Kruck20

Real Estate Earnings Halftime Report

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on July 29th.

Hoya Capital

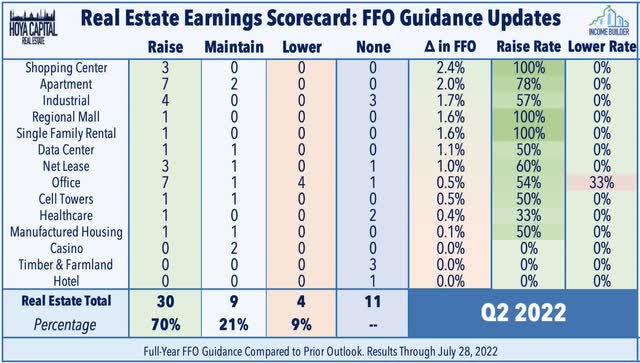

We’re approaching the halfway point of another newsworthy real estate earnings season with roughly 55 REITs representing 50% of the total market capitalization having reported results. Among the 43 REITs that have provided full-year Funds From Operations (“FFO”) guidance, 30 REITs (70%) raised their outlook while just 4 REITs (9%) have lowered or withdrawn their outlook. (Excluding several REITs that withdrew guidance due to pending acquisitions.) Strong results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 45% of S&P 500 companies boosted their outlook while 55% have lowered.

Hoya Capital

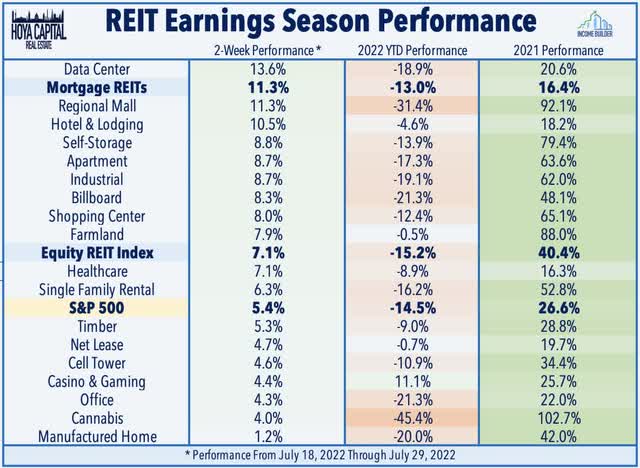

The fundamental earnings outperformance reflects the fact that REITs are still relatively “early” in their post-pandemic recovery relative to the broader market, having just recovered to 2019 FFO levels in early 2022 while total dividend payments are still about 10% below pre-pandemic levels, as discussed in our State of the REIT Nation report earlier this quarter. REITs generally perform their best in a relatively “slow and steady” economic regime – and volatile economic conditions since the start of the pandemic have been anything but slow or steady. A “soft landing” of moderating interest rates and slowing – but not sharply negative – economic growth would be an ideal macro environment, and the strong earnings season has coincided with a relatively favorable slate of economic news, sending the Equity REIT Index higher by more than 7% over the past two weeks while Mortgage REITs have jumped 11%, each outpacing the 5.4% gain from the S&P 500 over this period.

