Taitai6769/iStock via Getty Images

Investment Thesis

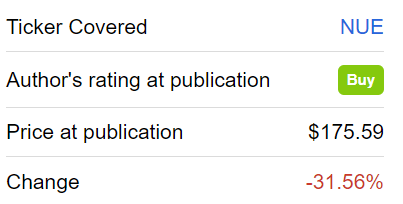

Nucor Corporation (NYSE:NUE) has sold off by 32% since I last highlighted this stock.

Author’s coverage of NUE Stock

This is clearly unsatisfactory. However, as you’ll see, even though the macro outlook is just as fuzzy as it was then, the stock now offers significantly better value.

To be clear, I’m not talking about senselessly buying the dip here. I’m referring to a company that is clearly undervalued. A company with a leading strong balance sheet.

Moreover, steel prices are stable and trading at a range-bound price. I believe that paying approximately 5x free cash flows for Nucor makes a lot of sense.

I rate the stock a buy.

Nucor’s Near-Term Prospects

There are many different moving parts when it comes to investing in Nucor. One big concern is the supply disruption of pig iron. Approximately 10% of Nucor’s pig iron supply has come from Russia. This supply has now been cut.

The other noteworthy impact is that there’s the expectation that a slowing economy will lead to a rapid build-up in steel products. Also, there are expectations that the auto industry will see demand slow down, which would lead to lower steel requirements.

Another noteworthy consideration is that China is now increasing its steel production and servicing Europe more aggressively.

There are many different risks and headwinds. But when all is said and done, prices for steel have been relatively stable, as you can see below.

Accordingly, I contend that during this ”risk-off” period, investors are overreacting relative to the underlying business dynamics.

Next, let’s drill further into what makes Nucor’s attractive.

Strong Balance Sheet, Bullish Consideration

Nucor carries $6.7 billion worth of debt as of Q1 2022. This is offset by $4.3 billion worth of cash equivalents. This implies that Nucor’s balance sheet carries $2.4 billion of net debt.

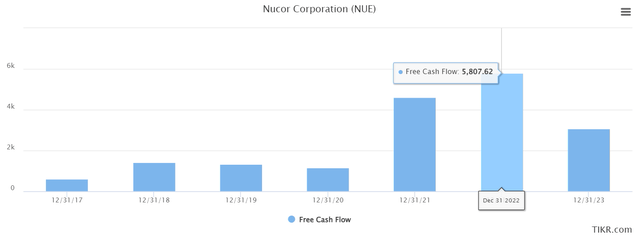

For a business that made around $2 billion of free cash flow in a 90-day period in Q1 2022, this clearly is a very strong balance sheet.

This has translated into Nucor having the strongest credit rating in the North American steel sector.

Focusing on Nucor’s Operating Leverage

Nucor saw its topline increase by 50% y/y. And on the back of this solid revenue growth, its bottom line truly impressed and was up 147% y/y.

Now, consider the following:

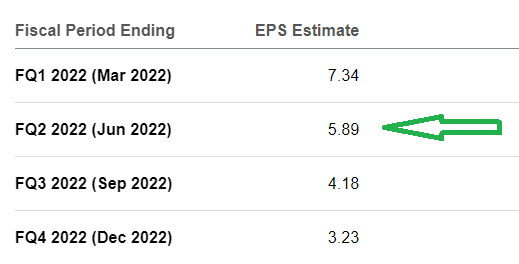

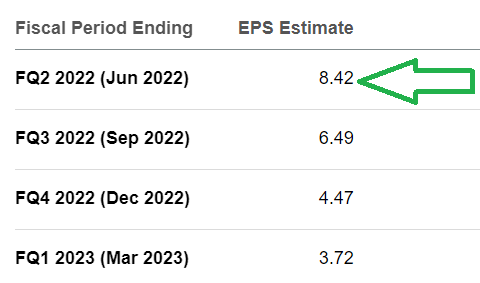

Nucor’s previous EPS estimates

Above you can see analysts’ EPS expectations for Nucor at the time of its Q1 2022 results.

Now compare the estimates above with the ones below, for analysts’ recently updated EPS expectations for Nucor:

NUE consensus estimates, June

What you see above is that in the last few weeks, analysts have increased their EPS estimates for Nucor by 43%. That’s clearly a totally different profit profile for a company that’s priced at $120 per share.

Nonetheless, the same issues overhang the stock that has hung around the stock for some time.

In the second part of 2022 and as we move into 2023, there’s the expectation that steel prices cool off that’s going to lead to Nucor’s profitability profile cooling off.

NUE Stock Valuation — Priced at 5x Free Cash Flow

Right now, the stock is priced at very approximately 5x free cash flow. But the fear that investors have is that as we move into 2023, Nucor’s free cash flow dries up and the stock ends up trading at around 10x free cash flow.

The Bottom Line

For someone with exposure to the steel industry, I recognize that you never want to buy into a commodity company that’s priced at a very low multiple, only to next year see the free cash flow dry up and all of a sudden the stock is priced at a double-digit multiple.

But then again, I circle back and think, I can either pay 10x free cash flow for a steel company that at least is making free cash flows right now. Or I can pay more than 10x forward sales for a business that may or may not be able to generate free cash flows in the future.

Ultimately, it’s all down to one’s temperament. I believe that when you invest in a cyclical company that’s priced at low multiples to free cash flows the odds are favorable.

It will not be a home-run investment. But there again, a lot of the companies that many thought would be home run in 2020 turned out to be little more than very longshot investments, with no actual chance at a home run.

It really doesn’t matter how one invests. We are all trying to buy something for less than it’s worth.

You have a good thought process and not be rewarded or you can have a faulty thought process, but because you didn’t pay a large valuation, you still end up getting rewarded.

Be the first to comment