wildpixel

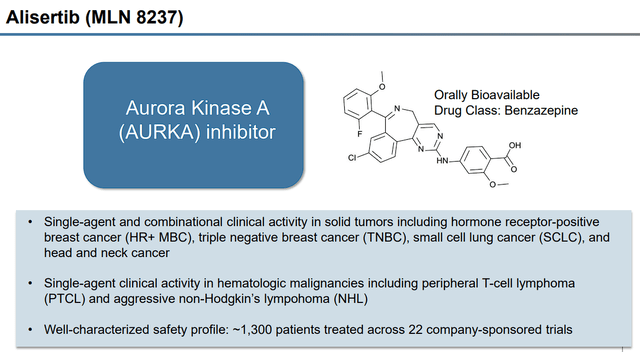

Puma Biotechnology (NASDAQ:PBYI), recently publicized a licensing deal with Takeda (TAK) for alisertib, “a selective, small-molecule, orally administered inhibitor of aurora kinase A.” Alisertib has already had experience in the clinic in several different cancers including breast cancer and SCLC. I believe the alisertib deal improves Puma’s long-term outlook and should be welcomed by investors. Unfortunately, Puma announced the deal during one of the worst weeks for the market, and the share price was unable to fend off the selling pressure. As a result, I am willing to adjust my ultra-conservative PBYI strategy to take advantage of the price action.

I intend to review the deal for alisertib and provide a brief background on the oral AURKA inhibitor. In addition, I discuss some of my downside risks to the deal. Finally, I reveal my updated strategy for taking advantage of PBYI’s slashed share price.

Alisertib Deal

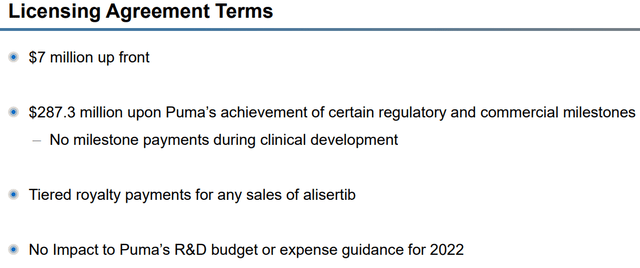

According to the press release, Puma now has worldwide rights to alisertib and will be responsible for the oral AURKA inhibitor’s development and commercialization. Puma is to pay Takeda $7M upfront as well as potential milestone payments of up to $287.3M, along with tiered royalty payments for net sales.

Alisertib Overview (Puma Biotechnology)

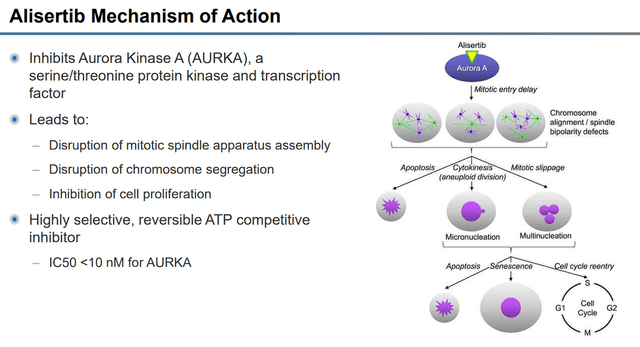

According to Puma, alisertib disrupts mitosis events in tumor cells that are reliant on aurora kinase A “AURKA”, which leads to apoptosis of the tumor cell.

Alisertib Mechanism of Action (Puma Biotechnology)

Thus far, alisertib has been tested in metastatic cancers including

- Breast Cancer

- Small Cell Lung Cancer “SCLC”

- Head and Neck Cancer

- Ovarian Cancer

- Peripheral T-Cell Lymphoma

- Acute Myeloid Leukemia

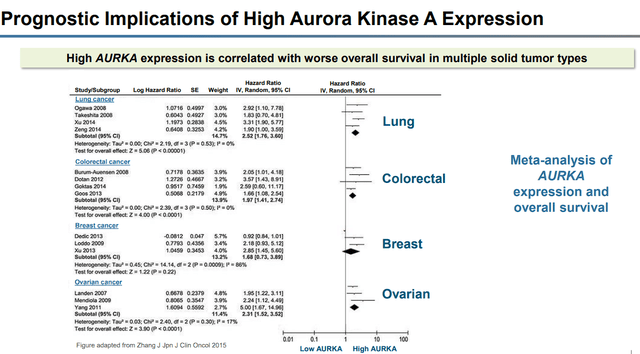

These cancers are known to have high AURKA expression, which has been shown to have “worse overall survival” compared to low AURKA.

Cancers with high AURKA expression (Puma Biotechnology)

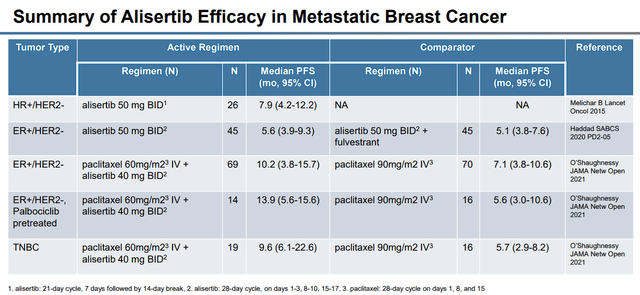

Puma is looking to initially target metastatic ER-positive HER2-negative breast cancer, TNBC, and SCLC. The company pointed out that alisertib has already been tested in a Phase II clinical trial in ER-positive HER2-negative breast cancer, where alisertib was able to improve PFS.

Alisertib in Metastatic Breast Cancer (Puma Biotechnology)

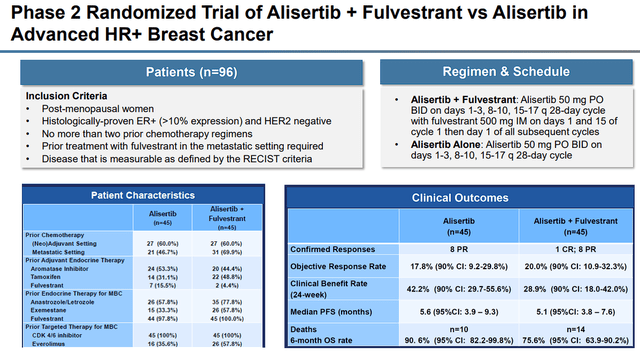

In addition, alisertib was in a Phase II trial matched up against fulvestrant for HR+ breast cancer, where alisertib was able to improve responses, PFS, and OS.

Alisertib in HR+ Breast Cancer with Fulvestrant (Puma Biotechnology)

Alisertib was also in a Phase II trial in combination with paclitaxel vs. paclitaxel monotherapy, which showed that “the addition of oral alisertib to a reduced dose of weekly paclitaxel significantly improved progression-free survival compared with paclitaxel alone, and toxic effects with paclitaxel plus alisertib were manageable with alisertib dose reduction.”

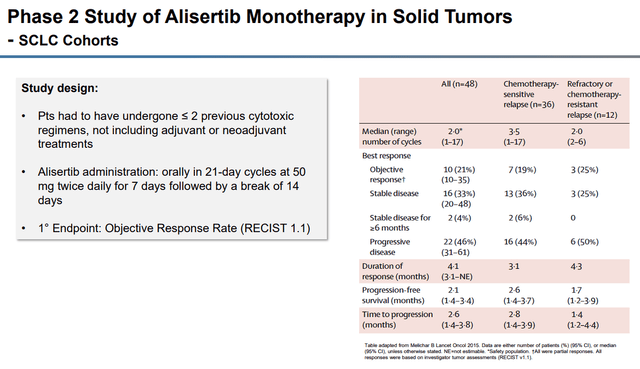

For TNBC, alisertib was in a randomized clinical trial in combination with paclitaxel matched up against paclitaxel alone. Alisertib has also been in the clinic in a Phase II trial verse SCLC and in a randomized Phase II trial in combination with paclitaxel matched against paclitaxel as a single agent.

Alisertib SCLC Cohorts (Puma Biotechnology)

In relapsed or refractory SCLC, alisertib had an objective partial response of 21%. Another study had alisertib in combination with paclitaxel verse placebo plus paclitaxel were tested in a double-blind study in patients with relapsed or refractory SCLC. The study showed improvements in progression-free survival over the placebo-paclitaxel combo.

Initial Opportunities

Despite the ever-growing number of new oncology agents and therapies, there is still a great need for innovative drugs that can help treat the worst cancers. Alisertib’s mechanism of action has the potential to be operative in numerous cancer types including metastatic ER-positive, HER2-negative breast cancer, and triple-negative breast cancer, which are in dire need of additional therapeutic options. In fact, the global breast cancer drugs market size was estimated to be at $17.9B in 2021 and is expected to hit $27B in 2026.

The same can be said about SCLC, where patients who progressed on or after platinum-based chemotherapy also have limited options. The global SCLC therapeutics market is expected to grow at around 10.0% CAGR to hit $21.44B by 2029.

So, if alisertib were able to make it through the FDA for its breast cancer and SCLC, it would be stepping into two massive markets that are rapidly expanding and could benefit from an oral AURKA inhibitor. Obviously, we cannot expect alisertib to take a large percentage of these markets, but even if it was to claim 1%, Puma would be pulling in hundreds of millions in annual revenue. Indeed, if alisertib were to be approved for any indication, and we don’t know when it could hit the market… we can say with there is a huge opportunity for alisertib both clinically and commercially.

My Thoughts on the Alisertib Deal

For me, alisertib appears to have multiple positive aspects that investors should take note of. First of all, it looks as if alisertib has demonstrated promising data points that point to antitumor activity in several cancer types.

Furthermore, I am happy about the fact alisertib already has a significant amount of data, so Puma won’t have to perform extensive preclinical, thus, reducing overall development costs.

Another important characteristic to note is that alisertib has demonstrated its ability to work both as a single agent and in combination with other oncology drugs. So, Puma should have multiple routes to get alisertib through the FDA.

Moreover, investors should be optimistic about alisertib’s broad utility considering the list of cancer types above, which would be an enormous commercial opportunity. Obviously, having an oncology drug that is operative in numerous cancer types would have a dramatic impact on Puma’s fundamentals and long-term outlook.

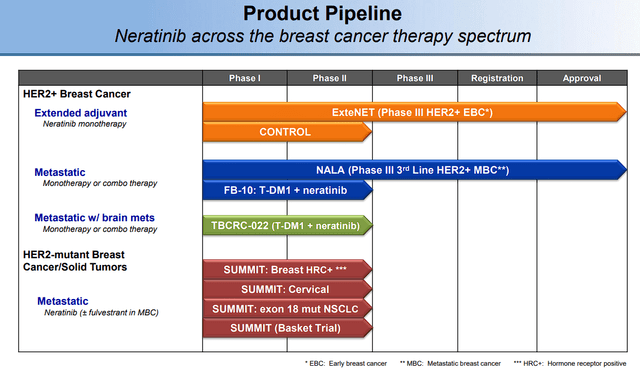

Another upside to alisertib is that it has expanded Puma’s pipeline, which up till now, was only populated by NERLYNX.

Puma Biotechnology Pipeline (Puma Biotechnology)

In addition, alisertib has the prospect to complement NERLYNX due to both drugs targeting breast cancer and other solid tumors. Clearly, this would be a huge benefit to their commercial efforts.

Finally, I would like to point out the advantageous structure of the licensing deal with Takeda.

Licensing Agreement Terms (Puma Biotechnology)

Puma only had to pay $7M upfront and they won have to pay milestones during clinical development, which will help with their cash burn while trying to push alisertib through clinical trials. Keep in mind, Puma is attempting to conserve their net-income-positive status… I believe the structure of this deal could allow them to stay in the green if NERLYNX sales continue to grow in the coming years.

Considering the points above, one must concede that the deal was a positive event for the company in both the near-term and long-term.

Downside Risks to Consider

Despite my bullish views on the alisertib deal, there are several downside risks to consider. First and foremost, the company will have competition in their target markets and from oncology drugs similar to alisertib. After doing some brief research, I couldn’t find an extensive list of AURKA inhibitors that could be strong competition for alisertib. However, I am concerned that Eli Lilly (LLY) has their own AURKA inhibitor, AK 01 (a.k.a. LY 3295668, erbumine), in development for NSCLC, breast cancer, and neuroblastoma. It is also important to point out that there are several oncology agents in development that are aurora kinase inhibitors. Indeed, some of these are aurora B inhibitors, or aurora A/B inhibitors… still, I believe Puma needs alisertib to outperform the competition both in safety and efficacy throughout the regulatory process if they want it to contend on the market.

Another concern is the expenses required to get alisertib through the regulatory process. Although the company was able to report a positive EPS in Q2, a drop in NERLYNX in sales, plus the cost of alisertib’s development could bring the company back into a cash-burning company. Luckily, the company finished Q2, with $60.8M in cash, cash equivalents, and marketable securities, so there isn’t an imminent need for dilutive funding. However, the market will probably punish the share price due to the cash burn outpacing the cash earned.

My last major concern is the fact that Takeda was willing to part with alisertib. One must agree that Takeda would probably hold onto alisertib if they thought it was a potential blockbuster drug. Indeed, perhaps Takeda did not want to devote the time, manpower, and finances to alisertib because they have plenty of other programs to focus on. Still, it is something to remember down the line.

Change in Plans?

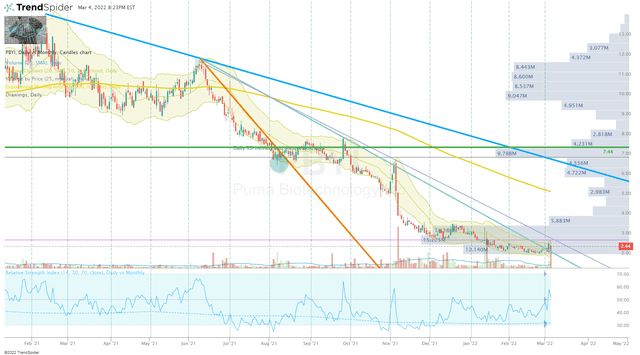

In my previous PBYI article, I discussed my intentions to wait for the PBYI to break the downtrend ray originating from June 2021. Fortunately, the ticker was able to bust through that downtrend and hit my buy target of $2.00, and I decided to pull the trigger on a modest purchase.

PBYI Daily Chart (TrendSpider)

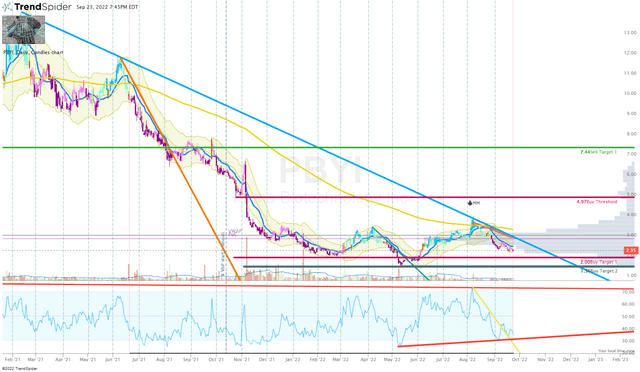

PBYI Daily Chart (TrendSpider)

Once the share price broke that downtrend, my next target was the long-term downtrend ray originating in February 2021 before making my next buy.

PBYI Daily Chart (TrendSpider)

Sadly, the share price failed to break that line back in August, so I haven’t pulled the trigger on a buy for several months. The market-wide sell-off has yanked PBYI away from the trend line and is quickly approaching our Buy Targets. Consequently, I have decided to alter my plan and will set some small buy orders around our Buy Targets in order to take advantage of the reduced share price.

If those orders are filled, I will set corresponding sell orders just under $7.40 per share in order to bank some profits and move the position closer to a “house money” state. Once I have generated a house money position, I plan on holding a respectable position for a long-term investment to see if the company can get alisertib through the FDA and onto the market.

Regardless of my renewed bullish outlook, I need to reiterate that I see PBYI as an ultra-speculative investment. It is possible that PBYI remains suppressed for a prolonged period of time and possibly deteriorates despite the company’s progress.

Be the first to comment