Hoya Capital

Residential Real Estate Halftime Report

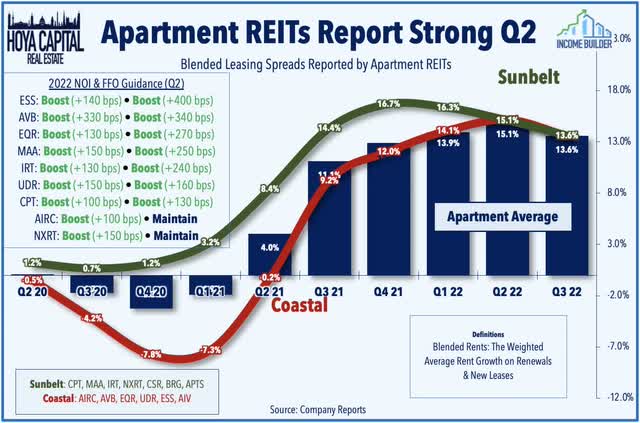

Apartment: (Halftime Grade: A) Nine of the ten major apartment REITs have reported results – nearly all of which have significantly exceeded expectations. All nine raised their full-year same-store NOI growth target – which is now expected to average more than 13% this year – while seven of the nine boosted their full-year FFO target with an average increase of 2%. Benefiting from the affordability issues plaguing the ownership markets of late, both Sunbelt and Coastal-focused REITs are seeing similar trends of sustained double-digit rent growth, historically high occupancy rates, and record-low turnover. The upside boosts from Camden Properties (CPT) and Mid-America (MAA) – each of which we hold in the Dividend Growth Portfolio – bring their cumulative FFO growth since 2019 to over 30%. Among the coastal REITs, Apartment Income (AIRC) continues to fly under the radar, now having posted six straight quarters of sequentially accelerating rent growth.

Hoya Capital

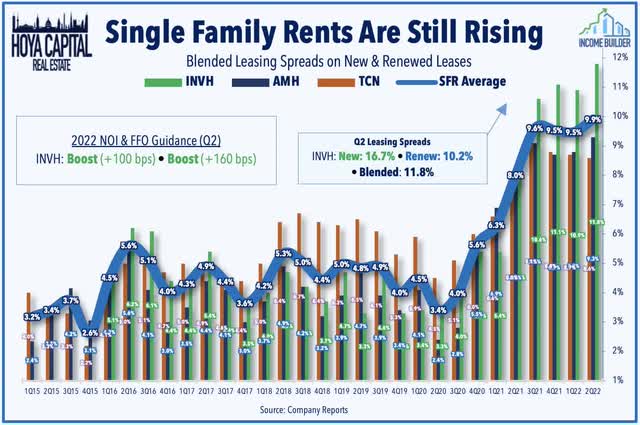

Single Family Rental: (Halftime Grade: A-) Invitation Homes (INVH) – the nation’s largest housing owner which we also own in the Income Builder REIT Dividend Growth Portfolio – also reported strong results and raised its full-year NOI and FFO guidance. Citing “favorable supply and demand fundamentals” in its markets, INVH saw an acceleration in rent growth in Q2 to an 11.8% blended rate – its strongest quarter on record. The “embedded” rent growth potential is substantial with INVH estimating that its current leases are 16% below market rate, on average, as SFR REITs have perhaps been a bit too “generous” to existing tenants on lease renewals. The SFR REIT now expects FFO growth of 12.5% this year – up 160 bps from its prior outlook – while also raising its NOI growth outlook by 100 basis points to 10.8%. We’ll hear results from American Homes (AMH) on Thursday.

Hoya Capital

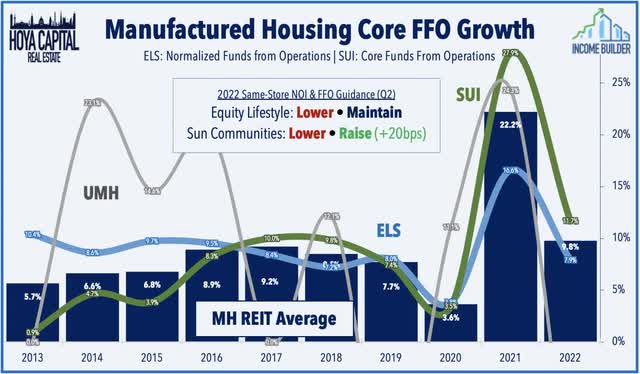

Manufactured Housing: (Halftime Grade: B-) We’ve heard results from two of the three MH REITs. Following a rare “miss” from Equity LifeStyle (ELS) in the first week driven by a gas-price-driven slowdown in transient RV demand, Sun Communities (SUI) reported stronger results last week, raising the midpoint of its Core FFO outlook based on its newly-reported constant-currency convention – which it began reporting following the acquisition of Park Holidays in the UK. SUI expects FFO growth of 11.7% this year following growth of nearly 30% in 2021 and yet still trades near its “cheapest” level in nearly a decade. We continue to expect core manufactured housing rents to surprise to the upside this year, and a gas price stabilization should help relieve some of the offsetting downward pressure from slowing transient RV demand. We’ll hear results from the recently-resurgent UMH Properties (UMH) on Wednesday.

