http://www.fotogestoeber.de

Radiant Logistics (NYSE:RLGT) reports agreements with many partners and a diversified customer base. RLGT does not need a lot of cash to operate, which makes the company interesting in terms of free cash flow margins. In my view, with further acquisitions, revenue growth will likely be more than expected, and could justify higher price marks. Even considering risks from M&A failures or regulatory fines, in my view, the stock appears very undervalued.

Radiant Logistics

Radiant Logistics offers transportation and logistics services in the US and Canada.

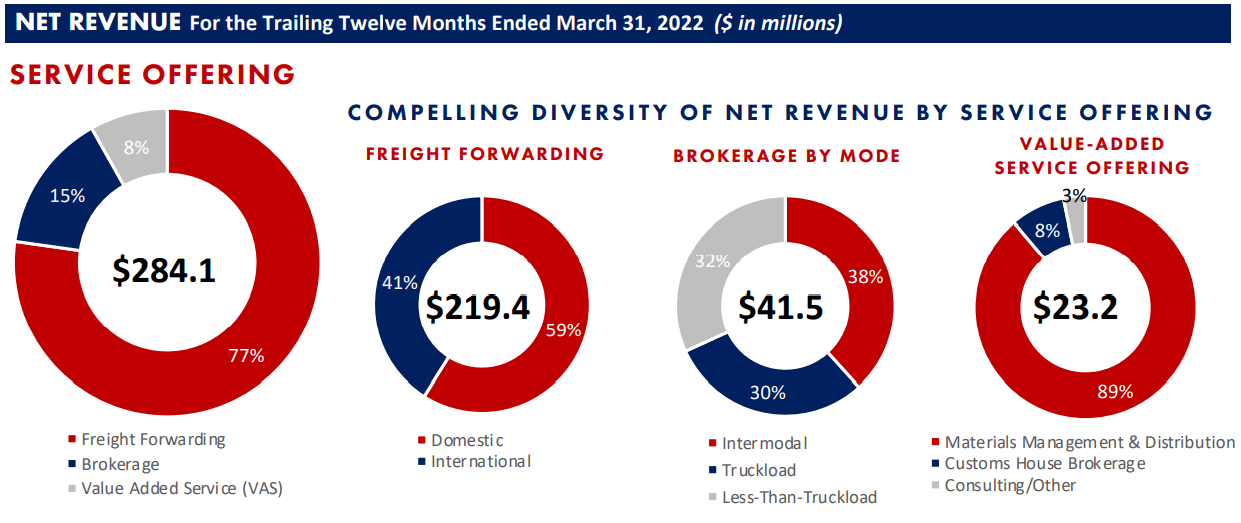

Radiant offers a diversified number of services to clients in the consumer goods, food and beverage, and manufacturing industries. The company’s most relevant service is freight forwarding, but brokerage and other value added services also represent a significant part of the revenue.

