Sundry Photography/iStock Editorial via Getty Images

We are hold-rated on the wireless giant Qualcomm (NASDAQ:QCOM) and urge investors to be patient for a better entry point. Qualcomm is a leading force in mobile devices and wireless products. QCOM has a significant role in the wireless industry. Like most technology companies in our coverage universe, Qualcomm’s business will face revenue headwinds over the next few quarters. While QCOM declined some 34% YTD, the stock could go lower as the demand headwinds materialize in the next few quarters. QCOM’s most significant segment, QTL, will face revenue declines. We believe the company is vulnerable to inflationary pressures, resulting in weaker demand for its 5G core smartphone and IoT products. Hence, we will be revisiting QCOM as the demand picture becomes clear, and the estimates have bottomed. We expect the shares to be under pressure in the near term.

QTL Business May Be In Trouble

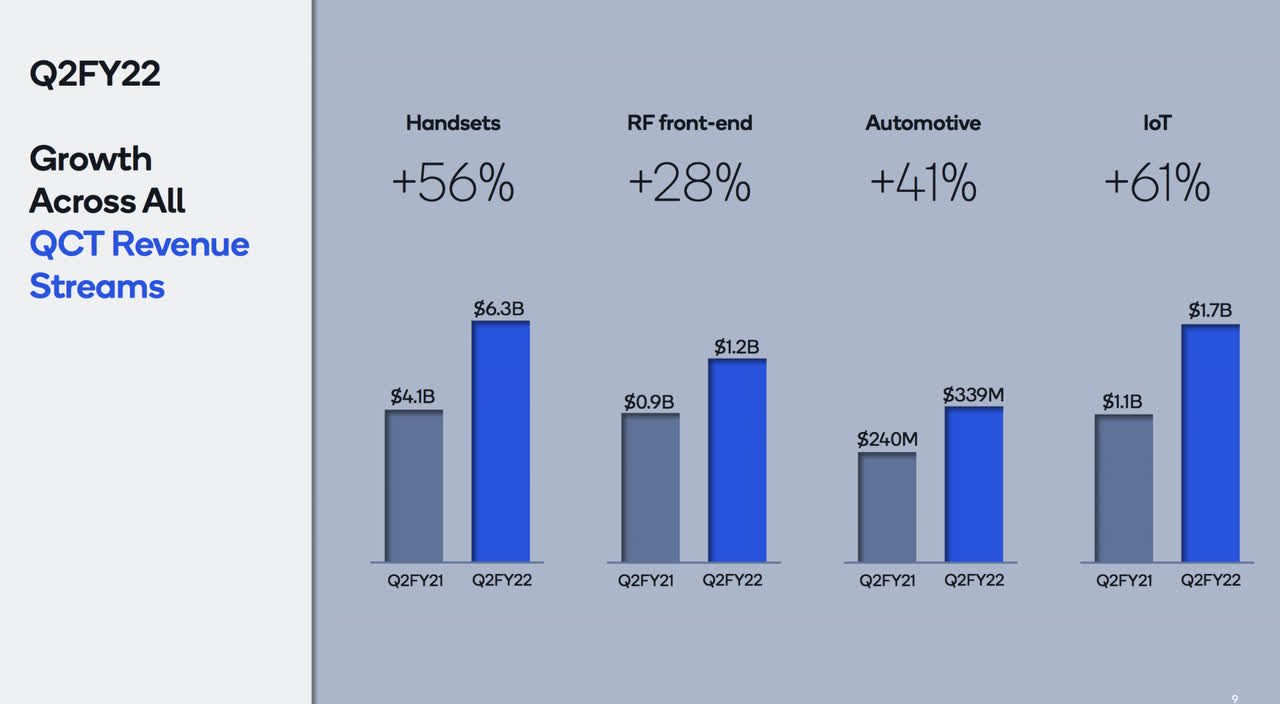

QCOM is a wireless semiconductor company with three segments: QCT, QLT, and QSI. Most of the company’s revenue comes from QCT, Qualcomm CDMA Technologies. The slide below from QCOM’s 2Q22 earnings shows how important QCT is for revenue. QCT develops and supplies integrated circuits and system software based on 3G, 4G, and 5G for mobile devices, wireless networks, and devices using the Internet of Things (IoT). In colloquial terms, the QCT segment makes products that enable devices (phones, cars, vehicles, etc.) to be mobile and connected. We believe current inflationary pressures and weakened consumer demand for smartphones and IoT will negatively impact the company’s most significant segment, QCT. We believe QCOM’s expectations for itself and the market’s expectations for the company are too optimistic. In turn, we believe QCOM’s shares will likely remain under pressure and will likely decline further from the current levels.

