Sundry Photography

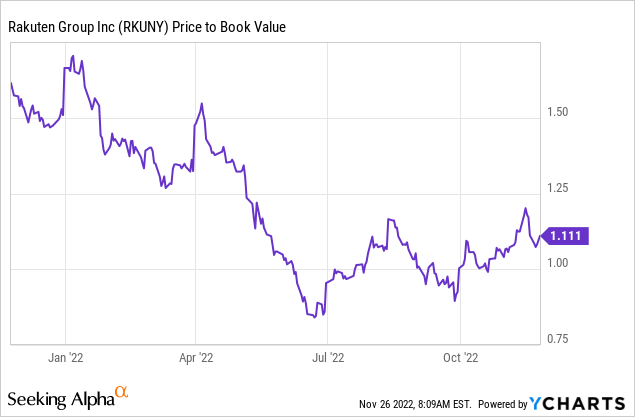

Rakuten (OTCPK:RKUNY) continues to perform everywhere but mobile, where aggressive investments are underway to build out the network across Japan. As a result, EBITDA profitability remains elusive, as high operating costs, including from roaming payments, weigh on the margins. Per my prior coverage of the stock, financial risk is a concern, albeit a declining one, following the improving IPO prospects for Rakuten Bank and the recent Rakuten Securities stake sale to Mizuho (at a favorable price). That said, a more sustained P&L improvement remains out of reach in the near term, with the mobile business turnaround likely to take a few years away at least. At ~1.1x book, the stock is cheap, but given the need for more funding to offset losses in the mobile division, I would hold off for now.

Wider Mobile Losses Cloud the Quarterly Results

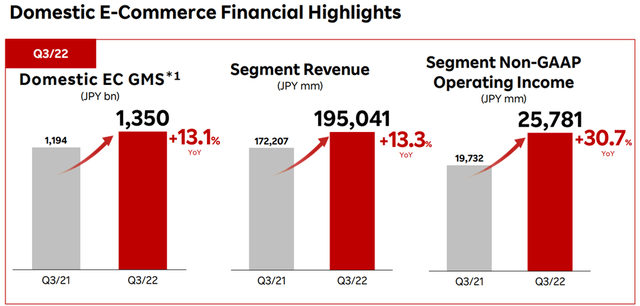

Overall revenue was up a solid ~15% YoY for the latest quarter, as stronger than expected growth in Internet Services, largely due to a recovery at Rakuten Travel, offset an in-line mobile performance. This didn’t stop EBITDA from further declining in the mid-teens % YoY, however, as more mobile losses weighed on the earnings. The silver lining is that the e-commerce and fintech businesses remained strong – domestic GMV was up 13%, driving segment profits up an impressive ~31%, while fintech revenue and profits were also up 10% and 19%, respectively.

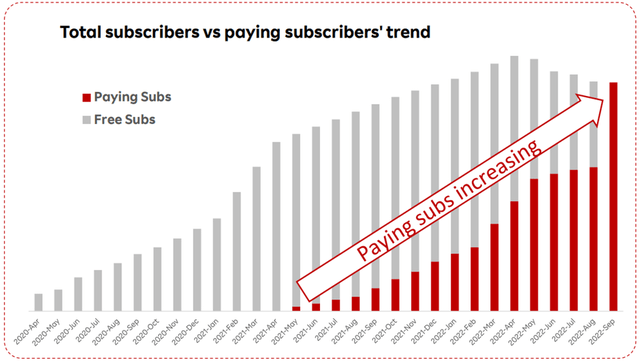

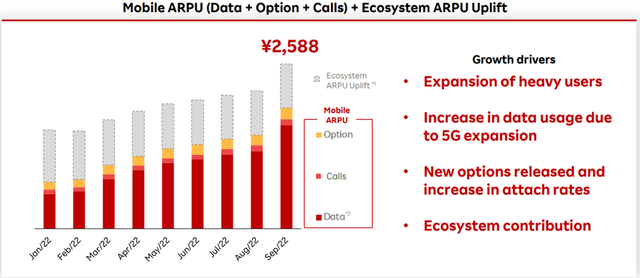

Mobile KPIs gave investors little reason for optimism as well. The ending of free service periods played a part, but the extent to which net adds were down at -280k (comprising MNO subs at -220k and MVNO subs at -60k) is concerning. The improved disclosures were helpful, though, confirming that ARPU was up in September after a promotional campaign; that said, the decline in free service plans likely skewed this metric favorably as well. Now that Rakuten Mobile’s subscribers are essentially paying customers and with the free user churn cleared, subscriber trends from here will be worth monitoring closely to gauge the underlying health of the business.

Positive Signs for the Mobile Outlook

Heading into Q4, things are looking better on the mobile side – per management, sign-ups have been exceeding cancellations in November, possibly implying a turnaround in subscriber additions. Given all customers will also be billed from November, achieving more ARPU gains (vs. disclosed ARPU of JPY2.6k in the mobile business in September) will be key to getting to operating profitability. Also helping margins will be the decline of roaming expenses, base station installation, and related maintenance expenses, as the 4G network rollout concludes in FY23 with ~60k base stations deployed (vs. the current ~50k). Pending better visibility into a mobile turnaround, however, I would be cautious about underwriting a fundamental upturn anytime soon.

Beyond the near-term, Rakuten continues to guide to achieving single-month break-even for the mobile business by end-2023. Meanwhile, operating trends are projected to improve as soon as 1H 2023 on the back of cost reductions and the launch of new enterprise services. Management also emphasized the launch of ‘platinum’ band frequencies in late March 2024 (assuming the standard five-year migration period), which helps to improve in-building coverage as a potential earnings contributor. I am less optimistic on this front, however, given the differing views among the major carriers on how to reallocate frequencies, and thus, the process could take longer than expected.

Strategic Tie-Up with Mizuho Lowers the Funding Risk

Heading into earnings, Mizuho Securities announced its decision to buy a minority stake of ~20% in Rakuten Securities for JPY80bn (or $552m). The positive surprise was the price – based on its most recent earnings disclosures, Mizuho is paying a pricey >40x trailing earnings (or ~2.7x book) for the stake. Of note, the deal comes on the heels of similar tie-ups between Sumitomo Mitsui (SMFG) and SBI Holdings (OTCPK:SBHGF), as well as Mitsubishi UFJ (MUFG) and Kabu.com, signaling good monetization prospects for the securities business ahead of a potential listing in mid-2023.

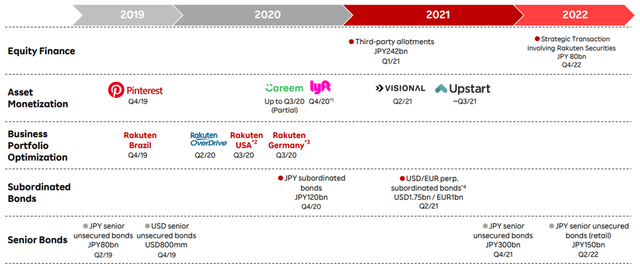

More broadly, the deal validates Rakuten’s access to capital and could pave the way for more non-dilutive fundraising over the coming months to boost the balance sheet. Key financing options that have been floated around include the issuance of hybrid securities and a potential Rakuten Bank IPO (on track for the end of this year). In sum, Rakuten Group looks well-positioned to maintain its financial flexibility despite the challenging market conditions, and thus, I see any credit risks (recall Rakuten had been given a negative credit outlook by S&P) as limited at this point.

Mobile Losses Weigh on the Outlook

Long term, Rakuten has a clear winner on its hands with e-commerce, but its venture into the telco business is an expensive complicating factor. The visibility into the mobile business turning profitable, even at the operating level, is cloudy, and given the recent subscriber weakness, I would be hesitant to underwrite a turnaround at this juncture. That said, management deserves credit for addressing the funding risks – Mizuho’s recent equity investment in Rakuten Securities, at a favorable valuation, indicates financing options remain open and should alleviate any near-term credit concerns. While the valuation is optically cheap at ~1.1x P/Book, the prospect of more mobile-driven book value erosion means the risk/reward remains unfavorable at this juncture.

Be the first to comment