My past few articles have been on, primarily, software companies with a significant market advantage. Today, I’d like to continue that trend with a leader in the creative world, Adobe (ADBE).

Adobe has, over the last few years, helped change the software landscape. They may not have been the first company to offer software as a service (SaaS), but they’ve certainly been among the best to play the game. Adobe’s software used to sell for thousands of dollars; now, it can be had, in its entirety, for $50/month. This pivotal swing opened up the market, allowing almost anyone to try their hand at creativity.

A Diversity of Offerings

It doesn’t matter what you want to do, if it’s creative in nature, Adobe likely has a tool for you in their Creative Cloud offerings. If you’re going to edit photos: Photoshop. If you want to edit movies: Premiere Pro. How about editing sound: Audition. The list goes on.

The wide net that Adobe casts means that users might come for Photoshop ($10/month) and find that they’re interested in creating a podcast too. That bump up takes them to $50/month, where they have access to all of the software Adobe creates. Whether they use it or not, this is a tremendous value for the user who, in the past, would have had to shell out $2,500 to be able to get a copy of everything Adobe offered.

Keeping Competition At Bay

Competition is a significant risk for many companies, but it seems less so for Adobe. For a moment here, I’d like to focus on their biggest tool, and most significant draw, it’s even a verb in the English language: Photoshop. I’ll spare description of the tool, as I am sure that many are familiar.

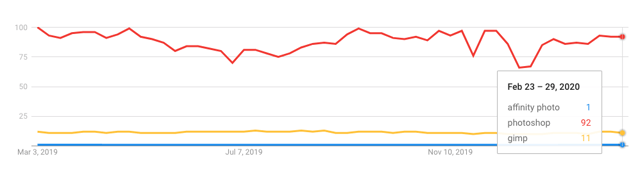

Photoshop has, in my opinion, two competitors worth talking about, GIMP and Affinity Photo.

Image: Google Trends for search terms related to competitor apps.

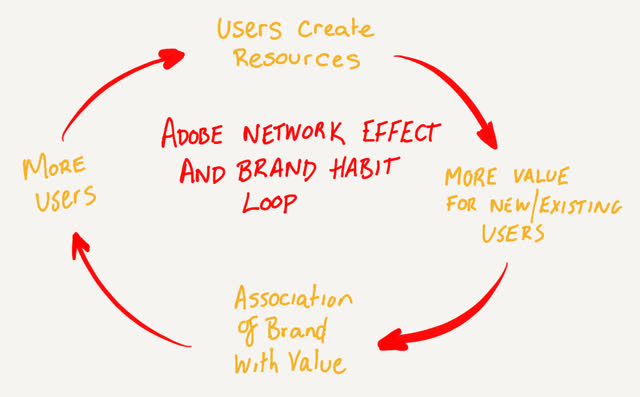

GIMP is free and open-source. Being free was a huge draw several years ago when Photoshop would cost a user $300, but now that the tool is available for $10/month, it’s much harder to break the network effect.

Affinity Photo is a $50 tool with much of the same functionality as Photoshop and GIMP. $50, while not being excessive, is still a leap from the $10 that Adobe charges to get you started with Photoshop.

So, why do these tools not pose a threat? Network effect. Photoshop has been the primary tool of photo editing for so long that it’s easy to find tutorials, or filters, or brushes. This ease of getting started and learning leads to fresh eyes that create more content, thus locking them in, and the next generation.

It’s not just Photoshop, either. Premiere Pro and After Effects see the same sort of lock-in on the video side of things. By costing only $50/month, teenagers aspiring to make movies have access to the same tools used to create Hollywood blockbusters.

Addressing Market Risk

While I don’t believe there are any significant competitive threats, there is the possibility of reduced commercial spending should a recession take hold.

Being a leader in their space, and a necessary tool for many creatives, Adobe is likely the last place commercial buyers will look to cut. Consumers, however, may see things differently.

As Adobe does not offer a breakdown of consumer vs. commercial spending on Creative Cloud, it is difficult to assign a value to this risk. In 2009, Adobe saw revenues drop 19% on the backs of the financial crisis. However, the company was selling software by the piece back then, not as a much more affordable subscription, so a revenue drop today would likely be substantially less.

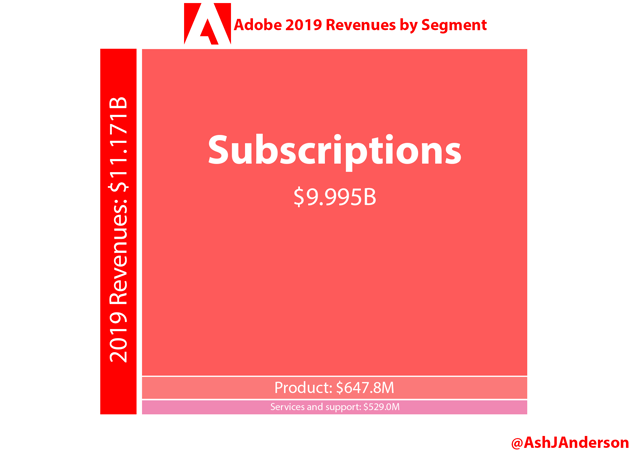

Adobe IS Subscriptions

A chart is worth a thousand words. Per Adobe’s last 10K, the company made 89% of its revenues from subscription services. This year, it’ll likely cross 90% with growth and a stagnant “Product” segment.

Subscriptions are also growing at quite a steady pace. In FY19, Adobe was just shy of $10B in annual revenues from subscriptions ($9.994B), which was a 25% jump over FY18. FY18 was in itself a 30% leap over FY17. Growth will continue to slow, and there’s no doubt about it. For 2020, I believe Adobe will still achieve a 20% growth in revenues.

Financials

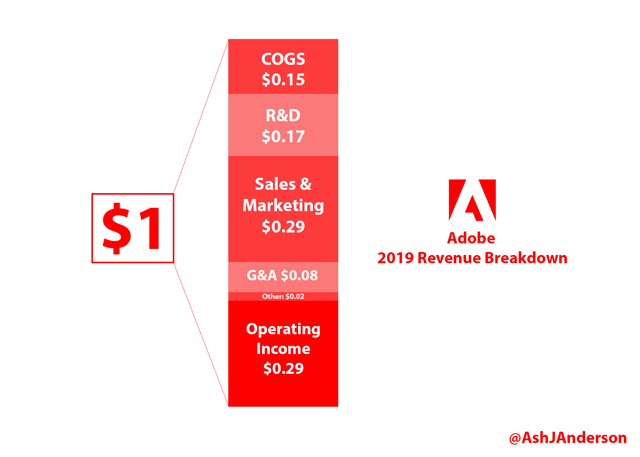

Subscriptions are all fine and dandy, but is this company making money? Oh, you bet they are. Adobe has been consistently growing net-income since the advent of its Creative Cloud. Probably the best thing about subscriptions of pre-packaged software is that they’re cheap from a cost of goods perspective, and Adobe is benefiting there.

That 29% operating margin is, at least in part, being returned to shareholders via share buybacks. Adobe bought back 9.88M shares in 2019 at an average price of $270.23, thus returning $2.67B to investors. The company still has, as per the 10K, $4.25B in remaining authorizations, which is roughly 2.5% of outstanding shares at today’s prices.

Given the cheap equity available, there have been many companies financing buybacks with debt. Not Adobe. Over the last several quarters, Adobe has aggressively paid down its long-term obligations. At its highs in November of 2018, debt has fallen from $4.1B down to just shy of $1B in the last report. All debt obligations are covered by available cash and short-term investments with $2.65B on the balance sheet.

Valuing Adobe

Valuing Adobe is difficult, and it has to take more of a storied approach than a quantitative one. Why? Well, quite simply, they’re a mind-share monopoly with almost impenetrable walls. Their product is not expensive, so customers are willing to pay monthly for access to it, and as long as prices remain accessible, customers will have a difficult time making inroads.

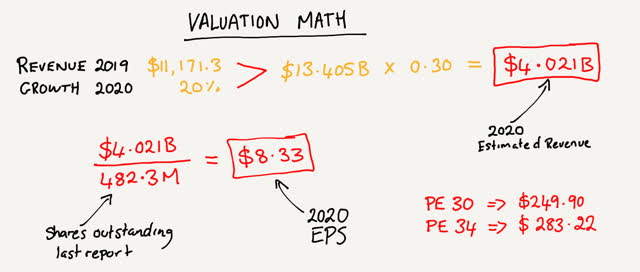

That said, let’s give it a shot. There have been no signs on the horizon that growth would halt in Adobe, but it is my opinion that said growth will continue to slow. 20% growth in FY20 seems more than achievable, however.

I also believe that net margins will continue to expand over time to a target of ~35% by FY25 thanks to cheaper delivery costs and the network effect continuing to assist with sales & marketing. 35% would be too excessive for 2020, so my assumption is a slight bump to 30% for the year.

This would leave us with FY20 revenues of $13.4B, and a net profit of $4.02B. Assuming no share buybacks occur in FY20 (even though they will), I have Adobe’s EPS at $8.33 for the year. Adobe’s average P/E over the last five years has been hovering around 36, but we should assume that drops a little thanks to slowing growth. At a P/E of 30, Adobe’s price is $249.90, and 34 it is $283.22.

I like setting ranges. In the middle, I am a small buyer, a little bit here and there. If it jumps out of the top bound, I wait for a pullback, and if it goes under that lower bound based on macro trends only, I am likely a big buyer. At the time of writing, Adobe is firmly between those bounds, but given market volatility, anything could happen between now and publish time.

It is also worth noting that Adobe will more than likely buy back 5-10M shares over the next twelve months. I did not factor this into my math given the uncertainty of the statement. If Adobe were to buy back 10M shares, however, this would act as a significant buffer to the valuation.

With the stability of the Creative Cloud and the moat that is built around it, Adobe is a great buy-and-hold in the tech space. The company is well managed, returning capital to investors, and maintaining double-digit growth.

Disclosure: I am/we are long ADBE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment