Petmal

Plug Power (NASDAQ:PLUG) has been a much-discussed company here on Seeking Alpha. In the past, I have also covered the stock in the article here. In my previous article, I wrote about how the stock is mostly a story stock and is valued by their future potential and not their current numbers. I made a comparison to an early-stage Tesla (TSLA).

Ever since I published my previous article, which was published about a year ago, the energy landscape of the world has changed quite dramatically. The energy crisis happened. Russia invaded Ukraine. Fossil fuel prices and especially natural gas prices skyrocketed. Though these prices seem to have cooled down a bit during the last couple of weeks, this volatility will continue to be a major topic for the whole energy industry for the short and medium term.

Plug Power has the ambition to achieve a revenue growth of 80% over 2022. In this article, I will critically examine Plug Power’s predictions: will they be able to meet their ambitious plans, and how will the reshaped macro environment influence the performance of the company on the short to medium term.

The numbers

In their Q2 2022 earnings letter, Plug Power reported the following numbers:

Revenue was $151.3 million in the second quarter, compared to $124.6 million for the second quarter of 2021. New product offerings represented over $56 million in revenue. We remind everyone of Plug’s historical seasonality for full year revenues which is expected to continue in 2022. Plug’s revenue in the first half of the year typically represents approximately 30% of the full year revenue with the second half representing approximately 70%. (Source: Plug Power Q2 2022 earnings letter)

When we extrapolate this $151.3 million of revenue and their Q1 2022 revenue of $140.8 million to the whole year of 2022, and account for the seasonality as Plug Power mentions, we get a H1 revenue of $292.1 million and full-year figures of $292.1 / 0.3 = $974 million of revenue.

But wait a minute: how realistic is this assumed seasonality? Let us look at their past earnings, starting with last year 2021. The year 2020 is not comparable, since the company reported negative revenues, and 2019 and before are not very helpful too, since the company reported revenues which were much lower than 2021 and 2022, and as such could be influenced heavily by a single order. Without further ado, I took a look at their quarterly reports and listed their revenue numbers in the following table:

| 2021 | Q1 | Q2 | Q3 | Q4 | Full year |

| Revenue (millions) | 72.0 | 124.6 | 144.0 | 162.0 | 502.6 |

| % of total | 14.3% | 24.8% | 28.7% | 32.2% |

Table 1: Quarterly revenue of Plug Power in 2021 (source: Plug’s quarterly investor letters)

When taking a look at these numbers, we can conclude that there seems to be some seasonality indeed. But is this seasonality caused by time periods in the year or simply because Plug has been growing its revenue aggressively? Likely the latter. If we add up the totals of Q1 and Q2 we reach a percentage of 39.1% of H1 compared with the full year of 2021.

Looking at these numbers I get the impression that the H1 estimate of 30% of full year revenue is overly optimistic. When we use the 39.1% value instead of the 30% value, we reach an estimated full year revenue of $292.1 / 0.391 = $747 million, quite a large difference from the almost $1B estimate we calculated earlier.

At the end of their investor letter of Q2 2022, Plug wrote:

Despite the numerous macro and supply chain constraints, we are working to deliver on our 2022 revenue targets of $900-$925 million with ~80% growth year over year. (Source: Plug Power Q2 2022 earnings letter)

Unless there are will be some very large revenues appearing in the last two quarters of 2022, these revenue targets seem out of reach, which Plug itself also concluded in their most recent revenue expectations update, in which they estimated that these revenues would likely be 5-10% lower in 2022.

Even this seems optimistic. If revenues would be 10% lower than the lowest bound of their estimate, they would still be $810M for 2022. This is still more than $50M higher than our estimate of $747M.

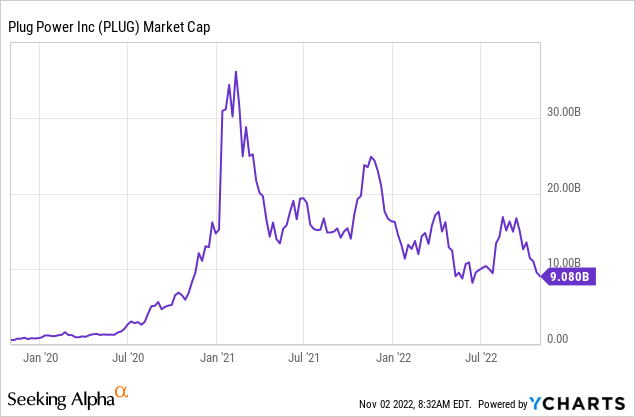

Graph 1: Plug Power market capitalization

Also, please note that we are talking about a company with a market capitalization of over $9 billion. I am aware of the fact that many quickly growing IT businesses get valued at a multiple of Plug’s 2022 price/revenue number of 9.08 / 0.747 = 12.15 (if my estimated $747 million of revenue in 2022 becomes a reality). Still, this seems expensive.