Investor Presentation

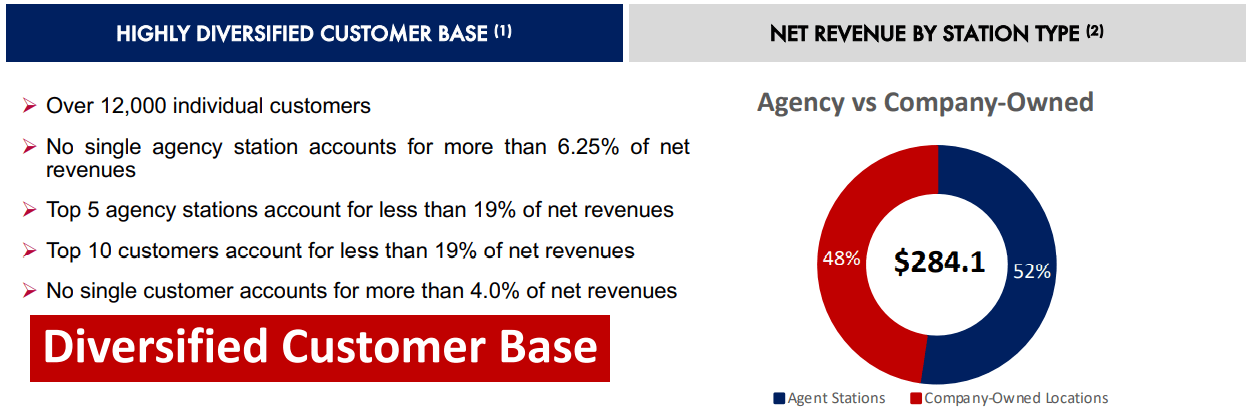

It is beneficial that Radiant reports over 12k different customers, and no single customer accounts for more than 4% of the net revenue. If the company loses one or two clients, the revenue decline will likely not be that volatile.

Investor Presentation

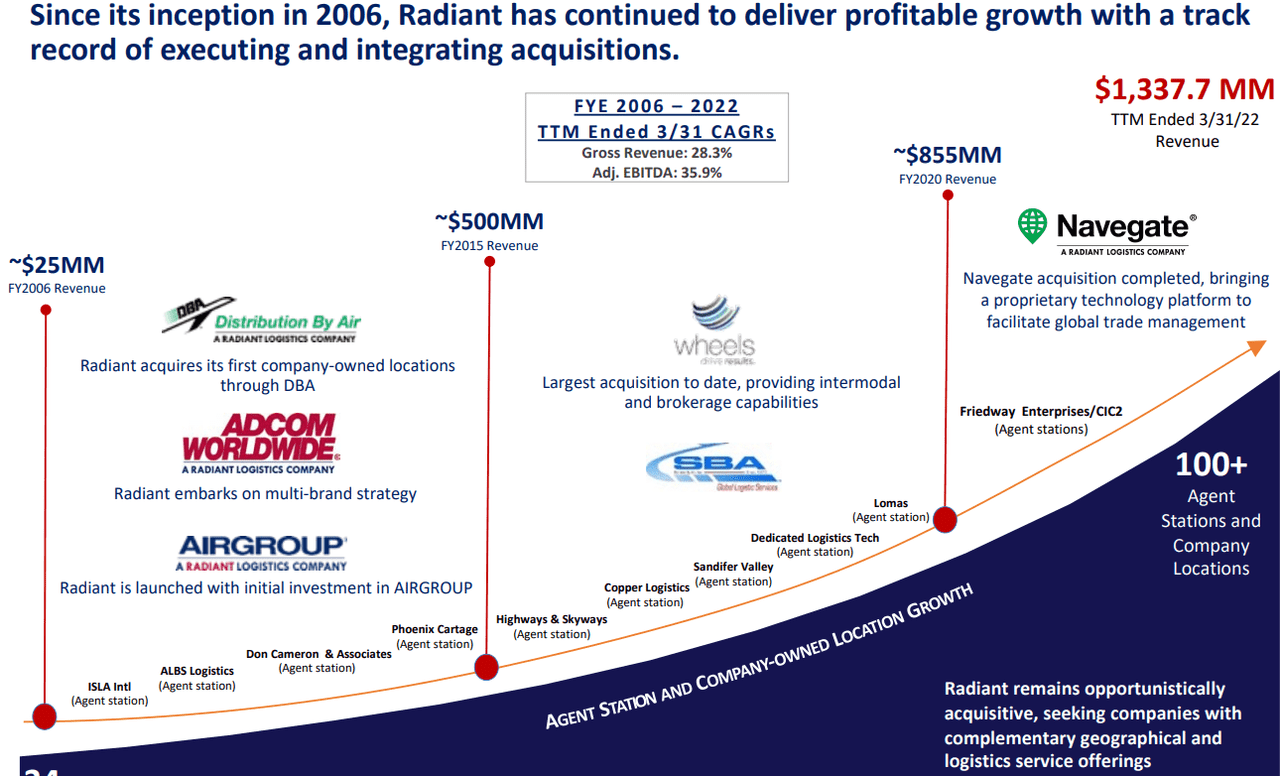

In the past, Radiant acquired a significant number of targets to grow. With this in mind, I believe that the company will likely grow through M&A in the future. Hence, in my view, Radiant will likely grow at a larger pace than the logistic market.

