Chinnapong/iStock via Getty Images

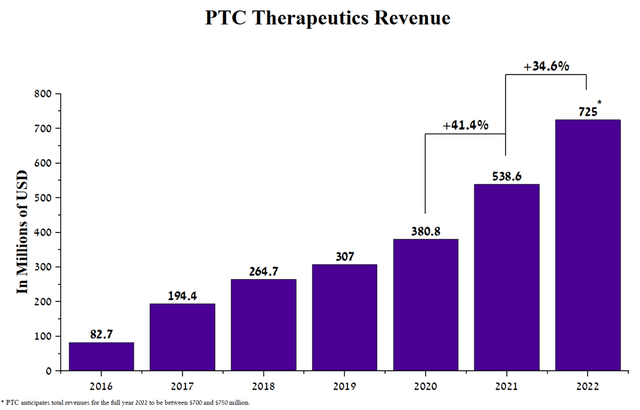

PTC Therapeutics (NASDAQ:PTCT) is a global biopharmaceutical company that is one of the leaders in the treatment of Duchenne muscular dystrophy and SMA. The company has many approved drugs, and the best-selling of them are Translarna, Tegsedi, and Evrysdi, which are aimed at combating genetic diseases. The effectiveness of medicines is reflected in PTC Therapeutics’ revenue growth of $538 million in 2021, up 41.4% from 2020.

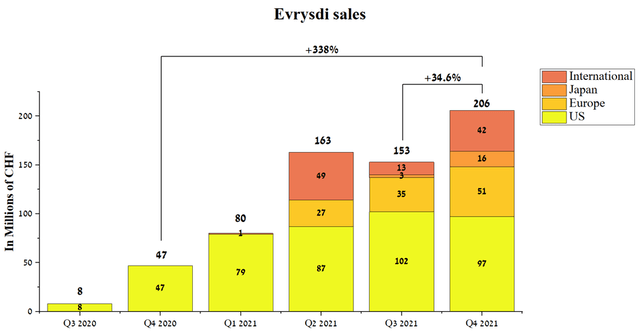

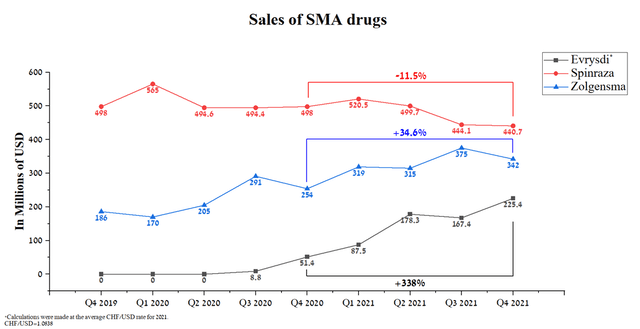

Evrysdi is one of the company’s key medicines, which is commercialized by the world pharmaceutical leader, namely Roche (OTCQX:RHHBY) (OTCQX:RHHBF), and has already been approved by more than 76 countries. This drug provides an effective and safe treatment for SMA, with many competitive advantages and pending additional approvals in more than 20 countries. Evrysdi’s global sales totaled $225.4 million in Q4 2021, up 34.6% from Q3 2021. While the sales of the two main competitors, namely Zolgensma, have a smoother growth trend, Spinraza sales are declining altogether.

Continued quarter-over-quarter revenue growth, the possible approval of several next-generation product candidates over the next 4 years, and a partnership with a global leader in the pharmaceutical industry make PTC Therapeutics an excellent candidate for long-term investors.

Company’s Financial Position

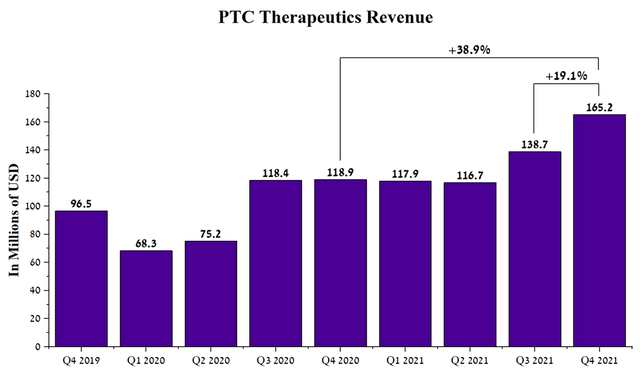

Despite the rise in inflation in the world, and the persistence of a large number of new cases of COVID-19, which is still negatively affecting most pharmaceutical companies, PTC Therapeutics’ business continues to grow at a significant pace. Under the leadership of Stuart W. Peltz, the company’s revenue rose to $165.2 million in Q4 2021, up 38.9% from Q4 2020.

