thexfilephoto/iStock via Getty Images

Author’s note: This article was originally posted May 3, 2022, in the Marketplace service, and has been updated to include current information.

Rattler Midstream (NASDAQ:RTLR) posted a positive comparison for the first quarter. Management, however, focused the market attention on a fourth quarter comparison which was not favorable. But the comparison may be overly conservative because the fourth quarter saw some rearrangement of the company portfolio of projects. Therefore, a quarter or two of “housecleaning” may be in order before results are comparable.

So, why write this now after Diamondback Energy (FANG) announced they would acquire Rattler? Simply because Rattler has put itself in a position to grow earnings without a lot of capital needs. This may not be a large part of Diamondback once it is merged back into the company. However, the ability to generate more cash without a lot of capital expenditures is in sharp contrast to the unconventional business. Any sort of cash flow (which will now translate into cost savings) is a big deal in a cyclical industry.

Furthermore, I intend to keep my Diamondback shares received as that dividend is rapidly growing. I may be “stuck” with the base dividend alone during a downturn. But Diamondback has a long history of accretive acquisitions. That history is very likely to continue the base dividend growth in the future.

Rattler Midstream First Quarter Results And Portfolio Positioning (Rattler Midstream First Quarter 2022, Earnings Conference Call Slides)

Clearly management made some moves to rearrange the operations so that the organization overall would have the needed assets in the right place. That led to a decline in earnings from the fourth quarter as management noted. Anytime the portfolio gets rearranged, there will be some one-time fees and optimization expenses. Since growth in the midstream industry is often single digits, then investors should not be surprised that there was a first quarter decline in earnings when compared to the fourth quarter.

The reported earnings were still better than the year ago period. Now that the industry recovery is clearly on the way, there is likely to be some better earnings on the horizon. That does not mean there won’t be a pause for some optimization expenses as well as the continuing Diamondback Energy (FANG) effort to continue to optimize acquisitions made.

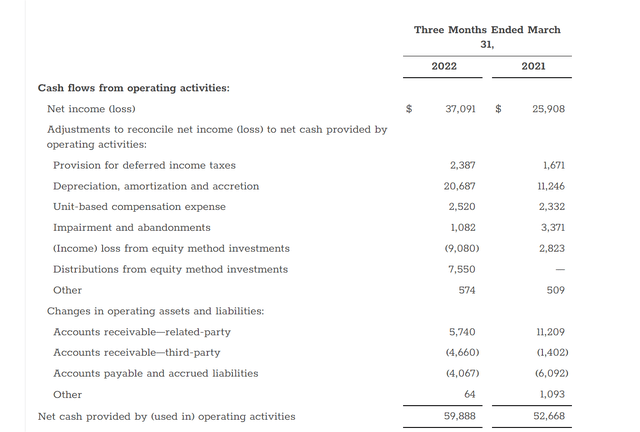

Rattler Midstream First Quarter Cash Flow From Operating Activities (Rattler Midstream First Quarter 2022, Earnings Press Release)

In the meantime, cash flow took a significant jump in the right direction during the first quarter. The prime reason for the cash flow increase was the distributions received shown above. Those distributions are coming from the long-haul joint ventures where the company has substantial money invested.

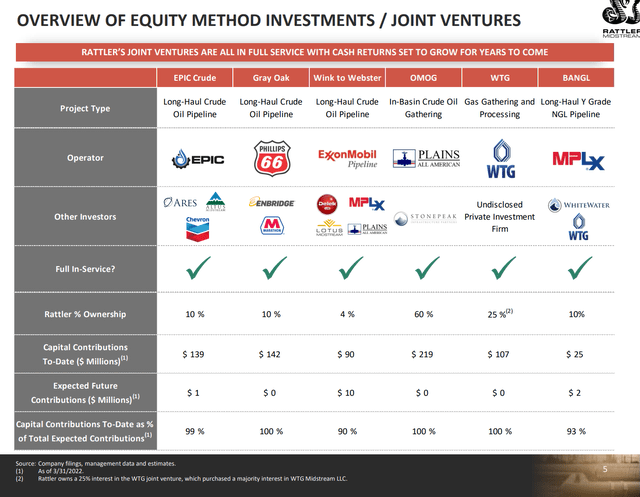

Rattler Midstream Presentation Of Equity Investments (Rattler Midstream First Quarter 2022, Earnings Conference Call Slides)

The significance of that receipt of some income from the joint ventures means that the transition from capital expenditures to build all these pipelines has begun to transition to a cash inflow for all the expenditures listed above. That is a tremendous cash swing in the right direction for a company of this size.

Things like the OPEC pricing war followed by the coronavirus demand destruction delayed the transition to bigger cash receipts. The pipelines were not going to fill up without a more favorable pricing environment. That environment has now arrived. Evidently profits to distribute to the partners is now beginning to happen.

The key for any Diamondback holder is that there are hundreds of millions of dollars in the long-haul pipeline. Long-term cash flow from those investments is about to accelerate in this environment of higher prices. Diamondback is going to be “in the catbird seat” holding interests in pipelines with excess capacity in a basin that is known to run into takeaway issues during the boom periods.

The result is probably a rising return to a fair amount for all the partners including this company that spent some years building all of this. For Diamondback shareholders, those investments will be an important source of future earnings growth (and cash flow growth) that is not dependent upon the plans of Diamondback Energy.

Note that there are still some capital contributions expected. But all the joint ventures shown above are now in service. So, there will be a way to fund any necessary capital contributions from the earnings of the joint ventures. The days of contributing large amounts of capital are clearly over.

Rattler Midstream Presentation Of Diamondback Energy Growth History And Guidance (Rattler Midstream First Quarter 2022, Earnings Conference Call Slides)

So far, the guidance offered by Diamondback Energy is for production about the same as the previous fiscal year. Then again, management made a small acquisition in the first quarter. This main Rattler customer has a long history of growing by acquisitions. So, the current “no growth” guidance could change not only with a small acquisition or two but also from the continuing advance of technology.

The other consideration is that Rattler does not service all of the Diamondback operations. Therefore, Rattler can and is in fact very likely to show some growth in the current fiscal year despite the plans of the major customer. Once Rattler is acquired, that Rattler growth will likely translate into cost reductions for Diamondback customers. That means that earnings due to cost reductions may grow even if Diamondback itself does not grow production.

Per share growth plans are likely to be enhanced by the repurchase of company shares from time to time. Management obviously believes the shares offer a good deal or the cash would be used elsewhere (or the distribution would be increased). It is very likely that shareholders need to be patient for a quarter or two. The operational picture of the new portfolio acquisitions is likely to clear up considerably by then.

In the meantime, the partnership offers a distribution that usually has a considerable tax-free portion until the growth opportunities show on the quarterly reports. Currently, Diamondback management is reacting to the tight labor market and possible transportation constraints. But historically, this management and much of the industry will sooner or later react to the strong commodity pricing environment. That means the midstream business will at some point at least consider and probably will execute a major growth project or two. But that is nothing close to the growth and cash flow needs of the past.

The partnership water business is relatively new and represents a serious growth opportunity. The Permian exists in an area that does not get a lot of rain. Therefore, water handling is essential to keep costs low. In the past, wells were awaiting completion in the industry due to a lack of water. Now, water gets recycled and reused with far more efficiency than in the past. Rattler will be the main component of water handling.

The only question here is if the organization under Diamondback would diversify the customer base under this business.

The other growth opportunity for Rattler and really the whole organization exists with natural gas. For a long time, natural gas was an afterthought because many decisions were made based upon the oil economics. Now natural gas prices are high enough to make it worthwhile to get that natural gas to market. The result is a profit source that is becoming more significant to the organization in the current environment. For a number of reasons, flaring is now far less acceptable and methane leaks are also an area of concern.

As a result, Rattler Midstream offers a combination of growth and income seldom seen in the industry. The units appear to be priced for income without any growth. That was probably a motivating factor for the Diamondback bid. The midstream area does not tolerate under-valuations for long. Therefore, shareholders are likely to do better in terms of valuation as Diamondback than they are as Rattler in the current market environment.

Midstream companies like this one appeal to a wide variety of investors because the leverage is very low, and the main customer is investment grade. This is likely to be a way to invest in Diamondback at a discount until the merger completes. But prices of both need to be checked before undertaking any such plan. I personally like the Diamondback dividend. The upstream risk is higher than is the case of just Rattler alone. Then again, Diamondback is investment grade. So that wide appeal in the currently robust upstream business environment probably still remains.

Be the first to comment