objective to generate superior long-term wealth creation on your investment, since Stornoway became Ravensource’s Investment Manager in July 2008, Ravensource’s NAV per unit has increased by 178.0% in total / 7.9% on an annualized basis, including re-invested distributions. By comparison, the S&P/TSX Composite Total Return Index has increased by 119.8% in total / 6.0% annualized over the same time period. More tangibly, a $100,000 investment in Ravensource has grown by $178,026 since July 2008, representing $58,227 / 49% more wealth creation than the S&P/TSX. We believe we have met our long term objective.

“Skin in the Game”

We believe that an investment manager should have significant “skin in the game”, sharing in the risk and reward of our decisions alongside other investors. Accordingly, each member of the Stornoway Team has a substantial personal investment in Ravensource. As of December 31, 2021, we owned approximately 14.2% of Ravensource’s outstanding units — increased from 11.8% as of the end of 2020 — and together, we are likely Ravensource’s second-largest investor. In short, we eat our own cooking. We are your partner.

Risks

We define risk as the potential for a permanent loss of capital. While assumed at the time we make an investment, risk is a dynamic metric that for us varies primarily as a result of attaining – or failing to attain – key milestones such as reaching a restructuring agreement, closing of a merger or repayment of a loan. We continually monitor the risk of each investment and its impact on our portfolio, taking actions or making changes to the size of our investment when warranted.

The most effective risk management tools we employ are: to establish a large “margin-of-safety” by investing at prices substantially below what we believe is intrinsic value; structure our investment to mitigate the risk of loss; and become actively involved with our investees to protect our investment. Through these mechanisms and processes, we can substantially reduce risk while increasing the potential for returns. However, sometimes we are wrong, ineffective in de-risking a company, or an investment’s potential fails to materialize exposing our investors to a loss.

We also note that our investments will likely experience periodic mark-to-market gains and losses over their investment life. While our investments are typically uncorrelated to most asset classes, when markets become disrupted – e.g in 2008 and 2020 – there will be a flight to the most liquid of assets. As we invest in underfollowed and unloved opportunities, Ravensource’s investments can be particularly exposed to temporary market losses during flights to quality. We may seek to capitalize on lower prices by prudently increasing an investment if the opportunity is compelling and the underlying company has ample liquidity to ride out the storm.

In addition to investment-specific risks, the Fund is exposed to macroeconomic factors as described in the Annual Information Form and in the notes attached to our financial statements. We encourage all investors to carefully read the Fund’s financial statements.

There has been no change during 2021 in the Fund’s stated investment strategy or in the execution of the investment mandate that would materially affect the risk of investing in Ravensource. We continue to believe the Fund is suitable for those investors seeking long-term capital growth rather than income, have a long-term investment horizon, and possess a medium to high risk tolerance to withstand the ups and downs that go along with investing in out-of-favor securities.

Concluding Remarks

In writing this review, we wrestle with the twin objectives of being thorough yet succinct. We recognize that despite our effort to cut to the essentials, there remains a lot of information to digest! We are available via phone or Zoom to discuss your investment further. We enjoy hearing from our investors and discussing our investments and strategy with you.

The Stornoway Team — Brandon, Daniel, Mahesh and me — greatly appreciate your partnership, fortitude and trust. We are dedicated to protecting and growing your capital in the years to come.

Onwards and upwards.

Scott Reid

President and Chief Investment Officer, Stornoway Portfolio Management Inc.

Investment Manager of the Ravensource Fund

Appendix 1 – Ravensource’s Use of Comparable Indices

Given the idiosyncratic nature of the Fund’s investment strategy, the Investment Manager does not believe there is an index that sufficiently resembles the Fund to the degree it should be considered or used as a “benchmark”. However, the Investment Manager provides historical performance data for several indices in addition to the results of the Fund for comparison purposes. The Investment Manager has chosen indices that it believes are relevant to the investment mandate of the Fund and / or to capital markets in general. However, while each of these indices overlap with certain aspects of the Fund’s mandate, none of them share significant similarities with the Fund’s investment portfolio:

- The S&P/TSX Composite Total Return Index (“S&P/TSX”) is the principal broad-based measure commonly accepted by investors to measure the performance of Canadian equity markets. The S&P/TSX is a relevant index for comparison purposes as the Fund’s investment portfolio contains Canadian equity investments and the Fund’s debt investments are frequently converted into equity securities as part of the restructuring process. However, the performance of the S&P/TSX will vary greatly from the Fund as its investment portfolio is primarily comprised of securities that are not included in the S&P/TSX.

- The S&P/TSX Small Cap Total Return Index (“TSX Small Cap”) tracks the performance of the Canadian small cap equity market. The TSX Small Cap is a relevant index for comparison purposes as the Fund invests in Canadian small cap companies that are attractively valued with catalysts to unlock value. However, the performance of the TSX Small Cap will vary greatly from the Fund as its investment portfolio is primarily comprised of securities that are not included in the TSX Small Cap.

- The ICE BofAML US High Yield Index (“BAMLHY”) is a USD-denominated index that tracks the performance of USD, sub-investment grade rated corporate debt. BAMLHY is a relevant index for comparison purposes as the Fund invests in corporate debt securities that are rated below investment grade. However, the Fund’s investment portfolio also includes defaulted debt and equity securities which are not included in the BAMLHY and thus the Fund’s performance may vary greatly from BAMLHY.

- The Credit Suisse Distressed Hedge Fund Index (“CSDHFI”) is a USD-denominated index that tracks the aggregate performance of investment funds that focus on investing in companies that are subject to financial or operational distress or bankruptcy proceedings. The CSDHFI is a relevant index for comparison purposes as the Fund’s investment mandate broadly overlaps that of the funds that make up the CSDHFI. However, it is likely that the composition of the Fund’s investment portfolio is unique from these peers and thus the Fund’s performance may vary greatly from the CSDHFI.

As the Fund makes idiosyncratic investments in securities which are overlooked by the capital markets, the Fund’s investment portfolio contains investments that are not likely included in any of the above indices and thus an investment in the Fund should not be considered a substitute or proxy for the underlying index. For the reasons stated above, these indices should not be considered a benchmark for the Fund and there can be no assurance that any historical correlation or relationship will continue in the future. Index data is provided by Credit Suisse and ICE Data Services.

Be the first to comment