NatanaelGinting

Investment Thesis

PubMatic’s (NASDAQ:PUBM) Q4 guidance left a lot to be desired. Even though the stock was already down more than 50% headed into its Q3 earnings, its guidance was mediocre at best.

More specifically, investors did not take well to its Q4 EBITDA guidance, which is pointed to be down slightly y/y.

If in 2020-2021 investors craved growth at any cost strategies, in the current market, investors want one thing above all else; predictable earnings.

And companies that fail to deliver steadily increasing earnings to investors are being pushed aside.

What’s Happening Right Now?

Recall, PubMatic provides a platform for publishers to monetize their inventory. PubMatic is a supply-side platform. This means that any company with a digital asset, for instance, a website or app, can monetize its ad space through PubMatic’s platform.

Now, to complicate matters, there are two elements weighing on PubMatic’s prospects.

Firstly, from Meta (META) to The Trade Desk (TTD) to Snap (SNAP) and even TikTok (Private), there’s not one report that I’ve read that shows that advertising as flourishing. Despite all companies having promising narratives of delivering highly targeted advertising.

Or perhaps, I should say, there is one exception. I’ve found that Perion (PERI) somehow continues to punch way above its weight.

Secondly, the other headwind that adtech companies are having to navigate is how to operate in a ‘cookieless’ world?

For its part, during PubMatic’s Q3 earnings call, PubMatic declared that it has an advantage over its walled garden peers, by remaining an independent platform and free from brand conflict (more on this soon).

PubMatic asserts that its strength comes from being able to get closer to publishers than many of its peers, providing brands with higher ROI metrics than typical cookie-led initiatives.

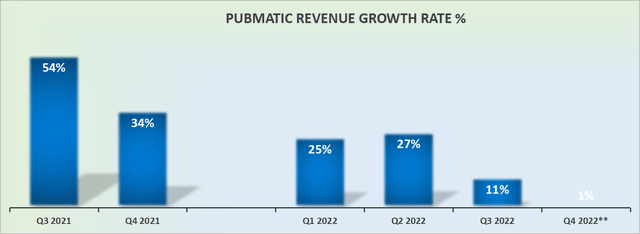

PubMatic’s Revenue Growth Rates Slow Down

However, when we peel back its narrative, PubMatic’s Q4 points to just 1% y/y midpoint revenue growth.

What’s more, as we’ve heard countless times throughout this earnings season, the macro environment significantly deteriorated in the back half of Q3.

So the market is now becoming increasingly fretful that as we look ahead to the coming few quarters, there’s a high likelihood that investors should brace themselves for mid-single-digit growth rates, as the best-case scenario.

Profitability Moves in the Wrong Direction

For Q4 2022, PubMatic expects $36 million of EBITDA. This puts its full-year EBITDA at $101 million. For a company the size of PubMatic, this is evidently a very strong end-of-year EBITDA.

The problem though is that PubMatic, like most adtech companies, is seasonally skewed towards Q4. And once we compare it with Q4 of last year, back then, PubMatic reported $39 million of EBITDA.

Put another way, we can see that despite expecting to see some topline growth in Q4 of this year, PubMatic isn’t seeing this revenue growth translating into an EBITDA improvement.

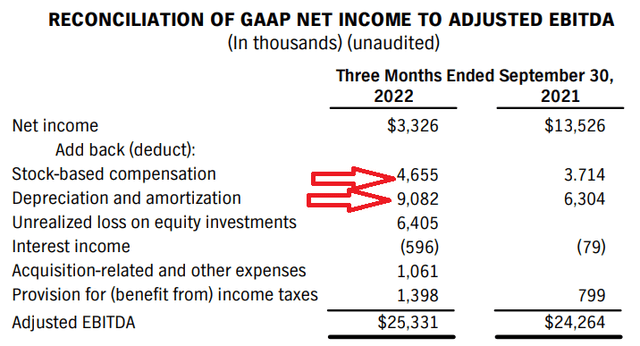

Next, consider PubMatic’s EBITDA.

What you see above is that PubMatic’s EBITDA is getting a lot of add-backs put into its adjusted EBITDA line. Back in 2020-2021, investors were not overly perturbed by this.

But as we head into 2023, with the only thing the market is intent on rewarding is sustainable free cash flow potential, investors are unlikely to put too much consideration into a shrinking Q4 EBITDA base with a significant amount of add-backs.

PUBM Stock Valuation – 7x EBITDA

As we look ahead to 2023, if we assume that PubMatic succeeds in growing its EBITDA line by 5% y/y, that would see PubMatic’s EBITDA reach approximately $105 million.

That would leave the stock priced at 7x EBITDA.

One part of me is only too eager to call this a very low-valued stock. While another part of me remains concerned about the advertising space for 2023.

Let me put it another way, if I can buy Alphabet (GOOG) (GOOGL) at less than 18x next year’s EPS, why would I pay what could be slightly more than this for PubMatic’s EPS?

Or perhaps, let us be generous, let’s assume that PubMatic is priced at 18x next year’s EPS too. Why would I reach out to PubMatic over Alphabet?

One has as its strength that it’s disrupting the Walled Gardens. The other is part of the Walled Gardens!

The Bottom Line

We are now well and truly into tax loss season. That means that investors are all looking through their portfolios and thinking very hard about what stocks are worthwhile for keeping and what stocks they are unsure over.

My suggestion is this, investors would do well to consider supply-constrained commodities over advertising stocks.

Even if those advertising stocks appear to be cheap on a trailing basis. Whatever you decide, good luck.

Be the first to comment