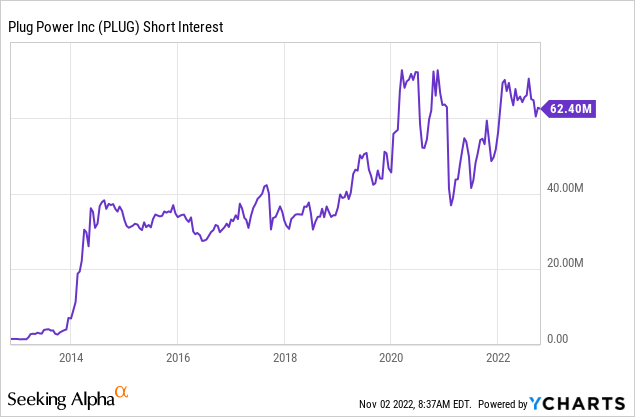

Graph 2: Plug Power number of shares sold short

As such, I find it of no surprise that Plug’s short interest is quite high, and shows no sign of dropping. As of today, it is at more than 62M shares, which corresponds with short interest of more than 12%.

Plug Power remains very optimistic about their growth prospects, however. In their annual symposium which was organized at the end of last month, a nice overview about projects in which Plug is active is given. The symposium presented a very positive impression about Plug Power, and the expectation about current and future projects in green hydrogen.

The macro environment

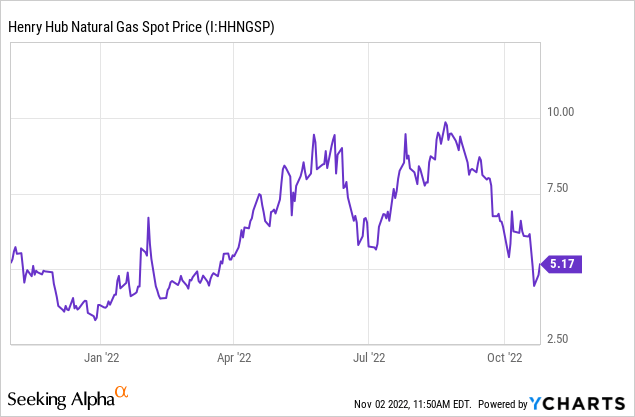

As I wrote in my brief introduction, the energy market has changed dramatically during the past year. Just take a brief look at natural gas prices as an illustration of this.

Figure 3: Natural gas spot prices

Fossil fuel prices and material prices have been influenced heavily by first the aftermath of the end of the worldwide COVID lockdowns and later the Russian invasion of Ukraine. Though price action has seemed to have cooled down recently, it is not clear whether energy markets will return to normal.

In its wake, volatility of natural gas and oil prices has increased the price of electricity and contributed to high levels of inflation now seen across the largest part of the globe.

Most hydrogen is still produced by steam reforming of natural gas, and as such the hydrogen market has been impacted by price volatility of fossil fuels as well. Of course, Plug Power tries to focus on green hydrogen production for the future, but even green hydrogen cannot stay out of harm’s way: green hydrogen is produced by using renewable electricity to power electrolyzers which split water into hydrogen and oxygen. The competition for green hydrogen is simply supplying the electricity to the grid, and when electricity prices are high, this is an attractive option. If hydrogen is sold for fixed prices when electricity spot market prices are variable, it might not make financial sense to produce hydrogen. Also, another important recent headwind for the hydrogen market are governments increasingly supporting fossil fuels as a result of the energy crisis to keep energy and fuel affordable for their citizens. Though hydrogen is not used to a large extent yet, these measures make the alternatives for hydrogen (fossil fuels) more attractive.

All in all, the short-term macro environment does not look all too bright for Plug Power.

Conclusion

When looking at the investor letters of Plug Power and watching their symposium, a very optimistic view about the company is presented. But if you investigate Plug’s numbers more closely, the question is whether these expectations might be too optimistic.

With regard to Plug’s revenue numbers, the company expected to achieve a revenue of $900-925 million in 2022, and adjusted this down 5-10% recently. But as I showed in this article, a revenue of $747M in 2022 would seem more realistic, which is way below the company’s own lower-bound estimate. Note that this still would mean that the company’s revenue is growing by 50% annually. This is still a very decent growth percentage, but not near the predicted 80% year-over-year growth which Plug was expecting to reach.

The macro environment does not seem to be very benign for Plug Power on the short term. The energy crisis has the potential to continue to impact the company’s business on the short to medium term. Plug Power is a company with a potentially bright future, but with too much short-term optimism baked into the price. I would stay away from their shares and expect that share prices still have much room to drop.

Thank you for reading! Please let me know in the comment section what you think about Plug Power and their revenue predictions!

Be the first to comment