Qualcomm

Growth Will Moderate If Its Drivers Disappear

There is a lot of hype around QCOM because of its recent ratings. The company beat EPS expectations of $2.57 for 2Q22, with a non-GAAP EPS of $3.21. QCOM revenue of $11.2B was ahead of expectations and maintained the third consecutive quarter of record revenues. We recognize the company’s growth over the past few quarters, but believe past growth does not matter because the catalysts once driving that growth are gone. The company’s QCT segment can be broken down into Handsets, RF front-end, Automotive, and Internet of Things (IoT) businesses.

Qualcomm

The following is an overview of the segments in which QCOM saw the most growth and an analysis of why this growth will moderate significantly in the coming quarters:

Handset Sector

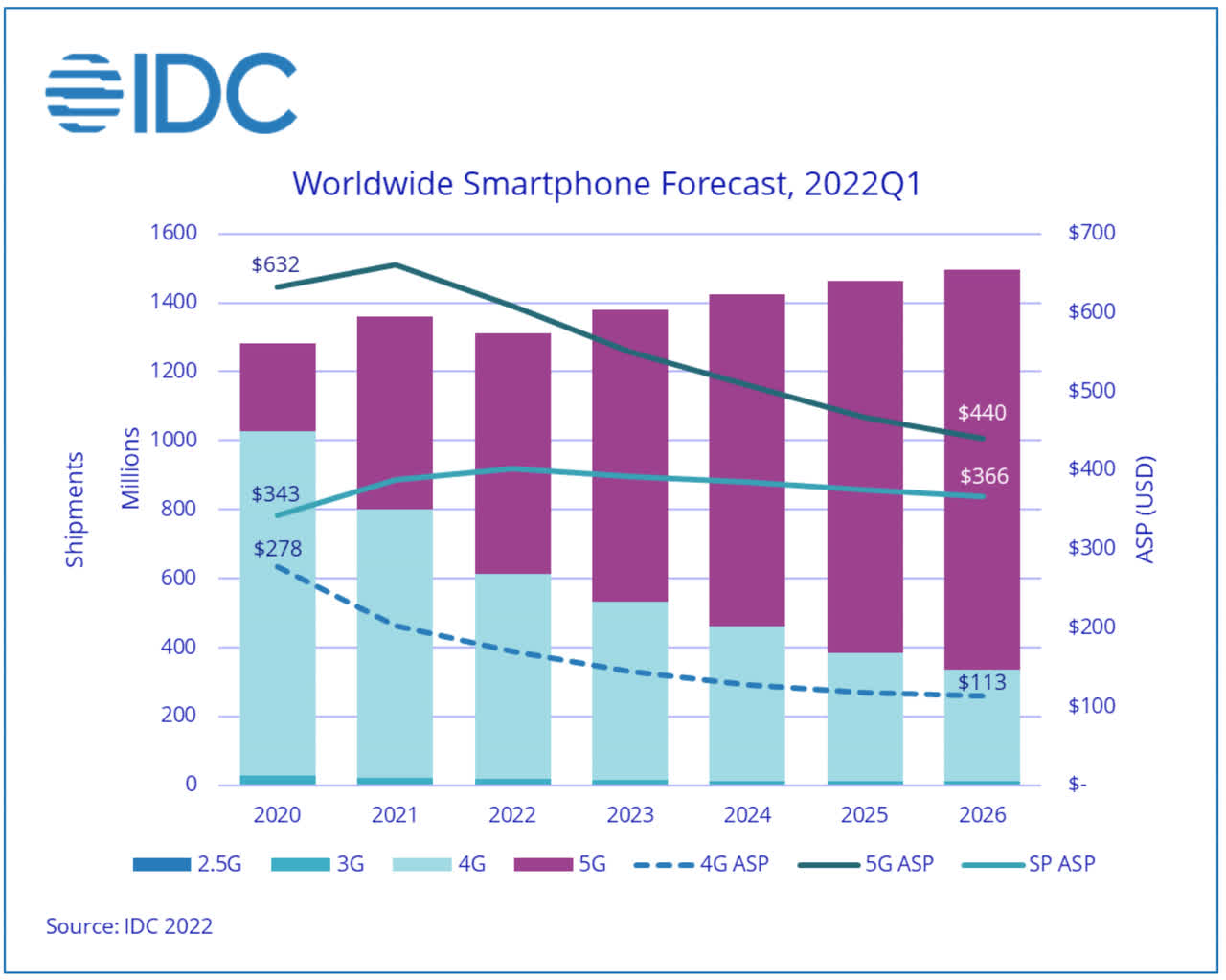

The handset sector grew around 50% year-on-year in FY22. The traction resulted from QCOM taking on 75% of Samsung’s Galaxy S22 business, compared to the original 40% in Samsung’s Galaxy S21. We expect this growth will moderate significantly with macro slowdowns. Consumer electronic demand is declining. According to the IDC’s worldwide quarterly mobile phone tracker, shipments of smartphones will decrease from 3.5% to 1.3% in 2022. Nabila Popal, research director with IDC’s Worldwide mobility and consumer device trackers, said, “the smartphone industry is facing increasing headwinds from many fronts – weakening demand, inflation, continued geopolitical tensions, and ongoing supply chain constraints.” The following IDC graph shows the worldwide smartphone forecast for the next four years. QCOM’s 10K explains that the company relies heavily on smartphone shipments and attributes its handset growth to the increased number of smartphone shipments over the past year. We expect the shipment numbers to decline and, in turn, believe QCOM’s handset sector growth will slow down.

