MicroStockHub

By Antoine Bouvet, Benjamin Schroeder, Padhraic Garvey, CFA

US CPI came in as expected, but was enough for the markets to view things as glass half-full

Market rates edged lower post the CPI number, but not for good reason. The report was in line with expectations in terms of the headline numbers. But moreover, an issue for bonds here is services less energy, which accounts for almost 60% of the index, which is up to 0.5% month-on-month for December (was 0.4% MoM in the previous month). That’s still hot. It annualises to over 6%. The jobless claims number was hot too (claims fell again and remain close to 200k).

Enough here to worry the Fed. Note that the Bloomberg version of financial conditions moved into loose territory this week as market rates fell and credit spreads tightened. Not the ideal combination from the Fed’s perspective, at least to the extent that they have concerns that the job is not yet done on inflation.

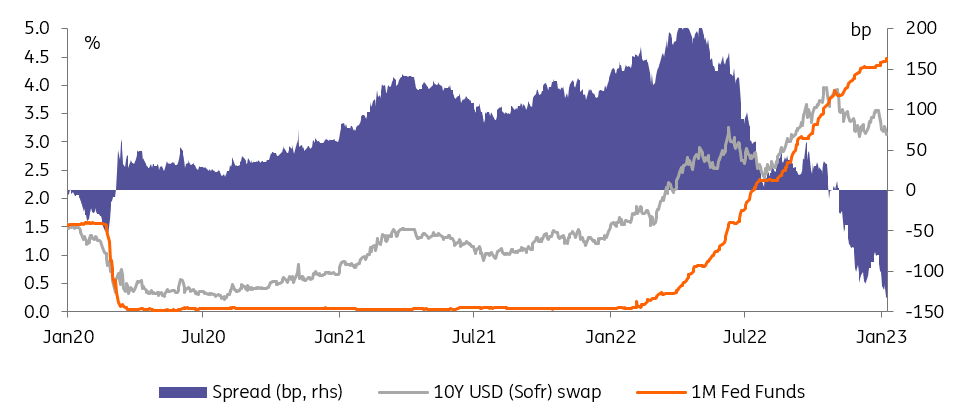

From the market’s perspective, note again the large spread from 3mth SOFR to Treasury yields. The US 10yr is in the 3.5% area versus 3mth SOFR at 4.6%. Any spread above 100bp (inversion) is extreme from an historical context. We’ve been higher, but typically not for long. And as the Fed hikes in the coming months, that spread stretches wider. Therein is the pressure for market rates to be pulled higher from a carry perspective, even if logic suggests that rates should collapse lower on recession risks. The issue here is a lot of that move has already been priced.

But the market is one-way at the moment, helped by a strong 30yr auction. This presents clear evidence of demand for duration, despite the recent run to money market funds. Funds are getting the best of both worlds here, with rolling longs on the front-end resulting in high running yield, plus performance further out the curve. Glass half-full seen from this the CPI report helped too.

Overall, this market is finding good excuses to continue to test the downside for yields. We have some reservations, as stated before, but that’s clearly the path of least resistance.

10Y Rates Dipping More Than 100bp Below Fed Funds Makes Them Vulnerable To A Re-Pricing Higher (Refinitiv, ING)

The next TLTRO repayment to shrink the ECB’s balance sheet

The European Central Bank will announce banks’ next targeted longer-term refinancing operations (TLTRO) repayment today. After the tweaks to the TLTRO terms in October, close to €800 billion has already been repaid or has matured. With the bulk of early repayment decisions likely having been made already and the largest part of the remaining €1.3 trillion to mature over the second half of the year, we do not see any particular reason to expect another larger repayment this time around. The median expectation surveyed by Bloomberg is €213 billion, but as with past early repayments, the range of estimates is wide, from €75 billion to €450 billion.

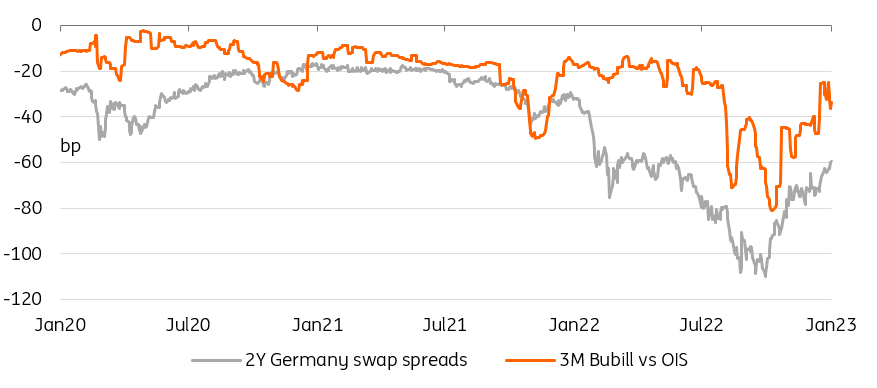

From a policy perspective, the ECB’s balance sheet is already on a clear downward trajectory, regardless of today’s figure. The TLTRO’s winding down has had and will have the largest impact on the excess reserves in the banking system near term, but also the asset portfolios have been announced to start melting off come March. That reduction in excess reserves was also seen as one factor contributing to the tightening of Bund asset swap spreads (ASW), as less liquidity now seeks a home in high-quality collateral. Indeed, the peak in excess liquidity broadly lines up with the peak in Bund ASW spreads, and the further trajectory of the former leaves room for more tightening of the latter.

Easing Collateral Scarcity Has Tightened Short-End Swap Spreads (Refinitiv, ING)

Today’s events and market view

The US CPI report has removed one obstacle for a further rally in rates. To the extent that this rally is more driven by confirmation bias, today’s University of Michigan consumer survey could prove more market-moving than comments from Fed officials. Slated to speak today is the Fed’s Kashkari. We will also hear from the Fed’s Harker again, who already yesterday called for raising rates by 25bp “a few more times”. Markets currently price in less than 50bp combined over the next two Fed meetings. In a typically hawkish fashion, Bullard was arguing for Fed Funds to be raised above 5% “as soon as possible” yesterday, noting better growth prospects than expected.

In the euro area, we will get final inflation readings for December out of several countries, and for the bloc as a whole we will also get industrial production and trade balance data. The TLTRO repayment announcement comes at 12.05 CET.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment