dani3315/iStock via Getty Images

Is it too late?

It’s not because Russia invaded Ukraine that I write about a defense electronics company. I’ve held RADA Electronic Industries (RADA) since February 2021 when I purchased it for $10.55 per share. In January 2021 it was also proposed (without knowing of my holdings) by one of the fellows in a private investment club in Belgium as an interesting pick. Given the technical setup that the price of RADA was developing since December, I decided to give it a closer look from a fundamental point of view. I also added to my position at the beginning of February. “Unfortunately” for readers, it has rallied so much recently, that it must be looking like a “too late” pick. However, I think that the stock still has room for the upside. Fundamentally speaking, RADA has an incredible growth story and is worth considering not only by anyone who is interested in the defense market but also by those interested in the Israel-based growth technology companies in general.

Products

Founded in 1970 by David Reitner, RADA Electronic Industries Ltd. has traded on the NASDAQ Stock Exchange since 1985. In February 2021 it entered also the Tel Aviv stock exchange, where right from the start it has been added to the Tel Aviv 90 index, TA-90. Its market cap is currently around $630 million.

RADA sells a variety of radar hardware platforms for use in combat vehicles as well as tactical protection applications for defense forces and border security. Ever since the first significant order for this product family in 2014, RADA’s tactical radars are primarily sold to governmental agencies, governmental authorities, and government-owned companies, many of which have complex and time-consuming procurement procedures. RADA’s products are either end-to-end solutions or form a part of more systems with other equipment provided by lead contractors who play for RADA the role of integrators. The integrator model is the predominant route for RADA to access big defense contracts in the U.S. and elsewhere. This business approach is what the company calls “RADA inside”. Sounds familiar?

Two current product lines are:

-

Tactical radars line for defense forces and critical infrastructure protection solutions. These compact and mobile software-defined radars provide hemispheric spatial coverage and can operate on the move. Tactical radars move with the maneuvering combat units in the field and provide real-time knowledge of whether and from where they are threatened.

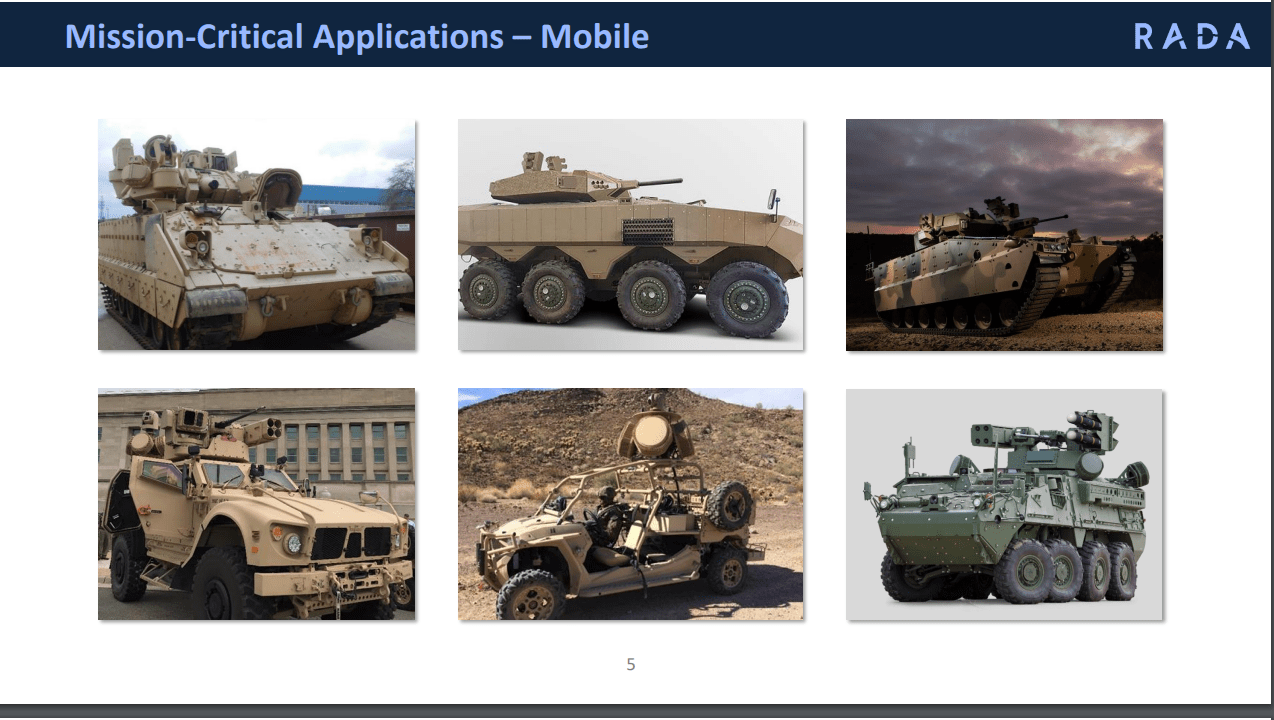

Mission critical applications – mobile (RADA Results Q1 2021)

Source: Q1 2021 Presentation

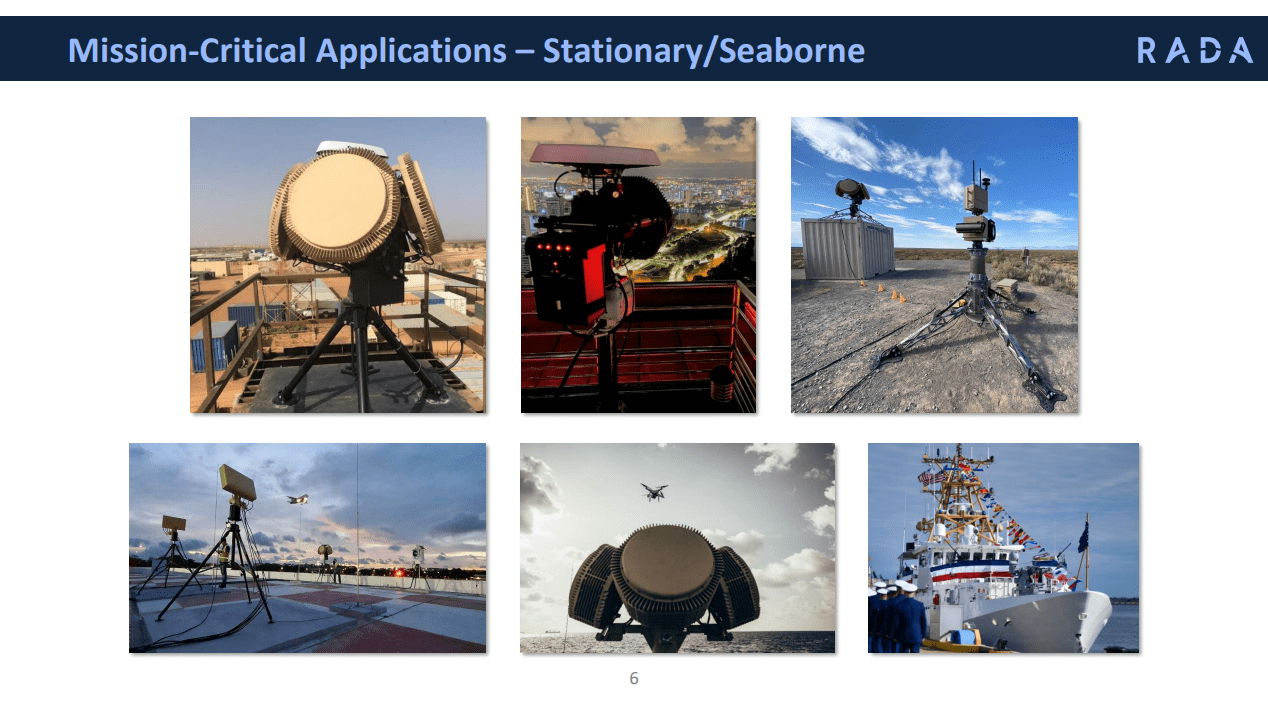

RADA develops related hardware platforms: the compact hemispheric radar, or CHR, followed by its advanced variants, eCHR and aCHR; and a family of multi-mission hemispheric radars, or MHRs, and its advanced variant, ieMHR, which are tailored for use in force (e.g. also on sea vessels) and critical infrastructure protection applications.

Mission critical applications – seaborne (RADA Results Q1 2021)

Source: Q1 2021 Presentation

2. Military Avionics solutions line which is subdivided into two categories:

-

Mission data recorders and debriefing solutions and HUD video cameras;

-

Avionics for UAVs (Interface control processors, engine control computers, Payload management computers and others).

RADA’s airborne products and system solutions are operated by leading air forces and prime integrators worldwide, such as the Israeli Air Force, Lockheed Martin (LMT), Boeing Company (BA), HAL, Embraer (ERJ), IAI, Rafael, the Chilean Air Force, and many others.

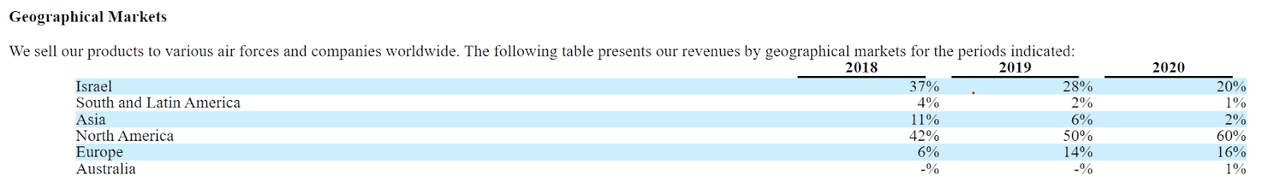

Market and customers – from Israel to the whole world

As indicated in the annual report (form 20-F) for 2020, nearly 80% of RADA’s sales were in Israel and the U.S.

Geographical markets in 2020 (Annual report 2020)

Source: Annual report 2020

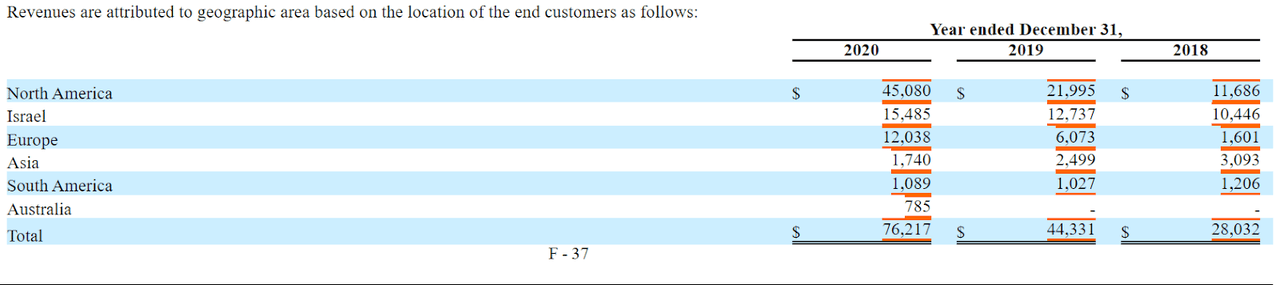

To put it into the monetary values, see the distribution in dollars:

Geographical markets in 2020 in dollars (Annual report 2020)

Source: Annual report 2020

Sales to other geographic areas are on the rise, with support of Israel’s defense export policy and within very stringent laws regulating the export of “dual-use” goods (“dual” refers to being sold both in the commercial and the defense markets) and defense export control legislation.

As seen above, RADA derives a substantial portion of the revenues from contracts with U.S. defense contractors and systems integrators that ultimately provide complex solutions to the U.S. government, including the U.S. Department of Defense. This strong US focus is facilitated by the fully-owned subsidiary RADA Technologies LLC, based in Germantown, Maryland, coming from the 2018 joint venture with SAZE Technologies LLC. RADA Technologies is focused on the adaptation of the tactical radar technology for the U.S. market, certifying them to U.S. standards, and since the first quarter of 2020 – also manufacturing the radars. An R&D subsidiary RADA Innovations LLC was created in July 2020 to perform classified work on radars for the U.S. market. Contracts coming from the U.S., besides the volume, are also very beneficial for RADA’s cash position, as the company values the speed with which they get cash quicker than from other markets.

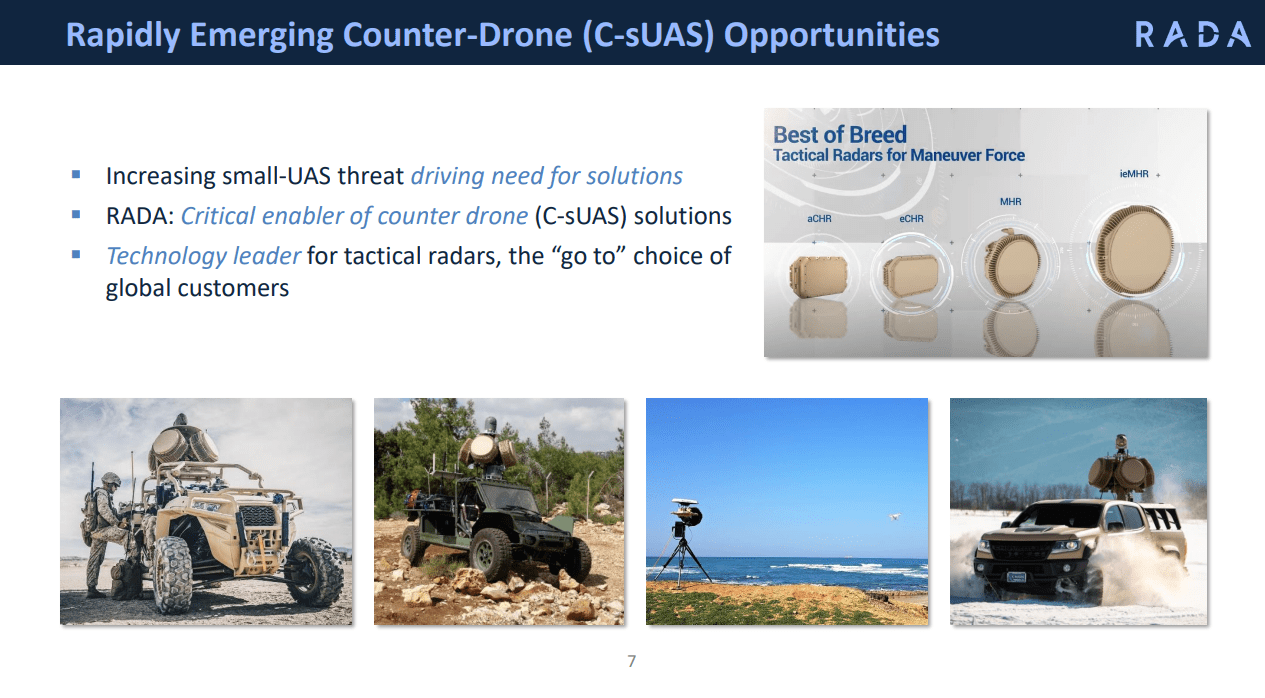

European and the Middle East markets started picking up in Q1 2021. CEO Dov Sella oftentimes underlined in his 2021 earnings calls that NATO countries have started adopting the U.S. M-SHORAD model (read more on Mobile Short Range Air Defense in a US Army’s April 2021 article “M-SHORAD system bolsters Army’s air defense capabilities”), as it is a growing niche of base defense solution, including to counter small UAS (counter drones).