Investor Presentation

Outstanding Sales Growth In 2022

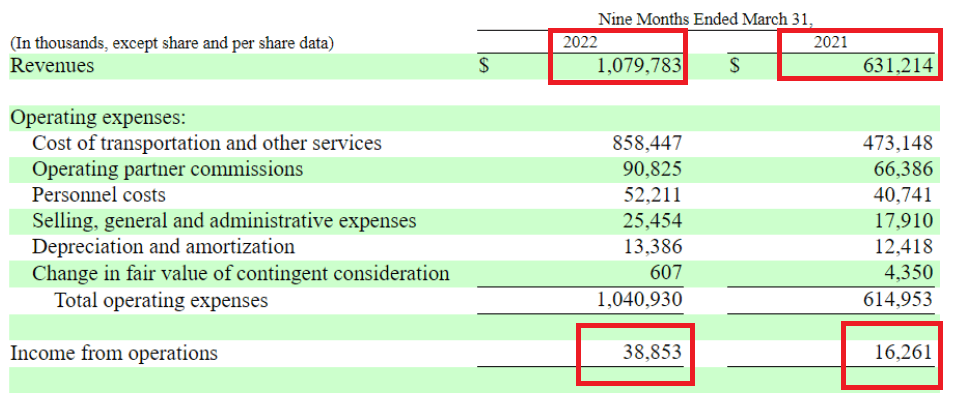

In the nine months ended March 31, 2022, the company reported revenue of more than $1 billion, 70% more than that in 2021. Income from operations also increased from $16 million to $38 million. This impressive growth made me research the company.

10-Q

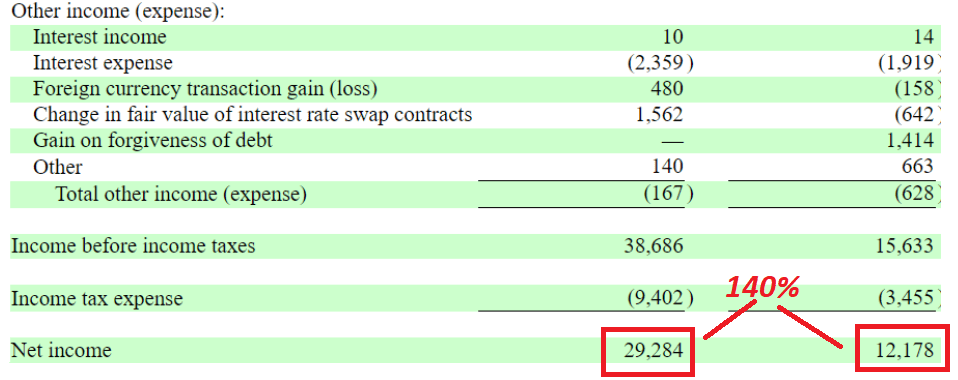

Though I don’t like talking about the past, I am making an exception here because the figures released are quite beneficial. In the nine months ended March 31, 2022, the net income increased by close to 140%.

10-Q

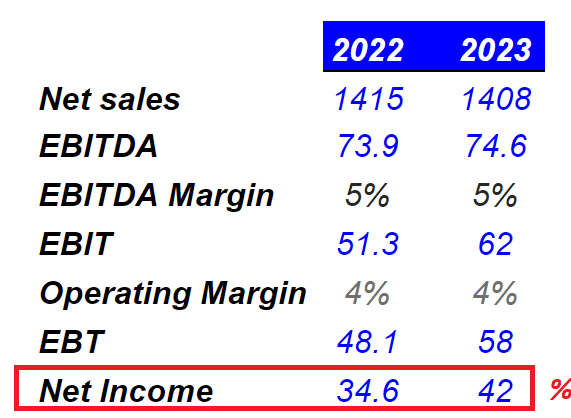

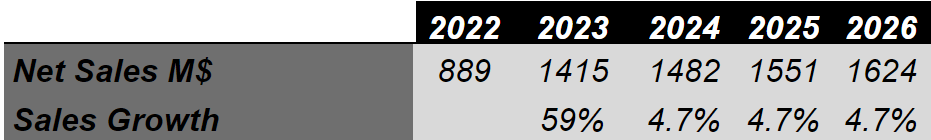

The guidance given by other financial analysts is also quite promising. Estimates given by other market participants include net income growth in 2023 and a small decrease in net sales. The EBITDA/Sales margin is expected to be close to 5%, and the operating margin would be 4%.

Marketscreener.com

Balance Sheet

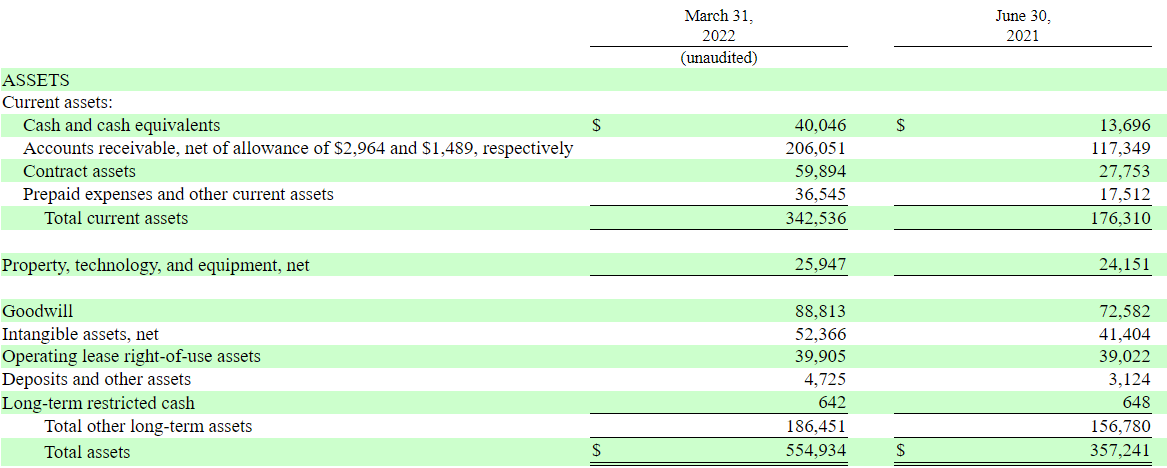

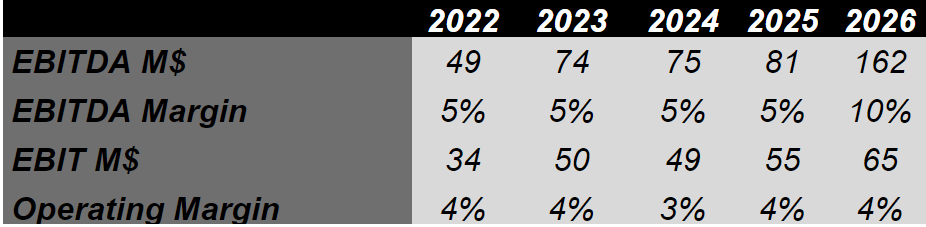

As of March 31, 2022, Radiant Tech had $40 million in cash, total assets worth $554 million, and total liabilities worth $369 million. I believe that the company’s financial condition is quite stable.

10-Q

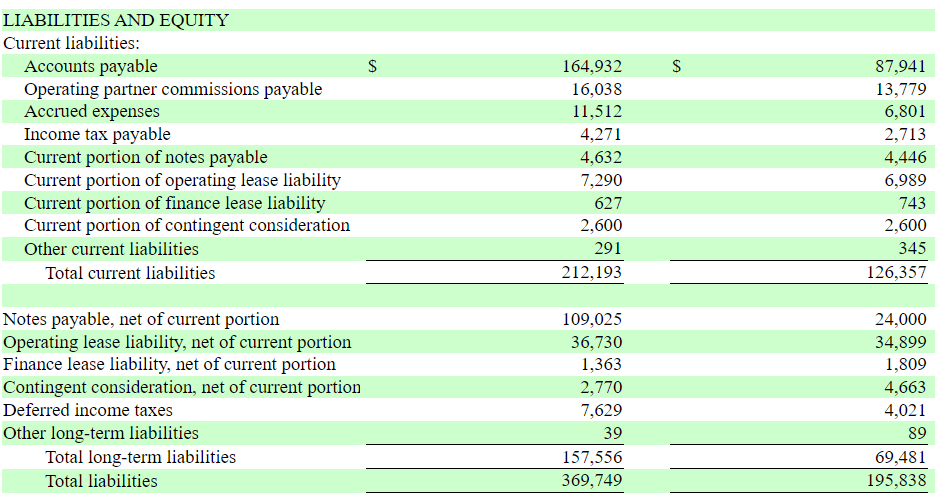

With notes worth $109 million and financial lease worth $1.3 million, I believe that the total amount of leverage is quite small. Management could easily receive further financing if necessary.

10-Q

Competitive Advantages Over Peers May Lead To An Implied Fair Price Of $26-$14

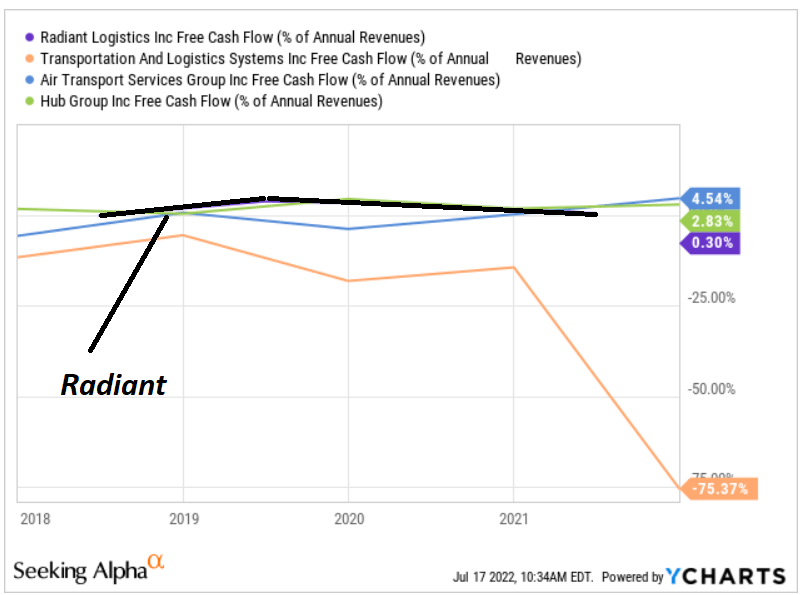

Radiant does not own a lot of assets, which means that the company can offer low-cost solutions. Besides, free cash flow margins will likely be a bit better than that of some peers. Larger free cash flow will likely imply higher stock valuations.

As a non-asset-based logistics provider, we own only a minimal amount of equipment. By not owning the transportation equipment used to transport the freight, which results in relatively minimal fixed operating costs, we are able to leverage our network of locations to offer competitive pricing and flexible solutions to our customers. Source: 10-K

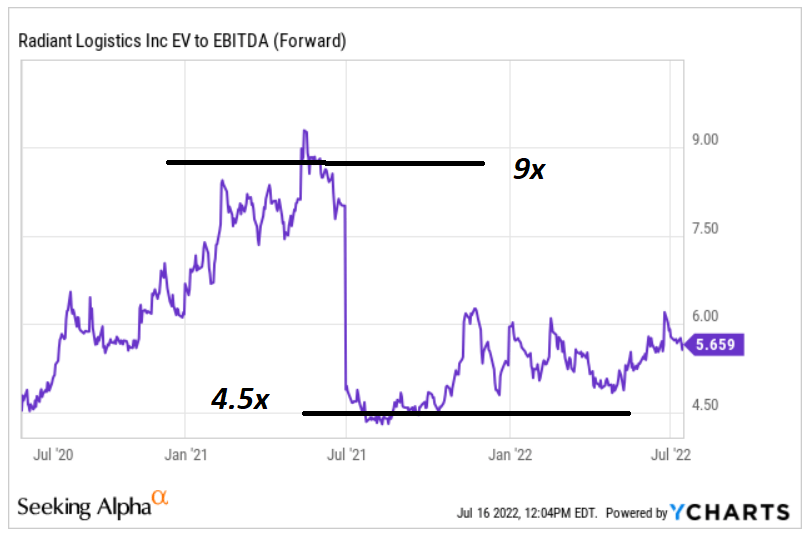

YCharts

Radiant will also benefit from its agreements with strategic operating partners. It allows management to invest a bit less, and have less operating risk. Keep in mind that partners also share some responsibilities.

We derive a substantial portion of our revenue pursuant to agreements with our strategic operating partners operating under our various brands. These arrangements afford us with a relatively low risk growth model as each strategic operating partner is responsible for its own sales and costs of operations. Source: 10-K

Finally, under normal conditions, I would expect more customer relationships, productivity improvements, and new services. As a result, revenue growth, in my view, will likely reach the expectation of market participants. The company revealed some of its strategies in the annual report:

Our organic growth strategy will continue to focus on strengthening existing and expanding new customer relationships, while continuing our efforts on the organic build-out of our network of strategic operating partner locations. In addition, we will also be working to drive further productivity improvements enabled through our value-added truck brokerage and customs house brokerage service capabilities. Source: 10-K

From 2022 to 2027, experts believe that the global logistics market is expected to grow at a CAGR of 4.7%. Considering this level of growth, in my view, Radiant will likely grow at the same pace. Let’s also note that I am not including any M&A operation, which is a quite conservative scenario.

The global logistics market reached a value of US$ 4.92 Trillion in 2021 and expects to reach US$ 6.55 Trillion by 2027, CAGR of 4.7% during 2022-2027. Source: Logistics Market Anticipated to Reach US$ 6.55 Trillion during 2022-2027

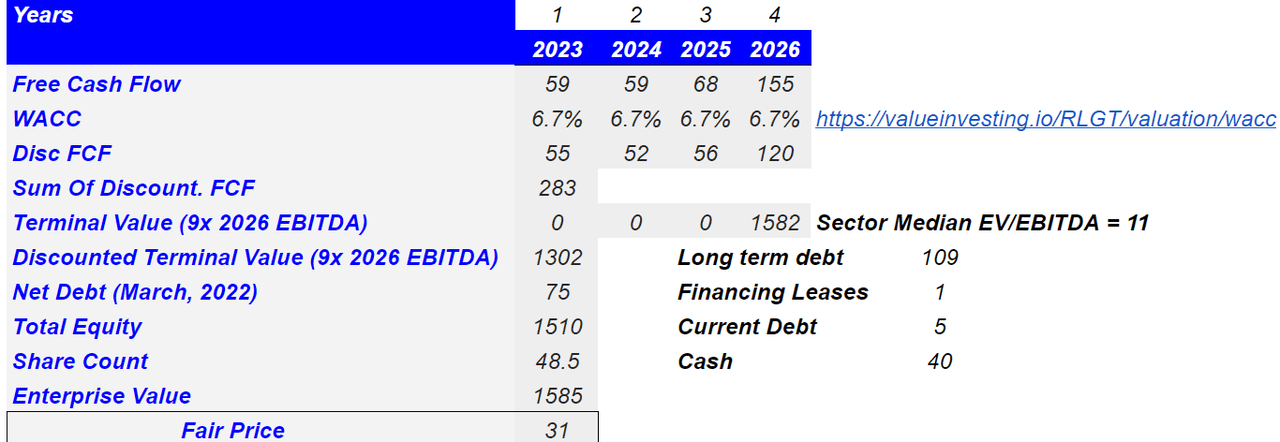

Lubo Capital

If we assume an EBITDA margin of 5% and an operating margin of 4%, we obtain 2026 EBITDA of $162 million and EBIT of $65 million.

Lubo Capital

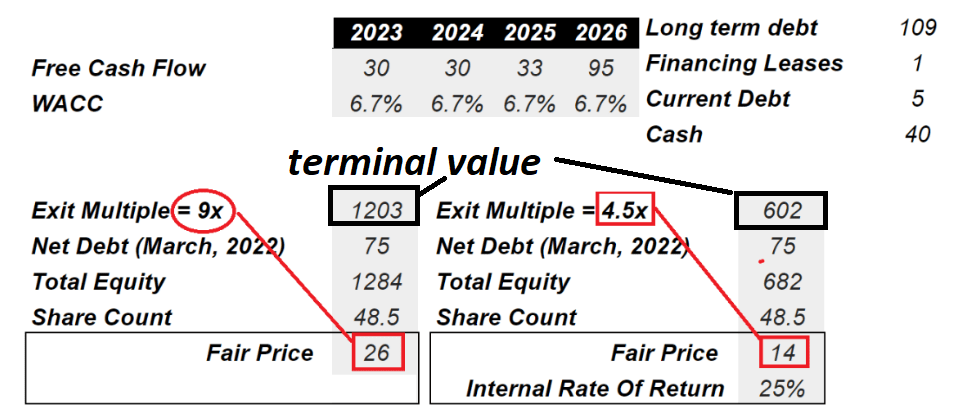

My results include free cash flow ranging from $30 million to $95 million, a discount of 6.7%, and net debt of $75 million. I used exit multiples of 9x and 4.5x because Radiant, in the past, traded at that multiples. With these figures, the implied share price would be between $14 and $26 per share.

Lubo Capital

YCharts

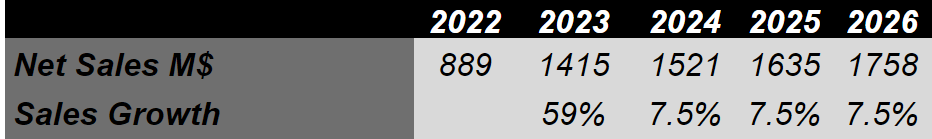

Including Further Acquisitions, I assumed Sales Growth Of 7.5%, Which Implied A Target Price Of $31.5

If Radiant acquires other companies, I believe that sales growth could reach 7.5% y/y from 2024 to 2026. It means that we could be talking about 2026 net sales of $1.75 billion.

Lubo Capital

With the previous figures, discount of 6.7%, and an exit multiple of 9x EBITDA, I obtained a fair price of $31 per share. I believe that the upside potential is significant.

