simonkr/E+ via Getty Images

Rising Inflation, Higher Borrowing Costs and Recession Risks Are Straining Household Coffers and Boding ill for Retail

Persistently high inflation is eroding the purchasing power of consumers, who would like to see a significant wage increase.

The latter is unlikely to happen because it risks triggering an inflationary spiral that the US Federal Reserve is trying to avoid by spiking interest rates, even at the cost of a recession. This also puts a strain on the family budget, and indeed people are looking to the future with pessimism.

This picture is very uncertain and will weigh heavily on the growth prospects of many retailers, including those operating on the internet or teleshopping.

Among the global video and e-commerce retailers in the US, Qurate Retail, Inc. (QRTEA) seems poised to feel the impact of the strong headwinds that will follow due to the above situation.

The company has a three-year project to resume sales, but revenue and profit margins have declined significantly recently, which is not irrelevant to shareholders.

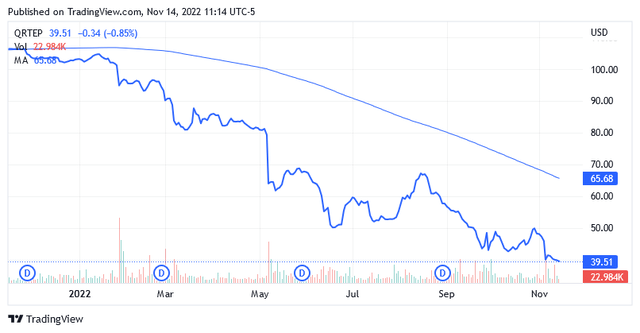

It is true that the preferred stock, which trades under the symbol (NASDAQ:QRTEP), has a dividend yield of 20.4% as of this writing, which compares impressively to the S&P 500’s 1.63% dividend yield, but it is also true that the stock price [$39.51 as of this writing] was well over $100 per share just a year ago.

Although the stock price is much lower now than it was a few months ago, the stock still appears overvalued as sales slowdown and near-term outlook looks set to pose a major challenge for the company. This is not an incentive to go beyond a hold position.

About Qurate Retail, Inc.

Headquartered in Englewood, Colorado, Qurate Retail, Inc. is an Internet retailer engaged in video retail and e-commerce businesses in North America and overseas.

Qurate Retail markets and sells a wide range of consumer products using retail-focused television shopping programming in addition to more advanced internet and mobile application technologies.

The company also offers clothing and household products, beauty care products and various accessories through its online channel. This allows consumers to interact with the online retailer and participate in shopping activities via apps, mobile and desktop applications.

Qurate Retail claims to have a portfolio of around 200 million globally distributed customers that it currently serves.

The Financial Results for the Third Quarter of 2022: Disappointing Sales and Margin Trends

The third quarter of 2022 [Q3 2022] was again not positive for Qurate Retail, Inc., which attributed the poor performance, particularly in terms of declining sales, to both the intense competitive environment and lower consumer spending.

Revenue for the third quarter of 2022 was $2.7 billion, down 14% year over year and missing analysts’ average estimate by $190 million. E-commerce revenue, which accounted for 62% of total revenue, was $1.7 billion in the third quarter of 2022, down 13% year over year.

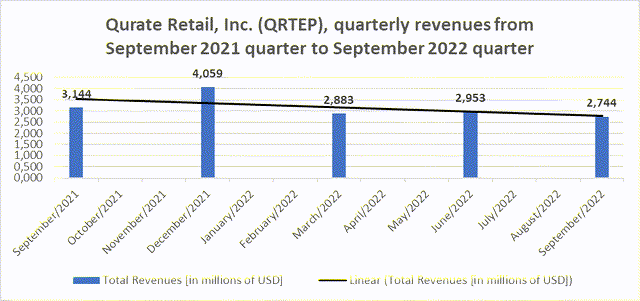

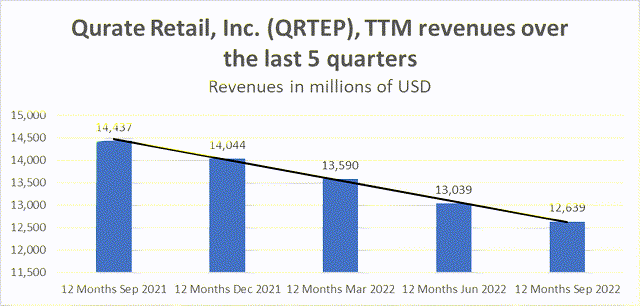

As illustrated in the two charts below, Qurate Retail, Inc.’s sales have been disappointing recently, for either consecutive quarterly periods or consecutive twelve-month periods.

This chart illustrates the negative trend in Qurate Retail, Inc.’s quarterly revenues from the September 2021 quarter to the September 2022 quarter

seekingalpha.com/symbol/QRTEA/income-statement

This chart illustrates the negative trend in Qurate Retail, Inc.’s TTM Revenues over the last 5 quarters.

seekingalpha.com/symbol/QRTEA/income-statement

By segment revenues decreased as follows:

- QxH revenue, which accounted for 61% of total revenue in Q3 2022, fell 8% year over year. The segment markets and sells goods not only through its U.S. televised shopping programs, but also through mobile apps, websites, and over-the-top [OTT] platforms. OTT is a technology that delivers both television and film content over the Internet. As this video content is what the individual consumer requests, it should meet his requirements.

- The QVC International segment, which accounted for 20% of total revenue, fell 21% year over year. The segment is a television network and shopping channel specializing in home shopping on television with an international reach.

- The Zulily segment, which accounted for 7.3% of total revenue, fell 39% year over year. The segment offers daily specials and many products at great prices for shoppers, their families, and their homes through its mobile apps and website.

- The cornerstone segment, which accounted for 12% of total revenue, fell 8% year over year. The segment consists of interactive dream home and clothing lifestyle brands such as Frontgate and Ballard Designs, but also Garnet Hill and Grandin Road.

The company ended Q3 2022 with a pro forma net loss of $0.08, missing analysts’ average estimate by $0.15.

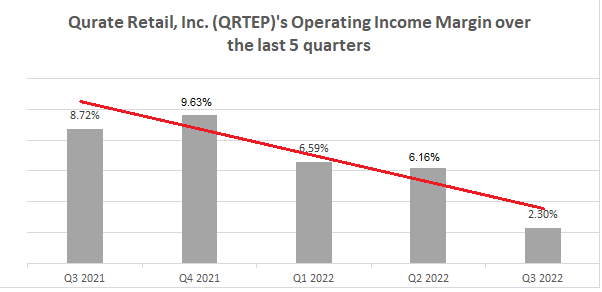

Operating income decreased 77% year-on-year to $63 million due to certain cash impairments related to goodwill and trade-names recorded in Q3 2022.

During the quarter, the company faced increases in administrative expenses as well as lower product margins. These two factors combined unfavorably with higher inventory obsolescence costs, resulting in a lower year-over-year operating profit margin of just over 2 percent.

The company’s operating profit margin is also declining, as shown in the chart below.

seekingalpha.com/symbol/QRTEA/income-statement

Negative Trends in Revenues and Margins Reflect Increased Competition Coupled with Uncertainty Weighing on Consumer Spending

The intensely competitive environment is due to the continued spread of Internet technology and its adoption by more and more companies around the world. By creating ad hoc websites, these companies advertise their products and services, which are available in brick-and-mortar stores or directly on the Internet with delivery to the consumer’s address by the couriers. With the continued mass adoption of cell phones, companies around the world are becoming increasingly aggressive in their sales techniques. They use all available means like social media, chat services and apps to attract the widest possible audience of potential consumers for online shopping and e-commerce activities.

Because most sales are made through the online channel rather than teleshopping through commercial television, Qurate Retail, Inc. pays for the presence of many online operators.

The company is trying to restore sales growth by focusing on the human factor and attracting highly qualified managers with extensive experience in the industry. As well as using streaming or Livestream technology for shopping which is very popular lately.

In addition, the company plans to improve customer service and customer retention, make its operations more efficient and optimize its brand portfolio.

Qurate Retail, Inc. will pay special attention to its maternal and baby product catalogs, an area that the company says many brick-and-mortar retailers are phasing out or have sharply reduced. It will take time for Qurate Retail’s sales to grow again, which is the hoped-for result of its 3-year growth plan called Project Athens.

Meanwhile, sales will most likely suffer from the impact of a likely further downgrade in consumer confidence, which is expected to weaken as it is weighed down by high inflation and higher borrowing costs because of the US Federal Reserve’s hawkish stance.

Last week, the University of Michigan released its US consumer sentiment for the month of November, showing a fall to 54.7 from October’s 59.9. It was also the lowest reading since July and missed the market’s forecast of 59.5.