Author’s elaboration, based on Seeking Alpha

In addition, the company’s management expects revenue of $700-750 million for 2022, up 34.6% from 2021. Several reasons are driving revenue growth, namely the continued geographic expansion of Evrysdi, and an increase in the number of patients taking Translarna and Emflaza as a treatment for Duchenne muscular dystrophy.

Source: Author’s elaboration, based on 10-K reports

Let’s take a closer look at the progress PTC Therapeutics has made in drug commercialization over the past year and why this trend is only going to get better over the next 4 years.

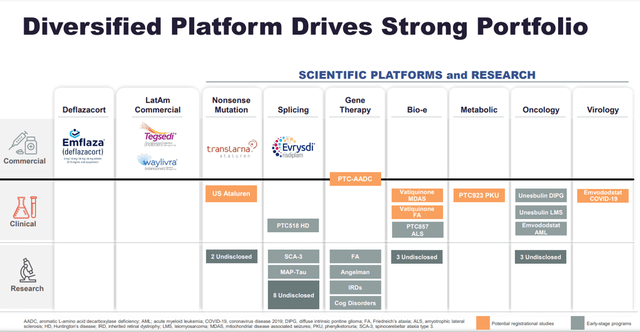

Global Commercial Footprint

PTC Therapeutics has an extensive portfolio in the treatment of rare diseases such as spinal muscular atrophy (SMA), hATTR amyloidosis, and Duchenne muscular dystrophy (DMD). Currently, the company has 5 approved medicines, namely Translarna, Emflaza, Tegsedi, Waylivra, and Evrysdi, which improve the quality of life of thousands of patients around the world.

Establishing the gold standard in the treatment of SMA

Evrysdi is a medicine used to treat spinal muscular atrophy in adults and children over 2 months of age. According to the company, approximately 1 in 10,000 children are born with SMA, and currently, about 20,000-30,000 people live with this disease, which requires effective and safe treatment to significantly improve the quality of life of patients. According to Roche, about 4500 patients have used this drug both in clinical trials and commercially, which is about 15-22.5% of the maximum prevalence of this disease and thus provides a window of opportunity to increase sales. Evrysdi is PTC Therapeutics’ third-largest drug with sales of CHF 206 million in Q4 2021, up 338% year-on-year and 34.6% quarter-on-quarter.

Source: Author’s elaboration, based on quarterly securities reports

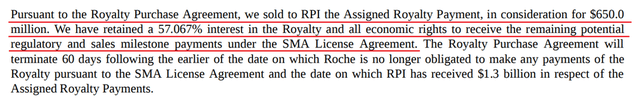

Before proceeding directly to a discussion of the competitive advantages of this drug, a comparison of sales dynamics relative to competitors, and the progress made in clinical trials, it is necessary to note the terms of the agreement with Roche and Royalty Pharma.

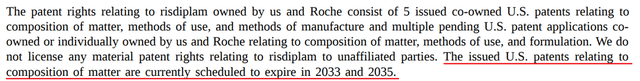

PTC Therapeutics and Roche entered into a licensing agreement to develop and commercialize Evrysdi in November 2011. Under this partnership, Roche is responsible for Evrysdi’s global commercialization and clinical trials under the research program. While PTC Therapeutics is eligible to receive up to $460 million for certain development, regulatory and sales milestones. At the end of 2021, the company has already received $160 million in these payments, leaving potential sales milestones remaining $300 million. In addition, PTC Therapeutics is entitled to receive payments ranging from 8% to 16% of Evrysdi’s net sales, which, given the rapidly growing sales of this drug, opens up huge potential for the company’s revenue growth shortly. Also, the company sold a portion of the Evrysdi royalties to Royalty Pharma for $650 million in 2020.

Source: Author’s elaboration, based on quarterly securities report

In my opinion, this was the right decision, which allowed us to accelerate the development of PTC Therapeutics’ product candidates aimed at treating rare diseases. As a result, the company’s pipeline was diversified and the risk in the development of the company’s business decreased. In addition, this agreement will be terminated as soon as RPI receives $1.3 billion, which I estimate will be in 2026, which is 7-9 years before the patents for this drug expire and, as a result, PTC Therapeutics will return 100% of the royalties on net sales of Evrysdi.

Source: Author’s elaboration, based on quarterly securities report

Competitor analysis

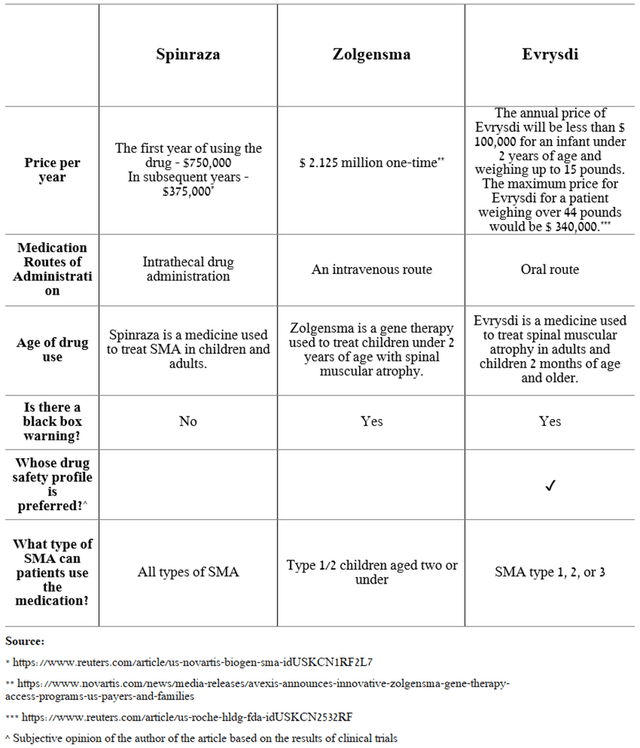

There are currently 3 medicines approved by global regulators for the treatment of SMA, namely Zolgensma by Novartis (NVS), Evrysdi, and Spinraza by Biogen (BIIB). Based on the results of numerous clinical studies, all these drugs have similar data on effectiveness, however, PTC’s drug has several significant advantages over competitors, which has a positive effect on sales growth.

Despite the growing competition, Evrysdi shows the highest sales rates, due to the expansion of the geography of the use of this drug and the above-described competitive advantages relative to key competitors. So, for example, Spinraza sales continue to decline from year to year and in my estimation, this trend will continue in the future. While Evrysdi’s main competitor will be Zolgensma, whose sales amounted to $342 million, up 34.6 in Q4 2021 from Q4 2020, but showing negative sales dynamics on a quarterly basis.

Current clinical research and government regulation

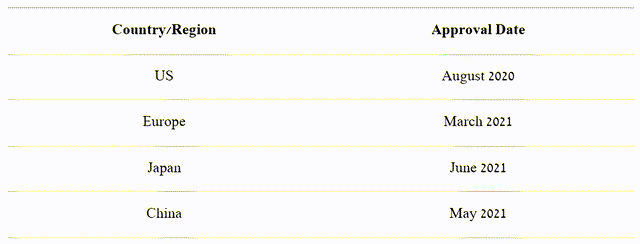

Evrysdi is currently approved in over 76 countries, including the key markets with the highest number of SMA patients, namely the US, the European Union, Japan, and China.

