primeimages

This inflation continues to dish up surprises.

“Inflation expectations” are metrics the Fed watches closely. They feature prominently in the FOMC statements and in the minutes of FOMC meetings. Powell refers to them in every post-meeting press conference. The theory is that when inflation expectations remain “anchored,” even raging inflation will start settling down again, but when inflation expectations become “unanchored,” it’s a sign that the inflationary mindset is becoming entrenched in the decision-making process of consumers and businesses, and thereby is turning inflation into something with a life of its own.

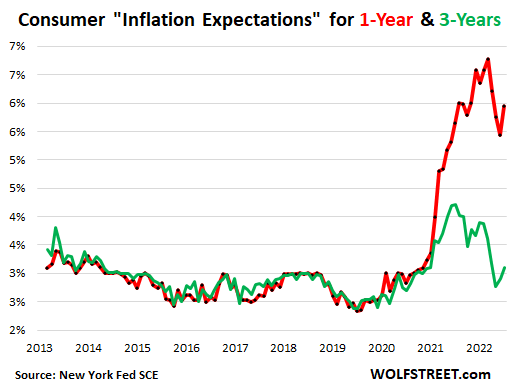

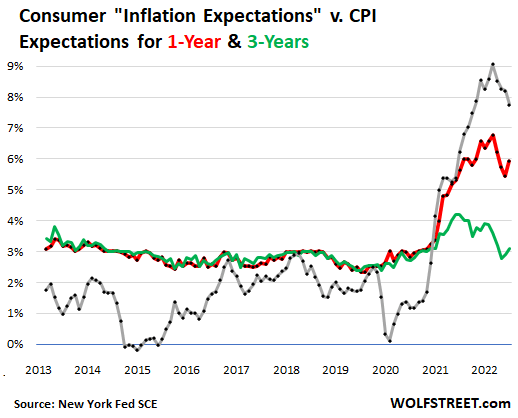

So here we go: Consumers’ median inflation expectations for one year out, after dropping three months in a row, jumped by 50 basis points, to 5.9% (red line), according to the New York Fed’s Survey of Consumer Expectations on Monday. Inflation expectations for three years from now jumped to 3.1% (green line).

Consumer Inflation Expectations For 1 Year And 3 Years (Author)

It’s interesting because there has been a lot of stuff in the media about inflation already coming down, that it peaked a few months ago, and there has been some stuff like that from the White House too, and this stuff is what consumers see on the internet or TV or whatever, and it worked for three months in a row, as consumers’ inflation expectations fell for three months in a row.

And suddenly there’s a change of mind across the spectrum of inflation expectations, across age, education, and income groups, according to the New York Fed?

Inflation expectations may be a product of actual inflation as consumers see it in their day-to-day price observations, and of what they imagine might happen in the future that will impact prices, and of what they read or hear about it, including in the media. “Talking down” inflation is a time-honored practice among political figures and central bankers – calling this raging inflation “transitory” was a perfect example – though it seems not to work and instead makes political figures and central bankers look silly.

Inflation expectations by major category are much worse

People expect much faster price increases where they actually spend most of their money – housing, food, gasoline, health care, and college education – than what they expect for the theoretical overall inflation rate.

These are the biggest categories in the basket of goods and services of the Consumer Price Index (CPI). Housing costs – derived from two rent measures – are the largest category, accounting for about one-third of overall CPI.

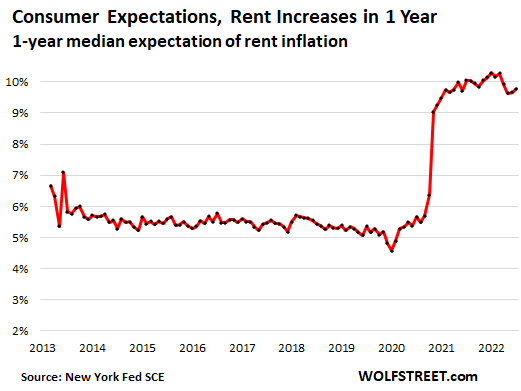

Expectations of rent inflation rise to near highs. Consumers expect that rents will increase a year from now by 9.8%, the second month in a row of increases and roughly in the same astronomical range since the summer of 2021:

Consumer Expectations, Rent Increases In 1 Year (Author)

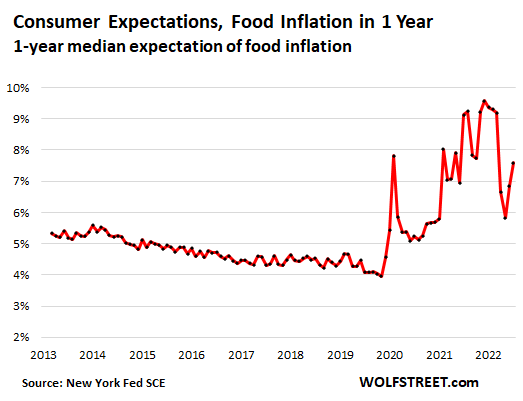

Expectations of food Inflation, after plunging, jumped again. In July and August, consumers expected to get a mini-break from food inflation. But that turned around in September, and in October, the median expectation of food price increases jumped for the second month in a row, to 7.6%:

Consumer Expectations, Food Inflation In 1 Year (Author)

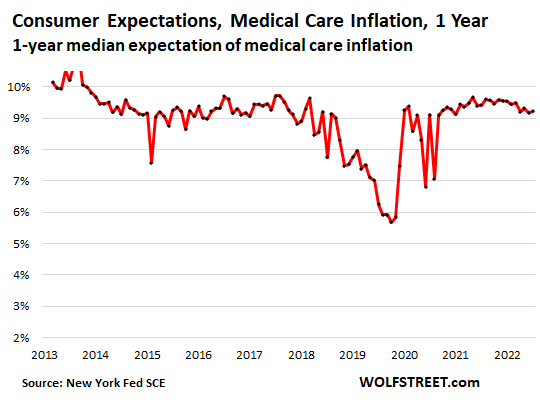

Expectations of Medical Care inflation stuck at 9%-plus. Consumers expect that the cost of medical care will increase a year from now by 9.2%, roughly in the same high range since early 2021, and that’s where it also was in pre-pandemic years, a testimony to the ravenous nature of the US healthcare industry that is more and more dominated by huge companies – among the stocks with the biggest market cap – and private equity firms. Consumers can see what’s coming their way:

Consumer Expectations, Medical Care Inflation In 1 Year (Author)

The New York Fed’s survey also tracks expectations of gasoline prices and college costs.

- Gasoline prices: +4.8% a year from now. Three months ago, consumers thought gasoline prices would be flat a year out.

- College education: +8.6%, in the same range since November 2021.

The Fed has got some work to do to re-anchor inflation expectations

The idea is that consumer price inflation is in part a psychological phenomenon, that once consumers expect inflation in the future, they will adjust to it and ask for raises and pay the higher prices – pay “whatever,” as I’ve come to call it – rather than refuse to buy at those prices and switch to a competitor or downgrade. And businesses, once the inflationary mindset kicks in, need to increase prices because they’re having to pay higher wages and higher input costs, and they know they can get away with price increases.

In that respect, the theory says that inflation expectations are a key factor in driving future inflation.

The chart below compares inflation expectations for one year out (red) and three years out (green) to the year-over-year CPI rate. You can see how inconvenient the current jump in inflation expectations is for watchers of inflation expectations, such as the Fed.

Also note that since the New York Fed started the survey 10 years ago, inflation expectations were roughly stable between 2.5% and 3.0%, and above the CPI rate. But when inflation took off in early 2021, inflation expectations fell behind. There is no historical data to compare this to prior periods of high inflation. But we can surmise from this chart – as we can from many other factors – that this inflation will dish up a lot of surprises still:

Consumer Inflation Expectations Vs. CPI – For 1 Year And 3 Years (Author)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment