malerapaso

Investment thesis

After some very positive quarters for Ranpak Holdings’ (NYSE:PACK) operations thanks to a strong e-commerce industry heavily bolstered by lockdowns and subsequent restrictions due to the coronavirus pandemic crisis, economies around the globe are returning to their normal courses, and with them Ranpak’s operations. Added to the disappearance of these tailwinds, we now have new headwinds that the company has to deal with, which has created a very delicate situation for Ranpak. On the one hand, revenues are declining as the forwardness in the consumption of certain goods during 2020 and 2021, as well as mandatory restrictions on leisure, has led consumers to currently prioritize consumption related to experiences and travel over goods. And on the other hand, current inflationary pressures, which are already being felt in the pockets of consumers, are having a direct impact on their consuming decisions for the most discretionary products, which are often purchased through e-commerce channels where the company has a wide presence.

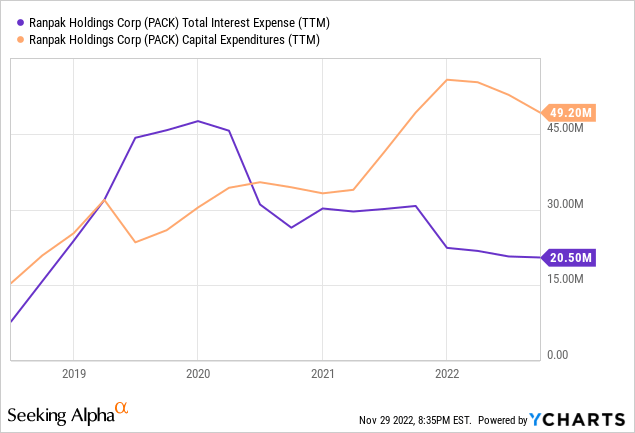

To the decrease in volumes, we must add the increasing material, freight, and labor costs for Ranpak, as well as the still existing supply chain issues and inflationary pressures, which have caused a significant decrease in the company’s margins at a time that was already delicate since the interest expenses derived from the debt are high at ~$20 million per year while the current stage of the company, marked by the business expansion, is leading to high capital expenditures of over ~$45 million per year.

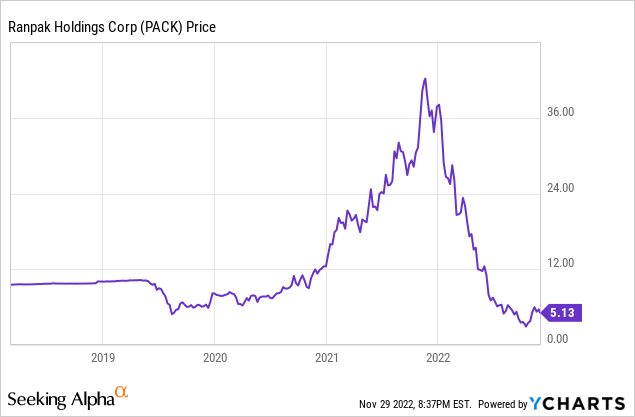

All these events have caused an 87.84% drop in the share price, and the management plans to apply a cash preservation strategy in the coming quarters by reducing its inventories while waiting for the inflationary pressures to ease in Europe.

A brief overview of the company

Ranpak Holdings is a leading provider of environmentally sustainable, systems-based, packaging product protective solutions and end-of-line automation solutions for e-commerce and industrial supply chains. The company provides automated paper packaging systems for a wide range of industries, including automotive, electronics, industrial manufacturing, medical supplies, warehouse and logistics, omnichannel retailers, home furnishings, food and beverages, and e-commerce. These systems use the company’s consumables, which are fiber-based, entirely or partially recycled, and contain little to no plastic or other resin-based components.

The business was founded in 1972 but recently became a public company when it was acquired by One Madison in 2019. Ranpak’s market cap currently stands at ~$460 million, employing almost 1,000 workers.

Ranpak logo (Ranpak.com)

Ranpak currently has 138,500 installed systems serving its consumables to over 35,000 end-users across diversified and growing end-user markets, and its products are designed for reducing paper usage in order to reduce material costs and automating packaging processes, thereby reducing the labor costs of customers. This makes Ranpak products an essential way to save costs and increase the packaging capabilities of its customers.

Currently, shares trade at $5.13, which represents an 87.84% decline from all-time highs of $42.20 on November 19, 2021. This represents a very sharp decline as a consequence of the ending of accelerated consumption during the restrictions derived from the coronavirus pandemic in 2020 and 2021 as the world’s economy is now facing a change in the trend in consumption habits that move more towards experiences, and not so much in discretionary goods. To this must be added the current inflationary pressures, which are reducing the company’s profit margins and the disposable income of the world’s population, especially in Europe where the company makes most of its revenues, and growing fears of a potential recession.

Expansion efforts continue

Ranpak has made great efforts to expand its operations in recent quarters, in which the company has delivered very acceptable revenue growth rates.

In August 2020, the company launched PadPak Guardian, a sustainable, paper-based, flexible, and ergonomic cushioning solution that reduces packaging time and protects light to heavy goods during shipment, in the North American market. During the same month, it also launched AccuFill, a simple-to-use protective paper packaging solution designed for automated packing environments, also in the North American market.

In March 2021, the company launched PadPak Auto-Coiler, an on-demand system that creates a sustainable, paper-based cushioning solution to displace environmentally harmful alternatives, such as foam and plastic, in the North American market. The system uses the company’s pads to form a protective spiral disc that supports a variety of products, including heavier items that exceed hundreds of pounds, and represents an optimal solution for hard-to-ship products. Later, in August 2021, the company also launched AutoFill in the North American market, a fully automated end-of-line packaging solution that reduces labor and material costs by calculating the optimal amount of void fill and paper needed in each package.

In October 2021, the company made a strategic investment in Creapaper GmbH, the inventor of grasspaper and provider of grasspaper products. Creapaper uses a patented process to produce graspap, a raw material required for producing grasspaper, which helps reduce CO2 emissions and water consumption across the paper and packaging industry. This news comes after an investment in Pickle Robot Company, a leader in the application of robots for automated sorting, loading, and unloading of packaged goods within logistical lines, in July of the same year. Finally, in December 2021, the company acquired Recycold Cool Solutions BV, a manufacturer of sustainable cool packs made from plant-based gel for the distribution of food, fresh ingredients, and pharma that operates in 14 countries across Europe.

In July 2022, Ranpak launched Flap’it! globally, which packages a variety of small products up to five times faster than conventional techniques while reducing material costs by up to 50%. During the same year, in September 2022, the company also launched Cut’it! EVO globally, which is a technology that enables improved packaging efficiency by reducing dimensional volume by up to 25% and labor costs while improving the sustainability profile of customers’ operations.

Now the company is expected to launch two new manufacturing facilities for 2023, one in the Netherlands, which will combine three facilities into one, and another in Malaysia. Both manufacturing facilities are expected to operate more efficiently and thus reduce Ranpak’s production costs.

The revenue decline is accelerating

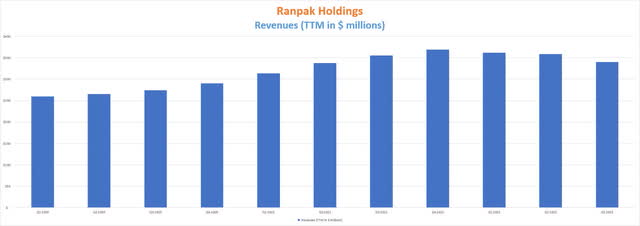

2021 was a good year for Ranpak as revenues increased by 27.14% compared to 2020 (revenues also increased by 10.72% in 2020), but the current trailing twelve months’ revenues of $340 million represent a 7.88% decline compared to $369.1 million during 2021.

Ranpak Holdings revenues (Seeking Alpha)

Although this can seem like a slight decline, it is mostly attributable to a significant decline during the past quarter. In this sense, revenues declined by 8.41% year over year during the first quarter of 2022, by 3.73% during the second quarter, and by 20.11% during the third quarter. Part of this decline is attributable to a stronger-than-usual dollar as revenues only declined by 12% year-over-year on a constant currency basis. A change in trends in consumer habits in which experiences and travel prevail over e-commerce after a period of accelerated purchases in 2020 and 2021 as a result of the coronavirus pandemic and the restrictions derived from it is causing a reduction in volumes after a boom period. It should also be noted that around half of the company’s sales come from operations in Europe, where the war between Russia and Ukraine is intensifying the headwinds related to the reopening of the world’s economy after the coronavirus pandemic crisis: supply chain issues, fuel, food and energy increased costs, labor shortages, all of which continue to be a reality as citizens continue to see their consumption capacity diminished.

In 2021, paper revenue represented 84% of the company’s total revenue, whereas 12% came from machine leases. Using 2021 as a reference, 38.3% of sales are generated within the United States, whereas 49.6% take place in Europe and 12.1% in Asia and other locations. Machine placement increased by 7.3% year over year during the third quarter of 2022 to 138,500 machines globally.

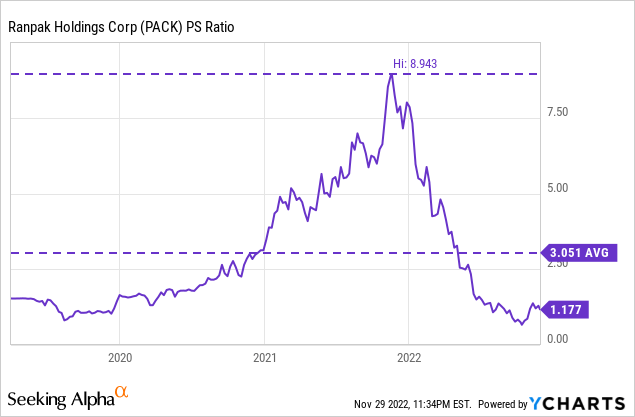

The recent decline in the share price has caused a sharp drop in the price-to-sales ratio, which currently stands at 1.177. This means the company generates revenues of $0.85 for each dollar held by investors in shares, annually. This ratio is 61.42% lower than the average since the company became public, and 86.84% lower than the all-time high of 8.943 in late 2021 as investors are placing less value on the company’s sales, mostly due to declining margins and the risk that this pose for the future of Ranpak.

Depressed margins are putting the future of the company at risk

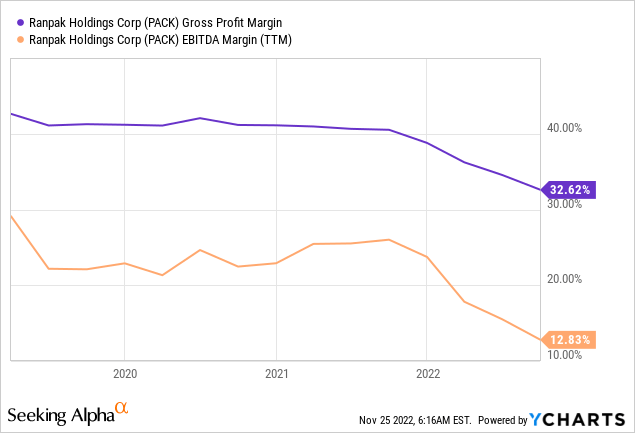

The company’s operations are currently facing inflationary and supply chain headwinds, as well as labor shortages, forex headwinds, and decreased volumes as a consequence of consumers reducing discretionary spending while looking for experiences and travel after the coronavirus restrictions that took place in 2020 and 2021. It is not surprising that the impact on margins has been so significant in the case of Ranpak since around half of the company’s sales take place in Europe, the continent where the conflict between Russia and Ukraine is taking place. Rising energy prices are having a significant impact on the company’s operations at a time when winter begins. Most of the increase in the cost of goods sold is a consequence of increasing paper prices and reduced volumes, and as long as the war between Russia and Ukraine rages on, both volumes and commodity prices will be volatile.