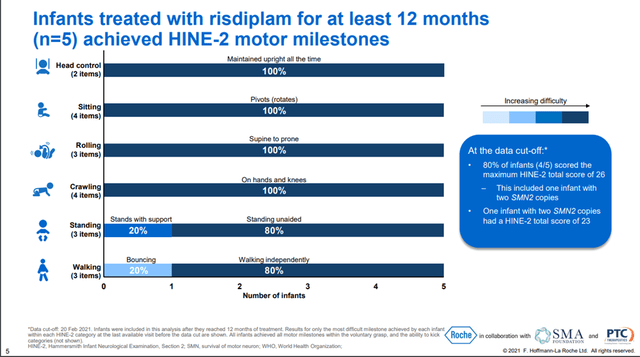

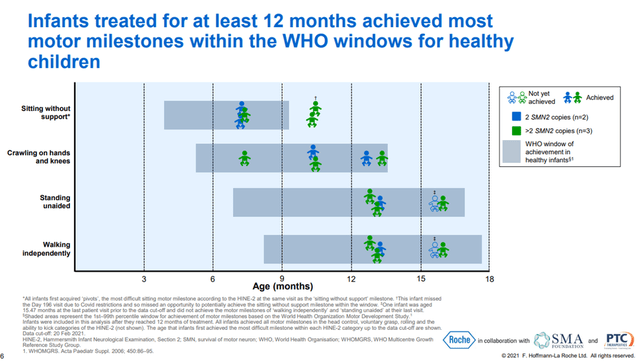

In addition, Roche continues to expand the geography of the use of this drug and the decision of the regulatory authorities of 29 countries is expected, which creates the prerequisites for continued growth in sales. Clinical studies are also ongoing, which are necessary to expand the use of Evrysdi. One of the most critical to the development of this program was the Rainbowfish study, which aimed to determine the efficacy and safety of Evrysdi in children under six weeks of age who were genetically diagnosed with SMA but had not yet developed symptoms. On September 24, 2021, Roche announced interim data from this ongoing study. The data showed that all participating children with SMA treated with Evrysdi for at least 12 months were able to meet most of the HINE-2 measures, such as head control, crawling, sitting upright, and rolling.

In addition, 80% of the children in the Evrysdi group achieved critically important indicators, such as independent standing and walking, according to WHO for healthy children, which are amazing results that can significantly improve the quality of life of patients in the future.

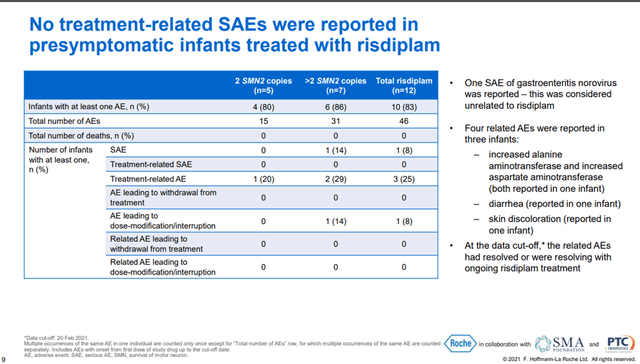

In my assessment, this showed a favorable safety profile of the drug, as none of the children treated with Evrysdi experienced any serious treatment-related adverse events. In general, adverse events occurring during treatment were as follows.

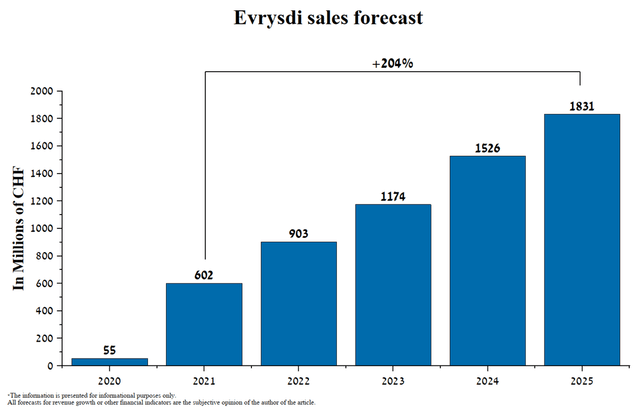

On January 25, 2022, the FDA granted priority review of an sNDA for the use of Evrysdi. In my estimation, the FDA will likely approve the expansion of the use of this medicine as early as Q3 2022 and Evrysdi will become the first drug approved for home use for the treatment of children under 2 months of age with presymptomatic SMA. This will increase the potential number of patients who can use this drug in the United States. In addition, I believe that between 2022 and 2023 Roche management will apply to regulators around the world to expand the use of Evrysdi for this indication, thereby bringing hundreds of children born with SMA closer to a healthy life. Thus, in my estimation, the drug from PTC Therapeutics/Roche will become the gold standard in the treatment of SMA and, as a result, demand for it will only grow due to the above factors, thereby taking away revenue from Spinraza. And I predict Evrysdi’s sales growth dynamics until 2025.