Hoya Capital

Homebuilders: (Halftime Grade: C+) Rates, rates, rates. While changes in mortgage rates don’t change the underlying long-term supply/demand fundamentals – which remain very compelling after a decade of underbuilding – they sure do have an impact on short-term demand trends – a theme that we’ve seen both on the upside and downside over the past several years. Normalizing home price appreciation is welcome and much-needed to prevent the need for a stepper and more painful correction after easy monetary and fiscal policy led to a significant price overheating that peaked in late 2021. All things considered, builders have reported decent results in Q2, underscored by results from PulteGroup (PHM) last week, which still sees revenue growth of more than 20% this year. Mortgage rates will ultimately determine how “soft” the landing will be, but with the skeptics out in full force with their perennial “bubble” predictions and with builders trading at single-digit P/E multiples, the stock price risk is certainly to the upside in our view.

Hoya Capital

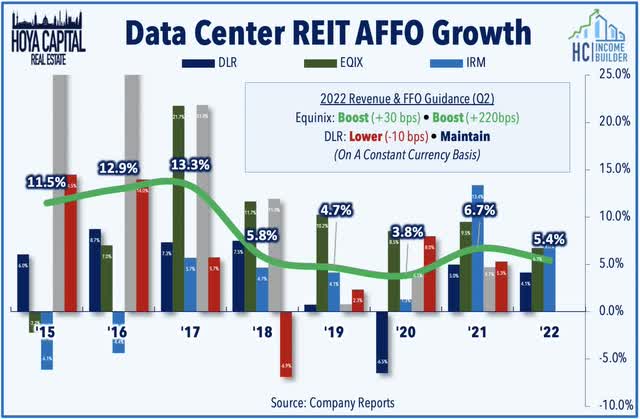

Technology & Logistics REIT Halftime Report

Data Center: (Halftime Grade: B) Equinix (EQIX) has been among the top performers this earnings season after reporting better-than-expected results driven by record-high levels of gross bookings in the first half of the year. EQIX raised its full-year FFO outlook to 9.5% on a constant-currency basis, up 220 basis points from its prior outlook. Data center REITs have become “battleground” stocks in recent months after short-selling firm Chanos & Company launched a $200m fund that will bet against US-listed REITs with a particular focus on data centers. Results from Digital Realty (DLR) were less impressive, however, with gross bookings falling short of estimates and with a slight downward revision in its full-year revenue outlook, consistent with our belief that network-dense data centers – which are the focus of EQIX – are more immune to the persistent competition from hyperscale cloud companies – Amazon (AMZN), Google (GOOG), and Microsoft (MSFT) – with nearly limitless resources.

Hoya Capital

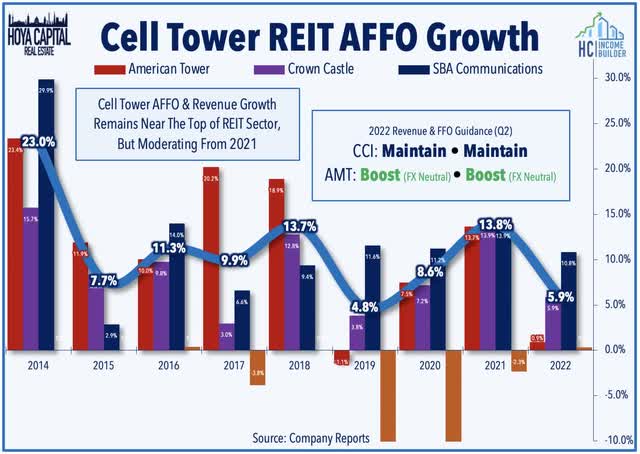

Cell Tower: (Halftime Grade: B-) After uncharacteristically lagging for most of the year, Cell Tower REITs have been among the best-performing property sector over the past quarter, benefiting from favorable macro shifts and positive industry-specific catalysts. Results from the two largest tower REITs were roughly in-line with expectations. Crown Castle (CCI) maintained its full-year outlook calling for FFO growth of 5.9% and revenue growth of 9.5%. Of note, CCI reiterated its belief that the “U.S. represents the highest growth and lowest risk market in the world for communications infrastructure ownership” and has dropped the “International” from its company name. The strong dollar took a bite out of American Tower’s (AMT) revenue and FFO, but AMT raised its full-year outlook on a constant-currency basis, citing “unabated demand for our communications assets.”