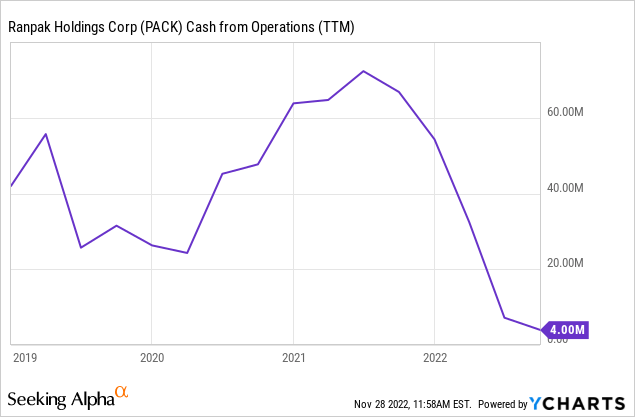

Profit margins seem to be stabilizing as the company reported gross profit margins of 31.36% during the third quarter of 2022 vs. 32.60% during the second quarter and an EBITDA margin of 12.47% vs. 10.02% during the second quarter thanks to cost-saving initiatives. Recently, certain headwinds are starting to relax as the availability of commodities has improved, including old corrugated containers, pulp, and lumber which has lowered their prices. The same is true for freight rates, which have dramatically declined in recent months. This should help the company’s margins to stabilize at a better level than the current one throughout 2023, something greatly needed as the company’s cash from operations has dramatically declined in recent quarters. Meanwhile, the company is applying an expense reduction strategy while looking for areas for potential efficiency improvements. In this sense, the company is currently reducing its headcount by around 10% while reducing discretionary expenses.

But the current margin contraction has caused a sharp drop in the trailing twelve months’ cash from operations to just $4 million. Still, inventories increased by $2.1 million during the same period while accounts payables declined by $10.3 million, more than the decline of $8.4 million of accounts receivable. The downside of this is that although the company’s operations have remained profitable during the past twelve months, the cash generated is not enough to cover current interest expenses of $20.50 million per year.

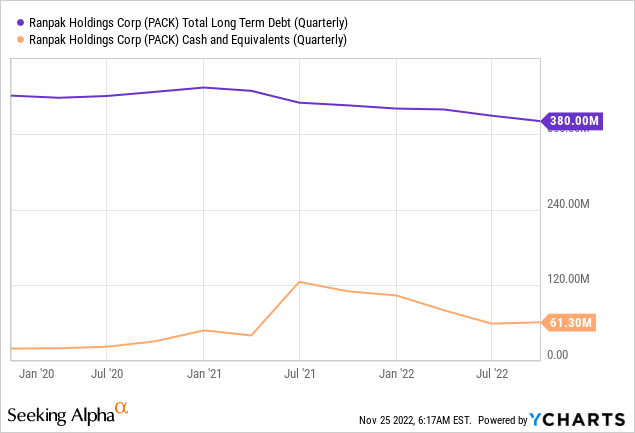

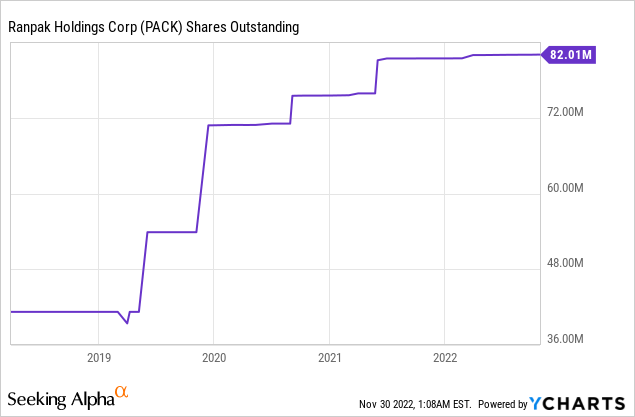

If we add to this the current annual capital expenditures of ~$50 million due to high efforts of operating expansion, we have a debt that is currently only sustainable (and reducible) by issuing new shares, which could create more share dilution, that is, a reduction in the size of the company that each share represents. Now, the management plans to preserve some cash in the coming quarters thanks to inventories of $32.3 million, but it will be necessary for margins to improve as soon as possible as cash on hand is just at $61.30 million.

Debt is not manageable in the current macroeconomic landscape

As we have seen, the company has not generated enough cash over the past twelve months to cover interest expenses, not to mention capital expenditures. As a consequence, cash on hand is rapidly declining. If the availability of paper doesn’t keep improving and energy prices, especially in Europe, don’t fall enough and volumes stabilize, the company may be forced to continue dipping into debt or share dilution in order to survive.

Luckily, there are no maturities in sight as the current debt pile will be due in 2026, and this will give the company plenty of room to maneuver during current headwinds. Therefore, the company is currently facing a stress test whose success will largely depend on the improvement of the current macroeconomic situation and the easing of current inflationary pressures that are affecting the cost of goods sold. The biggest risk is that its resources are quite limited due to low cash on hand and the macroeconomic landscape is out of the management’s control, which makes this investment a highly speculative one.

Risks worth mentioning

- The current macroeconomic landscape is causing inflationary pressures and supply chain issues that are depressing the company’s profit margins. Profit margins should remain depressed for as long as the war between Russia and Ukraine continues to affect energy supplies in Europe and inflation runs rampant, which will keep cash from operations at unusually low levels.

- Demand could continue to decline if the global economy enters into a recession deep enough as a result of central banks efforts to control inflation.

- The company’s debt pile generates annual interest expenses of ~$20.5 million, which cannot be covered with current cash from operations. To this, we must add the current capital expenditures of ~$45 million, which should be partly reduced for a few quarters as the management empties part of the inventories. As long as margins remain depressed, the company will need to use its cash on hand and inventories to keep operating until they are depleted, and then the debt could rise even higher. On the other hand, the company also has the possibility of resorting to share dilution to hold out a little longer waiting for the current macroeconomic landscape to improve.

- The number of shares outstanding increased by 6.64% in 2020 and by 7.74% in 2021, which will limit the potential upside of the share price once the current headwinds fade. Share dilution could continue to occur if the price of paper remains high and inflationary pressures, as well as labor shortages, supply chain issues, and lower volumes continue to impact the company’s operations.

Conclusion

I certainly think that Ranpak is a highly viable company in the long run if we take into account the company’s capacity to generate cash from operations before the current inflationary and supply chain headwinds began, and that’s where investors’ current hope lies. The company has launched new products and increased the number of leased machines, and operations were very sustainable before the current headwinds. Even so, its risk profile is high because operations are not currently sustainable due to depressed profit margins and high interest expenses and capital expenditures. In this sense, the success of this turnaround play depends on whether Ranpak is able to pass the current stress test, that is, to stay operational until the current headwinds ease, at least partially.

Although I believe that Ranpak has the resources to get by for quite some time due to its cash on hand of $61.30 million and its inventories of $32.3 million, I also think that the fact that the improvement of its operations depends on factors out of the management’s control make this investment one of a highly speculative nature, and for this reason, I recommend that investors take a very careful approach and know their own risk tolerance before participating in this turnaround play. I personally think that the company still has the resources to withstand an environment like the current one for at least three more years (taking into account cash from operations, interest expenses, and capital expenditures), the point is that the current environment is very volatile and the fears of a potential global downturn seem to grow as the days go by. For this reason, though, if the company manages to navigate the current and coming headwinds the potential upside is very significant.

Be the first to comment