John Li

Prudential PLC (NYSE:PUK) is a British multinational insurance company that underwent a massive refocus to Asia and Africa in 2020. Prudential is largely a leveraged bet on the Asian insurance market. The current 12x P/E appears attractive, however as is the case with many UK companies, it’s very easy to fall into a ‘value trap’ position. The UK market has historically always appeared undervalued, however these so-called ‘under-valuations’ have actually been justified by the continued financial underperformance of UK equities in comparison to US counterparts.

Whilst I don’t believe Prudential is a value trap as such, I do believe there are notable bearish signals that investors need to be considerate of. Primarily both the recent boardroom shake-up and the potential pitfalls of the dramatic change in strategy as headwinds grip Asia. For these reasons, I am waiting on the sidelines for now.

Digging In

The spin-off of the US-focused ‘Jackson Life’ business in 2021 means that Prudential is now purely focused on the Asian and African markets. Considering this demerger, financial comparison to previous years must be in respect to the ‘new business’.

Considering this, profit came in just over $2.5 billion for 2021, an increase of 13%. Annual Premium Equivalent (APE) sales grew 8% to just under $4.2 billion, this was significantly hampered by ongoing closures of the border between Hong Kong and China. If Hong Kong was to be excluded from the figure, APE sales were 16% higher. Hong Kong APE sales declined from $758M to $550M YoY. Prudential has a high sales concentration in certain geographies in Asia, which heightens the geopolitical risks, as shown through the effect of Hong Kong tensions. The company also highlighted the headwinds they may face as a result of the Ukraine-Russia war in their latest company presentation.

The current conflict in Ukraine could have wider implications for global economic and market conditions as well as geopolitical relation

The recent onset of the Ukraine-Russia war and heightened geopolitical risks associated with this have placed western firms operating in Asia in a more precarious position. This is particularly true for firms that have made a radical change in strategy. Both the US and China have now looked to protect their national interests and this has been highlighted by the introduction of new regulations that aim to protect data, technology and financial services. As a UK-based company operating in these Chinese markets, Prudential may be at risk of regulatory pressures in the future.

The board also boasted a 4% increase in the dividend, making it the 14th consecutive year of an increase in the dividend, yet that dividend remains relatively minute at 1.3%. This dividend is minimal in comparison to other British insurance firms such as Aviva (OTCPK:AIVAF) and Legal & General (OTCPK:LGGNY) that both have yields of over 7%.

The company also provided some insight into 2022 performance. 7% APE growth was achieved in January and then a decline of 1% in February. This decline can largely be attributed to the continued restrictions in place across large parts of Asia. With many key growth markets such as Hong Kong and India moving to more significant containment restrictions in 2022.

The Opportunity: Growth Runway

The opportunity for Prudential comes through the size of the Asian insurance market and the significant untapped opportunity it possesses. 85% of people in Asia still do not have insurance and despite profits well in excess of $2 billion, Prudential has still only captured around 5% of the Asian insurance market.

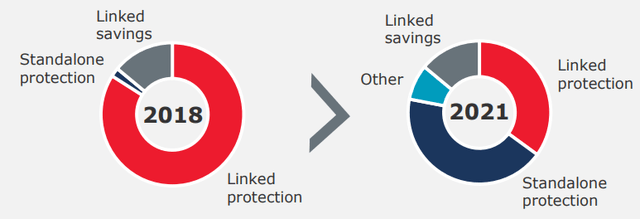

Prudential’s aim is to scale sustainably in these high-growth markets through a diversified and disciplined approach. And in many ways the company’s actions do show this, Prudential now has a solid foothold in numerous different Asian markets (they are ranked in the top three biggest insurance providers in eleven nations), and in many of those nations, Prudential is steadily growing both APE sales and profit. Indonesia is a good example of this, where APE has grown by 33%. Greater diversification is coming through an increased presence in different geographies and also breadth of product offerings driving a larger sales mix.

Indonesia sales mix (Prudential Plc company presentation)

This growth opportunity is impressive, and any success in making large inroads in tackling this large total addressable market will mean large shareholder value can be unlocked. However, Prudential’s ability to do this has been disputed due to a large leadership shake-up. Prudential CEO Mike Wells stepped down in March as he announced his plans to retire. However, it was then surprising to see him join Bermuda-based life insurer Athora Holding Ltd last week. This brings into question what his actual motives for leaving Prudential were in the first place. Athora has more than $79 billion in assets under management.

It wasn’t until late May when Prudential found his replacement – Anil Wadhwani, who joins from Manulife Asia. However, Mr. Wadhwani doesn’t start till February 2023. Considering the turbulent economic environment and the need for Prudential to move quickly to tackle the growth opportunity in Asia, this will stunt the start of their growth journey.

Conclusion

Prudential is now in a better position to start tackling the Asian and African insurance markets over the coming years, as the company has now fully repositioned its business. That opportunity is big, yet the notable headwinds Prudential faces as a result of heightened restrictions, increased geopolitical risks and a prolonged boardroom shake-up means capturing this opportunity will prove difficult over the near term. Due to this, I believe upcoming results may disappoint the market, and I am therefore taking a bearish stance on the firm.

Be the first to comment