narong sutinkham/iStock via Getty Images

Finding a sustainable 8% dividend yield is not easy in today’s market. You usually have to take on incredible risk that the cash payout will be cut this year or next to match the same rate as 40-year record YoY CPI gains currently. What’s even harder to find is a growing semiconductor company that manufactures 100% of its goods in America. Well, I have a pick that will give investors both of these rare setups.

NVE Corp. (NASDAQ:NVEC) is a company I have mentioned in the past, with my latest full-length presentation in October here. Its unique spintronic-based sensors and couplers are put together in a small building in Minnesota and shipped to the rest of the world. The enterprise owns most of the basic patents on data/memory storage using electron spin vs. the standard electron charge inventions of the past. This technology is more durable, with fewer errors reading and writing, while data remains constant even if a device is not plugged in or charged with energy. All of these advantages are turning their bread-and-butter sensors into the top-of-the-line inventions for medical devices and robotics.

Management at first hoarded cash for a decade, as the business expanded. Then, NVE decided in 2015 to send out large dividend checks supported by operating earnings and this cash stash.

So, here’s the deal for investors that didn’t exist in 2021… business has been good for the company in 2021-22 as OEMs have shifted to buying NVEC products, because the supply chain for competing semiconductors and sensors is jammed up and unpredictable. Revenues/earnings are climbing smartly, and a new product line was introduced in 2021. Taken together, the operating future is bright for this company, holding almost no liabilities and running some of the highest profit margins/returns on capital of any publicly-traded business in the U.S.

When the tech wreck smoke clears in the coming months, many will look back at all the bargains they missed. The bottom line is new investors are getting a wonderful 8%+ dividend check every year on any NVEC purchase price under $50. The technology crash of 2021-22 has pulled down NVE’s quote, throwing the baby out with the bath water. Intelligent long-term investors, especially passive income-minded ones, should be overjoyed such an opportunity exists. Honestly, I do not expect that this buy entry level will last for procrastinators, assuming the immediate direction is not straight down for equities in general on Wall Street.

Dividend Story

The company held a hoard of $55 million in cash at the end of March, including short-term investments and municipal bonds. An amazingly low $3 million in total liabilities is also part of the successful operating equation. Against today’s $48 stock quote ($11 in cash), equal to $228 million in equity market capitalization, it’s hard to turn away from the investment proposition offered by the marketplace right now, regardless of dividends.

NVE achieved a record-tying $3.00 EPS in fiscal 2022 (ending in March) vs. the present $4.00 dividend payout. So, you might ask yourself, is the high dividend yield really sustainable? When you dig deeper, the answer is clearly yes.

What are the business trends? The best summary of growth in underlying operations is taken from the Q4 earnings press release on May 4th here,

Total revenue for the fourth quarter of fiscal 2022 increased 15% to $6.72 million from $ 5.86 million for the prior-year quarter. The increase was due to a 12% increase in product sales and a 104% increase in contract research and development revenue. Net income for the fourth quarter of fiscal 2022 increased 22% to $3.82 million, or $0.79 per diluted share, compared to $3.13 million, or $0.65 per share, for the prior-year quarter.

For fiscal 2022, total revenue increased 26% to $27.0 million from $21.4 million for the prior fiscal year. The increase was due to a 26% increase in product sales and a 36% increase in contract research and development revenue. Net income increased 24% to $14.5 million, or $3.00 per diluted share, compared to $11.7 million, or $2.42 per share, for fiscal 2021.

Rising EPS from either operating growth and/or aggressive stock buybacks under $50, exchanging cash for undervalued ownership interests, could easily push income “per” share well above the dividend payout rate later in calendar 2022 or early 2023. At a minimum, stagnant income rates and the major cash position should support the dividend for another 11 years theoretically, without the need to change operations or borrow funds. Overall, I rate the dividend payout as one of the most secure in the smaller cap equity space on Wall Street.

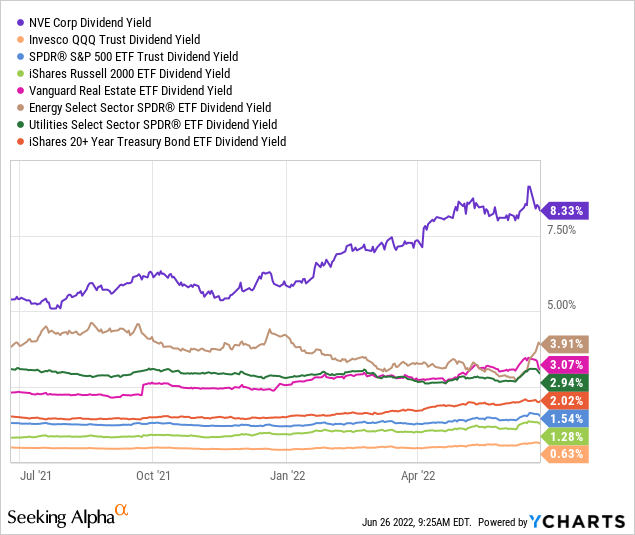

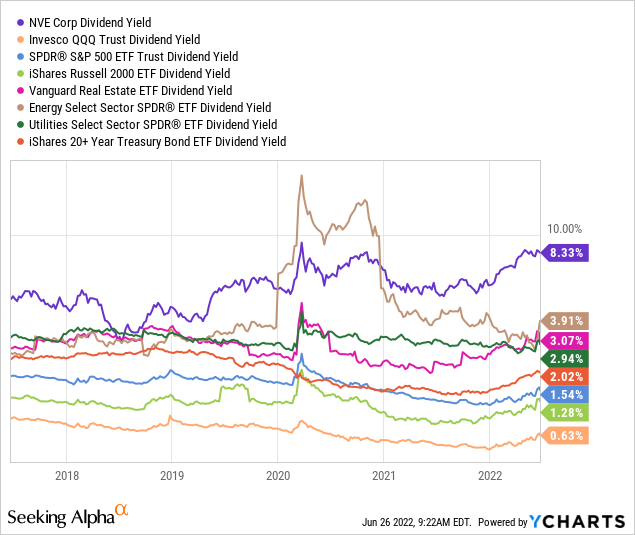

The current 8.3% cash distribution yield is the best “relative” position EVER for NVE investors, since it began paying a dividend. On the 1-year and 5-year charts below, you can review how the golden opportunity to purchase this unique yield evolved. Compared to tech companies in the Invesco NASDAQ 100 ETF (QQQ), or the market generally represented by the SPDR S&P 500 ETF (SPY), or smaller caps in the iShares Russell 2000 ETF (IWM), or dividend-focused Vanguard Real Estate ETF (VNQ) or Energy Select Sector SPDR (XLE) or Utilities Select Sector (XLU), or even safe bonds represented by the iShares 20+ Year Treasury Bond ETF (TLT), the annual cash yield available from NVEC is quite extraordinary today.

YCharts YCharts

Earnings Coverage

The subdued stock quote vs. record earnings per share into March 2022 of $3.00 means the earnings yield available for new investors is the strongest in over a decade. Reviewing accounting statements of the last two quarters, I am forecasting current business trends should support EPS of $3.20 to $3.50 over the next 12 months, depending on how the economy survives rising interest rates and OEM demand fluctuates as a consequence. (Of course, share buybacks would be materially accretive at present pricing and should be used to sensibly support $4.00+ EPS sooner.)

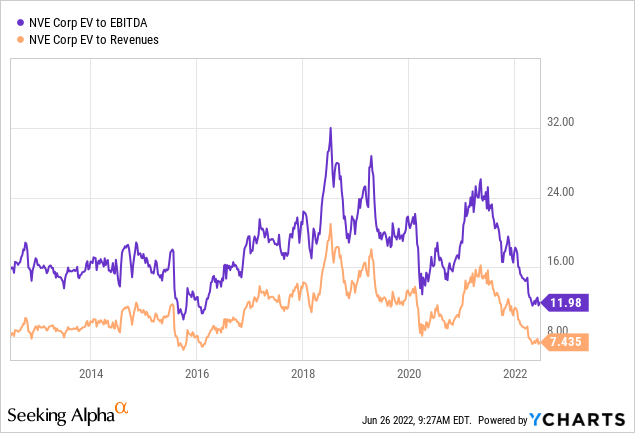

YCharts

With the large cash position, enterprise value calculations are truly telling of underlying worth. On either EBITDA (earnings before interest, taxes, depreciation and amortization) or Revenues, NVE is trading near a decade-low presently. Not pictured, I figure the forward 1-year earnings yield on EV is above 8% to as high as 9% at $48 per share. In contrast, the largest semiconductor companies loved by Wall Street are priced at equivalent yields of 3% to 5%.

YCharts

Technical Chart Improving

Owning shares since my last article writing effort, I have watched the quote decline despite strong operating results with frustration, for sure. If there’s any good news to be found, selling appears to be more arbitrage related to the tech sector swoon from late 2021. It is not a direct reflection of company woes (which do not exist).

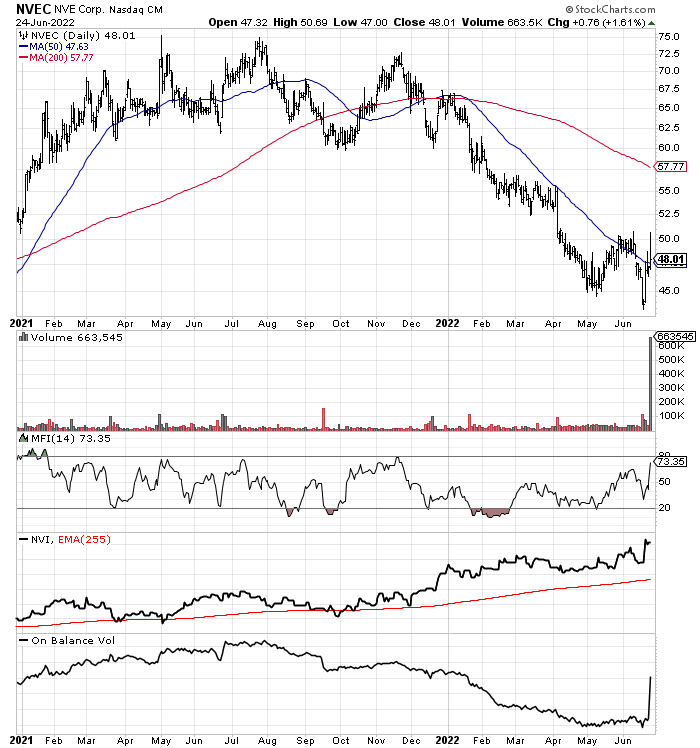

On Friday, volume spiked to almost 13% of outstanding float. And, it appears most of the interest was on the buy side, as represented by the On Balance Volume and 14-day Money Flow Index spikes on the $0.76 session price gain, drawn below. Another positive development is the Negative Volume Index of trading action on slower volume days shows no aggressive selling over the last 18 months. Nearly all of the momentum indicators I track are showing substantial improvement since early May. My read of the technical trading setup is NVEC would like to move higher in price, once the tech sell-off fades.

StockCharts.com

Final Thoughts

When you hunt around the stock market, NVE is truly a one-of-a-kind investment vehicle in June 2022. You are getting a secure, well-above average 8% dividend yield. But, you are also buying a company with actual potential for outsized growth in the underlying business. This one-two punch is quite rare to find, and now available to anyone reading this story. Hopefully, you feel enlightened and motivated to do more research into the investment proposition.

NVEC was dropped out of the Russell 3000 index after the close last Friday, which likely explains recent price weakness and the huge spike in trading volume on Friday. For bulls, price rising above the 50-day moving average is step one to begin a new uptrend.

What are the main risks to your NVEC investment capital? With little change in upper management (the long-time CFO retired last year) or the board of directors year-to-year, and consistent operating results over time, I am not overly concerned about labor wage hikes (with 50 total employees), shipping costs, or commodity input prices. In fact, robust growth last year in a variety of metrics should dispel usual company-specific worries around macro cost issues. However, I feel the biggest risk to operating growth is order flow could weaken in a steep recession scenario globally. Spiking inflation and interest rates, alongside their consumer/business spending and investment valuation repercussions, are real fears to contemplate. The next important risk is a new invention or far cheaper product alternatives may one day appear vs. NVE products. As far as I can tell, such is not a present danger, but bears close watch. Finally, a continuing stock market tech crash would likely pull down the share quote, just like the late-2021 and first-half 2022 experience.

Management appears confident the end of the pandemic will not hurt relationships or sales to the new customer base picked up during 2021-22’s semiconductor industry turmoil. In fact, happy customers may increase order totals and spread the word to others if the economy staves off deep recession. Other positives are the company pays no interest expense on debt and has a low fixed-cost setup for manufacturing. I can easily argue exaggerated inflation levels will quickly funnel to NVE’s bottom line as better profitability vs. competitors forced to raise selling prices to cover increasing costs at faster overall rates.

Pulling all the possible pros and cons together, risk/reward analysis heavily favors owning shares. I think a price below $45 will be difficult to maintain, unless we get a serious worldwide recession. The stock quote is already discounting a minor recession, in my view. Potential upside can be argued as unlimited if company sales remain in an uptrend. But for argument’s sake, I will put best-case scenario upside at $80 in 12-18 months (a tad above last year’s peak price). Using average EV to EBITDA and Revenue ratios the last decade, or a normalized/realistic dividend yield vs. alternatives, total return upside of +75% is possible over the next year vs. worst-case downside of -10%. To me, this setup is quite positive. I own a minor NVEC stake in my portfolio.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment