Melena-Nsk

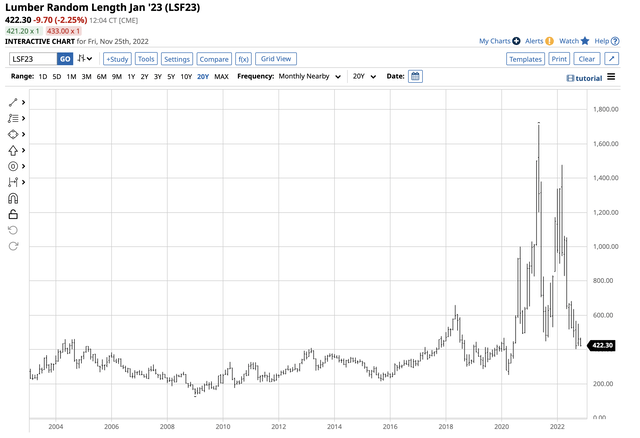

In 1993, random-length lumber futures reached a record $493.50 per 1,000 board feet high. The price remained below that level until 2018, when the price began an explosive move, taking the price to a new record high at over triple the 1993 peak. After reaching $1711.20 per 1,000 board feet in May 2021, the price imploded, falling to $448 three months later in August 2021. Explosive buying returned, pushing lumber futures to a lower high of $1,477.30 in March 2022, but the price collapsed, falling to $402.80 six months later in September 2022. Since then, the lumber futures market has gone to sleep, trading primarily below the $500 level.

The CME has rolled out a new physical lumber futures contract, hoping to increase market participation, but the volume and open interest levels have not improved. Illiquidity in the lumber futures market is a reason to avoid the commodity, but wood’s price can provide valuable clues about the path of least resistance of other industrial commodities. While I never trade lumber, I watch the price like a hawk for clues about oil, copper, and other raw material prices.

The most direct route for a risk position in lumber is via the CME’s random-length or physical lumber futures. However, the iShares Global Timber & Forestry ETF product (NASDAQ:WOOD) is a liquid alternative. WOOD holds shares in companies that have exposure to lumber prices, including Weyerhaeuser Co. (WY), a unique real estate investment trust with a lumber call option attached.

Lumber futures are sleeping

There’s not much going on in the random-length lumber futures arena these days.

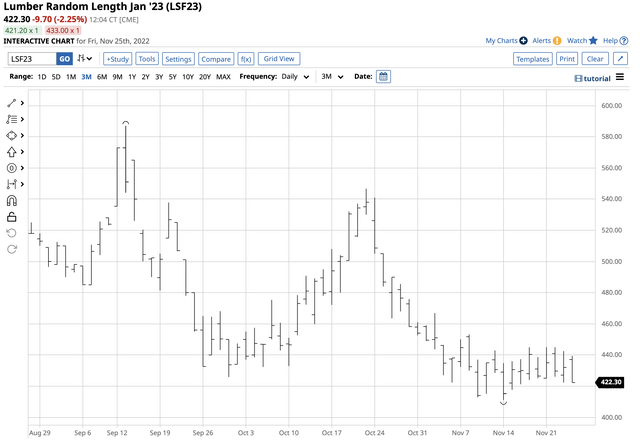

Short-Term Chart of CME Random-Length Lumber Futures (Barchart)

The chart highlights that nearby January random-length lumber futures have traded between $411.10 and $453.20 per 1,000 board feet since Nov. 3.

Long-Term Chart of CME Random-Length Lumber Futures (Barchart)

After reaching $1711.20 in May 2021 and a lower high of $1477.40 in March 2022, lumber futures have declined below the pre-2018 record $493.50 per 1,000 board feet high from 1993.

The new physical contract is more expensive

The Chicago Mercantile Exchange rolled out a new physical lumber contract in 2022 and plans to delist the old random-length contract over the coming months. The new contract is smaller. The random-length lumber futures represent 110,000 board feet, while the new physical contract contains 27,500 board feet. The new contract includes the delivery of more lumber grades and supports the delivery of a truckload, while the old contract restricts the delivery of a railcar full of wood.

Meanwhile, the random-length lumber contract for January delivery was at the $422.30 level on Nov. 25.

