Ben Gabbe

In the mid-1980s, the online shopping channel of choice in the US was television. Fast forward four decades later, it became small digital devices that we carry in our pockets daily. With more than 263 million American consumers shopping online, we believe that e-commerce is the future, just like how 80% of the population in the US would agree with us. However, there is still a lot of value in the preloved television shopping industry. This article will explain why we see a potential catalyst in Qurate Retail (NASDAQ:QRTEA) as a turnaround company using its balance sheet and cash flow to support its 3-year investment plan. We will also explain why we think that at its current valuation, QRTEA provides an investment opportunity with asymmetric risk-reward for investors looking to add this diamond to their portfolio for cheap.

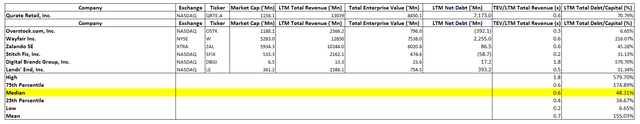

But first, to address why we think QRTEA is a diamond that hasn’t lost its luster, let us compare the company’s trading multiples to its industry peers, specifically selecting those that are online retailers of brands across different category mixes (i.e. apparel, furniture, accessories). We think it is an unloved diamond because it has been undercovered by analysts and unloved by Wall Street. Compared to Stitch Fix and Wayfair with a minimum of 10 analyst ratings, QRTEA receives only less than a handful, with not a single buy call.

Company Overview

Qurate Retail is the largest video commerce (vCommerce) player in North America, Europe, and Asia. The company markets and sells various consumer products primarily through merchandise-focused televised shopping programs, the Internet, and mobile applications. With 7 retail brands (QVC, HSN, Zulily, Ballard Designs, Frontgate, Garnet Hill and Grandinroad), the revenue mix comes from the sales of women’s, children’s, and men’s apparel; and other products, such as home, accessories, and beauty products to more than 200 million homes worldwide via 14 television networks and millions more through its app, mobile, and desktop applications.

Stable Balance Sheet and Cash Flow

Q2 Earnings Summary

Qurate Retail failed to meet analysts’ expectations on both EPS and revenue in Q2 2022. None of the business segments (i.e., QxH, QVC International, Zuily and Cornerstone) managed to surpass last year’s record revenue figures. Thus, the adjusted OIBDA for this quarter declined 41%, with the adjusted OIBDA margin decreasing by 650 bps. The management also flagged out a decreasing gross margin by approximately 370 bps, spurred on by unfavorable fulfillment expenses (i.e. higher freight rates, wages, and fuel costs) and inventory obsolescence. With regards to debt, the company has repurchased 71% of its 4.375% Senior Secured Notes due 2023.

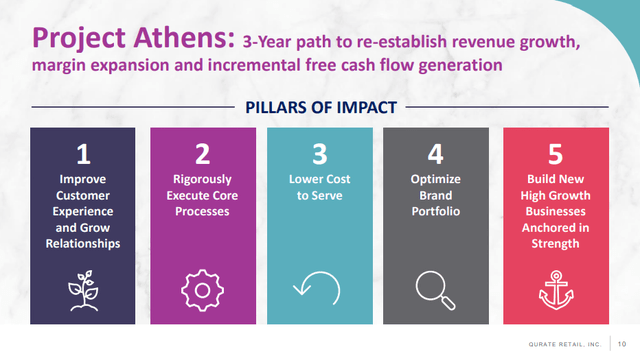

However, as emphasized in the Q2 earnings, Qurate Retail continues to push forth Project Athens, after revealing the 3-year plan to investors in June that seeks to reorganize the company through a combination of marketing, pricing, and inventory management strategies. We believe this is the much-needed catalyst required to turn the company around, and the effects could be felt as early as now.

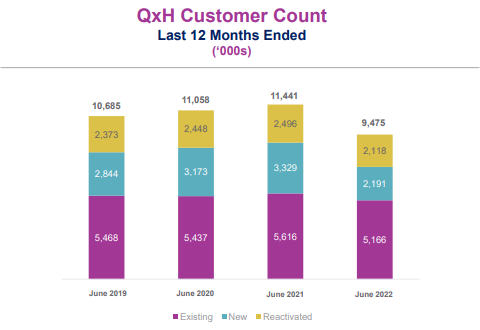

QRTEA’s Customer Base (Company’s June 2022 Presentation)

Looking at their presentation materials, we notice that the company has been experiencing a relatively stable existing customer base compared to their new customer count. As such, the company is able to retain its bottom line of loyal customers while looking to capture new customers by onboarding new brands at QVC such as Studio Park, Lands’ End, Sport Savvy and Encore by Idina Menzel and a partnership with Fanatics at HSN. The rigorous execution of their core business will pay off as shifting their category mix to apparel and reducing that of electronics will improve sales in times of persistent inflation, and consumers are reducing big-ticket purchases. As a whole, we believe that the strategic shift in QVC and HSN’s category mix to target female consumers will improve profitability margins for the company as the markups in apparel, beauty and accessories are more generous.

Peer Comps

Compared to its peers that have already a predominant online retail presence, QRTEA only boasts lesser customers than some of its peers like Wayfair (23.6 million) and Zalando (48 million). By onboarding more brands and pivoting into the online e-commerce space, the company is set to increase their customer count.

Trading Comps for QRTEA (Capital IQ)

Qurate Retail is priced fairly in line with its peers based on its EV/Total Revenue, despite having a higher debt-to-capital ratio than its peers’ median figure. Even if we strip apart the 579.70% outlier figure, the QRTEA stock still remains very much overleveraged compared to its peers. That will be addressed towards the end of this section and in the value proposition.

Valuation

Referring to its balance sheet, Qurate Retail displays fortitude against an overall decline in the total customer count and supply chain disruptions. QxH recorded a 5% increase in average spend per customer and an 8% increase in items purchased, cushioning the 12% decline in revenue primarily caused by lower unit volume. Across the category mix of products sold, we think that the revenue weakness was compared to an unprecedented year of sales in 2021, which reveals the lackluster results that Qurate Retail displayed in this quarter. The company actually did more sales as compared to the previous quarter in such a bearish economic state of the markets, showing some fruition for Project Athens.

Aside from the consistent rhetoric of rising interest rates affecting every business, Qurate Retail is also not immune to macro headwinds of inflation and supply chain challenges like other retail companies. However, the total company’s free cash flow improved materially from Q1’s use of $244 million to a positive free cash flow of $107 million for Q2. Although this is largely attributed to the insurance recovery related to Rocky Mount fire, Qurate is also in the midst of deleveraging at the cost of entering into several sale-leaseback agreements for its real estate assets. The company has raised approximately $685 million and utilized its free cash flow to pay down its QVC bank credit facility.

Of course, it is still too early to conclude any success while the company is going through major transitions of the brand through Project Athens. But we believe that if management can surprise investors and surpass the analysts’ low expectations for earnings in upcoming quarters, the potential appreciation of the stock price could be appealing at its current valuation.

Value Proposition

With the rise of e-commerce slowly displacing other means of shopping, we think that television shopping will still retain a dwindling proportion of the older generation that grew up with cable TV.

We believe that dominant market players could acquire QRTEA in the retail and e-commerce space. The company could be vertically integrated into companies like Walmart which has a significant retail presence in the United States. According to Edge by Ascential, online e-commerce giant, Amazon is expected to grow its U.S. retail market share from 10.8% to 14.9%, whereas Walmart’s share will shrink from 13.2% to 12.7%. A target acquisition of some retail players with a sizeable base of loyal, returning customers could do well for Walmart in the near future. Amazon could even be one of the potential acquirers of QRTEA, increasing its outreach to more customers through more channels and diversifying its distribution streams.

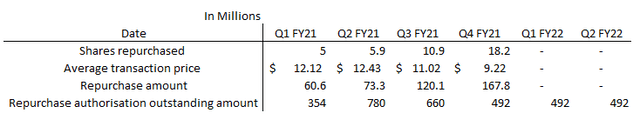

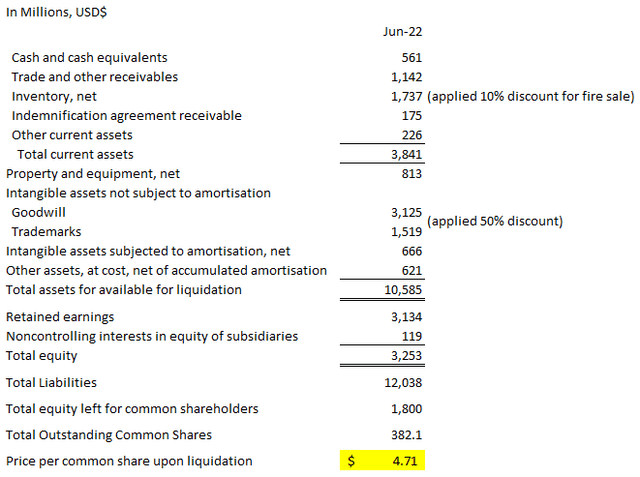

Author’s Spreadsheet Calculations (Company’s Earnings Announcements)

Qurate Retail’s buyback program could provide an alternative strategy for the company to increase shareholder value on top of Project Athens. The outstanding repurchase authorization is left at approximately $492 million as of 1 August 2022. At its current share price, the company would be able to repurchase approximately 85% of the shares that it did in FY21 with last year’s average amount of cash utilized for share repurchase. Looking at their remaining repurchase authorization amount, it is likely that the company will repurchase a significant amount of its shares while it is relatively cheap to historical prices. Of course, all of these assumptions will depend on market conditions, securities law limitations, and other factors that could affect the company’s profitability and subsequently free cash flow.

