Dilok Klaisataporn

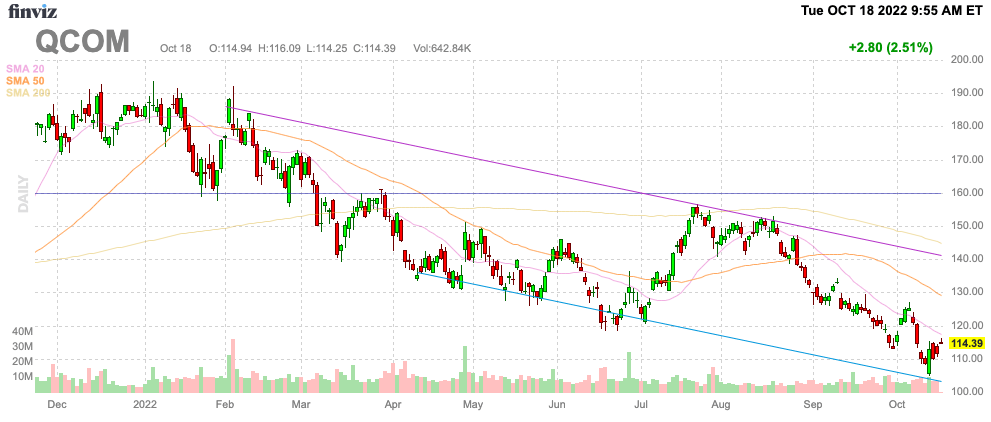

As with most semiconductor stocks, Qualcomm (NASDAQ:QCOM) has fallen substantially this year on macro concerns and China chip fears. Most sector participants have already verified limited impacts from the new China chip restrictions, yet the stock has fallen on irrational fears. My investment thesis remains ultra Bullish on the wireless chip giant trading at an unreasonably low price following this massive selloff.

Source: FinViz

China Restrictions

The stock market is always peculiar when a company like Qualcomm can provide a bullish presentation on massive demand in a new sector like auto tech with a huge boost to forecasted backlog, yet only weeks later the stock is down substantially due to other issues. The stock traded up around $125 following the bullish presentation and Qualcomm fell $20 to the lows in the process.

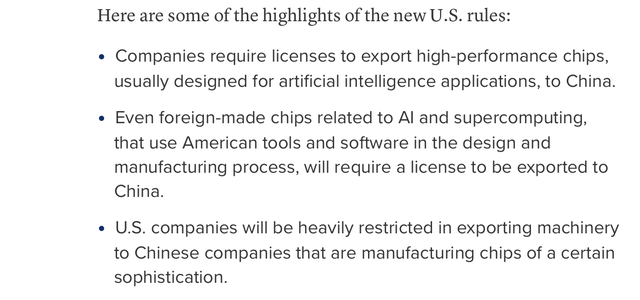

The big impact has been U.S. government restrictions on advanced chip sales to China. NVIDIA (NVDA) originally discussed a $400 million revenue impact, but companies from Advanced Micro Devices (AMD) to TSMC (TSM) have already proclaimed the chip sales restrictions aren’t going to impact chip production and sales. The main issues with the new regulations is with semi. equipment manufacturers like Applied Materials (AMAT) running into problems with sales to the communist country. Applied Materials cut FQ4 revenues estimates by ~$400 million, but the impact is short term as sales will only shift to other regions around the globe.

CNBC highlighted the focus of the new rules:

Source: CNBC

Qualcomm doesn’t make high-performance chips sold to the Chinese military. One shouldn’t expect the wireless chip company to have a bigger impact than NVIDIA, whom already reported an immaterial impact from the next export restrictions.

Qualcomm didn’t sell chips to Huawei and recaptured premium Chinese smartphone business in recent years. Per CEO Cristiano Amon at the Goldman Sachs 2022 Communacopia conference a month ago:

I think we have been a beneficiary of that, especially when you look at some point, Huawei had 50% share in China, and you look where the share went, Apple picked some, but then a lot of other customers become companies like Xiaomi, Oppo, OnePlus, Vivo, Honor.

The wireless chip giant has spent the last few years focusing on premium smartphones where the SnapDragon is worth the extra costs. The company naturally sells 5G modems to OEMs like Apple (AAPL), so any restrictions in selling iPhones would impact Qualcomm. The bigger impact would be Chinese OEMs unwilling to pay license fees for 5G technology, but the messages from NVIDIA suggests no real issue dealing with legitimate businesses in China.

An NVIDIA spokesperson emailed the following statement to Seeking Alpha:

These regulations impose on the broader industry controls on processors meeting certain thresholds that we were already subject to. We don’t expect the new controls, including restrictions on sales for highly dense systems, to have a material impact on our business.

Qualcomm doesn’t appear to have addressed the new China chip restrictions issue directly. Ultimately though, the U.S. government restrictions aren’t trying to prevent Chinese companies and consumers from using advanced chips. The goal is primarily to prevent China from having the advanced chip equipment from the likes of Applied Materials or ASML (ASML) needed to produce their own advanced chips for the military along with requiring a license to export such chips to China in order to control any advanced chips from making it to the military.

The license revenue business is only a fraction of revenues now with the boost in Automotive and IoT sectors. The QTL division still produces about 25% of the EBT profits due to 70% EBT margins. Naturally, the Chinese business is a fraction of those totals.

Focus On The New Era

The market is so wrapped up in fears that the new era for Qualcomm is being ignored. The chip company is only a few weeks removed from increasing a revenue target for the auto sector to $4 billion annually in FY26, up from $3 billion previously.

Qualcomm now has a massive $30 billion design-win pipeline in the auto tech sector. The amount builds on IoT demand, which includes the AR/VR devices from Meta Platforms (META), to offer shareholders a revenue stream beyond handsets.

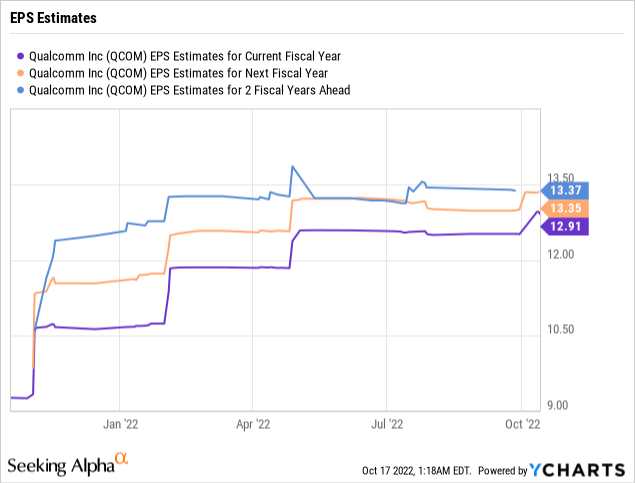

The chip company is likely to enter a period of consolidating EPS growth from the last couple of years. A tough global smartphone market will prevent EPS growth in the short term, but Qualcomm is still poised for a $13 EPS run rate over the next couple of years.

Qualcomm only earned $8.54 per share in FY21 ending last September. Without any revenue or EPS hit from China, the chip company is poised for producing the type of profits to warrant a vastly higher strong price.

The auto tech growth combined with IoT should provide the growth drivers to warrant a higher multiple going forward. Qualcomm shouldn’t trade at less than 10x current EPS targets despite the tough environment for chip sales.

Takeaway

The investor takeaway is that too much fear is built into the stock here with a price around $115. A normalized forward P/E multiple of at least 15x argues for Qualcomm trading closer to $200.

The stock was actually one of the few tech stocks not trading at a premium valuation when Qualcomm peaked last year at only $194, yet the stock still collapsed similar to the sector providing a great long-term buying opportunity due to irrational fears.

Be the first to comment