Product Pipeline

PTC Therapeutics is a mid-cap company, which is reflected in the high number of product candidates that are in development in the final stages of clinical trials.

PTC923

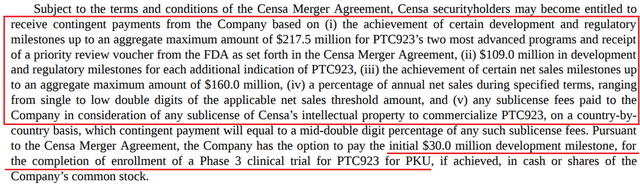

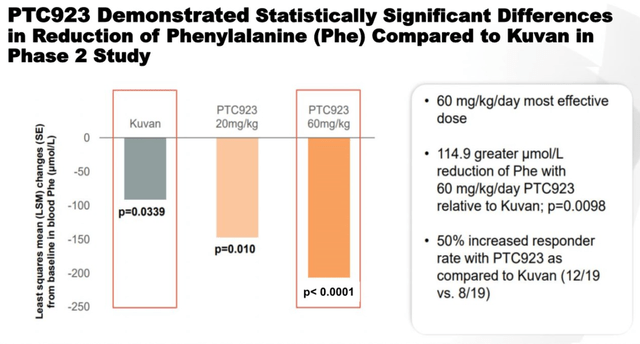

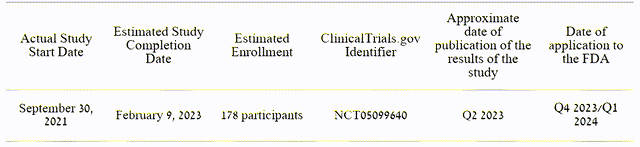

PTC923 is a product candidate that contains synthetic sepiapterin as an active ingredient. The drug was developed by Censa Pharmaceuticals and was acquired by PTC in May 2020. PTC923 is currently being developed for the treatment of patients with hyperphenylalaninemia (PKU). According to the company’s analysis, there are about 58,000 patients with this disease in the world, which sets the stage for a commercially successful launch. In December 2019, it was announced that a Phase 2 study comparing the efficacy and safety of various doses of PTC923 with BioMarin’s approved drug, namely Kuvan, had reached its primary and secondary endpoints. In addition, PTC’s product candidate showed a clinically meaningful improvement in blood phenylalanine reduction compared to the Kuvan group.

This indicator is the primary endpoint in phase 3, which increases the likelihood of successful completion of this clinical trial. In addition, it creates certain prerequisites for improving the effectiveness of the currently approved medicines. And I expect the next stages in the development of this program.

