cudger/iStock via Getty Images

Quanta Services, Inc. (NYSE:PWR) is a specialty construction and engineering contractor providing infrastructure solutions for the electric power, renewable energy, and underground utility industries. While many projects are in North America and the company is headquartered in Houston, Texas, some projects are international.

Technically, “quanta” is the plural of “quantum,” which means “the smallest discrete unit of a phenomenon,” with the example that a quantum of electricity is an electron. Living up to that example, much of Quanta Services’ work is on electricity delivery infrastructure such as transmission and distribution.

I have sold my shares of Quanta Services and am down-ranking it from strong buy to sell, or short.

Quanta Services is not a familiar company, one reason factors affecting it are somewhat hidden. While the major change catalyst is partially understood, its upcoming flowthrough effects for Quanta Services are less well known. Due to the Russian invasion of Ukraine and all the follow-on actions, the globe, and especially the UK and Europe, are experiencing dramatically, desperately higher energy prices. A prime example is the $85/MMBTU spot liquefied natural gas cost in Europe: a year ago it was only 1/6th as much. (Today’s US gas price, the highest since 2008, is still a much cheaper $10/MMBTU).

Moreover, Ambassador David Satterfield expects no quick end to Russia’s ability to leverage its energy exports to result in higher energy prices worldwide.

Quanta Services is built around renewables, yet this catalyst of far higher cost for reliable energy suggests the growth peak or acceleration in renewables construction—a staple of Quanta’s business—has passed. While this is a factor few large investing funds recognize or admit, countries are attempting to achieve just the basics of energy security and reliability in the face of much higher costs for all fuels, whether nuclear, coal, wood pellets, oil, or especially natural gas.

This catalyst is not anticipated by the market because many ESG investors—including many fund heads controlling trillions of dollars–wish it to be otherwise and choose not to admit how challenging the energy picture has become. They would like to assume—as they might, given the IRA bill’s passage—that ESG and renewables are still on a steep upward trajectory.

They also ignore the same nimbyism that stalls oil and gas pipeline construction can and has stalled some wind turbine and electricity transmission construction projects, as it notably did for an Oklahoma wind turbine-to-Tennessee utility electric transmission line.

Yet the flowthrough from this catalyst, already manifests in at least three ways for Quanta Services: a) reduced future demand growth for renewable construction from its customer utilities as they struggle to first provide basic service given higher fuel costs before trying to hit longer-term, more difficult renewables goals, b) higher materials supply costs and reduced availability—a specific example is the one-year supply delay to buy key insulated gate bipolar transistors or IGBTs made in (natural gas and manufacturing-strapped) Germany, and c) the Puerto Rico governor’s and population’s unhappiness with Quanta’s performance in a 15-year contract to repair and sustain operations of the island’s troubled electrical grid, coupled with too-expensive backup generator fuel Puerto Rican businesses cannot afford when the grid goes down.

One need only look at the challenged history of Mammoth Energy (TUSK) when it undertook the same Puerto Rican electric grid repair work a few years ago. Mammoth is now a shadow, in capitalization terms, of its former self.

Other factors that make Quanta Services stock less attractive are the tiny dividend, a stock price already at the top of the 52-week range, a 53% capital appreciation in the last year, the benefit of the known passage of infrastructure billions in the (misnamed) Inflation Reduction Act is already in the stock price–e.g. buy the rumor, sell the news—and inflationary increases in all costs.

Quanta Services Second Quarter 2022 Results

Quanta Services reported $4.2 billion of revenue in the second quarter of 2022. This divides as about half for the Electric Power division and quarter each for the Renewable Energy and for the Underground Utility divisions. Consolidated operating income was $208 million.

GAAP net income for the quarter was $88 million or $0.59/share compared to $117 million, or $0.81/share for 2Q21.

Project highlights included the selection of Quanta Services for deployment of a national electric vehicle fast charging network: up to 2000 DC charging stalls at hundreds of US locations. Construction is expected to begin in 2023.

Quanta Services Projects

Key to the company’s business is that as utilities add intermittent renewables like solar and wind, often in locations that are remote from demand, they need new transmission lines. Other important functions include hardening the electrical grid, providing interconnections with battery storage, providing redundancy—particularly for intermittent sources, doing emergency repairs after storms, repairing underground lines of all kinds—gas, communication, and electricity—and providing routine but necessary maintenance.

An obvious consequence of both the need to reduce methane leakage and the high cost of natural gas is the need for more natural gas distribution system repair throughout the US.

Specific Quanta Services projects include:

*a utility-scale Florida battery energy storage center;

*multi-year undergrounding of 10,000 miles for Pacific Gas & Electric (PCG) to prevent or limit transmission-line-caused wildfire destruction to property and people (this is extremely expensive to do);

*the previously-noted partnership with Atco to support operations and maintain Puerto Rico’s electric power and distribution system;

Ironically, the regulatory and environmental impediments that shut down the Mountain Valley Pipeline construction, a Quanta project, go precisely to the difficulty in building infrastructure.

Governance

At July 31, 2022, Institutional Shareholder Services ranked Quanta’s overall governance a 6, with sub-scores of audit (8), board (5), shareholder rights (7), and compensation (4). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

ESG rating from Sustainalytics as of August 2022 was “high” with a total risk score of 35 (79th percentile). Component parts are environmental risk 8.2, social 16.8, and governance 10.1.

Controversy level is 2 on a scale of 0-5, with 5 as the worst.

On July 29, 2022, shorted shares were 5.0% of floated shares. Insiders own a small 1.2% of outstanding stock.

The company’s beta is a moderately high 1.10: its stock moves in the same direction as the overall market but a bit more sharply.

As referenced in the book Superpower by Russell Gold, Jayshree Desai, now Quanta’s chief financial officer and formerly its chief corporate development officer, gained early experience in the issues of connecting high voltage transmission lines to renewable sources in a prior job as chief operating officer of Clean Line Energy Partners LLC.

As of June 29, 2022, most of Quanta’s stock was held by institutions, some of which represent index fund investments that match the overall market. The top six institutional holders are Vanguard (11.0%), Blackrock (8.5%), JPMorgan Chase (4.0%), FMR/Fidelity (3.95%), Peconic Partners (3.8%), and State Street (3.8%). Peconic Partners is a hedge fund.

Vanguard, Blackrock, JPMorgan, and State Street are signatories to the Glasgow Financial Alliance for Net Zero, a group that, as of May 31, 2022, manages $61.3 trillion in assets worldwide and which (despite desperately less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner. However, given this policy, investing in a company focused on transmission for renewable energy sources like Quanta Services, is a natural fit.

Financial Highlights for Quanta Services

Closing price on August 23, 2022, was $141.22/share, 96% of its 52-week high of $146.84. The closing price is also 94% of the one-year target price of $149.80/share.

This closing price gives a market capitalization of $20.2 billion and an enterprise value of $24.3 billion. A year ago, these were $12.9 billion and $14.1 billion, respectively.

Trailing 12-months EPS is $3.03/share for a price/earnings ratio of 47.

The current dividend of $0.28/share yields a forgettable 0.2% at the company’s current stock price.

As of July 31, 2022, the company’s share repurchase program has $368.4 million remaining of authorization.

For full-year 2022, Quanta expects net income attribute to common stock of between $491 million and $541 million, or EPS of $3.32-$3.65. Free cash flow, a non-GAAP measure, is expected to be between $550 million and $750 million for the year.

As of June 30, 2022, the company had balance-sheet liabilities of $7.9 billion including $3.9 billion of long-term debt net of current maturities and $2.4 billion of accounts payable. Assets of $13.0 billion gave the company a liability-to-asset ratio of 61%, higher than the 49% a year ago.

The debt/EBITDA ratio is 3.2.

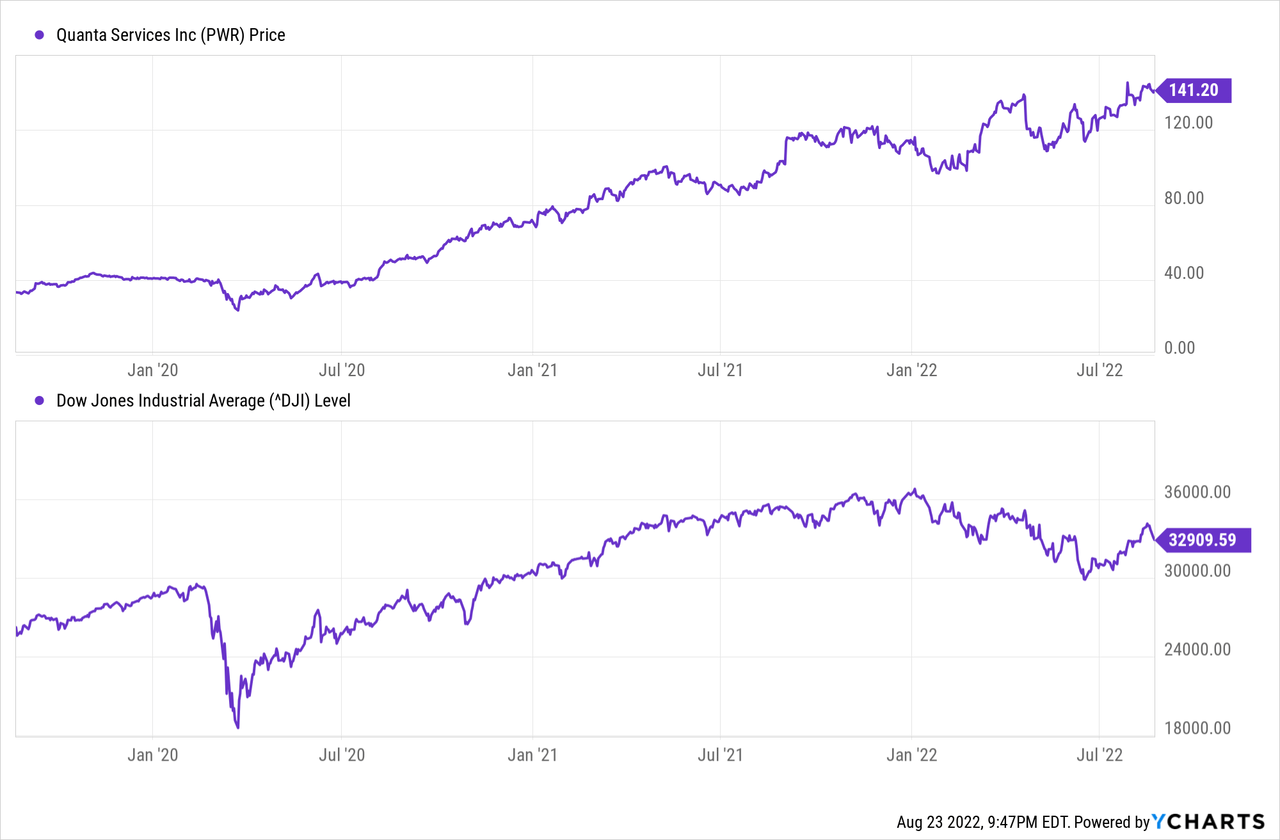

The graphs below show Quanta Services’ stock price and the Dow Jones Industrial Average.

Notes On PWR Stock Valuation And Risk

The company’s market value per share is about four times its book value of $35.83/share, indicating positive investor sentiment.

The rate of future electricity demand growth is directly linked to the level of economic activity. With more inflation, the projected growth in renewables and EVs—and thus the need for backup, connections, and lines—could be slower than anticipated.

Indeed, the inflation already experienced in the US could further increase labor, materials, operations, and financing costs.

Recommendations

I recommend selling (or shorting) Quanta Services and have sold my shares.

A token dividend of 0.2% makes the company unattractive to dividend investors.

The stock is trading at 96% of its 52-week high: investors cannot expect the same 50%+ share price appreciation experienced in the last year.

Benefits of the passage of the US climate change/internal revenue hiring legislation, (the misnamed Inflation Reduction Act), are likely already incorporated in Quanta’s stock price with the passage and signing of the bill.

The desperate shortage of reliable, baseload energy shortage in Europe and the UK going into winter suggest that we may have already hit peak renewables, or at least peak renewable growth, a catalyst for change in Quanta’s prospects few are willing to discuss or even consider.

A high price-earnings ratio of 47 and the higher liability-to-asset ratio of 61% compared to 49% a year ago are also non-positive signals.

The company’s participation in a 15-year contract to repair the Puerto Rican electric grid could prove challenging, as it was for predecessor Mammoth Energy. Complaints about the Quanta-Atco (Luma) service have already arisen, including criticism by the island’s governor. System repair is proving difficult and is likely to continue to be an operational and political headache for Quanta.

Nor is Quanta Services helped by supply chain problems (insulated-gate bipolar transistors, many of which are produced in manufacturing-strained Germany) and expected additional US interest rate increases. This will affect financing costs not just for Quanta but more importantly, for its utility customers.

Quanta Services can be expected to continue to interest hardcore ESG investors; however, in view of the factors noted above, I have sold my shares.

Be the first to comment