Aranga87/iStock via Getty Images

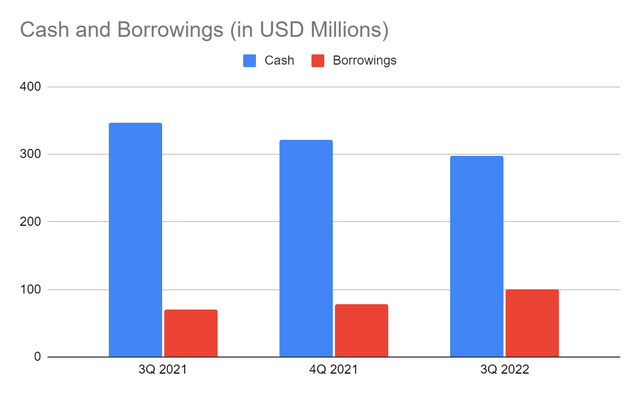

QuantumScape Corporation (NYSE:QS) continues its work toward its goal. The development is speeding up after the delays it faced earlier this year. Its adequate cash reserves prove its capacity to sustain the current operations and cover borrowings.

Yet, it is still a long road ahead for QS. Inflationary and recessionary headwinds are some factors to consider. Market opportunities are enticing, but it faces many challenges and barriers. The production itself is already challenging and costly. Market penetration is another thing.

Meanwhile, the stock price stays hammered but not cheap. A reversal may not happen anytime soon. Also, insider selling is worrisome.

Company Performance

EVs are one of those industries at the forefront of climate resilience. Their essence has been highlighted further in the last year amidst the skyrocketing fuel prices. QuantumScape Corporation also sees this trend.

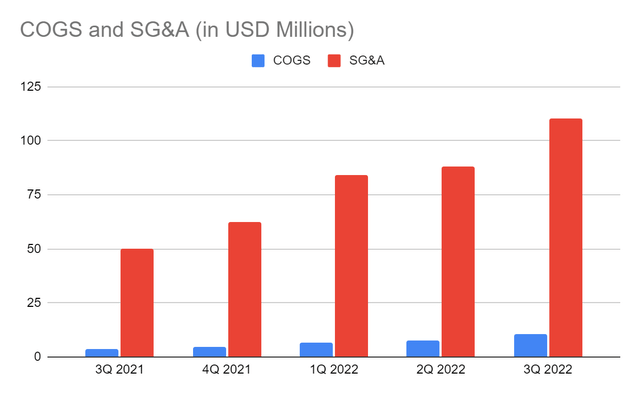

This quarter, it incurred costs and expenses amounting to $121 million. The combined amount already doubled its value in 3Q 2021. Even so, the trend is reasonable as product development continues. It also faces inflationary headwinds, raising the price of raw materials, research expenses, and salaries.

Moreover, QS was able to make a substantial reduction of contaminants in its 24-layer A sample. This sample will be used to show the relevance of its cell format. Even better, the number of layers is a substantial improvement compared to the previous series of samples. But it is yet to complete its product validation before it can begin shipping battery cells for product testing. As of now, QS only has its single cell used for independent sample validation. Despite the market anticipation and process ramping up, QS still has a long way to go. It must prove that products can mass beyond one layer.

QuantumScape does not produce pure SSBs. They have hybrid SSB-lithium-metal batteries. Putting highly differentiated raw materials takes a lot of patience, money, and skills. Dendrite-related problems are possible, requiring it to have separators. Other potential issues are thermal expansion, adhesion, deposition repetition, and the like. Note that it can be challenging to make thin metals and ceramics work as one. It is possible but tough due to ceramic instability inside a thin-film form.

Market Risks And Opportunities

EVs play a crucial role in the fight against Global Warming. Right now, gas and diesel-powered vehicles remain prolific across the region. In the US alone, they account for over 90% of vehicles on roads. They are a household staple as commuting using private cars remains the top choice. In a study, over 70% still use private cars as a mode of transformation. What is more noticeable is that only 7% use electric-powered vehicles and bikes.

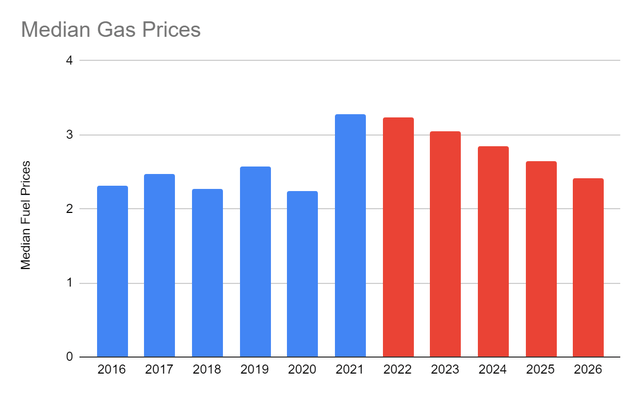

However, we cannot deny the social costs of internal combustion engines. They are one of the primary contributors to climate change. Also, gas and fuel prices remain elevated. They have lulled in recent months but stay higher than pre-pandemic levels. The US has oil and gas reserves, but it must import to ensure adequacy. The conflict in Europe and port congestion make it tough and expensive to transport energy commodities. For the next few years, I expect them to keep decreasing. I attribute it to the cooling of new and used car sales. But it may take time before prices go back to their original level.

Median Gas Prices (ST. LOUIS FED And Author Estimation)

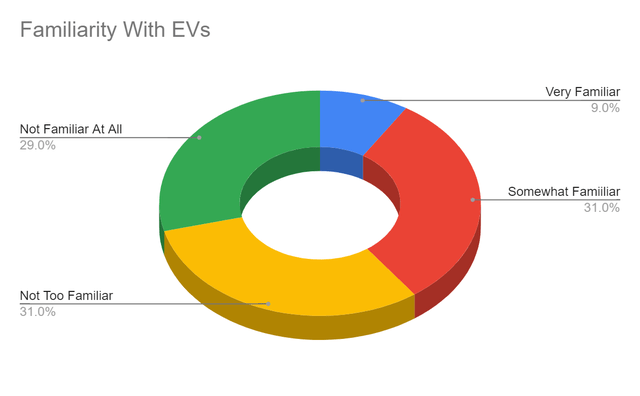

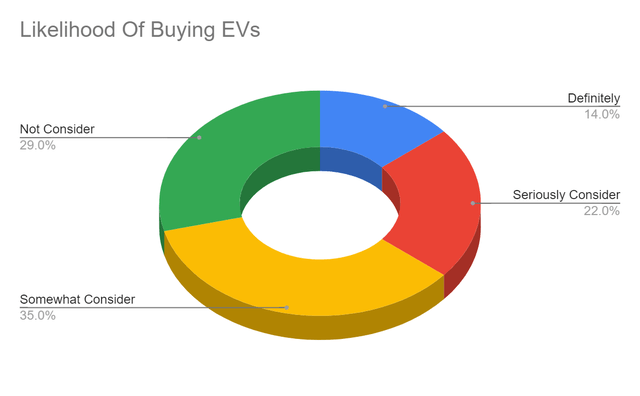

Given the market changes, the possibility of going electric is emerging today. But the EV market may have to exert more effort to penetrate the market. Currently, only 9% of Americans are very familiar with EVs. Over 30% have some level of familiarity but need more. The remaining portions are still unfamiliar. It is consistent with the potential EV consumer behavior. About 36% of Americans show a serious consideration of purchasing EVs. The rest of the respondents are not keen on getting one. Despite this, it is a good start for an emerging industry.

Familiarity With EVs (Consumer Reports) Likelihood Of Buying EVs (Consumer Reports)

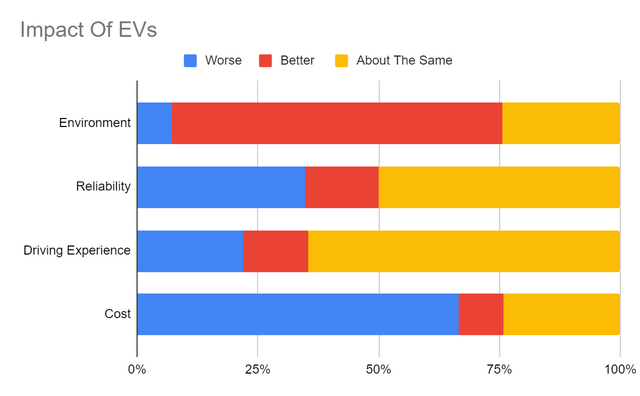

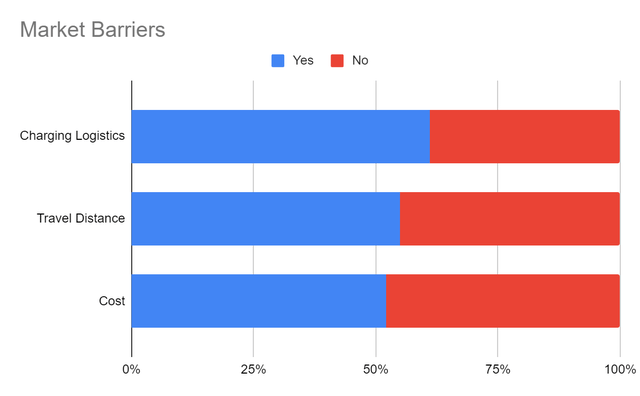

Various factors affect consumer perceptions of EVs. The most common is the environmental aspect, with nearly 70% believing its positive impact. Yet, the EV market skepticism in the US remains prevalent. The majority of consumers think EVs are worse regarding driving experience, reliability, and costs. These market barriers manifest in many ways. First, EVs need to charge their batteries from time to time. Travel distance is more limited compared to fuel-powered cars. So I expect the market to work on improving EV charging logistics. It is possible if EV manufacturers work as one. The problem may arise if charging stations have car brand and battery specifications.

Impact Of EVs (Consumer Reports) Market Barriers (Consumer Reports)

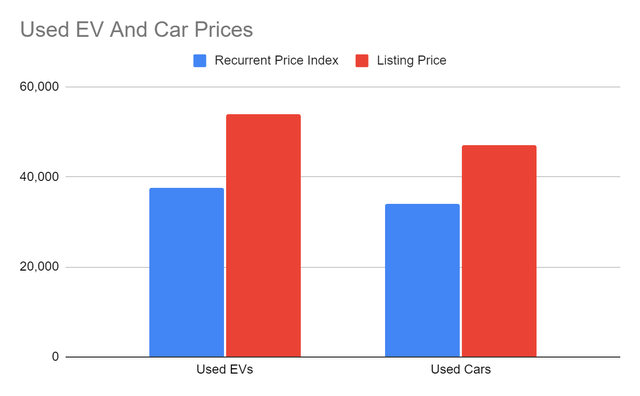

EV cost is another barrier. Let’s face it. EVs are more challenging to produce, leading to higher costs. The used EV price index of $37,598 is higher than the used car price index of $33,900 only.

Used EV And Car Prices (Edmunds )

Core Competencies

With regard to competition, QS may face a tough one. It must watch for Toyota (TM) and Panasonic (OTCPK:PCRFY). Yet, the analysis may be different due to some reasons. From its press releases, QS has provided the most details in testing and current performance. The information shows that, in effect, QS leads the SSB-Lithium development race.

Going back to fundamentals, QS shows adequate capacity. Its stellar balance sheet is something stakeholders may hold on to. Cash reserves are stable despite the 25% reduction. These are more than enough to sustain CapEx and borrowings. QS can continue investing in technologies to speed development without raising borrowings and issuing shares. It remains self-sufficient and liquid, with cash comprising 20% of the total assets.

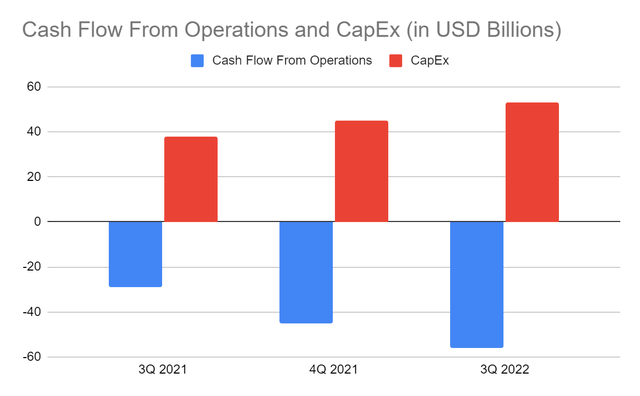

Cash And Borrowings (MarketWatch)

It is consistent with the current cash outflows. Its over $50 million CapEx is almost twice the value in 2Q 2022. But it remains within the company’s expectations. Also, QS focused on reducing contaminants in its materials. It was one of the reasons for the sudden drop in CapEx. The potential problem can be related to cash burns versus cash reserves. If cash burns stay at the current rate, cash reserves can only cover two years of it. On a lighter note, we must also consider its marketable securities, which it can convert into free cash. So even if CapEx stays at the same rate, QS can proceed with its 2025 commercialization roadmap. QS talked about its plans to stabilize costs to ensure adequate capacity. Thankfully, inflation has cooled down to 7.1%, and hopefully, it will keep decreasing. Near-term upsides are limited due to the looming recession. But once the economy bounces back, growth avenues may become more evident.

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price

The stock price of QuantumScape Corporation remains hammered. It never went back to its initial price during its SPAC. At $6.19, it has already been cut by 76%. But what appears disturbing is the series of insider selling. We may still adhere to its reasonability due to the hammered stock price. But even the employees and executives are not confident with the stock. Investors must also watch out for stock-based compensation as the number of employees increases. Overall, the stock price remains uncertain. While I see a solid fundamental capacity of QS, the result is yet to be seen. QS also sees mixed market impact. Hence, the current market capitalization may be too high amidst market uncertainties.

If we look into the intrinsic value of the stock, we can see an improvement. TBVPS rose from 0.43 to 3.17. We must consider that its SPAC and Volkswagen investments primarily drove the increase. It is reasonable since it is still in the development phase. However, the enterprise value does not indicate the affordability of the stock price. If we use the EV method ($1.5B+$0.198B)/435,957,000 shares, the target price will be $3.89. There may be a 30% downside in the next 12-18 months. Interested investors must wait for a better entry point before making a position.

Bottomline

QuantumScape Corporation still has a long way to go, but its fundamentals remain sound. It has a sound balance sheet, serving as its cornerstone. Cash reserves are adequate to cover cash burns and potential investments. Although the EV market must still improve its penetration, there are opportunities it can use to its advantage. The fight against climate change can increase its appeal. I expect more changes once the economy bounces back and the product testing speeds up. But these things remain to be seen. Meanwhile, the stock price is not cheap despite losing almost 80% of its value. The recommendation, for now, is that QuantumScape Corporation is a hold.

Be the first to comment