monsitj

Thesis

We updated in our previous article in May that the Invesco QQQ ETF’s (NASDAQ:QQQ) bottom was near and urged investors not to fret over the high level of pessimism. We are pleased to inform investors that we are confident that the QQQ bottomed out decisively in June/July, in line with our assessment of the broad market bottom seen in the SPDR S&P 500 ETF (SPY).

The QQQ has recovered remarkably from its June lows, surging more than 24% toward its August highs before the recent deep pullback post-Jackson Hole. Therefore, some bearish investors have suggested that the “bear market rally” has run its course. As a result, the market would wake up to the realities of the recessionary themes, and a still hawkish Fed, putting further downward pressure on the tech-heavy QQQ.

However, our price action analysis suggests that Jackson Hole was merely an opportunity for astute investors who bought the June/July lows to unwind some long bets and cut exposure. Investors who chased the August rally at its highs have undoubtedly been hurt, given the pace of the pullback, as the market digested all its August gains and more. Hence, we posit that the pullback in the QQQ proffers patient investors another opportunity to add to weakness as the weak hands fled the scene.

Accordingly, we reiterate our Buy rating on the QQQ.

Don’t Fear The Post-Jackson Hole Selling

Fed Chair Jerome Powell appeared to spook the market, as the market sold off hard after his address at Jackson Hole last week, as investors parsed his hawkish commentary.

As a result, the market expectations of a 75 bps rate hike at the Fed’s September meeting have increased markedly to more than 70% probability (as of August 30), given Powell’s forceful and direct address to market participants. Therefore, the market has been pricing in the potential for a 75 bps hike as the firm base case, with Edward Yardeni even suggesting the possibility of a 100 bps hike cannot be ruled out (August 29 morning briefing).

However, we already noted that the index was well-overbought in mid-August (pre-Jackson Hole), as we informed our marketplace subscribers to be extra cautious. We highlighted:

Both [the market] indexes are well overbought, and the underlying sector ETFs within the S&P are also deeply overbought. Hence, we are still patiently waiting for a meaningful pullback, which has yet to transpire. So, we will continue to bide our time for the pullback. (Ultimate Growth Investing Daily Market Analysis – 15 August 2022)

Therefore, we had Powell to thank, as we have been biding our time for a significant trigger to activate the market pullback. We posit that the market has been using the opportunity of Powell’s hawkish address to adjust their expectations of another “unusually large” hike. We also didn’t buy aggressively into the August surge, as we noted that a pullback was imminent.

Be Confident About The QQQ’s June Bottom

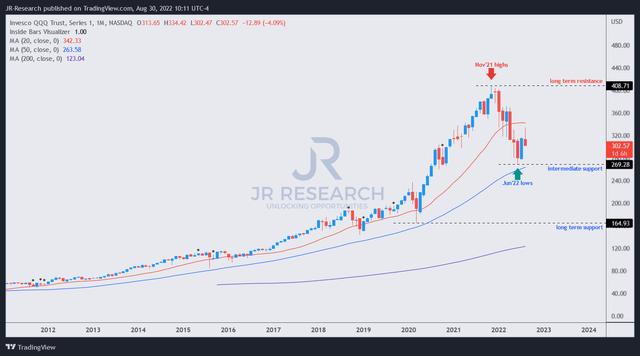

QQQ price chart (monthly) (TradingView)

As seen above, QQQ moved further down to stage its June lows after our previous update in May. However, it also closed in on its robust 50-month moving average (blue line), supporting the QQQ’s long-term uptrend over time. Therefore, we are highly confident that the price action in June and the recovery in July corroborated the buying momentum seen at its June lows.

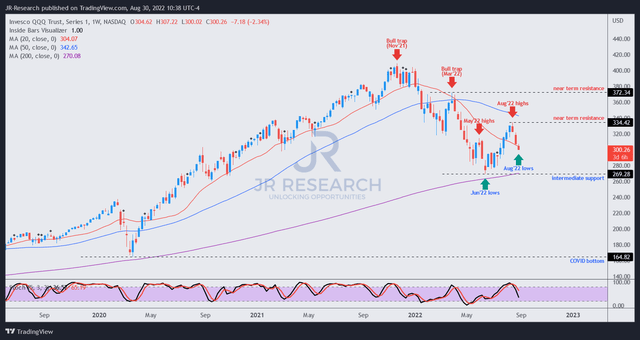

QQQ price chart (weekly) (TradingView)

Note the sharp pullback from the QQQ’s August highs as all its August gains dissipated. The QQQ has also given back more than one-third of its July gains, as investors were concerned whether the QQQ could re-test its June lows.

However, we are confident that the price action seen in June corroborates our thesis that the QQQ has bottomed out. First, the basing signals at its June lows were constructive of a quiet accumulation phase. Secondly, in our July article on the SPDR S&P 500 ETF (SPY), we noted a decisive bear trap (indicating the market denied further selling downside). Therefore, it augurs well for the QQQ, given their correlation. Next, investors need to consider that the QQQ’s August highs have already created a higher-high price structure as it broke above May’s highs decisively.

Therefore, if the QQQ can stage a robust bottoming process with the current pullback above June/July lows, we will be increasingly confident of QQQ’s sustained bottom in June. Hence, we urge investors to parse the QQQ’s price action closely.

Is The QQQ ETF A Buy, Sell, Or Hold?

We remain confident that the QQQ’s June lows will hold decisively. Therefore, we retain our thesis of the recovery of the medium-term bullish bias on the QQQ and posit that the deep pullback offers patient investors a fantastic opportunity to add more positions.

Therefore, we reiterate our Buy rating on the QQQ.

Be the first to comment