RF Front-End Sector

RF front end refers to components that convert information to radio signals that travel via air. We know them more commonly as 3G, 4G, and 5G. QCOM is gaining on the 5G front as the world moves from 4G to 5G. QCOM had significant gains in the RF front end, which is why it beat expectations over the last several quarters. Yet, QCOM beat expectations because they gained market share when the US government banned Huawei. We believe QCOM beat expectations because analysts did not factor into Huawei’s market share. We do not expect QCOM to be able to beat expectations again and, in turn, prefer to wait on the stock until expectations are adjusted.

IoT Sector

Not enough analysts talk about IoT, although it produced significant gains for QCOM in the past few quarters. IoT grew from $1.1B in 2Q21 to $1.7B in 2Q22. IoT is mainly Wi-Fi, which boomed in response to the switch to work-from-home environments during the pandemic. We believe this sector’s growth will moderate significantly because the pandemic is ending. The pandemic was the growth catalyst for IoT. Now, while COVID restrictions ease (apart from China), we expect the IoT revenue will moderate meaningfully.

Outlook For QCOM Is Too Optimistic

QCOM did not change its IoT TAM and even maintained its 5G TAM, although the two other industry players, MediaTek and Qorvo (QRVO), lowered TAM. We believe QCOM’s TAM is too optimistic. QCOM maintained its 5G TAM at $750M. While MediaTek lowered 5G TAM expectations to $660-680M. QRVO also dropped 5G TAM as well to $650-675M. We also believe that expectations for QCOM are too optimistic and fail to consider the declining consumer demand, post-pandemic environment, and inflationary pressures. Therefore, we believe the company will be unable to keep up its performance, and we will revisit the stock when expectations seem more realistic.

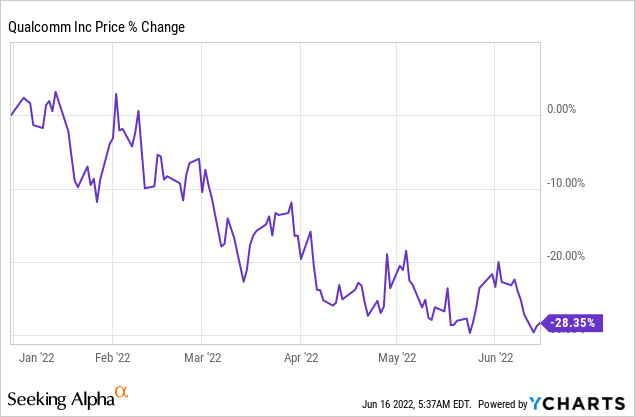

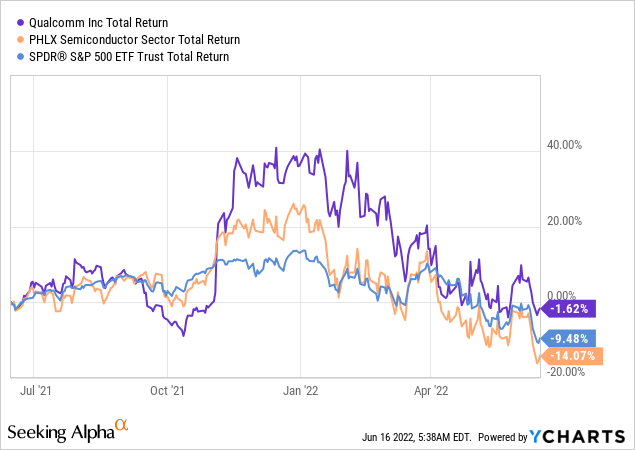

Stock Performance

QCOM had a remarkable run, with the stock rocketing in March 2020 with the pandemic’s start. The stock is up 130% over the past five years, compared to Broadcom (AVGO) at 123%, Nvidia (NVDA) at 336%, and MediaTek Inc (TPE:2454) at 229%. The stock reached the height of $193 at its 52-week high and a low of $122. Yet, QCOM’s stock has fallen into a negative flow more recently. The stock has been down around 2% over the past year. YTD, the stock is down about 28%. We believe the downward draft is not done yet. There will be more heartache in the next couple of quarters. As the inflationary pressures increase and smartphone demand weakens, we would not be surprised if the stock dips below its low of $122. The following graphs outline QCOM’s stock performance.

Ycharts Ycharts YCharts

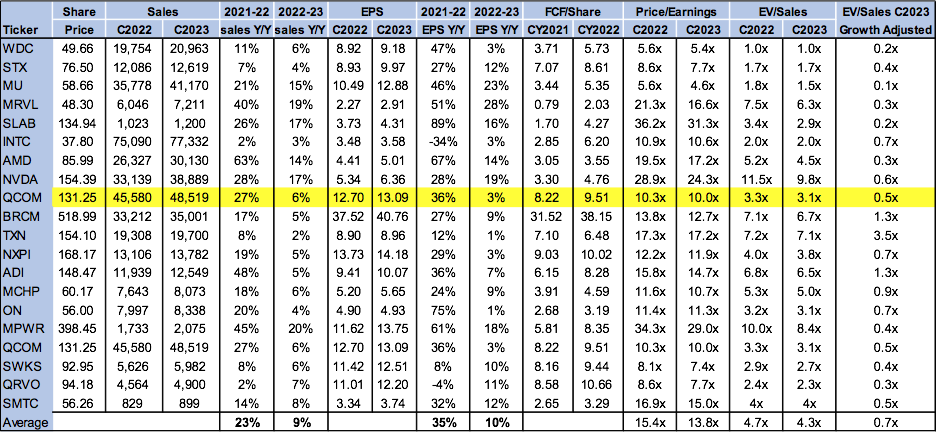

Valuation:

QCOM is trading at around $167 and is a relatively cheap stock compared to its peers. On the P/E basis, QCOM is trading at 10x C2023 EPS of $13 compared to 13.8x for the semiconductor peer group. The stock is trading at 3.1x EV/C2023 sales, versus the peer group average of 4.3x. Adjusted for growth, QCOM is trading at 0.5x C2023, compared to the group average of 0.7x. The following chart illustrates the semiconductor peer group valuation.

Refinitiv TechStockPros

Word On Wall Street

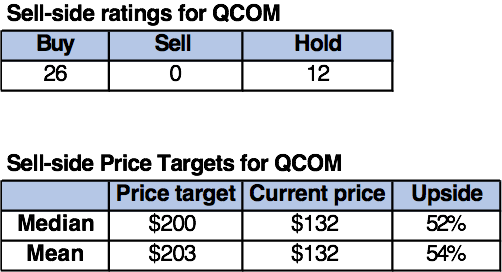

Market consensus on QCOM is a buy. Of the 38 analysts covering the stock, 26 are buy-rated, 12 are hold-rated, and none are sell-rated. Analyst optimism is reflected in the upside presented by the sell-side price targets. QCOM is currently trading at around $132. The sell-side median price target is $200, and the mean is $203, for an upside of 52-54%. The following chart indicates QCOM sell-side ratings and price targets:

Refinitiv

What To Do With The Stock

We believe QCOM does not present a favorable risk-reward situation. The company is at the peak of cyclicality with demand headwinds in smartphone markets and weakened IoT demand as the world moves out of the work-from-home environment. We believe the company finished the last couple of quarters strongly, but do not expect this pattern to continue coming forward. We will revisit the stock when demand headwinds ease up.

Be the first to comment