jetcityimage

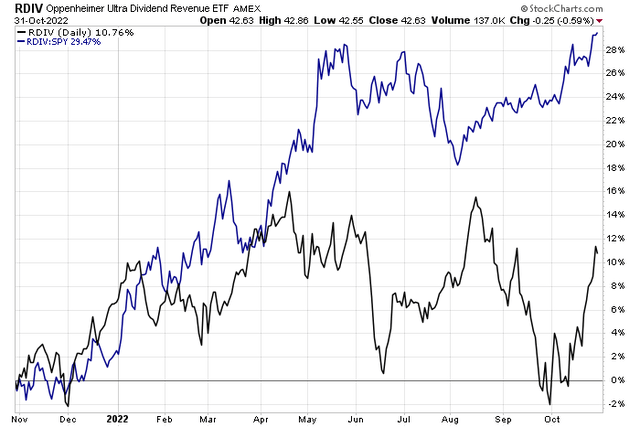

Dividend stocks have caught a second wind since early August. The group was a popular theme among investors to start 2022, but the relative rally stalled in May. A shift back toward value and cyclical sectors, and away from growth, benefits the Invesco S&P Ultra Dividend Revenue ETF (RDIV) which closed October at a fresh high vs the S&P 500 since January 2020. One of its biggest holdings reports Q3 numbers Tuesday night. Does the stock show similar upside? Let’s find out.

RDIV: Dividend ETF At Fresh Relative Highs

According to Bank of America Global Research, Prudential Financial (NYSE:PRU) is a globally-diversified life insurer with operations predominantly in the U.S. and Japan. The U.S. business underwrites and distributes annuities, life insurance, group benefits, asset management, and retirement products and solutions. The International businesses primarily operate in Japan through captive agency and independent agency distribution with a focus on life insurance.

The New Jersey-based $39.2 billion market cap Life and Health Insurance industry company within the Financials sector trades at a slightly high 19.5 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.6% dividend yield, according to The Wall Street Journal.

Prudential has become an industry leader in helping corporations manage and derisk their pension obligations. Recent turmoil in the U.K. is evidence of how important that task is. Moreover, solid international exposure, despite a weak foreign market, is a long-term asset for PRU. Earnings from Japan are solid with high returns. Downside risks include a further deterioration in the equity and fixed-income markets. Reduced corporate capex could also hurt Prudential. Near term, Hurricane Ian reportedly spared PRU’s portfolio of policies, though.

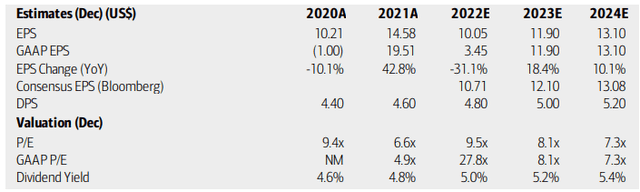

On valuation, analysts at BofA see earnings falling sharply in 2022 but then rebounding strongly both next year and in 2024. The Bloomberg consensus forecast is about on par with what BofA sees. Dividends are expected to steadily rise for this company which is in a few dividend-theme ETFs. Prudential’s GAAP and operating P/Es have retreated to low levels, though Seeking Alpha rates the firm with just a C+ valuation. Overall, I like the valuation here when using forward numbers, but it was certainly more attractive before the stock’s latest jump.

