cemagraphics

The iShares MSCI USA Quality Factor ETF (BATS:QUAL) is a relatively lightweight ETF for your portfolio that attempts to capture stocks that associated with factors that might define quality. Things like ROE, little accounting gimmickry and low leverage characterise the stocks in this ETF to make a minimum variance portfolio, which doesn’t mean an optimal portfolio. What does not show up is any evidence of a flight to quality in the latest correction, but that might not be the ETF’s fault. Overall, QUAL has some interesting exposures, but it’s not particularly cheap and could be safer, and we feel that there are more specific ETF bets that one could make that better tackle the complex of issues plaguing today’s market.

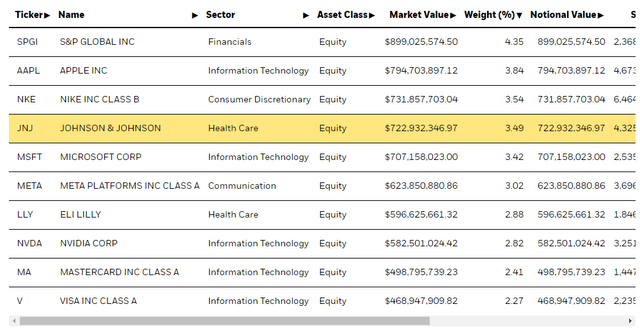

QUAL Breakdown

The ETF has low fees at 0.15%, but also a low yield of around 1.34%. The PE is moderate and in line with S&P averages at 18x. As the rest of the market, we think the implied earnings yield around 5-6% here is too low relative to lower risk corporate debt given the risks in the markets. Nonetheless, looking at the holdings you do see companies that are at least relatively safe, although equity markets altogether pose risks.

S&P Global (SPGI) is the first stock to appear, which relies on securitisation volumes and mandates associated with that, as well as DCM volumes and needed credit ratings and research on bonds and companies. Capital market interaction is strained and the outlook for DCM isn’t that great since rates are rising. Apple (AAPL) features which is one of the rare consumer facing companies that has shown resilience in the last earnings season. Nike (NKE) is next which is the first of the consumer discretionary exposures which amount to 11% of the sectoral exposures. We do not like consumer discretionary exposures in a market where rates are rising and unemployment is cued for a rise too. Then Johnson & Johnson (JNJ) is the first of the healthcare exposures amounting to 14% of the sectoral breakdown. This is another sector that should be looked into more carefully because Democrats are passing tax the rich laws that specifically target pharma in relation to their sales of drugs for Medicare covered people. Much like the broader market, IT is the biggest exposure at 27% of the fund, and most of the exposures are the corporate facing tech companies that were still levitating last earnings season not yet seeing the reckoning of falling consumer confidence.

Conclusions

There’s nothing too wrong with this ETF, but it doesn’t stand out. Our main problem with it is that quality depends on the market. A vague approach to determining the quality of a stock is foolish. Rates are rising and unemployment could be rising too, also inflation may not be curbed. The subset of equity markets that can function well in that kind of environment is very slim, and looks nothing like the broader market which has suffered for very good reasons. Moreover, stable earnings growth over a period of incredible monetary accommodation is not a high threshold. Also, in our opinion, ROE as a metric is nonsense. We don’t feel there was much skill in putting this ETF together and investors must take more specific bets in complex market environments, not this lazy stuff.

If ETF investors are on the hunt for something that can actually protect capital and has a stronger concept in the current environment but is still an ETF, there are plenty of REIT ETFs on offer that could be worthy of research, also providing above average yields compared to other ETFs. REITs outperform both in downturns and in the rebound of markets after those downturns. They are a great pick right now and hard assets with cash flows and yields guarantee some modicum of return where capital appreciation is going to become very unreliable.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment