JHVEPhoto

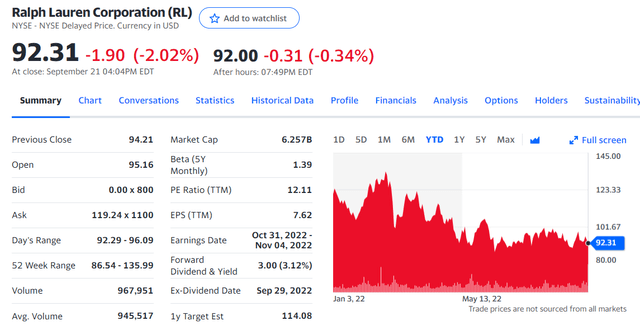

Two days ago, Ralph Lauren Corporation (NYSE:NYSE:RL) presented its updated strategic growth plan thanks to a live investor day event in New York (Conf. call recap in the link). Before analyzing the plan implication, it is important that our readers are well acquainted with the story up to now:

- 08/03/2022 – Mare Evidence Lab initiation of coverage: The Polo Horse Starts To Gallop. In our first analysis, our buy case recap was based on: 1) a confident view of the luxury sector with a positive pricing delta versus cost inflation, 2) excellent numbers and a solid FCF generation, 3) new platforms to engage a young clientele and to enhance the company’s profitability, 4) new launches initiatives such as ‘The Lauren Look’;

- 10/08/2022 – Ralph Lauren: Comments On Q1 Analysis with a positive performance partially offset by currency development.

Ralph Lauren’s stock price performance was not in line with our expectations; however, we believe that the just-released plan is aligned with our forecasted assumptions. Starting with the CEO’s words, he explained that “since RL’s last investor day in 2018, we have transformed our business – building a strong foundation with multiple engines of growth that are already showing momentum“. He also said that Ralph Lauren’s “strategies are expected to drive sustainable long-term growth and value creation – fuelled by operating discipline and a strong balance sheet – as we reinforce our leading position as a luxury lifestyle company.” This is music to our ears! We know that RL’s price decline was more due to the subdued market environment, however, we hope this plan might raise earnings estimates.

Ralph Lauren Corporation stock price evolution (Source: Yahoo Finance)

Our take from RL’s Investor Day

Aside from the CEO comment, here below the main key takeaway from a financial point of view:

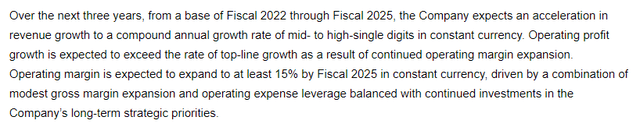

- After 4 years of brand re-evaluation, the company expected a mid/high digit CAGR over the long-term versus the low/mid numbers presented during the previous plan. The most important change in RL’s forecast is in North America, where the company plans to add new higher-income customers willing to buy products without discounts. Top-line sales growth will be achieved by new retail store openings – the same strategy is expected in the APAC area. China will also be reinforced by a digital strategy with online sales at a 30% CAGR. As regards Europe, Ralph Lauren raised the bar too, sales are expected to increase from mid to high single digits. With the ongoing macroeconomics situation and energy price development, we believe that Europe is the biggest execution risk for the company’s plan, however, Ralph Lauren’s CEO was quite reassuring in its growth path leveraging the company’s ability to increase market share thanks to wholesale and increased e-commerce penetration;

- Going down to the P&L, the company plans to drive margin expansion at the GM level, forecasting a plus 50 to 100 basis points. Ralph Lauren expected that marketing costs will remain flat (at 7% of top-line sales), suggesting that selling, general & administration expenses will be cut by almost 100 basis points over the next three years. Moreover, the company identified $400 million in cost savings that add an EPS cushion in the worst-case scenario;

- The operating profit margin is forecasted to be at 15%+ for the 2025 numbers. Our internal team thinks that this might be achieved at constant currency, but not at the current rate. During this year, we have forecasted a minus 170 basis points at an average of 13% EBIT margin. Ralph Lauren is forecasting a 50-basis point margin yearly increase until 2025. These are strong predictions;

- On the investment side, the company plans to open more than 250 stores with a CAPEX expenditure of 4-5% of revenues.

Ralph Lauren CMD details (Source: Ralph Lauren corporate website)

Valuation And Conclusion

Here at the Lab, we definitely tend to see these supportive numbers just presented. While currency volatility might reduce future visibility, we still prefer Ralph Lauren for its track record and top-line sales/margins improvement over the last year, coupled with a solid balance sheet to navigate short-term macroeconomic challenges. To add it up, Ralph Lauren expected to return $2 billion to shareholders, which is equal to 32% of its entire market capitalization. The remunerations will be made thanks to a constant payout ratio of mid-30% (this year the company increased the DPS by 10%) and via a share buyback. According to our calculation, RL’s shares will be reduced by approximately 15% over the plan considered. Regarding the valuation, we decreased our target price to $130 per share while maintaining the outperforming rating, and this was just due to the depressed valuations within the apparel sector on a P/E basis. The risk paragraph is included in our initiation of coverage.

Be the first to comment