Prudential: Earnings, Valuation, Dividend Forecasts

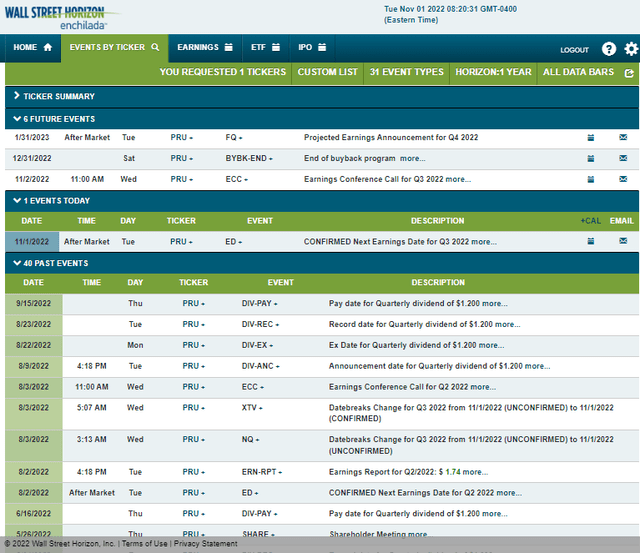

Looking ahead, Prudential has a confirmed Q3 2022 earnings date of Tuesday, Nov. 1 AMC with a conference call Wednesday morning. You can listen live here. Be on the lookout for any details about its share repurchase program as the current plan ends on Dec. 31.

Corporate Event Calendar

The Options Angle

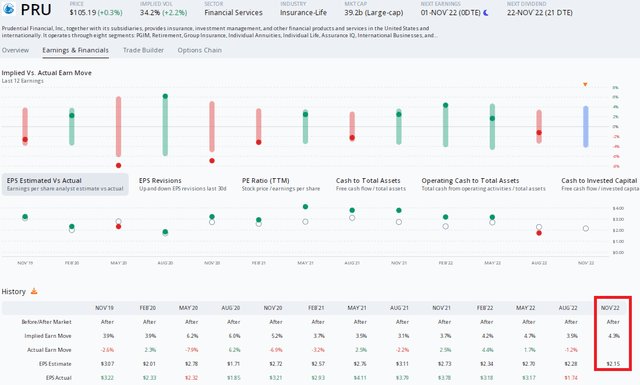

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $2.15 which would be a big 43% drop compared with per-share profits earned in the same period a year ago. That expectation follows an earnings miss last quarter – the first after a string of eight consecutive quarters of beating on the bottom line.

In terms of the expected stock price swing post-earnings, ORATS reports that the nearest-expiring at-the-money straddle prices in a 4.3% move. That’s roughly in line with past quarters, but the stock does not have a history of large price changes after earnings results hit. So, I would avoid going long options here.

PRU: Options Somewhat Expensive vs History Into Earnings

The Technical Take

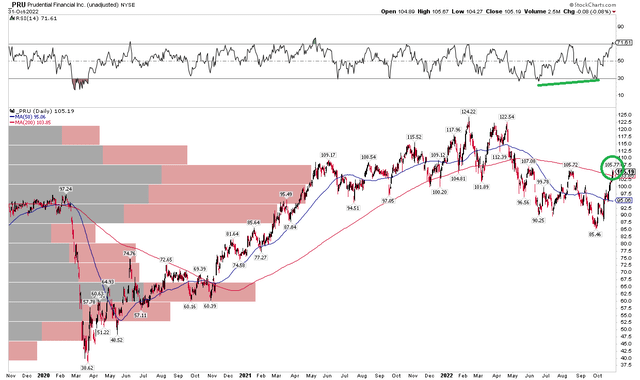

PRU has rallied more than 20% off its low about a month ago. The decline to near $85 came with marginally positive divergence in the daily RSI indicator. Also bullish is that shares have climbed above the 200-day moving average, which had been a key pivot point dating back to the middle of 2020. Moreover, the $105 to $107 area is a scene of the crime where bulls and bears have duked it out in months past. I’d like to see a weekly close above $107 to help confirm that a low is in and a bullish trend is in play.

Overall, the stock is pausing after a strong run-up. Traders should wait for a breakout above $107 or a bearish breakdown from this possible resistance point.

PRU: Shares Hover At Key Resistance, 200dma

The Bottom Line

With a stock at a key battleground level and a valuation that looks decent, long-term investors should consider owning PRU here. A high yield is another benefit. Short-term traders might want to wait for more signs of a breakout, though.

Be the first to comment