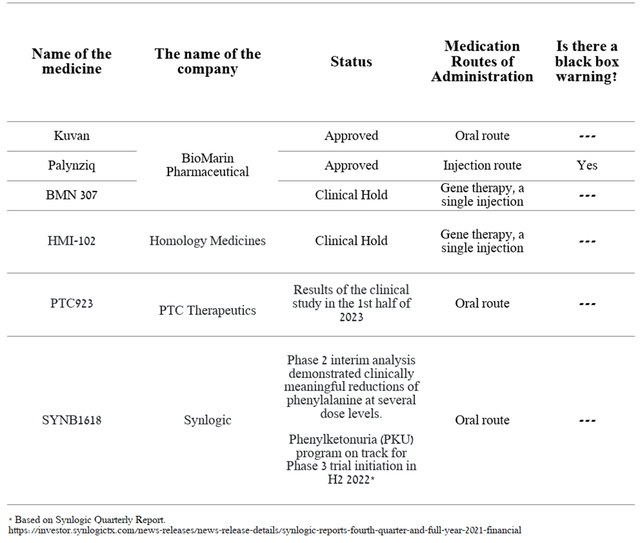

Currently, only 2 drugs are approved for the treatment of PKU, namely Kuvan and Palynziq. As noted above, according to preliminary data, Kuvan has a lower efficiency relative to PTC’s product candidate. While Palynziq is also used to treat PKU, however, in the phase 3 clinical trial, it was found that about 10% of patients suffered from anaphylaxis, an acute life-threatening allergic reaction. Also, Palynziq is a daily injection therapy, which creates inconvenience in the treatment process. HMI-102 and BMN 307 are currently being developed as gene therapy for the one-time treatment of phenylketonuria. However, negative safety profiles have been shown in preclinical and clinical studies, leading the FDA to suspend Phase 1/2 clinical trials of both drugs, which is a favorable moment for PTC.

As a consequence, I believe currently approved drugs have significant shortcomings, which opens up opportunities for PTC923 if approved by the FDA due to the oral route and efficacy shown in phase 2.

Risks

Stock Dilution

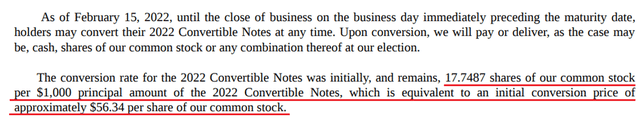

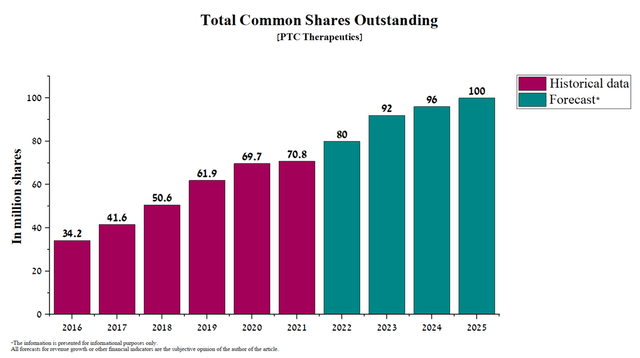

Currently, PTC Therapeutics has a negative cash flow. As of December 31, 2021, the cash balance was $773.4 million and the quarterly net loss was about $130-140 million. In addition, the company has long-term debt of $535.4 million, which was created by issuing two senior notes maturing in 2022 and 2026. In August 2022, the company is due to redeem $150.0 million of convertible senior notes that were issued in 2015. According to PTC Therapeutics, the fair value of these bonds was approximately $158.3 million as of December 31, 2021. In my estimation, most of these notes will be converted into shares of the company, which will increase the total number of shares.

Source: Author’s elaboration, based on 10-K

In addition, the company will have to pay at least $30 million to Censa Pharmaceuticals due to the completion of the recruitment of patients for a clinical study evaluating the effectiveness of PTC923 in the treatment of PKU. Also, the company has a multi-million dollar commitment to achieving certain events that, in my opinion, should occur in 2023-2024.

Source: Author’s elaboration, based on 10-K

In combination with the above factors, I believe that PTC Therapeutics will need additional capital to fund the company’s activities, which include conducting several Phase 3 clinical trials, promoting product candidates to larger randomized trials, and redeeming senior notes. In my estimation, there is a possibility that the company will dilute shares through a public offering in the next 8-12 months.

Development and commercialization of medicines

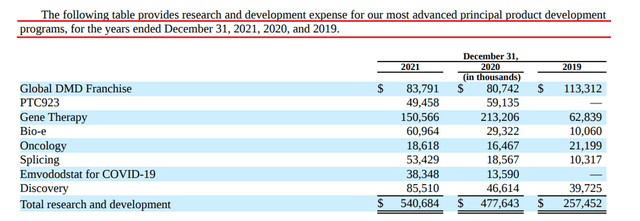

Currently, PTC Therapeutics is developing several product candidates aimed at improving the lives of thousands of patients suffering from rare and ultra-rare diseases. The process of developing new drugs takes an average of 10 years, and the combined cost of preclinical and clinical trials is billions of dollars. For example, the company continues to increase spending on R&D year after year to accelerate the achievement of critical data for approval.

Source: Author’s elaboration, based on 10-K

It should be noted that despite the demonstrated efficacy and safety data in phases 1 and 2, there is a possibility that the primary and/or secondary endpoints in phase 3 clinical trials will not be met, which will prevent the company from obtaining regulatory approval. In addition, there is a risk that the company’s drug will not be commercially successful due to the benefits of other treatments. As a result, the profit from sales will be lower than the costs that were spent on its development or commercialization, which will lead to the inability to achieve a positive cash flow for the company. This risk can lead to a negative impact on the financial position of PTC Therapeutics’ business and a decrease in interest from investors.

PTC Therapeutics Forecast and Price Target

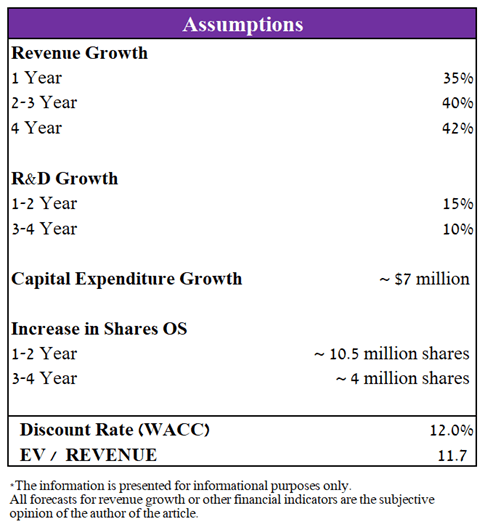

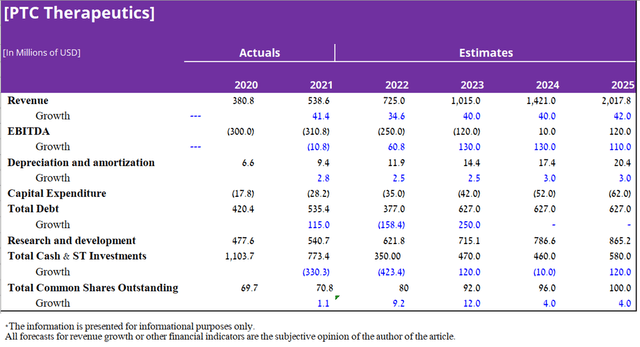

To determine the target price of PTC Therapeutics, I used a discounted cash flow model until the end of 2025, using the EV/Revenue ratio to estimate the value of the company. I have made certain assumptions based on historical data and my estimate of sales of approved medicines and developments over the next four years.

Source: Created by author

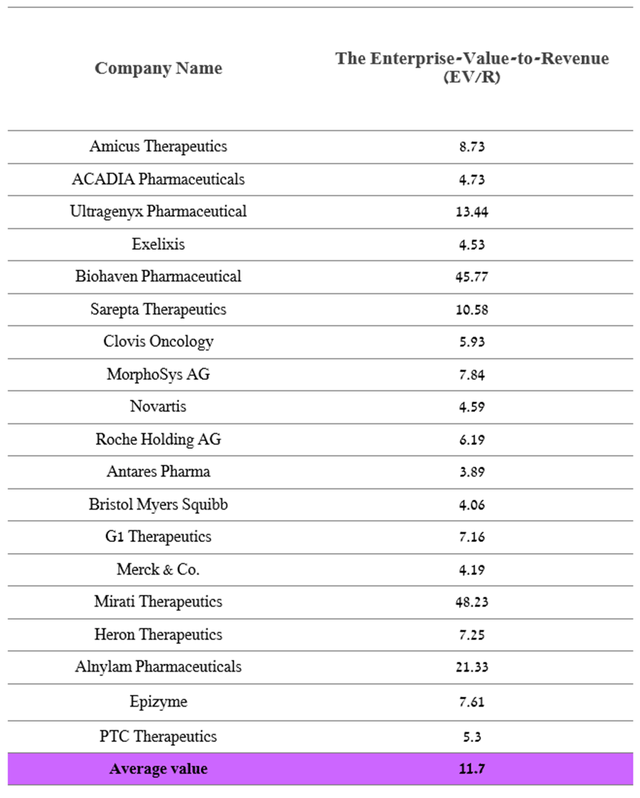

Several criteria were taken into account in determining the company’s target price, namely: an enterprise value to revenue ratio of 11.7x, calculated based on data from both the largest pharmaceutical companies in the world and companies that, like PTC Therapeutics, have only a few approved drugs.

Source: Author’s elaboration, based on Yahoo Finance

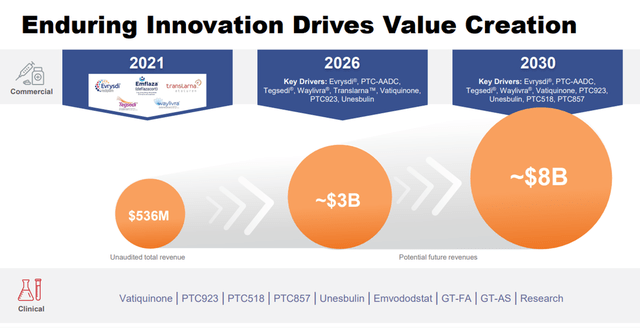

In 2022, I expect the company’s revenue to be $725 million, which is in the middle of the $700-750 million range projected by the company’s management. Starting in 2023, I expect revenue growth to accelerate as Evrysdi expands to new metrics and is also approved in additional regions of the world. In addition, the company is completing phase 3 clinical trials evaluating the efficacy and safety of product candidates in the treatment of diseases such as Friedreich’s Ataxia, Phenylketonuria, Huntington’s Disease, etc. The total number of potential patients in case of approval in the US, Europe, and Asia are more than 100 thousand people. As a result, I estimate that PTC Therapeutics’ drug sales revenue will be more than $2 billion by 2025, which is lower than the company’s management predicts, which estimates at $3 billion by 2026. In addition, I expect annual spending on research and development in the period 2022-2023 to continue to grow at an average of 15% year on year. However, during the period 2024-2025, the rate of R&D expenses will start to decline due to the completion of large clinical trials that are currently underway. Thus, my forecast for the main financial indicators of PTC Therapeutics, taking into account the above assumptions, is as follows.

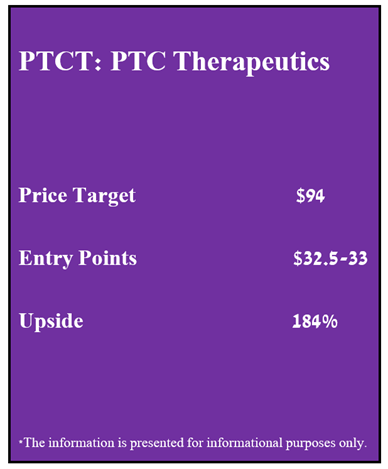

Based on the DCF Model and my assumption that sales of the company’s key medicines will continue to grow by at least 35% YoY, the development of PTC Therapeutics product candidates will be successful and also given the risks associated with the company’s business and the macroeconomic situation in the world, then my target price is $92 per share by 2025. It should be noted that due to the risks described in this article, I expect PTC Therapeutics’ share price to decline in the range of $32.5-33, where I plan to start investing in the company.

Source: Created by author

Conclusion

PTC Therapeutics has many approved drugs, with the top-selling ones being Translarna, Emflaza, and Evrysdi, which target genetic diseases such as DMD and SMA. The drug’s effectiveness is reflected in the company’s revenue growth of $538 million in 2021, up 41.4% from 2020.

Evrysdi is one of the company’s key products, commercialized by the global pharmaceutical leader Roche and already approved in more than 76 countries. This drug provides an effective and safe treatment for SMA with many competitive advantages. Evrysdi’s global sales were $225.4 million in the fourth quarter of 2021, up 34.6% from the third quarter of 2021. While the sales of the two main competitors, namely Zolgensma, are on a more gradual upward trend, Spinraza’s sales are generally declining.

Continued year-on-year revenue growth, possible approval of several next-generation product candidates over the next 4 years, and partnership with Roche make PTC Therapeutics an excellent candidate for long-term investors. Based on the risks and catalysts described in the article, I set a price target for PTC Therapeutics at $94 per share.

Be the first to comment