kate_sept2004/E+ via Getty Images

Q2 earnings were almost entirely good news

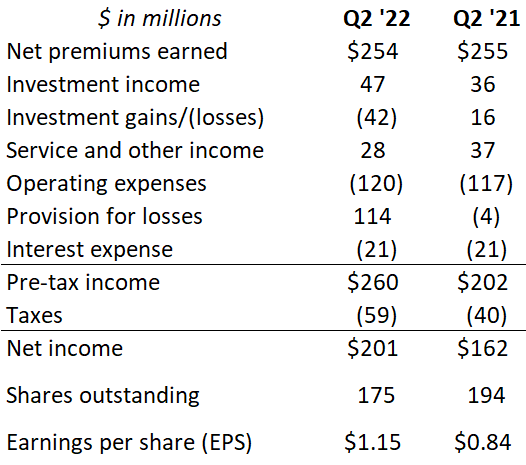

Radian (NYSE:RDN) reported Q2 EPS of $1.15, way above Wall Street analysts’ $0.76 estimate. Operating EPS wasn’t as good, but was still $0.86, or $3.44 annualized. Here is a summary of the income statement this Q2 versus a year ago:

Radian press release

Source: Radian press release

Here’s a review of the highlights:

Net premiums earned were flat with a year ago. That isn’t great, especially in this growth-obsessed stock market. Why? Radian is earning premiums on $254 billion of mortgage insurance in force, up 6% from last year. That growth is roughly in line with national mortgage debt growth, so fine so far. But the average insurance premium fell to 39.3 bps, down 2.2 bps, or 5% from a year ago. Why? Three reasons:

- Older insurance paying off had higher premiums but greater risk. Newer insurance has lower premiums and less credit risk. This drag is steadily declining.

- Some of the insurance has a single upfront premium that Radian normally amortizes into revenues over several years. But when the underlying mortgage refinances, the entire premium is added to revenues. Slowing refinance activity has reduced those revenue bumps, but refinancing activity can’t go much lower than it is at presently.

- Radian reinsures a lot of its default risk. The reinsurance has a cost, which varies each quarter.

Net/net, the insurance premium is stabilizing, which should mean that within a year or so revenues will start growing.

Investment gains/(losses). Radian invests its insurance premiums largely in investment grade medium term corporate and other bonds. The sharp rise in rates this year has of course materially reduced the market value of these investments. I exclude these gains and losses from operating earnings.

Provision for losses. The strong housing market of the past few years has contributed to substantially reducing the claims Radian is required to pay when loans it insures go into default. During Q2 Radian only made $3 million of claims payments, compared to $57 million during Q2 four years ago. Radian is so confident that losses will remain low that it reduced its (non-cash) reserve for future claims payments by $117 million in Q2, following a $106 million reserve release during Q1. Since loss provisions are non-cash management judgments, I use actual cash claims payments – in Q2’s case the $3 million – when calculating operating earnings.

Shares outstanding. A 10% reduction! This story begins with the fact that Radian has been generating very large amounts of cash flow – $2.2 billion over the last 3½ years, or over $10 per share. Meanwhile over the same time period its capital required to back its insurance book only grew by about one-third of that amount. Radian’s excess capital therefore kept mounting, reaching $1.9 billion a year ago. Radian began returning that excess capital to shareholders by buying back its low-valued stock.

Radian has plenty of capacity to continue aggressive buybacks. It ended Q2 with $1.4 billion of excess capital, which could buy back 35% of its existing shares at the current stock price. And it is generating close to $150 million per quarter in new cash, which could buy back over 3% of its stock per quarter. In other words, Radian could generate flat dollar earnings going forward and still grow EPS by 10% or more.

The odds of the big risk to Radian’s story – a large rise in claims payments – is small.

I personally believe the U.S. is in recession today. And the housing market, just recently roaring, is now in a recession too. But enough to see a wave of families losing their homes, which is what is required for Radian’s claims payments to rise sharply? I don’t see that at all, for four reasons:

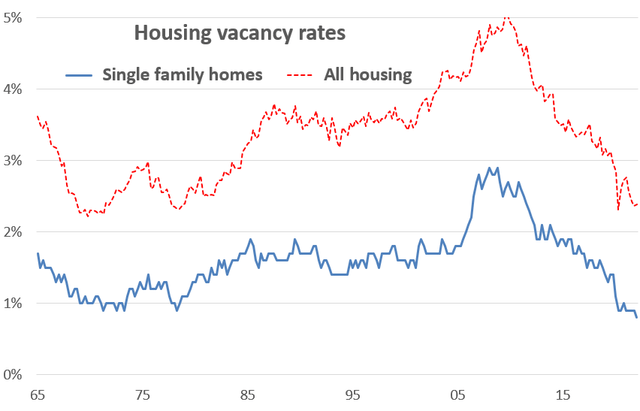

1. The U.S. has a serious housing shortage. I estimate that we are short at least 1½ million housing units, based on current record-low housing vacancy rates:

Source: U.S. Census Bureau

And from today’s New York Times: “The New York metropolitan area needed more than 340,000 additional homes in 2019, according to a May analysis by Up for Growth, a Washington policy and research group.”

Note the record excess of homes that preceded the ’08-’11 housing meltdown. Today is the polar opposite.

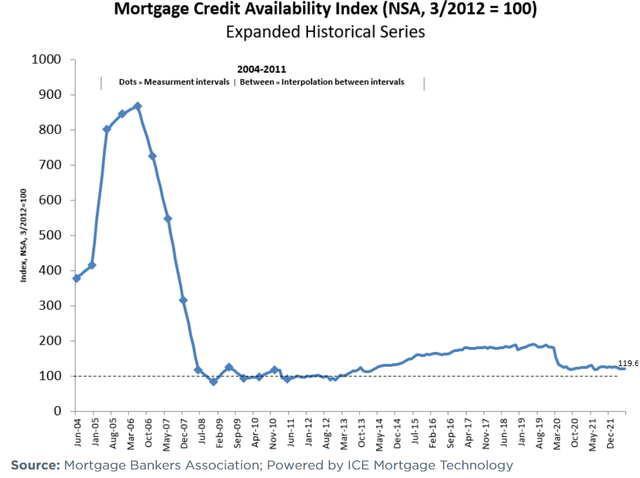

2. Mortgage lending standards remain very conservative.

Too-easy mortgage lending standards put people in homes they can’t afford and are at risk of losing in a recession. A Mortgage Bankers Association history of mortgage credit availability shows how tight lending standards have been for over a decade:

Again, today is the polar opposite of lending standards prior to the ’08-’11 housing bust.

3. The U.S. economy has some key strengths that make a serious recession highly unlikely. I detailed them in a recent article for Seeking Alpha, but the headlines are:

- The banking industry has not over-loaned, and has a very strong capital position.

- Businesses still have a record 11 million of unfilled jobs versus a normal 5 million level.

- Consumers have a strong cash position relative to their debt.

Radian’s claims payments will certainly rise from Q2’s annualized $13 million rate. $100 million, or about $0.50 a share, is possible a few years from now. But much more than that is highly unlikely.

4. Radian actively reinsures its credit risk. Like its peers, Radian uses reinsurance to reduce its losses in the event of a foreclosure wave. Radian’s current reinsurance coverage has reduced its need for regulatory capital by $1.2 billion.

This stock is cheap!

As I said above, Radian earned an annualized $3.44 in operating income during Q2. Let’s normalize that to $3.00 per share to account for more home foreclosures. I expect Radian to grow that $3.00 by about 10% a year due to share repurchases and eventually revenue growth.

What are investors willing to pay for that story today? To put it in perspective, the S&P 500 is currently selling at a 19 P/E. Radian? A 7 P/E. A 60% lower valuation than the average stock.

I own Radian. I also own its peers MGIC (MTG), National Mortgage (NMIH) and Essent (ESNT), all of which actually trade at lower than Radian. I like my chances.

Be the first to comment