Hoya Capital

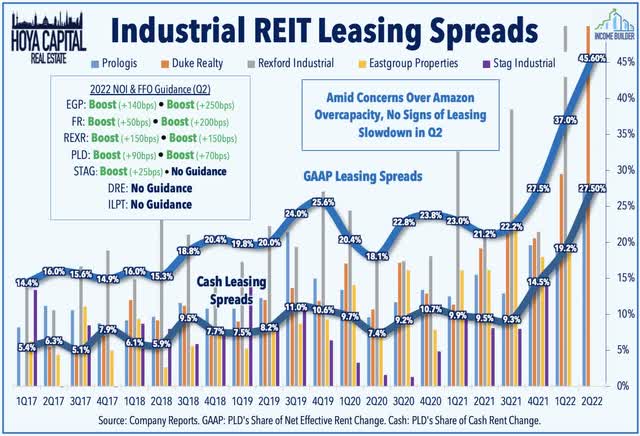

Industrial: (Halftime Grade: A-) No signs of slowdown here. Seven of the thirteen industrial REITs have reported results – each of which has shown that – despite the pullback in logistics spending from Amazon (AMZN) – demand for logistics space continues to outpace supply. Upside standouts have included First Industrial (FR) – which we own in the Dividend Growth Portfolio – which significantly raised its full-year outlook citing strong leasing trends and record-high occupancy rates. Prologis’ (PLD) results were also impressive, boosting its full-year NOI and FFO outlook while recording an acceleration in renewal rates with a record-high 45.6% increase in effective rents. Rexford Industrial (REXR), meanwhile, reported incredible leasing spreads of 83% GAAP and 62% cash while maintaining a 99% occupancy rate. STAG Industrial (STAG) – which we own in the Focused Income Portfolio – also delivered impressive results with rent growth on new leases of over 25%.

Hoya Capital

Retail REIT Halftime Report

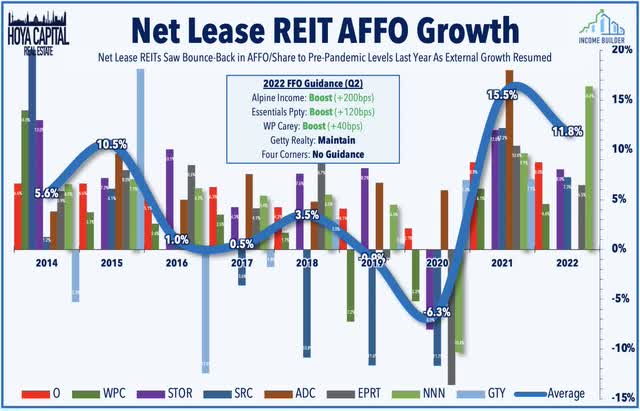

Net Lease: (Halftime Grade: B+) Earnings season is still young for the net lease and retail sector, but results thus far have been quite strong while also benefiting from the retreat in long-term rates. W.P. Carey (WPC) delivered very strong results this morning, benefiting from its sector-leading upside exposure to inflation through its CPI-linked lease structure. WPC raised its full-year FFO outlook by 40 basis points while delivering record-high same-store rent increases. Results from Essentials Property (EPRT) and Getty (GTY) were also solid – each of which has decent inflation-hedging characteristics per our recent analysis. Small-cap Alpine Income (PINE) delivered a sizable beat and raised its full-year outlook by 200 basis points. Of note, PINE commented that despite the jump in interest rates, private markets pricing of net lease properties remains firm, citing “a lot of high net worth individuals and some institutional investors buying these properties at Cap rates that really haven’t changed too much from six months ago.”