Lubo Capital

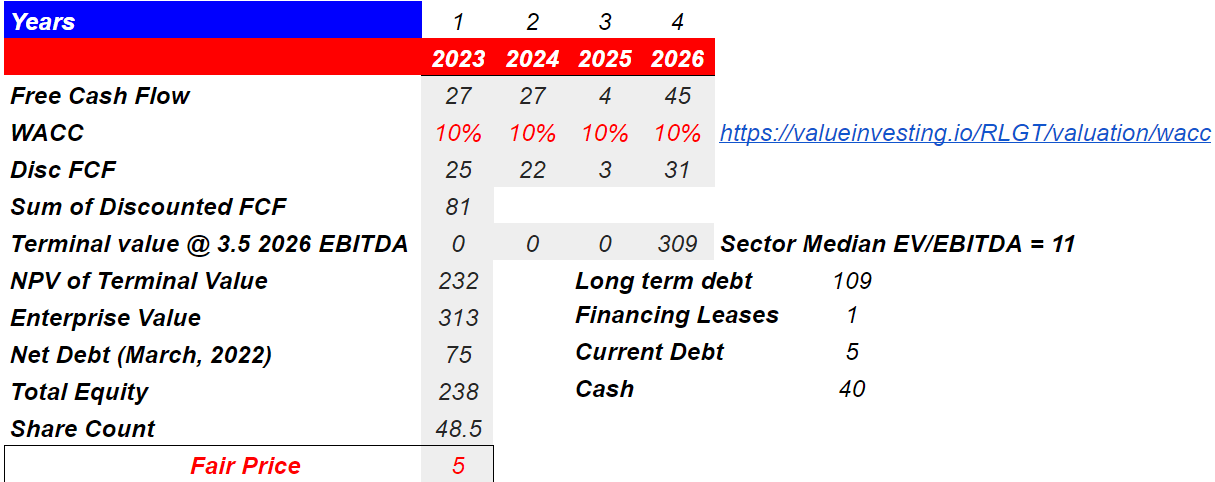

Bearish Market Conditions Could Push The Stock Price Down To $5

Radiant’s CEO owns close to 20% of the total share count, which means that he may have a significant amount of influence on the Board Of Directors. Certain shareholders may not appreciate this fact, which would lead to less demand for the stock. If the cost of equity increases, the weighted average cost of capital may increase, and the valuation would decline:

Under applicable SEC rules, our Founder, Chairman and Chief Executive Officer, beneficially owns approximately 20% of our outstanding common stock as of June 30, 2021. Accordingly, Mr. Crain can exert substantial influence over our management and affairs and matters requiring stockholder approval, including the election of directors and the approval of significant corporate transactions, such as mergers, consolidations or the sale of substantially all of our assets. Source: 10-K

Failed acquisitions and failed integration efforts would be very detrimental for Radiant. The reputational damage may reduce the demand for the company’s stock, and create selling pressure. The free cash flow figures could also be lower than expected.

A core component of our business plan is to acquire businesses and assets in the transportation and logistics industry. There can be no assurance that we will be able to identify, acquire or profitably manage businesses or successfully integrate acquired businesses into the Company without substantial costs, delays or other operational or financial problems. Source: 10-K

Radiant operates in an industry with certain regulations, which management has to respect. If the company does not comply with regulations, shareholders may suffer fines, which would lead to free cash flow declines:

We are regulated, among other things, as “indirect air carriers” by the Transportation Security Administration of the Department of Homeland Security. Failure to comply with these requirements, policies and procedures could result in penalties and fines. Source: 10-K

Finally, the company operates with many third parties, which may decide to raise their prices as inflation increases. If Radiant can’t pass the price increase to clients, free cash flow would most likely decline:

We rely on commercial airfreight carriers and air charter operators, ocean freight carriers, trucking companies, major U.S. railroads, other transportation companies, draymen and longshoremen for the movement of our customers’ cargo. Source: 10-K

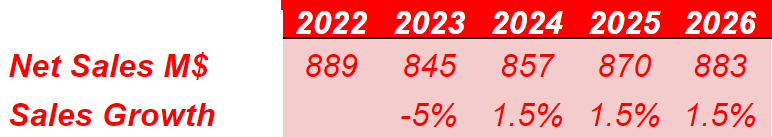

With a small decline in sales growth y/y in 2023 and sales growth close to 1.5% until 2026, net sales in 2026 would stay at $883 million.

Lubo Capital

The previous financial results would most likely lead to declines in the stock demand. If investors sell their shares, Radiant would pay more cost of equity. Hence, I decided to use a discount of 10% and an EV/EBITDA multiple of 3.5x. The implied fair price would be around $5 per share, and the internal rate of return would stay close to 8%.

Lubo Capital

Conclusion

With a diversified customer base, agreements with many partners, and not many assets, Radiant does not need a lot of cash to operate. It is also quite beneficial that management has a lot of expertise in the M&A markets. If Radiant continues to acquire other companies, revenue growth will likely be larger than expected. I see some risks from failed acquisitions and non-compliance of regulations. However, considering the current price mark, I do see significant upside potential in the stock price.

Be the first to comment