RichLegg

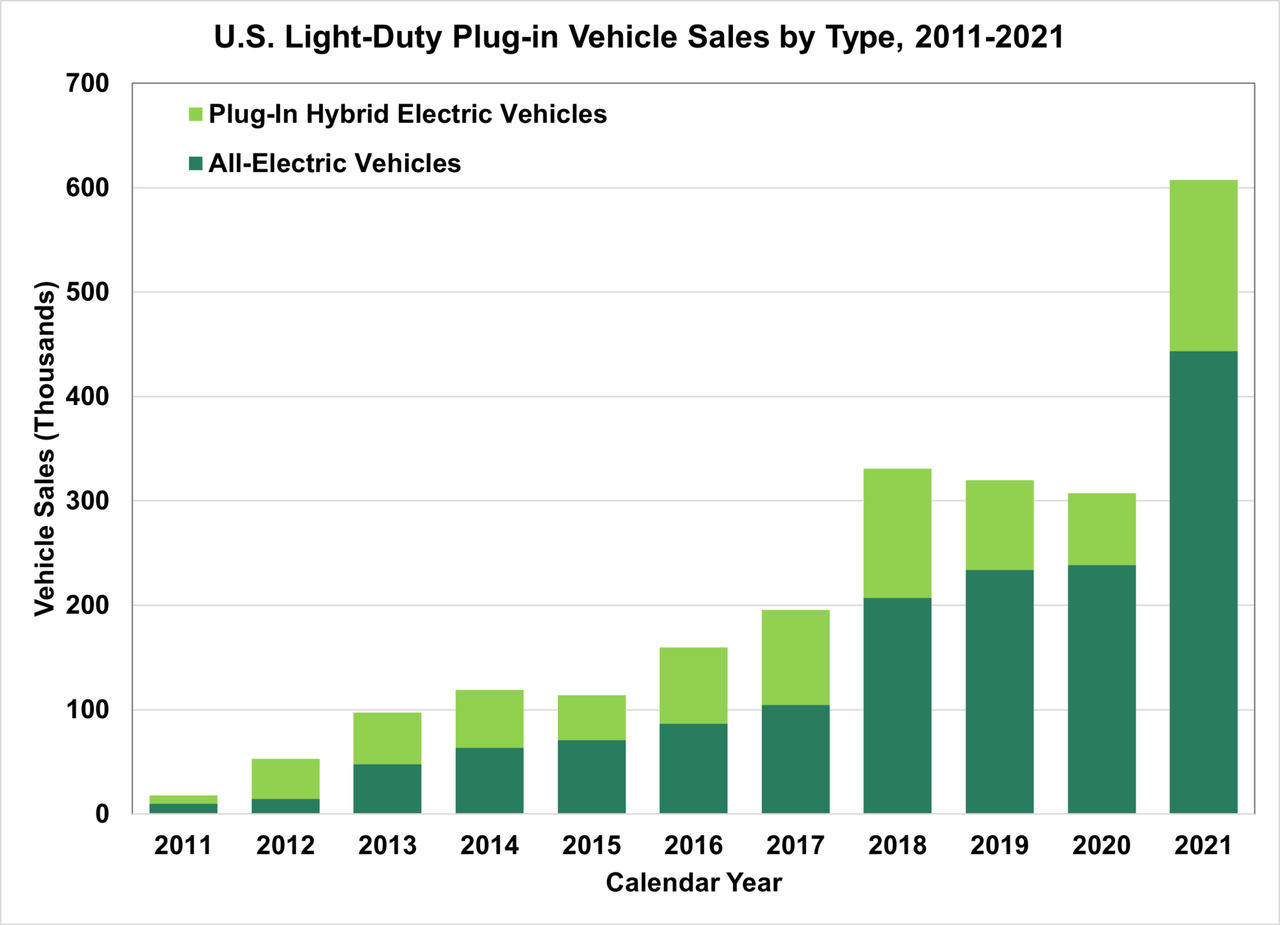

I’d be remiss not to state that the skepticism around electric vehicles and the potential of solid-state batteries is justified. In the United States, 608,000 plug-in electric vehicles, including hybrid EVs, were sold in 2021. Whilst this was a material 97% increase from 2020, it was still a fraction of the total 2021 automotive sales volume of around 15 million.

Against this, it would be easy to dismiss EV sales as broadly insignificant but that would ignore their upward ramp. The ramp is significantly more mature in countries like Norway, where EVs accounted for 64.5% of all automobile sales. This paints a vivid picture of the direction of the world. EVs are not a fad, and their sales are growing rapidly in most of the developed world. The core question that now exists is can QuantumScape (NYSE:QS) deliver on its promises for the commercialization of its solid-state batteries from 2025?

Department of Energy

With the adoption curve of EVs in the US already past the innovators and into the early adopters, solid-state batteries hold the potential of supercharging adoption past the early majority into the later stage late majority. Of course, the elephant in the room is whether the technology has been hyped up beyond its true disruption potential, whether it can be manufactured at scale, or whether the company will even meet its target for the start of production in 2025.

Further, whilst bears have raised how there are no working models, the company completed third-party tests with its single-layer lithium metal solid-state cells last year. The tests showed the 10-layer battery achieving 800 cycles at better than one-hour charge rates at 77ºF while retaining more than 80% of capacity. The company plans to keep increasing the number of layers up to a few dozen once the pre-pilot production line

Solid-State Batteries: Does The Hype Match Reality?

Replacing conventional lithium-ion batteries with its non-combustible anode-free lithium-metal technology is not easy and faces intense structural challenges. This has seen many companies abandon efforts at commercializing the technology. Indeed, Massachusetts-based SES AI (SES) folded up its solid-state battery manufacturing team, describing the technology as challenging to manufacture and impossible to commercialize.

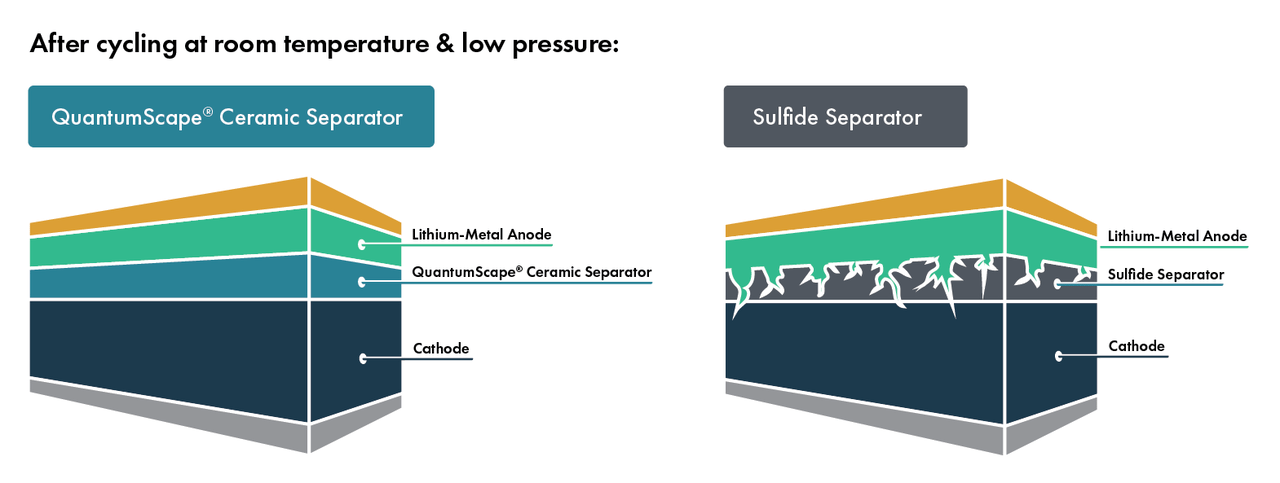

One of the challenges is lithium dendrite growth. This is when metallic microstructures form on the negative electrode as the battery charges. When extra lithium ions accumulate on the anode surface and cannot be absorbed into the anode they tear apart the cell from the inside and cause total battery failure when they reach the cathode. QuantumScape aims to solve this problem by using a ceramic separator.

QuantumScape

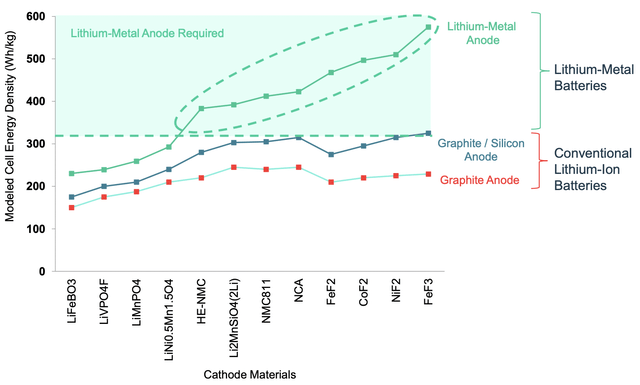

The company is using a ceramic separator to prevent the formation of dendrites under practical conditions. This should see significant gains in density, speed of charging, and safety for EVs when produced at scale. QuantumScape’s management has stated that customer requirements for mass-market adoption will center on the totality of a 300-mile range, less than 15 min charge time with an average life of more than 12 years. A non-oxidizable solid separator and a retail price point of $30,000 or less as part of this totality.

QuantumScape recently reported its pre-revenue earnings for its fiscal 2022 second quarter. Important to note was a capital expenditure of $27.6 million and cash and equivalents of $1.27 billion against the broader market recovery and economic weakness. The former was below guidance for at least $35 million in CapEx and placed negative free cash flow at $79 million. This was a sequential decrease of around 9%. The company expects operating expenses of around $225 million to $275 million for fiscal 2022 and CapEx to be between $175 million and $225 million. This is lower than the guided CapEx spend of not less than $325 million, with management stating they expect to push this into 2023.

The company has also filed to raise $1 billion through a mixed securities shelf offering. A move that will, unfortunately, add to dilution but creates flexibility to take advantage of any opportunities that might emerge in the space.

Build It And They Will Come

Bringing solid-state batteries to US roads will be a multifaceted and multilayered problem. If commercialized, it will be a critical moment in the still young history of EVs breaking the status quo bias and supercharging mass-market adoption.

Fundamentally, it will be hard to state whether QuantumScape will be able to commercialize the technology required for the EV ramp. Bulls will have to trust that management is competent and truthful with their targets. The world will see a true revolution in automobile transportation if the problems with solid-state batteries are solved, and they can be manufactured at scale. Geopolitically, this will be an important part of the coming struggle between free capitalist democracies and the alliance of autocracies for global influence. Solid-state batteries will constitute the demand destruction required to increase energy independence and reduce imports of oil. Aggregated with this and against the technological benefits, when solid-state batteries arrive you will want an electric car.

Be the first to comment