Astrid Stawiarz

Thesis

Qurate Retail, Inc. (NASDAQ:QRTEA) jumped as much as 15% (pre-market reference) after Michael Burry – one of the world’s most prolific value investors – disclosed having invested more than $10 million worth of equity in the company. According to Burry’s 13F filing for the September quarter, QRTEA is his second-largest single stock holding – lagging GEO Group (GEO) by about $5 million.

Investing in QRTEA looks to be like a strong value play. Since, the stock has lost approximately 75% of value year-to-date versus a loss of about 17.5% for the S&P 500 (SPY)…

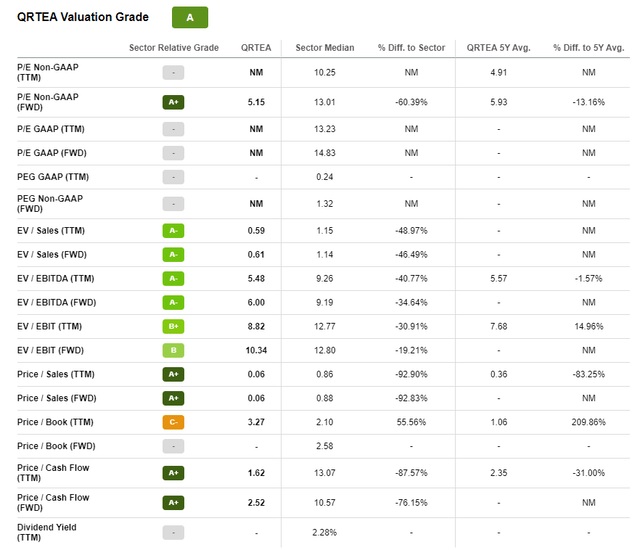

…QRTEA stock is now trading at an attractive one-year forward EV/EBIT multiple of x10, which implies a 20% discount to the sector median.

About Qurate Retail

Qurate Retail is the largest U.S. video commerce retailer, selling video-focused value propositions to customers via linear TV, ecommerce sites, digital streaming, and social media platforms. Notably, Qurate retail is listed as a Fortune 500 company and the company’s portfolio includes brands such as QVC, HSN, Zulily, Ballard Designs, Frontgate, Garnet Hill, and Grandin Road.

According to company sources, Qurate reaches more than 200 million households – selling mainly apparel, home lifestyle/living products, accessories, and beauty products via 14 television channels. The company’s single biggest market is the U.S., but Qurate also has operations in broader North America, Europe, and Asia.

Fundamentals Look Pressured…

Given the rise of new media, and new digital shopping experiences such as influence marketing, Qurate’s core value proposition has gradually become less appealing for marketers looking to sell merchandise. Consequently, Qurate’s financials have struggled to grow in line with the fast-growing eCommerce/digital advertising verticals.

From the period 2018 until 2022 (TTM reference), Qurate’s topline contracted by a CAGR of approximately 3.7%, falling to $12.6 billion. Over the same period, QRTEA stock has fallen by more than 90%.

…But Value Is Certainly There

However, there is more to the story. Value investors might want to consider that Qurate’s topline has actually remained flat versus 2018, if the 2022 period is considered a recession-driven setback. In 2021, Qurate managed to record revenues of $14.04 billion, which is in line with 2018. The same argument could be made for profitability: Although Qurate’s operating income dropped from $1.43 billion in 2018 to $841.0 million in 2022, operating income in 2021 was still at $1.47 billion – actually a slight improvement as compared to 2018.

Moreover, even if an investor assumes that the sharp profit drop versus 2021 is structural (not purely recession-driven), the company is likely still undervalued versus financials – assuming no further deterioration in profitability.

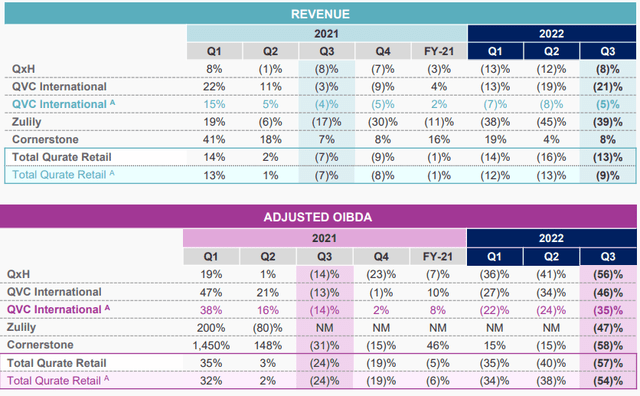

Qurate’s Q3 results, which have been reported only recently, hint that the loss of profitability YTD is based more on the macroeconomic environment, and less on company-specific challenges. The company’s CEO, David Rawlinson II, highlighted that the business was strongly impacted by the “promotional environment and weakened consumer sentiment,” a trend that has been noted by companies across industries and maturity cycles. Long term, management is confident that not only margin expansions, but also topline growth could be possible (emphasis added):

Despite soft results, we maintained our focus on progressing the five pillars of Project Athens, our three-year strategic plan to re-establish revenue growth, adjusted OIBDA margin expansion and incremental cash flow generation…

…We are augmenting our team and attracting executive leadership talent with top tier experience who will help drive this transformation, including a Chief Operating Officer, President of Streaming Operations, a Chief Merchandising Officer for QVC US and a Chief People Officer.

For reference, QRTEA stock is currently trading at an EV/Sales of about x0.6, which represents a 49% undervaluation versus the sector median. The company’s EV/EBIT valuation is x8.9, which implies a discount to the sector median of about 31%.

Debt Is A Key Concern

The key concern for me – when considering an investment in QRTEA – is related to the company’s high debt load. As of 30 September 2022, Qurate has $7.17 billion of financial debt, against cash and short-term investments equal to 624 million.

However, if the profitability dip in 2021 is indeed due to macro headwinds, then I am confident to believe that $624 million in liquidity is enough to bridge the economic downturn. Moreover, investors should consider that Qurate’s cyclically adjusted annual operating cash flow has been consistently well above $1 billion for the past decade. And, even for the TTM, Qurate’s operating cash flow balance has remained positive, at $470 million.

Investor Takeaway

In my opinion, Qurate deserves a speculative “Buy” rating. The company’s financials indicate an unreasonably strong selloff versus fundamentals, and a value thesis can be made. It is also supportive to know that other value investors, most notably Michael Burry, like the stock and have concluded that an equity investment is reasonable.

Personally, I estimate that an EV/EBIT multiple of about 13x could be reasonable for Qurate, which would translate into an unlevered yield of approximately 7.7% (inverse the EV/EBIT multiple). Accordingly, I see Qurate between 20% – 30% undervalued – an estimate that would also be in line with the industry median.

Be the first to comment