Hoya Capital

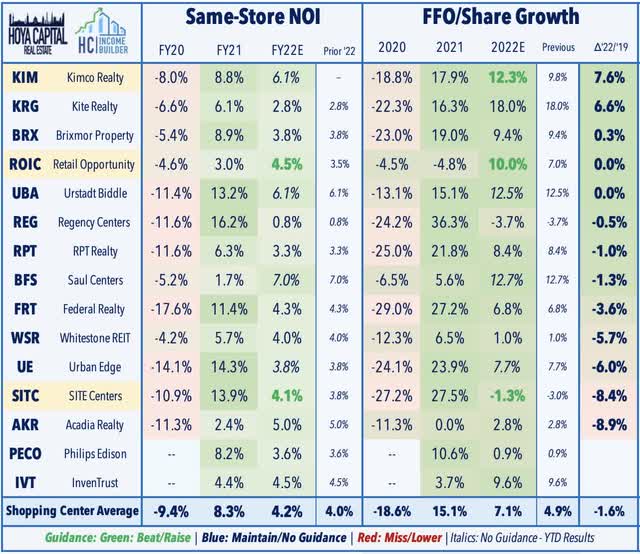

Shopping Center: (Halftime Grade: A-) We’ve heard results from three of the 16 shopping center REITs, each of which raised their full-year FFO and NOI growth outlooks. Kimco (KIM) has been an upside standout after boosting its full-year FFO growth outlook to 12.3% – up 250 basis points from its prior outlook. Of note, KIM commented that one of the key drivers is their focus on “last mile locations” which are seeing positive traffic patterns at 101.3% relative to the same period last year, consistent with the trends discussed in our recent report Shopping Center REITs: Winning The Last Mile. SITE Centers (SITC) also boosted its FFO growth outlook by 170 basis points while recording its highest quarterly new leasing volume since early 2017. Retail Opportunity Investment (ROIC) raised its FFO growth outlook to 10.0% this year – up 300 basis points from its prior outlook – which would bring its FFO back even with its pre-pandemic rate in full-year 2019 driven by double-digit rent growth on same-space new leases and renewals.

Hoya Capital

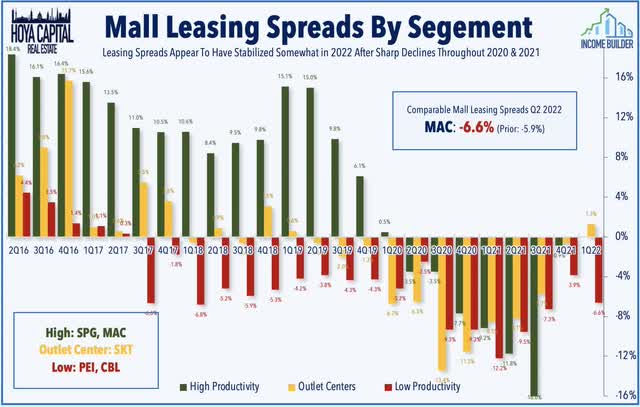

Mall: (Halftime Grade: C+) Macerich (MAC) posted in-line earnings results, and slightly raised the midpoint of its full-year adjusted FFO outlook, but to levels that would still be more than 40% below its pre-pandemic 2019 full-year FFO. Occupancy rates in its consolidated centers improved a bit to 90.9% – 230 basis points higher than the prior year – but still well below the 94% occupancy rate in 2018 before the pandemic. Rents remain under pressure, however, as MAC’s newly-signed leases were more than 6% below its expiring leases with potentially more downside to come as new lease rates are roughly 14% below its overall Average Base Rent rate. We’ll hear results from Simon Property (SPG) on Tuesday.