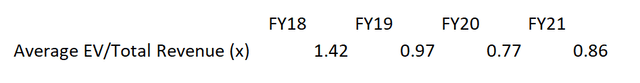

QRTEA’s Historical EV/Revenue (Capital IQ)

Not only that, Qurate Retail is an excellent risk-to-reward investment after taking many scenarios into account. Comparing trading multiples, the QRTEA stock historically trades at 0.7-0.9x EV/Total Revenue. The current market conditions for equities and discretionary spending reduced household spending on clothes, toys and other wants, thus pricing the company at a 0.65x multiple at the time of writing this article instead. Should the trend of spending on items reemerge after this bearish episode, we could see a reversal to higher revenue figures and EV/Revenue multiples. If Qurate Retail continues to pay down its debt with its free cash flow, its market capitalization will be expected to rise as investors begin to realize its shine. However unlikely, the company could still face total bankruptcy if it does not generate sufficient free cash flow to cover its interest payments and start defaulting on its debt.

Analyst’s Spreadsheet Calculations (Data from CapitalIQ)

In that case, we have calculated a fair value of $4.71 per common share to be distributed in an event of liquidation of the business. This is heavily relying on their intangible assets (goodwill and trademarks) to be worth at least 50% of their carrying value, which is a conservative estimate. We believe that despite undergoing several M&A and restructuring operations in the previous decade, there should be a transfer of some goodwill (eg, Alaskan cable GCI and HSN) and trademarks to any buyers. This is still a 50% upside in terms of their share price at the time of writing this article.

Key Risks

One of the risks that we identify is a possible liquidation of business in today’s bearish market environment and a downward trend in television shopping in the next decade to come. Revenue could further decline if the company does not implement its strategy to pivot into the online and media retail space fast enough, slowly destroying its balance sheet. We would like to think that if the company were to be liquidated today, equity investors would likely receive approximately $4.71 per share after the debtholders have been paid. However, this takes into account valuing their intangible assets (goodwill and trademarks) that take up a huge proportion of their total assets at a 50% discount, which could be essentially worth zero in a case of a write-off in subsequent fiscal years. In that case, after the debtholders are being paid, equity investors would likely receive no money at all, resulting in a permanent loss of capital for common shareholders.

Another risk that we identify is potential interest rate hikes on their debt schedules. As the company has already taken a lot of debt, it is likely that the company would not be able to load on anymore or are only able to restructure some of its short-term debt. We believe that medium-long term debt would not be restructured as of now since any restructured debt needs to be re-written with the current interest rate, the Fed’s hawkish stance against inflation could cause the interest part of the debt to dominate amortization during the majority of its lifecycle. In other words, the current interest rates are expected to be much higher than the original interest rates of medium-long term debt, which defeats the purpose of restructuring such debt. As such, QRTEA will only have to depend on its free cash flow generated to pay down short-term debts.

This brings us to the biggest risk that we have identified, which is the company’s turnaround plan itself. An implementation of such a plan that would require substantial CapEx would be a risk to the capital of the company should it not attain the intended effect of the management team. Perhaps the greatest effort to target the needs of consumers to increase their LTV would be the 5th pillar of impact, which is also the source of our concern.

Qurate Retail June 2022 Investor Day Presentation (Company Presentation)

The company unveiled its new team, vCommerce Ventures, to support and scale high-growth businesses through its streaming platforms. It is expected to complement its core business of television shopping with more content on large-screen television apps and expand video-driven shopping across linear TV, e-commerce sites, digital streaming and social platforms. We believe that it will require a substantial amount of CapEx to create content and expand QVC+ and HSN+, the two new streaming service experiences designed to reach new and existing customers via the web. Thus, it will come at the expense of QRTEA’s free cash flow, affecting the ability to make interest payments on its debt.

Conclusion

At the current valuation, the QRTEA stock intrigues us with its cheap trading multiples compared to historical data and provides a good risk-to-reward ratio even for potential catastrophic events for the entire company. As revealed in their debt structure, the capital structure of the company remains a source of concern for the management to convince investors that it would be possible to repay their short-term debt, at least through projected FCF. Moving on, we think that the company’s ability to reposition itself in the internet and direct marketing retail sector primarily revolves around its execution of Project Athens. It is likely that there would be initial outflows of capital due to the implementation of this turnaround scheme, but we are confident that Qurate Retail will have what it takes to execute its plan. All that is left to do is for the market to price in unexpected revenue and OIBDA growth in any quarters moving into 2023 as guided by the management.

Be the first to comment