Igor Travkin/iStock Editorial via Getty Images

Summary

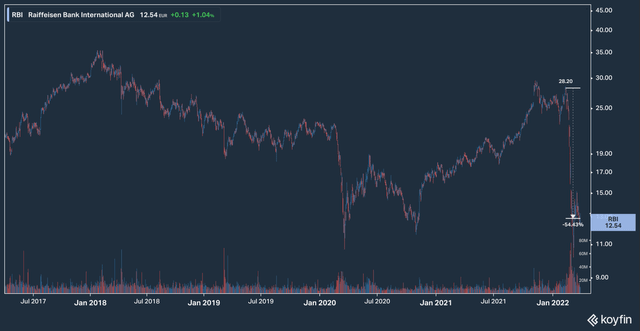

Raiffeisen Bank International AG (OTCPK:RAIFF) (OTCPK:RAIFY), also listed in Vienna under ticker “RBI” (which I will use for the rest of this article) and in Frankfurt as “RAW”, is a leading international bank brand in Eastern Europe. Since Russia invaded Ukraine on 24 February 2022, RBI has been one of the most direct ways to trade Russia exposure given the trading halts on many Russian stocks, GDRs and ETFs. 58.8% of Raiffeisen International is owned by a cooperative of hundreds of largely autonomous Raiffeisen cooperative banks mostly based in Austria, based on a cooperative credit union model started by Mr. Friederich Wilhelm Raiffeisen in the 19th century. Raiffeisen International is largely known as the Raiffeisen’s expansion into Central and Eastern Europe, including Russia and Ukraine, which explains why it was one of the most significantly sold off bank shares in the wake of the invasion and sanctions. While price moves alone rarely get much of my attention, this time seeing a well-known international bank sell at less than 50% of recent levels, a price correction significantly more than the March 2020 “COVID crash”, challenged me to ask whether this was still a good bank selling at a deep discount, versus whether it might be a value trap.

Raiffeisen’s Central and Eastern Europe Portfolio

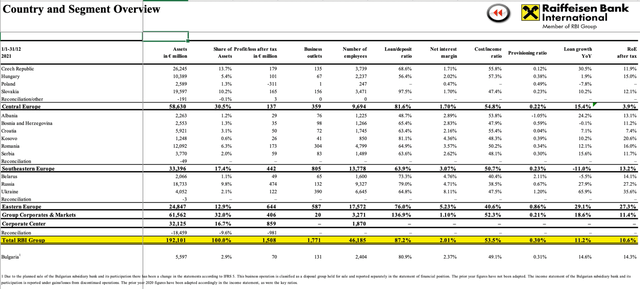

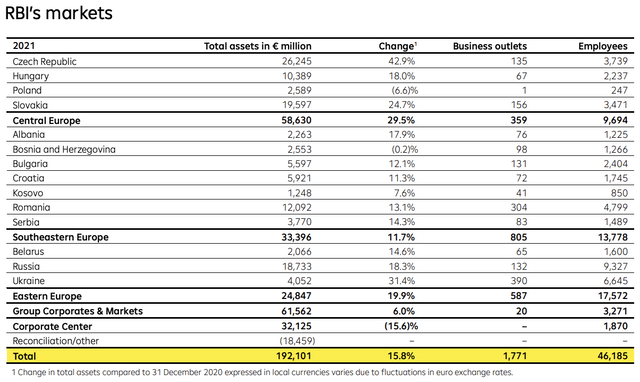

The Investor Relations page provides several tabs of financial data in Excel format, but the simplest snapshot I could find of the geographic distribution of Raiffeisen International’s business is on page 20 of the 2021 Annual Report, labeled “at a glance”:

Very roughly, we see that Russia was a little less than 10% of RBI’s assets as of the end of 2021, while Ukraine and Belarus make up another 2% and 1%, respectively. These three countries look like a more significant part of RBI’s business when measured by headcount, where Russia, Ukraine and Belarus were the respective places of employment of about 20%, 15% and 4% of RBI staff. This disproportionately high headcount in three former Soviet states seems to make more sense when we look at the below profitability ratios, and see that at least in 2021, these were by far RBI’s most profitable markets, with net interest margins and RoE rates almost double those seen in the rest of Central and Eastern Europe. So while the first and most obvious impact I expect from the Russia-Ukraine situation to RBI’s business would be to its balance sheet, which we will look at in the next section on valuation, the more significant long-term impact may be in losses of these more profitable segments of its business over the longer term.

As of 17 March 2022, RBI was still “considering” exiting Russia, and we continue to await news on what it will do next. An article published the next day estimated the bank would still be safe even after accounting for this Russia exposure.

RBI 2021 Annual Report, Data in Excel Format, “Country Overview” tab

Numbers and Valuation

On the extreme end of impact analysis, we could assume that the €18.5 billion of assets in Russia, and perhaps also the €4 billion in Ukraine and even the €2 billion all somehow need to get written down to zero. That would more than wipe out RBI’s €18.5 billion in equity capital and likely trigger a bailout from the majority owner Raiffeisen Bank, or even the European Central Bank, but is a far more extreme scenario than we see possible given that most of those assets are funded locally by customer deposits in those three countries. If we subtract out those customer deposits, we see a net value of around €4 billion in Russia, and €600 million in each of Ukraine and Belarus. A total loss of these would still put a significant dent in RBI’s equity capital, but would still be less than the decline seen in RBI’s share price since the invasion.

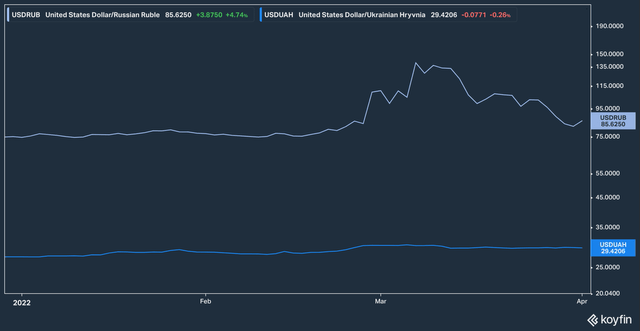

As one measure of how much Russian or Ukrainian bank equity is likely to be impaired, at least according to market prices, we can look at how currency markets have devalued the Russian Ruble, and to a far lesser extent the Ukrainian Hryvnia, over the past 3 months.

The partial recovery of the Ruble might be read as an indicator that the worst case scenario is looking less likely to play out, but that can serve as one anchor for our valuation: a roughly 33% impairment of book value, bringing tangible book value per share down from the €44.18 reported at the end of 2021, to around €29.50, still almost double the current market price. Even if we assume RBI should only be trading at around 70% of book value, that still implies a target price just above €20/share. As a rule of thumb, I often think that excellent banks (those with a return on asset ratio consistently above 1%, and steady history of dividend hikes) should trade around 1.2x book, average banks at around 1x book, and something’s wrong when a bank trades below 0.8x book. RBI’s return on assets ratio has fluctuated between 0.5% and 1.0% over the past five years, and it has a history of cutting its dividend in years of weak earnings, and in ordinary times I would consider it an average bank, so think the 0.7x book target is conservative.

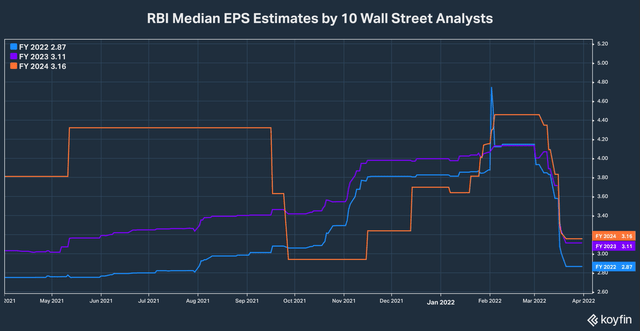

On the income statement, we could be more aggressive in assuming a total loss of RBI’s after-tax profits in Russia, Ukraine, and Belarus, which totalled €644 million in 2021, or around 42% of the group’s total profits. That would bring the roughly €2.00-3.70 earnings per share numbers seen over the past four years down into the range of €1.10-2.20 per year, and a bear case could start by assuming earnings stay at those depressed levels for 5-10 years. This is below the €1.90 bottom end estimate of the 10 sell-side analysts covering this name out to 2024, and as the below chart shows, the median 2024 EPS estimate has so far only been revised down to €3.16 from just above €4.40 before the invasion. If we take that the top end of our revised estimate and the bottom end of the Wall Street estimate is around €2.00 per share, and assume RBI should be trading at around 10x that, we also get a price target of around €20/share.

Risk Factors

We’ve mostly talked about risk and write-downs so far, but in this section we will try to more explicitly enumerate some of the key risk factors, starting with the obvious ones.

- The Obvious Geopolitical Risk – We are already seeing Western companies abandon their businesses in Russia, and open Russian confiscation of foreign assets like airplanes, suggesting the most obvious risk is total loss of all business in Russia, and perhaps in Ukraine and Belarus as well. This could take the form of nationalization of RBI’s assets with no compensation to having assets effectively locked in due to sanctions, and several other forms in between. This needs to be checked against the second risk factor.

- Liability Offset Risk – The adjusted book value above assumes that 100% of the net value between the local assets and local customer deposits in each of these three countries would be lost. Even in that extreme case, this assumes limited liability of operations in these countries (which is generally the case for subsidiaries, but not branches), and the assumption that the deposits are in the same currency as the assets.

- Off-Balance Sheet Liability Risk – The above adjusted book value also looks at only the liabilities that are on the balance sheet, at book value. Off-balance sheet liabilities could cause a significantly deeper cut to that book value.

- Contagion Risks – The above analysis assumes the losses in Russia would also extend to Ukraine and Belarus, but that those losses would end there. There are several consequences of the conflict, starting with just the shocks seen already to commodity prices and supply chains, which could impact the other Raiffeisen markets across Europe.

- Valuation Multiple Contraction Risk – Those trading RBI shares over shorter time horizons, by which I usually mean less than at least 5-10 years, may see the Price/Book and Price/Earnings multiples continuing to fluctuate even more than the underlying book value or earnings numbers. While this could work in a trader’s favor if these multiples recover to pre-invasion levels within the next few months, it is just as likely that these multiples could continue to decline even if the fundamentals stabilize.

Timeline and Execution

I started looking into and buying this name when it crashed below €15 per share, and don’t expect it to break back above that level until we see some more clarity or good news. Given the level of risk, I wouldn’t see this as more than a 1% position, and expect to put on that whole 1% below €15 per share. I would start taking some profits at €20 and get out at €25, unless we start seeing a clear path back to dividend hikes by that point.

Be the first to comment