Hoya Capital

Office, Hotel, & Healthcare Halftime Report

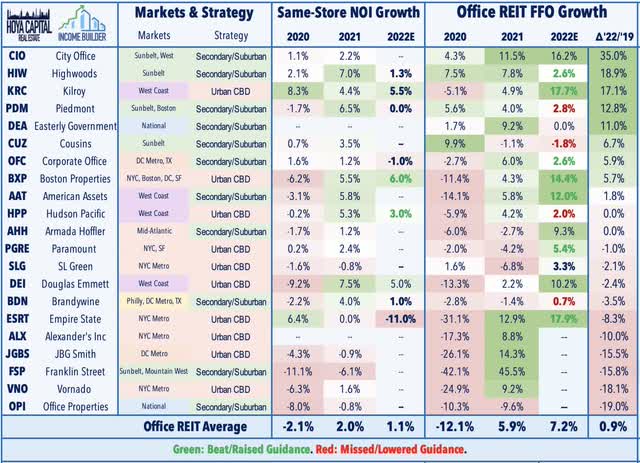

Office: (Halftime Grade: B) We’ve seen results from 13 of the 23 hotel REITs, of which seven have raised their full-year FFO growth outlooks while four have lowered their outlook, underscoring the market-by-market bifurcation we noted in our recent office report. Upside standouts have included Sunbelt-focused Highwoods Property (HIW) – which we own in the Focused Income Portfolio. HIW raised its full-year FFO target to levels that would amount to nearly 19% cumulative growth since the end of 2019 – tops in the sector. Coastal-focused Boston Properties (BXP) also delivered surprisingly strong results as strong lab space demand and solid leasing trends at high-tier “trophy” assets offset softness in other segments. Results thus far have been consistent with the theme that despite persistently low utilization rates at offices across most major markets, corporate decision makers have been reluctant to make permanent decisions to reduce square footage.

Hoya Capital

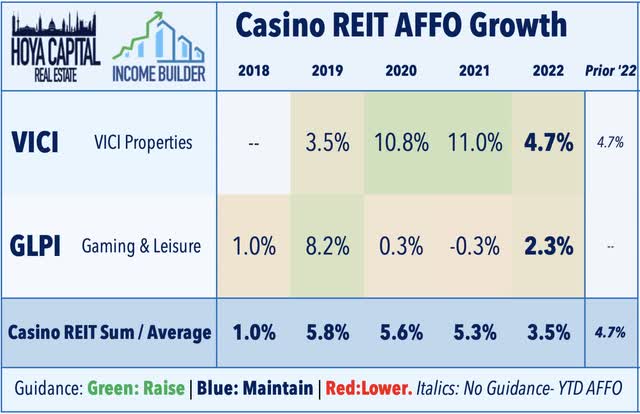

Casino: (Halftime Grade: B) Both casino REITs reported Q2 results that were in-line with estimates this past week with no major surprises. VICI Properties (VICI) maintained its full-year outlook calling for FFO growth of 4.7% while Gaming & Leisure Properties (GLPI) reinstated guidance targeting 2.3% FFO growth for the year. Of note, with REITs now owning a significant share of casino real estate properties in the U.S., VICI reiterated that it is looking at non-gaming asset classes for future growth opportunities, hiring a new Chief Investment Officer to “focus on non-gaming.” Casino REITs have been among the best-performing property sectors this year, benefiting from an upward “re-rating” from investors as the sector has matured following the VICI acquisition of MGM Growth Properties and resulting in an investment grade credit status and inclusion in the S&P 500.

Hoya Capital

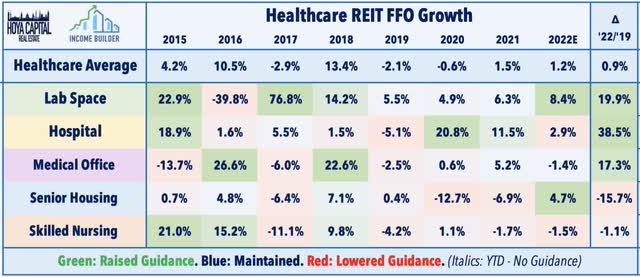

Healthcare: (Halftime Grade: N/A) We’ve heard results from just three of the sixteen healthcare REITs. Lab space-focused Alexandria Real Estate (ARE) – which we own in the Dividend Growth Portfolio – has been an upside standout after reporting better-than-expected results and raising its full-year outlook. Lab space demand showed few signs of cooling as ARE’s beat was driven by a record rental rate increase – 45.4% GAAP and 33.9% cash – and a historically high leasing volume of 2.3M square feet, the third-highest quarter of leasing volume in the company’s history. ARE now sees FFO growth of 8.4% this year – up 40 basis points from its prior outlook – and raised its same-store NOI growth outlook by 30 basis points to 7.8% at the midpoint. LTC Properties (LTC) reported an active quarter of lease renegotiations with troubled tenant operators, a chronic issue that has re-emerged for SNF REITs as government relief funds have dried up – a focus in the week ahead with results from Omega Healthcare (OHI) and Sabra Health Care (SBRA).

Hoya Capital

Mortgage REITs Halftime Report

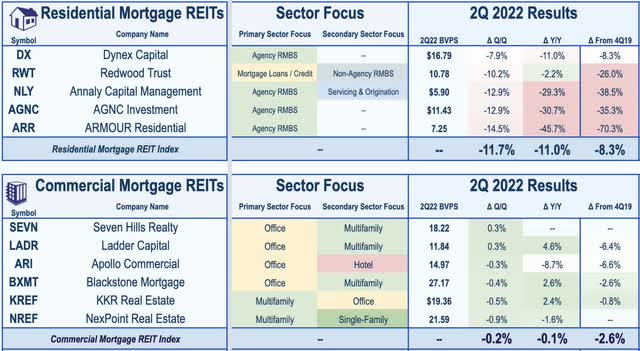

Residential mREITs: (Halftime Grade: B-) We’ve seen results from 5 of the 24 residential mREITs in our coverage. Consensus expectations called for Book Value Per Share (BVPS) declines of around 10% in Q2 during a historically brutal quarter for fixed income securities – particularly MBS securities – but mREITs have rebounded in recent weeks as the MBS market is now on pace for a historically strong month of returns in July. Annaly Capital (NLY) and AGNC Investment (AGNC) each reported BVPS declines of 12.9%, but reported better-than-expected earnings-per-share growth with NLY citing “historically attractive new investment returns” on Agency MBS. Dynex Capital (DX) has so far reported the most modest BVPS decline at 7.9% while ARMOUR Residential (ARR) has reported the steepest decline at 14.5%.

Hoya Capital

Commercial mREITs: (Halftime Grade: B+) On the commercial mREIT side, we’ve seen results from seven of the 17 commercial mREITs, where the movement in BVPS has been far more muted. Blackstone Mortgage (BXMT) – which we hold in the Focused Income Portfolio – posted better-than-expected results with Q2 distributable EPS of $0.67, topping the $0.63 consensus and rising from $0.62 in Q1 2022. Citing its “floating-rate portfolio and strong liquidity position,” BXMT’s book value per share (“BVPS”) was essentially unchanged. Arbor Realty (ABR) – which we also recently added to the Focused Income Portfolio – reported better-than-expected results driven by strong multifamily fundamentals and raised its dividend for the ninth consecutive quarter. Seven Hills (SEVN) is the leader in the clubhouse thus far with a 0.3% gain in BVPS in Q2 while NexPoint Real Estate (NREF) has been the laggard with a 0.9% decline. The earnings calendar heats up in the week ahead with results from two dozen mREITs.

Hoya Capital

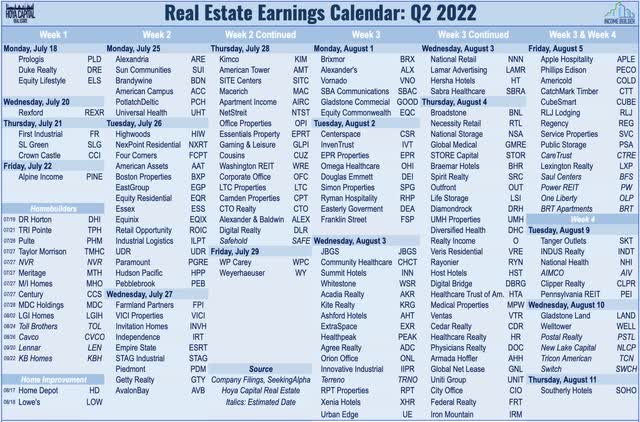

Previewing The Second Half of Earnings

Among the 43 REITs that have provided full-year Funds From Operations (“FFO”) guidance, 30 REITs (70%) raised their outlook while just 4 REITs (9%) have lowered or withdrawn their outlook. Upside standouts this earnings season have been Apartment, Shopping Center, and Industrial REITs. Currency headwinds have been a theme in the technology space, but core results surprised to the upside. Office REITs have been the lone source of negative revisions. The back-half of earnings season is generally more volatile as we’ll see nearly the full-slate of retail and hotel REIT reports and results from most of the remaining small-cap REITs. We’ll continue to provide real-time coverage for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout earnings season.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Be the first to comment