The index signals a deterioration in consumers’ current economic conditions, in addition to the highly uncertain future that consumers are facing for at least the next 3 years. Their expectation is affected by inflation, which has reduced the purchasing power of wages, and the higher cost of money, making access to credit more difficult than in the recent past.

Additionally, analysts expect the global economy, 70% driven by consumption, to decelerate in 2023 and grow in 2024, but at a much slower pace than this year. Moody’s lowered its estimate for G20 gross domestic product [GDP] growth to 1.3% for 2023 from the previous estimate of 2.1%, while growth is expected to come in at 2.5% this year. Moody’s forecasts GDP growth of no more than 2.2% for the G20 economies in 2024.

The other 40% of the company’s business that relies on teleshopping via commercial television will probably not see its sales improve either. On the contrary, they will suffer the same effects of a weaker economy and lower demand for consumer goods.

The U.S. teleshopping market, valued at $13.9 billion in 2019, is expected to decline by more than 1.5% per year in the coming years, reaching $12.7 billion in 2026, according to MarketResearch.com estimates.

Consensus Revenue Estimates

Analysts are forecasting Qurate Retail, Inc. revenues to decline 13.75% year-on-year to $12.11 billion in 2022 and 2.06% year-on-year to $11.86 billion in 2023.

Lower sales will most likely result in a further increase in loss and a further narrowing of margin, and these two elements could be enough to drive the stock price much lower than it is now.

The Share Valuation: Despite the Slump, the Stock Is Not Cheap

As of this writing, Qurate Retail, Inc. shares are trading at $39.51 per unit, giving it a market cap of $759.71 million and a 52-week range of $37.09 to $106.69.

After falling more than 60% over the past year, shares are trading well below their long-term trend of the 200-day moving average of $65.68 and slightly above the lower bound of the 52-week range.

That doesn’t mean the stock is cheap. The stock is still likely to trade lower due to the factors outlined in this article, which forecast further declines in sales and margins and the potential worsening of the net loss.

Qurate Retail’s 14-day relative strength indicator of 34.28 means shares are not that far from oversold levels, although the share price still has room for a decline.

What could revise forecasts for Qurate Retail, Inc. upwards would be a sudden change in the US Federal Reserve’s interest rate maneuver, a significant increase in wages to make up for most of the lost purchasing power due to the rapid rise in prices, and an improvement in how consumers look to the future.

As of today, these three events stand little chance as inflation is more hostile than previously thought and the 2023 recession is now certain to hit.

In addition, the environment in which Qurate Retail, Inc. operates is becoming increasingly competitive as the Internet continues to expand and other technologies such as personal computers and other portable devices make it easier for more and more businesses to exploit the potential of the Internet.

The above scenario could adversely affect Qurate Retail, Inc.’s quarterly cash dividend of $2 per share, which the company pays to preferred shareholders, or the issuer’s redemption of the security.

The financial condition of the company is not so strong. As of September 30, 2022, total cash was $624 million against total debt of $7.17 billion. The Interest Coverage Ratio for the quarter that ended September 2022 was 0.59, meaning that the company may have difficulty paying the interest expense on the outstanding debt. The ratio is calculated as the operating income divided by the interest expense. Fundamental investors usually settle for a ratio of no less than 1.5.

The stock has an Altman Z score of 0.72, indicating that this company is exploring financially distressed areas, which means there is a high probability of bankruptcy within a few years.

For beginners, the Altman Z-Score measures the likelihood of bankruptcy. When this is less than or equal to 1.8, distress zones are displayed, so there is a high risk of bankruptcy.

If the Altman Z-Score is greater than or equal to 3, this indicates safe zones, i.e., no risk of bankruptcy.

An Altman Z-Score between 1.8 and 3 indicates gray areas and the likelihood of bankruptcy is medium to low.

Analyst Recommendation and Price Target

According to marketwatch.com, Qurate Retail Inc. Preferred Stock (QRTEP) has a Hold rating composed of two Hold recommendation ratings and one Underweight recommendation rating.

Conclusion – Downside Risks for This Stock

This stock isn’t doing well, and the stock’s plunge over the past year is consistent with disappointing revenue and operating margin results. As for the net income, this is now a loss.

These negative trends are expected to continue due to inflation, high borrowing costs and an uncertain future. These three aspects affect the purchasing power of consumers. A further downward movement of the share price is possible.

Be the first to comment