Counter-drone solutions (RADA Results Q1 2021)

From the most recent (Q4 2021) call we learn:

“The European/NATO countries are typically following the doctrine and solution of the U.S. military and the need for SHORAD and Point-Defense is becoming recognized. Currently, the market is in its incubation phase. We are engaged with quite a few prominent European weapon system providers and our radars are integrated and continuously being tested as part of these solutions. We estimate that the market will uptick in the near future.”

As for the specific European countries, the Netherlands was mentioned in a couple of last calls, as well as Poland.

Also, the Indian market is growing, with RADA expecting a JV in India. Noteworthy to mention the Middle and Far East zones, where the need for critical infrastructure defense against drone attacks has been very mediatized and where RADA has also gained new business

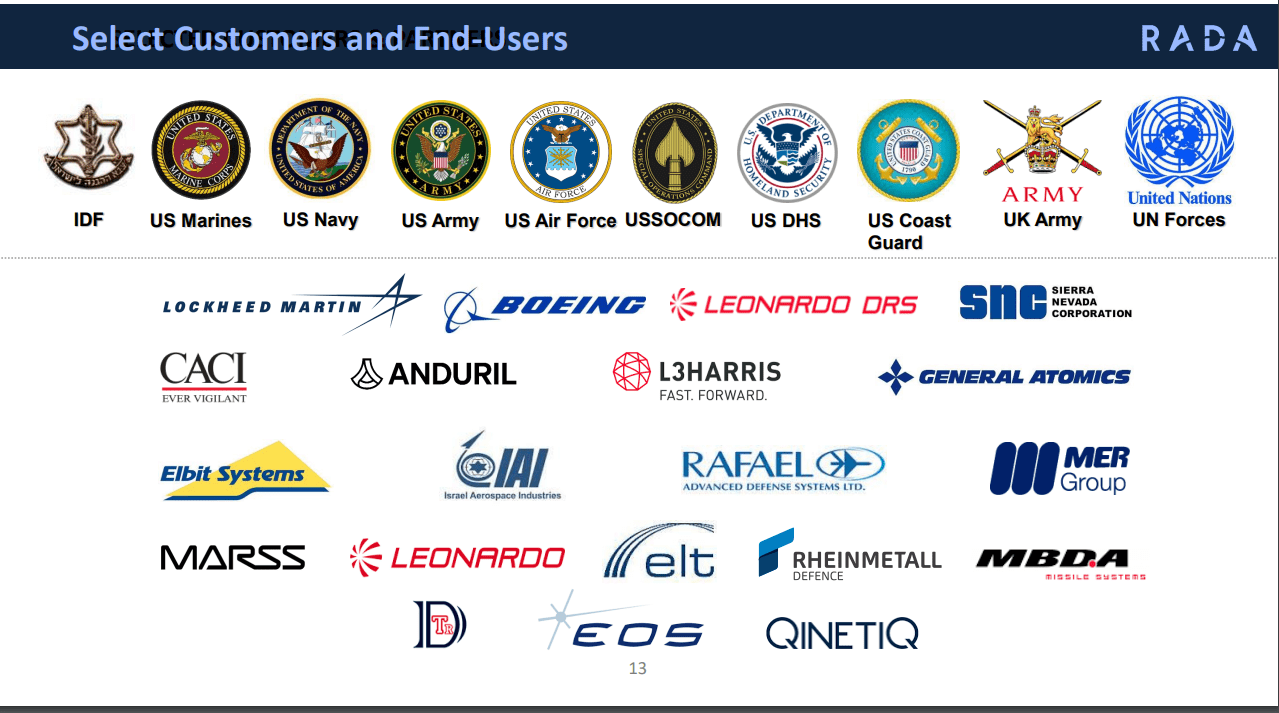

To get specific about the main clients of RADA (some of them playing roles of integrators), among the customers and users are leading defense forces and defense contractors worldwide, including the Israeli MOD, IMI (an Elbit Systems ESLT subsidiary – for “Iron Fist” Active Protection Systems – read more about APS in Elbit’s materials here), Rafael (for DRONE DOME Counter Unmanned Aircraft Systems C-UAS – read here), MER Group, Lockheed Martin, Boeing, Leonardo DRS (for M-SHORAD integration), Anduril, CACI, General Atomics, Elettronica, the U.S. Marine Corps and Navy, the U.S. Air Force, Indian Security Forces, Rheinmetall, and many additional integrators and end-users.

Main clients (RADA Results Q1 2021)

Source: Q1 2021 Presentation

Following the official filings, during the years ended December 31, 2020 and 2019, 63% and 61% of RADA’s revenues, respectively, were attributable to nine customers. Some of the same customers or partners are also among RADA’s competitors. On tactical radars, these are IAI (through its subsidiary, Elta), SRC Inc., Raytheon (RTX), Northrop Grumman (NOC), Leidos (LDOS), SAAB, Thales, Hensoldt, and Leonardo Selex. In the avionics and recorder markets, principal rivals include Elbit Systems Ltd., Honeywell International Inc., IAI, Northrop Grumman Corporation, Sagem Avionics LLC., Thales Group, and Zodiac Aerospace Group. They are all bigger and more recognized names than RADA Electronics.

Total Addressable Market

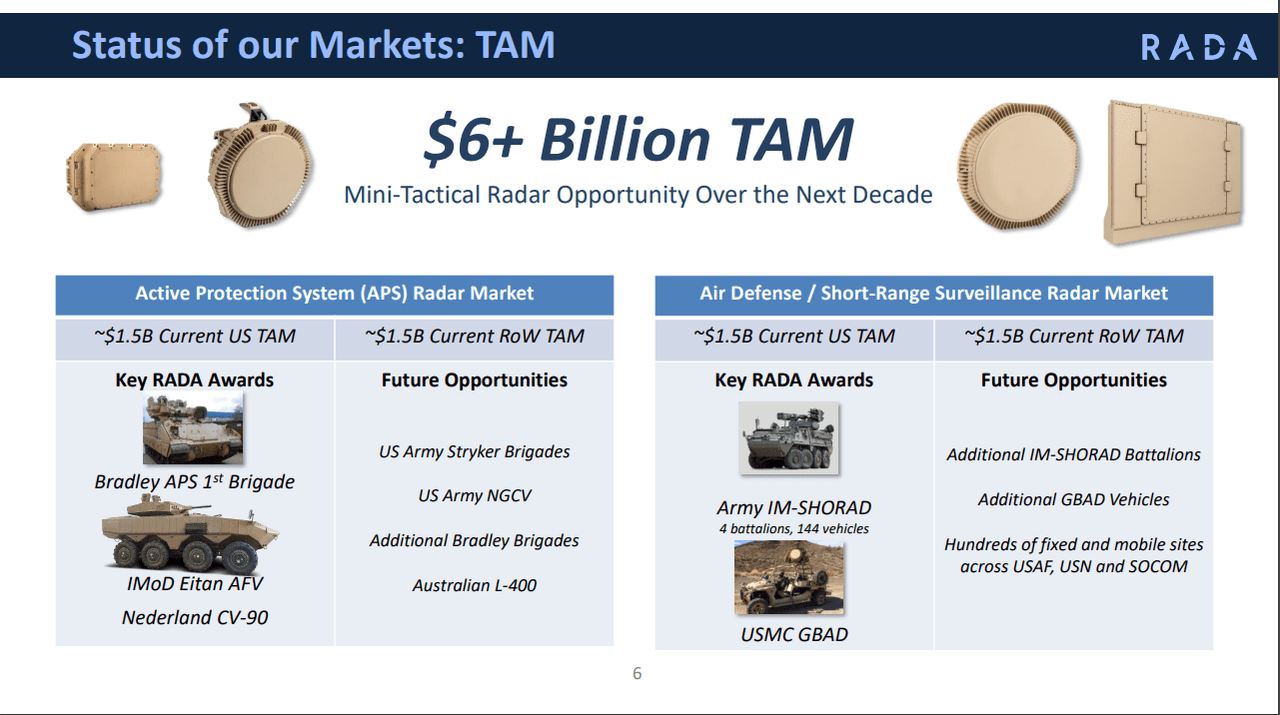

RADA estimates that their Total Addressable Market is approximately $6 billion.

TAM (RADA Results Q4 2021/ Full 2021)

Source: Full 2021 Results – Q4 2021 Earnings call Presentation

According to the company, this market is almost equally divided between APS solutions and Air Defense/Short-Range Surveillance Radar solutions. In both of these pillars, the U.S. market occupies half of the market (so, twice a quarter), and the RoW (Rest of the World) takes the other two quarters.

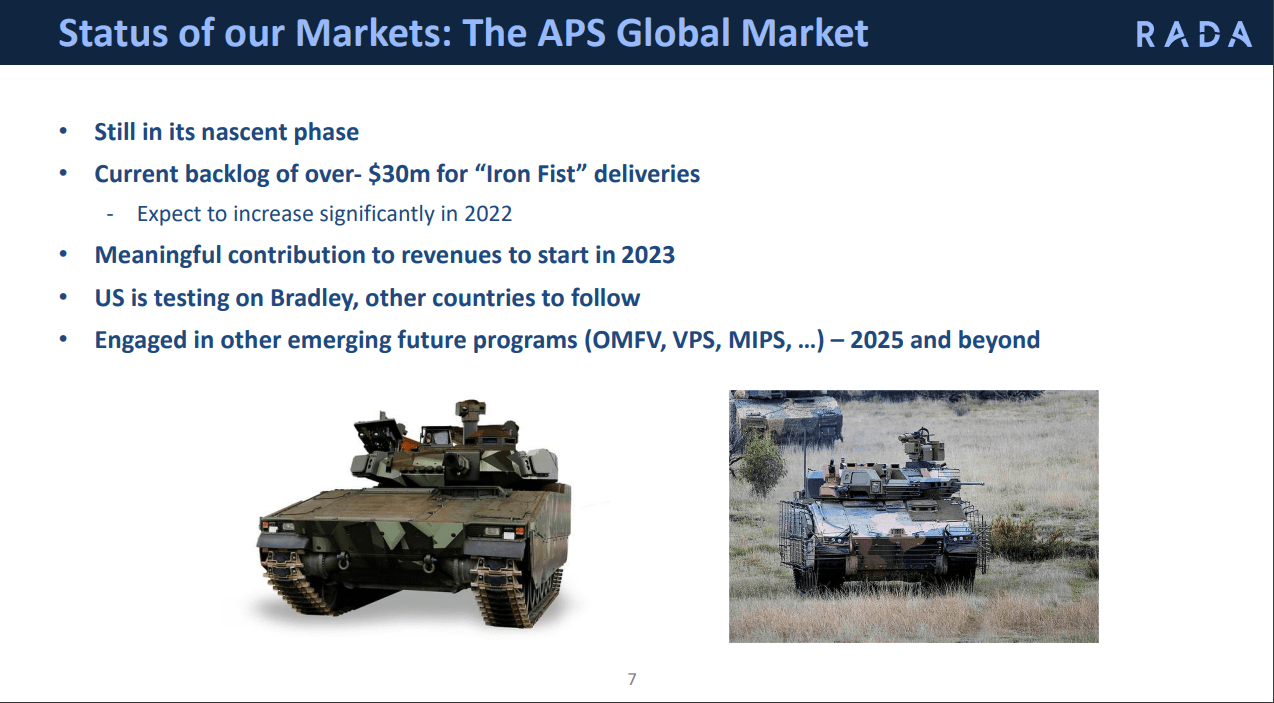

APS global market (RADA Results Q4 2021/ Full 2021)

Source: Full 2021 Results – Q4 2021 Earnings call Presentation

APS deliveries already started but will multiply and significantly affect the top line starting from 2022.

SHORAD market (RADA Results Q4 2021/ Full 2021)

Source: Full 2021 Results – Q4 2021 Earnings call Presentation

In the U.S., SHORAD market demands are shifting towards addressing bigger UASs and cruise missiles threats.

SHORAD non-US market (RADA Results Q4 2021/ Full 2021)

Source: Full 2021 Results – Q4 2021 Earnings call Presentation

As mentioned already, the rest of the world takes note of the modernization trends in the U.S., and orders from these markets are expected to grow.

Chips crisis

On the side of suppliers, RADA acquires most of the components from suppliers and subcontractors located in Israel and the U.S. Just before COVID-19 pandemics started, RADA increased the inventory of chips (enough for 1 year of production) and these chips came mostly from the US, Europe, and the Far East. The additions to the inventory have marked each of the 2021 quarters and proved providential for RADA’s delivery of both planned big contracts as well as ad hoc short lead-time orders. Not only was the access to chips ensured by massive buys, but also RADA was doubling their Israeli and U.S. production capabilities through 2020 and 2021. The manufacturing sites are still left with room for ramping up.

Growth story

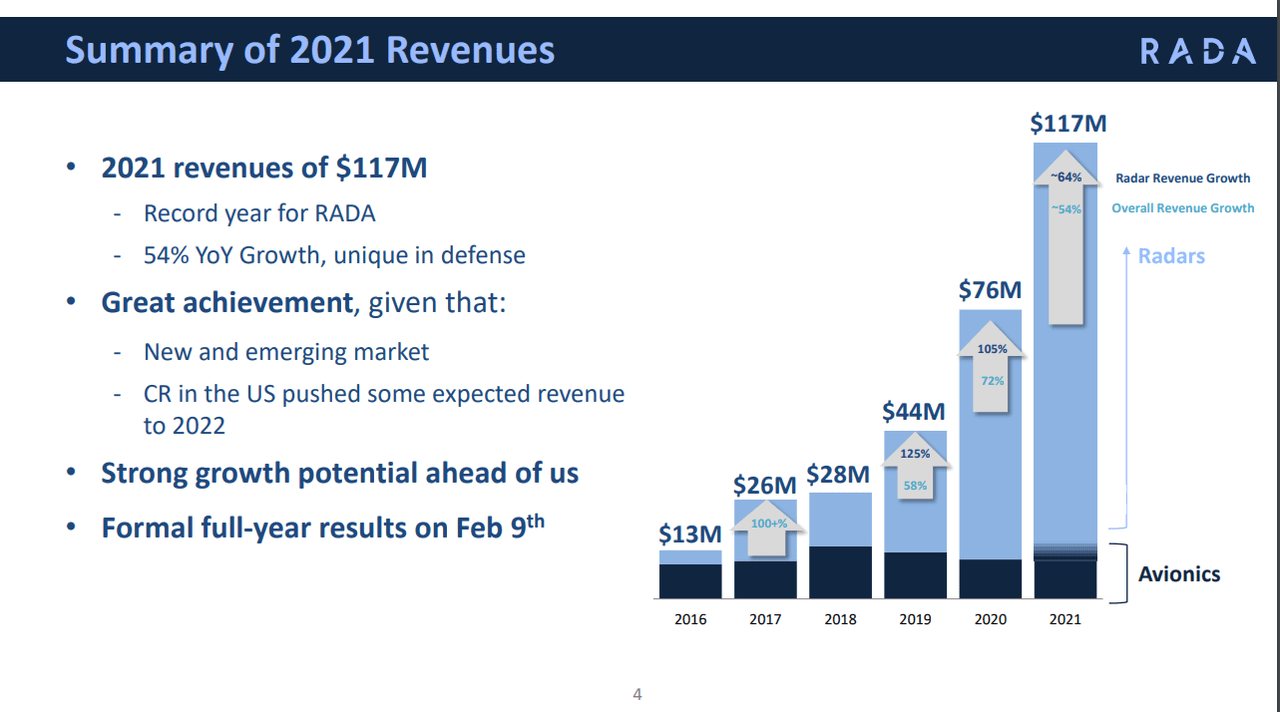

RADA has experienced an enormous growth already from 2019 to 2020 by 72%, when they also gave guidance of $ 120 mln for 2021 (projecting a growth of 60%). They missed it just by $3 million – for the 2021 RADA’s revenue was $117 million, up 54% YoY. For the year, the gross margin was 41% versus 37% in 2020. The management is expecting to maintain gross profit at the level of 40-41% and a much slower pace of OpEx growth than that of the revenues.

Growth of revenues (RADA Results Q4 2021/ Full 2021)

Source: Full 2021 Results – Q4 2021 Earnings call Presentation

EBITDA for the year was $27.3 million versus $9.7 million last year – almost tripling, which demonstrates operating leverage in their business model. As I mentioned above, RADA has the manufacturing capacity for revenues at significantly higher levels than delivered in 2021. They ended the Q4 2021 with $79 million of net cash and with no debt.

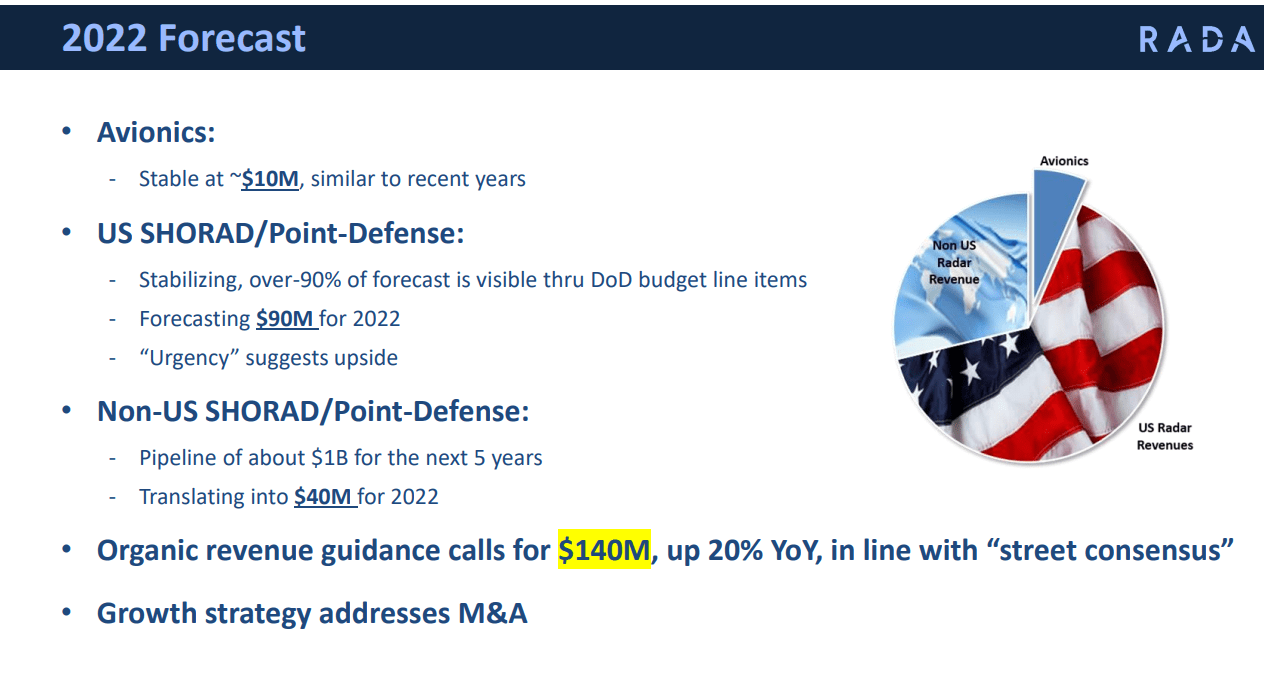

The management communicates a strong conviction in the exponential growth of the revenues in the coming years. The guidance for 2022 is $140 million, representing a growth of nearly 20% YoY. About 90% of RADA’s guidance is incorporated in the defense budget line items. Despite the lumpiness characteristic for the defense spending, a long-delivery contract might help to achieve the goal of $250 million in annual revenue within 3 to 4 years, which implies an acceleration of the revenue growth in 2023 and beyond. A significant driver will be the APS (“Iron Fist”) market with multiple deliveries rolling out this year, as well as the transition from testing to purchases in multi-year plans.

2022 Guidance (RADA Results Q4 2021/ Full 2021)

Source: Full 2021 Results – Q4 2021 Earnings call Presentation

There are prospects of growth also through acquisitions, and who knows – maybe even going outside the defense market. In February 2021, RADA announced the signing of a Term Sheet to invest $3 million in consideration for a 12% interest in RadSee Technologies Ltd., an early-stage advanced radar technology company. This investment aims at creating synergetic radar technologies applicable also in non-defense – specifically, automotive – industries. RADA wants to exploit the advantages of compatible algorithms in products of both companies and bring down the cost of automotive radars. As shared in the Q4 2020 call, RadSee had plans to test the new solutions in Tier 1 and 2 OEMs.

Technical analysis

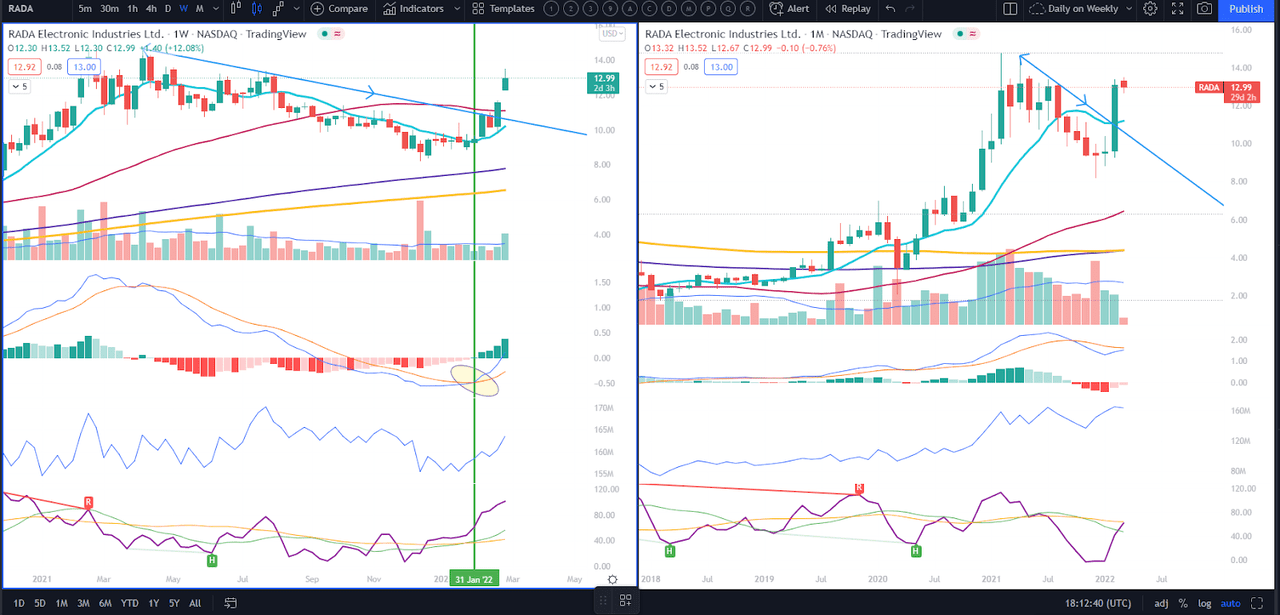

Because RADA was already amongst my holdings, since the end of 2021 I have been watching a setup unfolding on the weekly chart where MACD was approaching its signal. You can see below on the left pane (it’s a weekly chart; the right one is monthly) in the yellow circle that MACD was crossing up its signal. I also placed the vertical green line there so that you see where it crosses the green price candle, which on its own right is closing above the blue line of the 10-week Moving Average. The candle for that week closed at $9.47. The 10-week MA has turned up and is on its way to cross the 50-week MA (dark red).

RADA chart (TradingView)

Source: TradingView chart of RADA

You can see on the monthly chart that the candle for February has crossed the 10-month MA almost exactly in the same spot where the trendline (blue line with double heads) crosses the same MA. Also, the monthly MACD is approaching its signal from below and the confirmed crossing could signify a prolonged rally of the stock – possible with a pause around the 5-year high of $14.80

Conclusions

I like the fundamentals of the company. I believe that the years of unprofitability have finished for now and that RADA has some good periods ahead with serious contracts coming in. Definitely, one to keep on your watchlist or to start a small position before it proves its momentum on crossing the 5-year high.

Be the first to comment