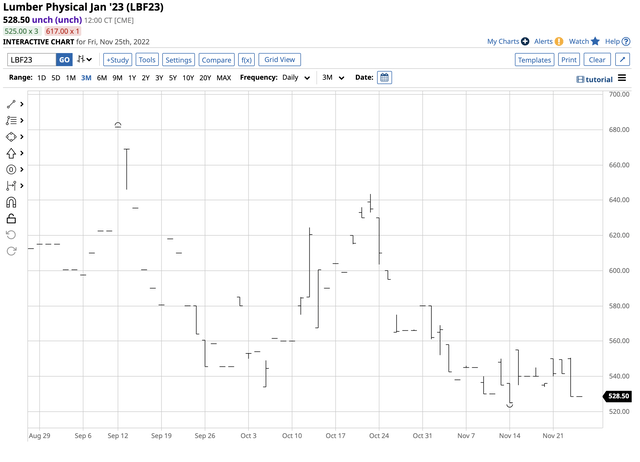

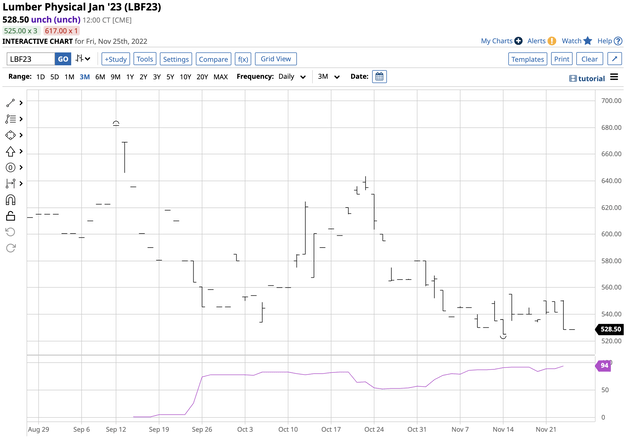

Short-Term Chart of the CME’s new Physical Lumber Futures Contract (Barchart)

The chart illustrates at $528.50 per 1,000 board feet, the new physical contract’s price is $106.20 higher than the existing random-length contract for the same delivery. The premium for smaller quantities could be a significant factor for wood’s future price action.

Lumber remains a highly illiquid futures market

The CME’s motivation in constructing a new lumber contract is to encourage more hedging, trading, and investing activity in the wood market. Increasing volume and open interest, the total number of open long and short positions in the lumber futures arena, is the goal. So far, the new physical contracts have not displayed the critical mass necessary for a liquid futures market.

Lumber has always suffered from a lack of liquidity.

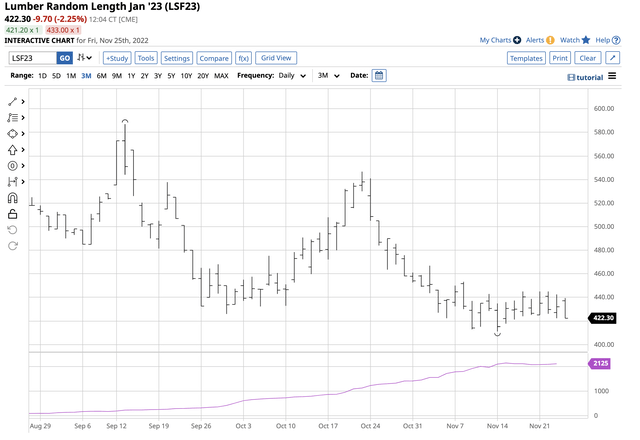

Open Interest in January 2023 Random-Length Lumber Futures (Barchart)

The chart shows a total of 2,125 contracts of open interest in the January random-length lumber futures contract.

Open Interest in January 2023 Physical Lumber Futures (Barchart)

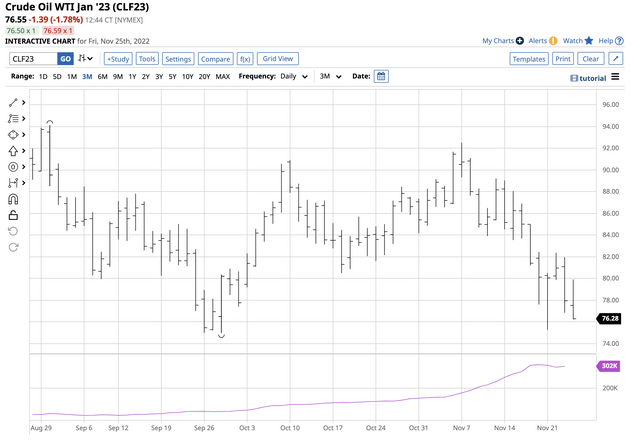

The January physical contract shows an open interest level of only 94 contracts. The CME’s NYMEX crude oil is a highly liquid futures market.

Open Interest in the January NYMEX Crude Oil Futures Contract (Barchart)

The chart shows more than 302,000 contracts of open interest in NYMEX crude oil for January delivery. Low liquidity makes executing buy and sell orders challenging, inhibiting hedging and other market activity. Illiquidity fuels volatility as bids to purchase disappear during selloffs and offers to sell evaporate during rallies. Illiquidity is the most significant challenge the lumber futures market faces and is why it tends to go from boom to bust.

While hedging, trading, or investing in the lumber futures arena is virtually impossible, the price action is a barometer for other industrial commodities as the illiquid lumber price tends to move with a vengeance, reflecting the economic landscape. Moves in lumber’s price often sign similar price action in other industrial commodity futures markets.

The pros and cons of lumber for 2023

The factors weighing on lumber are the same that pushed the price from $1,477.40 on March 2022 to below $430 on Nov. 25:

- The path of least resistance of US interest rates has made buying new homes prohibitive for those seeking financing. Higher rates weigh on new home construction and lumber demand.

- A rising US dollar because of US interest rates is also bearish for commodity prices, and lumber is no exception. The dollar index is sitting at its highest level in two decades at over the 105 level.

- The heart of the winter tends to be a slow period for construction, weighing on wood demand.

- The trend remains lower, with lumber futures making lower highs and lower lows over the past months and years. The trend is always your best friend in markets across all asset classes.

As we move toward 2023, the following factors could ignite rallies in the lumber market:

- A shift from the Fed’s present hawkish monetary policy stance that pushes interest rates lower could cause a significant relief rally in the illiquid lumber futures market.

- An end to the war in Ukraine that removes some fear from markets could be a bullish factor for lumber.

- Random-length lumber futures have held above the $400 per 1,000 board feet level, a significant technical support level.

- The over $100 per 1,000 board feet premium for the new physical lumber contract could indicate the market expects higher prices.

- Seasonality favors lumber in the spring and summer.

While the most direct route for a risk position in lumber is via the dangerous and illiquid futures arena, some alternatives track wood’s price and offer the critical liquidity necessary to execute buying and selling activity.

The WOOD ETF product follows the price of lumber

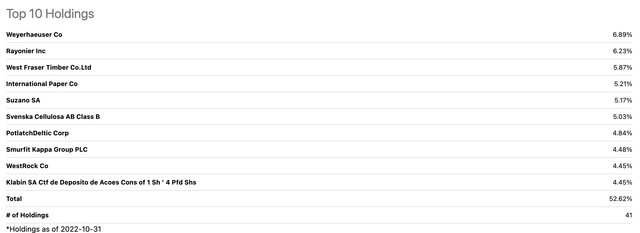

The top holdings of the iShares Global Timber & Forestry ETF product (WOOD) include:

Top Holdings of the WOOD ETF Product (Seeking Alpha)

The chart shows WOOD’s leading holding is Weyerhaeuser Co., a real estate investment trust in the US and Canadian lumber market. At $76.55 per share on November 25, WOOD had $220.11 million in assets under management. WOOD trades an average of 14,580 shares daily and charges a 0.40% management fee.

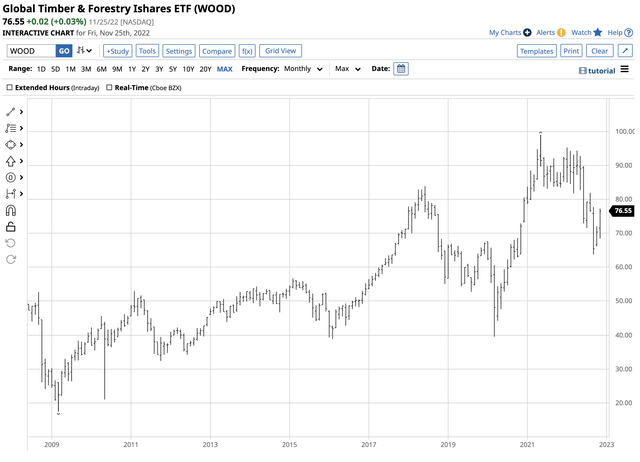

Chart of the WOOD ETF Product (Barchart)

The chart shows WOOD reached a record high of $98.98 per share in May 2021, when lumber futures rose above the $1,700 level. WOOD tends to underperform lumber futures on the upside but outperforms wood’s price during market corrections, which can be brutal in the futures arena.

Meanwhile, WOOD pays shareholders a $3.08 dividend, translating to a 4.02% yield at $76.55 per share. The five-year dividend growth rate has been 14.04%. If lumber futures are consolidating and the landscape allows for another rally in the spring of 2023, WOOD will likely move higher with lumber prices. Meanwhile, the futures arena remains untradeable, but it’s an invaluable barometer for industrial commodity prices. Illiquidity that creates volatility magnifies signals for other markets. Watch lumber futures, but never dip a toe in the arena until volume and open interest levels support the execution of buy and sell orders with tight bid/offer spreads.

Be the first to comment