Christopher Jue/Getty Images Entertainment

Investment thesis

The 19.99% stake sale in the online brokerage subsidiary and recent debt issuance at a 12% yield highlight Rakuten’s (OTCPK:RKUNY) financial stress as it continues to invest in its mobile telecommunications business. We see no evidence of a turnaround, believe market expectations are low and with most negatives priced in, we rate the shares as neutral.

Quick primer

Rakuten Group is a Japanese conglomerate with over 70 diverse business lines, ranging from its legacy online shopping operation to personal loans, online broking, life insurance, professional sports clubs, e-readers, and mobile network/technology businesses. Rakuten has a 12.6% market share in domestic e-commerce, steadily losing share against Amazon (AMZN) Japan at 25.7% (source: Euromonitor). The company is the challenger in mobile telecommunications, ranked fourth after NTT (OTCPK:NTTYY), KDDI (OTCPK:KDDIY), and Softbank Corp (OTCPK:SFTBY).

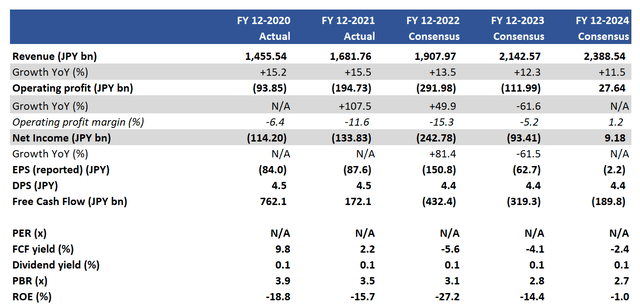

Key financials with consensus forecasts

Key financials with consensus forecasts (Note: free cash flow from consensus and actual include financial assets and hence not an accurate indication of underlying trends) (Company, Refinitiv)

Our objectives

We revisit our sell rating from May 2022, with concerns over management’s high-risk approach to allocating capital to its mobile business, resulting in cash burn and a high-risk credit profile.

The financial stress from investing in the mobile business has led to the following recent developments. Firstly, in October 2022 the company sold a 19.99% stake in its online brokerage business (Rakuten Securities) to Mizuho Financial Group (MFG) for JPY80 billion/USD0.5 billion and has reorganized its financial services business under a holding company structure for an IPO to raise further funds. Secondly, in November 2022 the company raised USD500 million via 2-year senior notes priced at an excruciating 12.0% yield – the marketing was said to be an uphill struggle for this private transaction, as the company has been downgraded to high-yield (junk) status. The bonds were marked at a discount to provide some reassurance to investors.

Recent results reflecting management concerns

Q3 FY12/2022 results highlighted that whilst Rakuten’s core business remains steady and profitable, the rate of sales growth remains in the mid-teens at 16% YoY, with its core business growing at 10% YoY (page 3). Despite an overriding emphasis on growing its ecosystem of services and cross-selling, customers inevitably have low switching costs and shift over to other platforms to meet their needs – Amazon Japan for shopping, LINE for social, Yahoo Japan for search and portal, and PayPay for settlement. At the end of the day, Rakuten is aiming to become a ‘super-app’ like Tencent (OTCPK:TCEHY) but from our perspective has made a strategic error by aiming to shift to becoming a low-margin and capex-intensive mobile infrastructure provider.

The company has shown no sign of changing course, and the mobile business continues to operate at a loss although there are some signs of stabilization although operating margins hover at around -130%. Revenues grew 62% YoY in Q3 FY12/2022 but grew only 5.4% QoQ which is a concern given continual marketing efforts, and the aim remains for the business to become profitable by December 2023.

Continued losses at the mobile division have given rise to a new cost reduction exercise, but the overall cost structure is expected to improve dramatically once base station construction is at full scale, allowing for a major decline in roaming costs and MVNO fees. Still, revenue growth can only come from taking market share primarily via price discounting which to date has had a limited impact with the customer base of only 5.18 million achieved over 2.5 years. We do not see mobile telecommunications as the answer to driving growth in the business, and the ROI from this endeavor is unlikely to be high.

Asset sales

Rakuten has been selling off strategic assets to fund mobile telecommunications expansion, such as the sale of its stake in Pinterest (PINS) in February 2020, ride-hailing company Careem to Uber Technologies (UBER), and digital reading platform OverDrive to KKR (KKR). Now it is cutting into its core assets by firstly selling a 19.99% stake in Rakuten Securities, and setting up an IPO for its financial services business which includes the investment management and crypto wallet businesses.

The valuation of the total business is expected to be north of the implied valuation of the brokerage at JPY400 billion/USD2.7 billion, but we expect Rakuten to keep a 50% plus stake in order to keep it a consolidated group company. Consequently, unless there is a primary element to the deal, a secondary offering can only raise about JPY200 billion/USD 1.4 billion which is less than the cash burn experienced in Q1-3 FY12/2022 of JPY548 billion/USD3.8 billion. This transaction is unlikely to make the company sufficiently liquid to fully meet its funding needs.

Other options include further debt financing although this is proving to be expensive, as well as other asset sales such as its 8.91% stake in LYFT (LYFT).

Valuation

With no earnings and no free cash flow, PBR at 3.1x expected at FY12/2022 is the only available valuation multiple for this conglomerate. On a sum-of-the-parts basis, the core e-commerce businesses (shopping and travel) would be worth in excess of JPY1.5 trillion in our view (based on EV/EBITDA of 10x), but debt and mobile telecommunications losses bring down the overall valuation.

Risks

Upside risk comes from management suddenly deciding to exit the mobile telecommunication business, which will instantly boost operating profits and limit cash burn. The mobile business could see a major acceleration of subscriber growth, becoming profitable earlier than the current target of December 2023.

Downside risk comes from a poorly received IPO for Rakuten’s financial services business, failing to raise anticipated levels of funding. Excess debt raises could lead to over-borrowing, resulting in the company going bust.

Conclusion

Difficulties over Rakuten’s expensive plans to expand into mobile telecommunications are well known, and the recent asset sales indicate that there is financial stress. Although we view upside risk to be limited, all the bad news appears priced in for the time being, and expectations of a turnaround appear low. On this basis, we rate the shares as neutral.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment