guvendemir/E+ via Getty Images

Investment Thesis

Amidst tough competition in the aerospace and defense industry, RADA Electronic Industries Ltd (NASDAQ:RADA) emerges as a high growth defense stock. The company’s high quality products have proven to be useful in the field and has since gained a strong reputation among different defense companies and militaries. With constant demand for its products as well as promising opportunities to grow, there is a great buy opportunity for RADA’s stock.

Business Overview

Based in Israel, RADA Electronic Industries Ltd. is a defense technology company that develops, manufactures, and sells defense electronic products to different governments and companies around the world. Their business is primarily through the sale of two different product lines: land-based tactical radars and military avionic devices.

Land-Based Tactical Radars

These tactical radars have many applications in the field such as defense force protection and critical infrastructure protection. They are compact, fully digital, very reliable, and mobile. The radars move with combat units in the field and give real-time knowledge of any threats and how to evade them. RADA has developed two different radar hardware platforms: the compact hemispheric radar, or CHR, and the multi-mission hemispheric radar, or MHR. The CHR is mainly used for short-range air surveillance and perimeter/border protection. It helps to identify any aerial and surface intruders as well as any threats that may be fired at combat vehicles. The MHR is mainly used for 3-D perimeter surveillance and hostile fire detection. These radars help to identify different types of aerial vehicles as well as locate threats to mobilized forces. Currently, some of the primary customers for RADA’s radars are Boeing (BA), Lockheed Martin (LMT), U.S. Marine Corps and Navy, U.S. Air Force, and the Indian Security Forces.

Military Avionics

For the past 25 years, RADA has developed and fielded a wide range of military avionic devices such as digital recorders, cameras, and debriefing systems for military and aerospace applications. The adaptability and compatibility of the avionic devices work well with any new military aircrafts and UAVs worldwide. RADA’s military avionics are currently operated by many big military forces and companies such as the Israeli Air Force, Lockheed Martin, the Chilean Air Force, and the Boeing Company.

Industry Analysis

The aerospace and defense market consists of salves of aircrafts, weapons, radar, and military equipment. This industry is expected to grow from $700.30 billion in 2021 to $1047.07 billion in 2026 with a compound annual growth rate of 8.5%. The market is mainly driven by investments in the aerospace and defense sector from governments and militaries. The recent COVID pandemic has put a restraint on the industry as supply chain disruptions led to trade restrictions and manufacturing delays. However, the aerospace and defense market is recovering very quickly and will continue its high growth prospects.

The competition in this industry is tough internationally. Big players in the space include The Boeing Company, Lockheed Martin Corporation, General Dynamics Corporation (GD), and Raytheon Technologies (RTX). Also, regulations in this industry are very big as companies must constantly monitor their products and make adjustments as needed. The market is particularly influenced by the constant demand to enhance and upgrade the capabilities of their product portfolios. This results in constant high costs that are put towards R&D to continually develop more sophisticated product offerings, which makes it hard for new companies to gain a significant market share.

Competitive Advantage

Compared to its competitors such as Raytheon Technologies, Elbit Systems (ESLT) and Honeywell International (HON), RADA lacks in size, abundance of resources, and market share. However, there are a couple of advantages for RADA that help the company grow among the tough competition. Firstly, RADA is the market leader in mini tactical radars and this claim was supported by the U.S. Army when they included RADA in their counter UAS systems. This claim has helped RADA gain market share, which is critical for the company’s future growth. Secondly, the company has a record of successfully winning contracts with major customers like the U.S. Air Force, and the U.S. Marine Corps. Finally, its radar systems are significantly lighter than those of their competitors, making it easier to maneuver and more effective on combat vehicles.

Growth Prospects/Opportunities

RADA Growth Strategy

RADA’s ultimate goal is to be a part of large Department of Defense Programs. The company’s more short-term goals include building a strong reputation for providing high-quality and field-efficient avionics and defense devices, establishing a large, stable presence in their primary target markets like the United States, and forming strategic relationships with leading integrators in its primary target markets. As the company continues to produce its products, it is already coordinating and working with different integrators to get involved in different projects and eventually become part of some Department of Defense Programs.

Increase Production

When taking a look at RADA’s balance sheet, we can see that the change in inventory is negative, meaning that the demand is outgrowing production. With constant high demand for its military products, RADA needs to make sure that it has enough inventory to meet all of its demand, which poses a great opportunity for the company to increase production.

Global Reach

Another opportunity for RADA is to expand internationally. Currently, most of the company’s sales come from the United States and Israel, which make up around 75% of its revenues. If RADA were to tap into the militaries of other countries such as those in Europe and Asia, that would greatly increase the company’s global influence and market share. Currently, the company is sending business consultants to these European and Asian countries where RADA’s devices may be used.

Non-Military Growth Opportunities

Recently in the past few years, there have been multiple drone attacks or drone disturbances. Some of them include the drone attack on two Saudi Arabian oil facilities in September of 2019 and the drone spotting on the runway at the UK Gatwick airport in 2018, leading to thousands of canceled flights. These incidents have shown that it may not only be the military who needs to use RADA’s devices. The need for anti-drone defense systems becomes stronger in order to protect citizens, travelers, and workers.

Financials

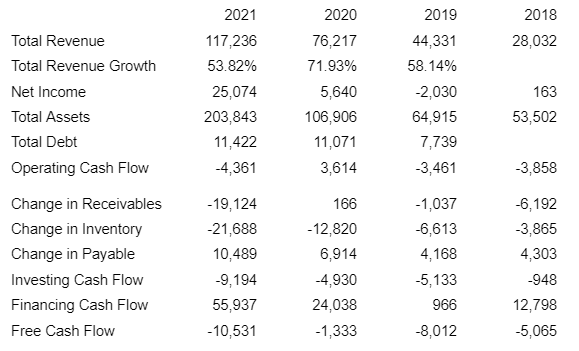

Yahoo Finance

The company’s revenues and asset growth were both strong with consistent increases. The aerospace and defense industry always has constant demand, which has been one of the main drivers for RADA’s sales. At first thought, when taking a look at the company’s statement of cash flow, it may seem a little worrisome to see negative free cash flows. But I see something different. When taking a closer look at the different cash flow segments, at the operating cash flow, we can see that the change in working capital is negative, including negative change in receivables, negative change in inventory, and positive change in payables. This seems to be a signal for growth. It shows that the company may still be investing back into itself for things like production and product development. In addition, we can see from the financing cash flow that the company is still raising a lot of capital to be put towards the growth of the company.

Valuation

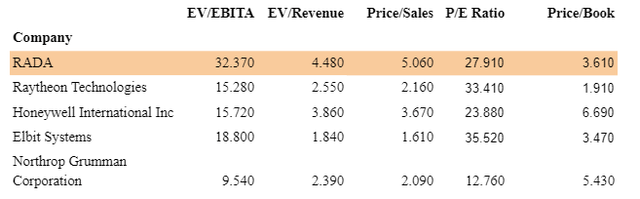

Peer to Peer Analysis

If we compare current valuation metrics of RADA with some of its competitors, it seems that RADA is a bit overvalued. However, based on the company’s growth rate in the past few years and its future growth projections, RADA seems undervalued.

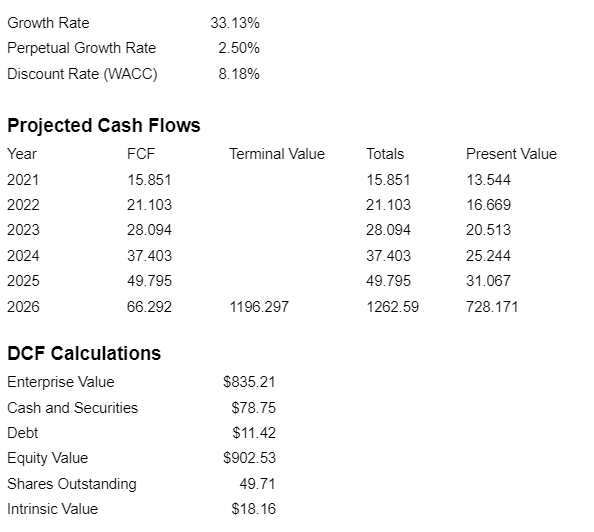

I have performed a discounted cash flow analysis below. Since the company is incurring negative free cash flows, I have used EBITA as a proxy for free cash flow. For the growth rate, I used the RADA’s CAGR based on its growth in the past 5 years and the perpetual growth rate is 2.5%, which is between the historic inflation rates of 2-3% to match the economy growth. Finally, for the discount rate, I used RADA’s weighted average cost of capital.

Calculations done by author

Risks

Constant High Costs

Due to the highly competitive nature of the aerospace and defense industry and just the constant need for more advanced equipment, RADA will have to consistently invest a lot of money into R&D and the development of high tech military devices. Since RADA is a smaller company compared to its competitors, it may have an effect on its profitability, although the chance of that is fairly small, judging by its recent surge in net income.

Defense Funding Uncertainty

Currently, most of RADA’s revenues come from the sale of its military products. With the United States being its biggest target market, the company expects that the U.S. government will continue to place high value on its national security and continue to invest in RADA’s products. However, there is still uncertainty about the U.S. defense funding levels and priorities from the Biden Administration. Any decrease in funding or shifts in national priorities would adversely affect the demand for RADA’s products.

High Dependence on a Few Customers

Although RADA has many customers from different defense companies and militaries around the world, a big portion of its revenues comes from a small number of customers. In 2021, 49% of its revenues came from only five customers. This makes it very important for the company to maintain good relationships with the company and continue to deliver high quality products. Even the loss of one of these key customers could have a big impact on the company’s business as a whole.

Conclusion

I would rate RADA as a buy with a price target of $18.16. The company has a clear growth strategy that it is currently carrying out along with a strong competitive advantage against its competitors despite its smaller size and reach. In the next three or four years, we may see a big turn for RADA as it undergoes its growth strategy, forming partnerships with different integrators and earning a larger global market share.

Be the first to comment